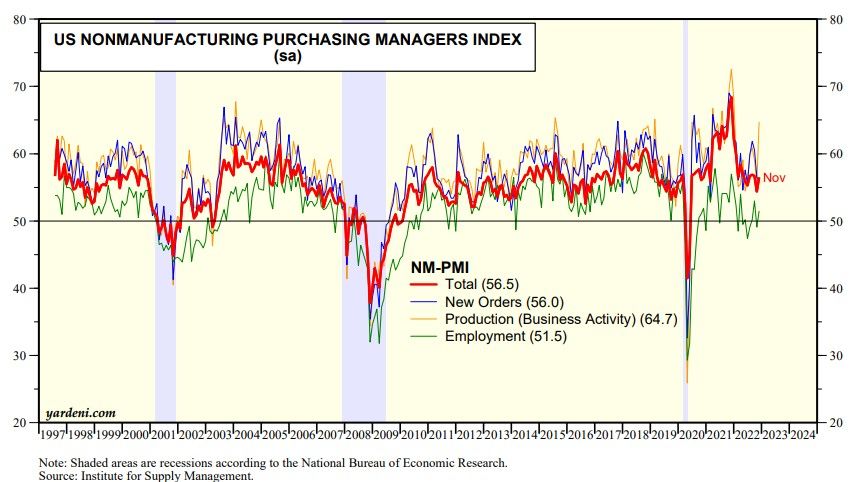

The stock market has the jitters as investors worry that the economy may be too strong and too weak at the same time. Yesterday the S&P 500 fell because November's non-manufacturing purchasing managers index was stronger than expected (chart). Investors concluded that the economy may be too strong requiring the Fed to raise interest rates still higher, increasing the risk of a recession.

Today, stock prices tumbled again. This time, the concern is that a recession is on the way no matter what. Indeed, during an interview with CNBC today, JPMorgan Chase's CEO Jamie Dimon declared that inflation and its impact on the consumer “may very well derail the economy and cause a mild or hard recession that people worry about.” Separately, Morgan Stanley announced that the company will cut 2% of its workforce.

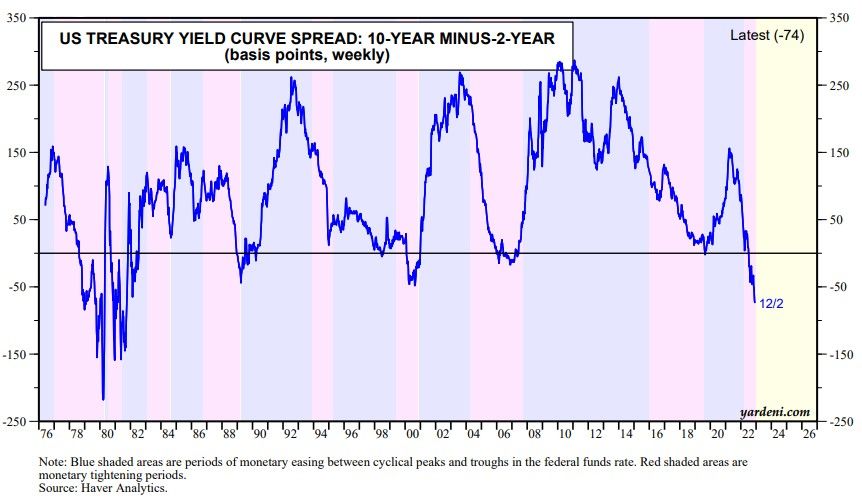

Meanwhile, the yield curve spread between the 10-year and 2-year Treasuries suggests that the Fed's monetary policy tightening cycle is almost over (chart). That's either because a recession is imminent or inflation is likely to keep falling maybe without a recession.

Odds are we will get a clearer picture on Tuesday, December 13, when November's CPI is released. That's the same day as the FOMC starts it 2-day meeting. A lower-than-expected report would likely give another lift to Santa's yearend rally.

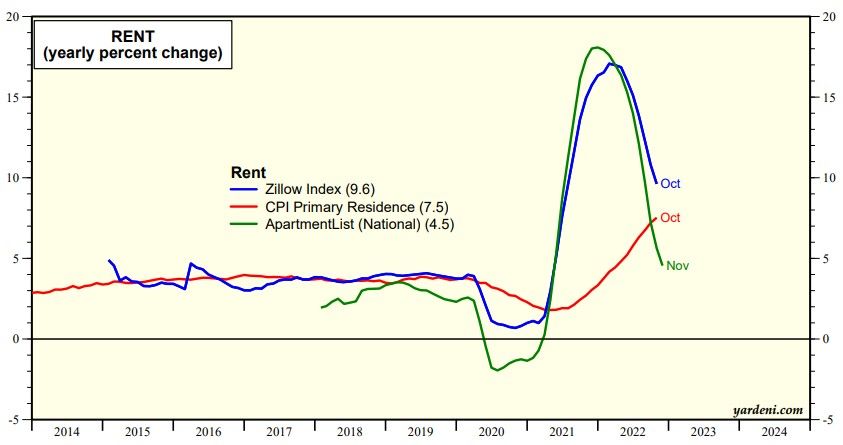

We know that gasoline and used car prices fell in November. Durable goods inflation probably continued to moderate. Heck, even rent inflation is plunging according ot ApartmentList (chart).

Here comes Santa Claus!