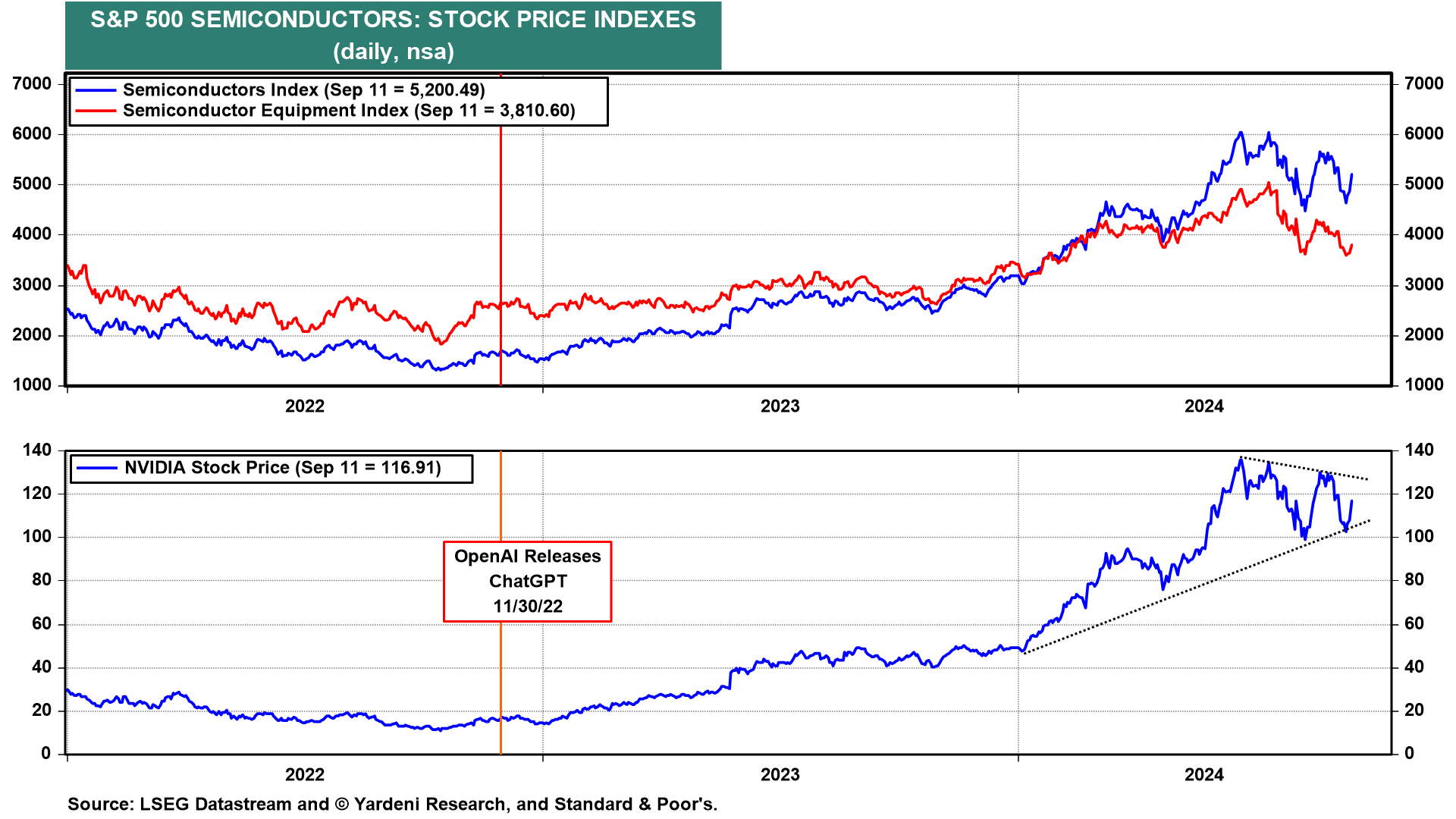

Yesterday, stock prices initially fell sharply following August's CPI report, but AI fever quickly turned the S&P 500 around to a 1% gain. Yesterday, Oracle announced it is taking orders for the first "zettascale" AI supercomputer, which will be powered by up to 131,072 Nvidia Blackwell chips. Nvidia CEO Jensen Huang also told a Goldman Sachs conference that demand for their Blackwell chips is so high that some of its customers are getting "emotional." Nvidia rose 8.3% yesterday and was up another 1.8% or so this morning (chart).

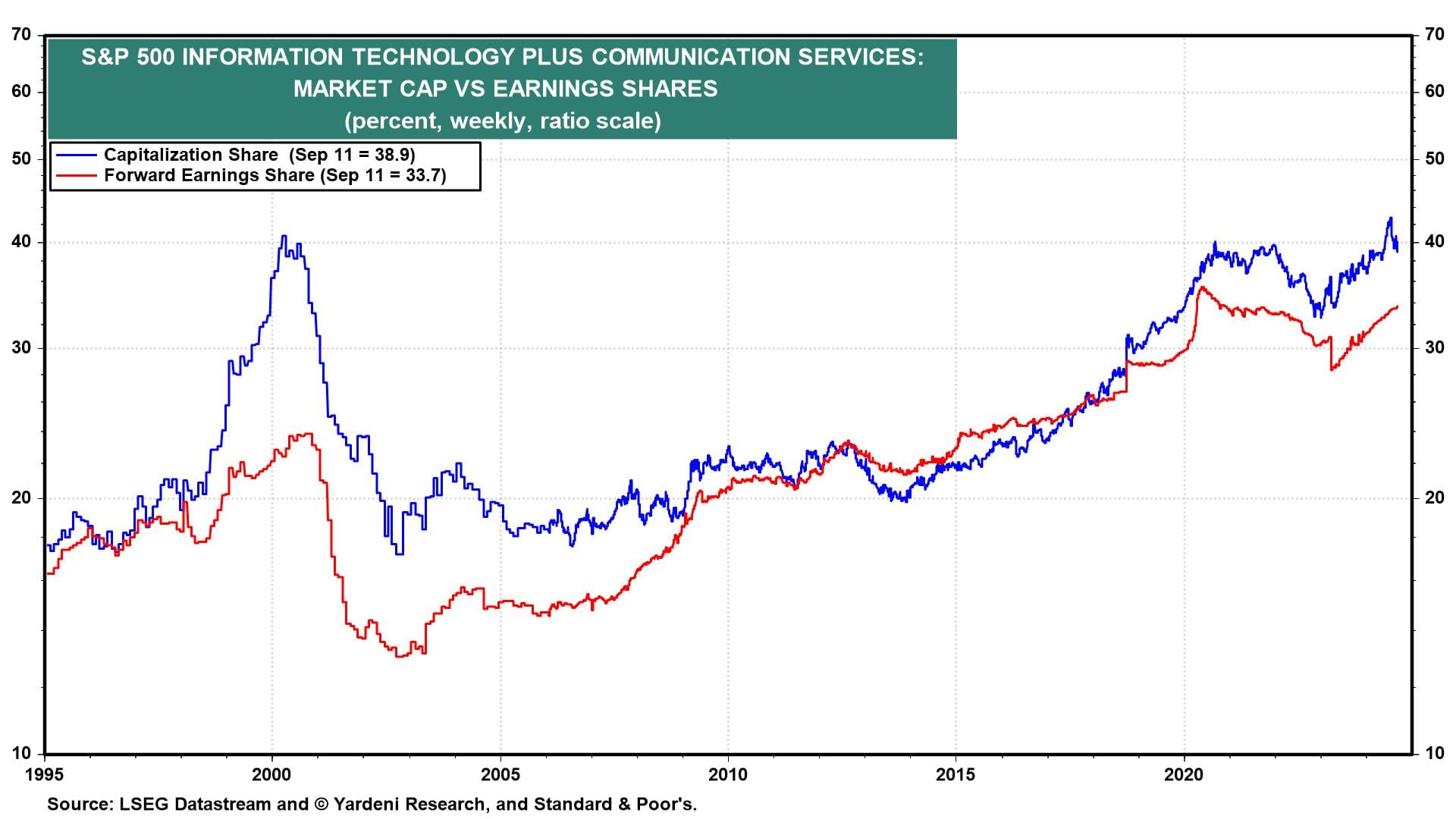

These developments support our prediction of a technology-driven productivity growth boom in our Roaring 2020s scenario for the US. The latest news from Oracle also supports our belief that the forward earnings of tech companies like Nvidia are much more likely to be realized than the irrational expectations during the dotcom bubble (chart).

With that said, let's take a look at today's more mundane news: