Treasury Secretary Janet L. Yellen said on Monday, May 1 that the United States could run out of money to pay its bills by June 1 if Congress does not raise or suspend the debt limit, putting pressure on President Biden and lawmakers to reach a swift agreement to avoid defaulting on the nation’s debt. In a letter to House Speaker Kevin McCarthy, she wrote:

"After reviewing recent federal tax receipts, our best estimate is that we will be unable to continue to satisfy all of the government's obligations by early June, and potentially as early as June 1, if Congress does not raise or suspend the debt limit before that time. This estimate is based on currently available data, as federal receipts and outlays are inherently variable, and the actual date that Treasury exhausts extraordinary measures could be a number of weeks later than these estimates."

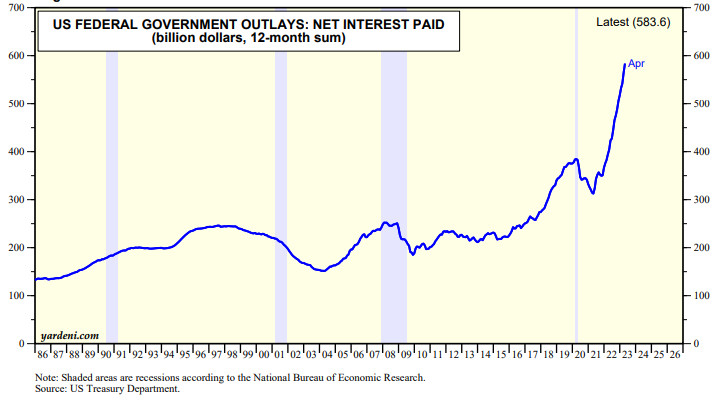

This doesn't mean that the Treasury will have no choice but to default on the government's debt as widely feared. Over the past 12 months through April, the US federal government's outlays on net interest paid rose to a record $583.6 billion (chart).

Over that same period, the government's receipts totaled $4.6 trillion (chart). The Treasury has plenty of revenues to cover the interest payments on its debts as long as it slashes other outlays enough to balance the budget. That would avert a debt default crisis but could push the economy into a recession and trigger a political crisis.