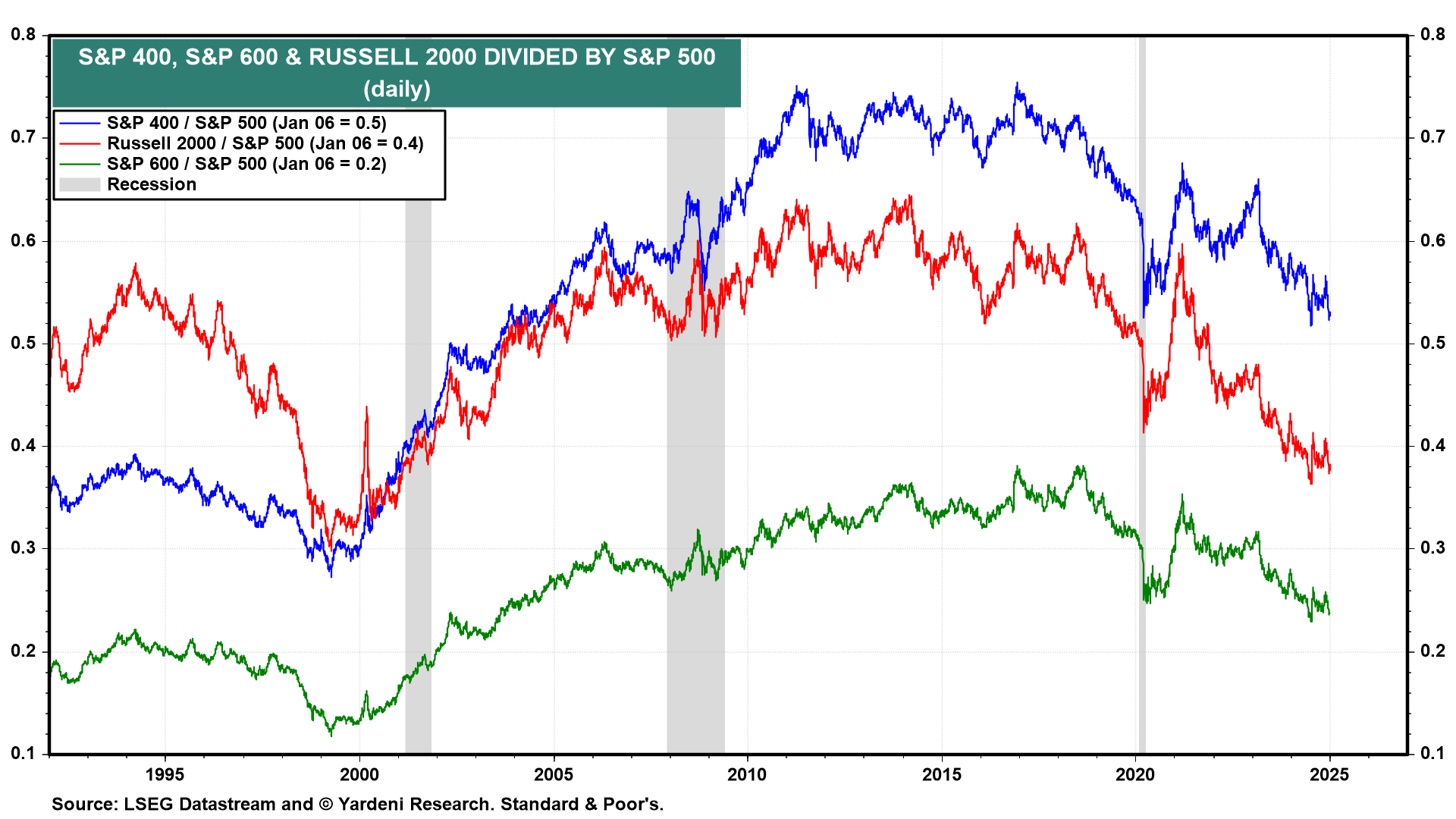

Today was another good day for technology stocks, semiconductor stocks, and the Magnificent-7. In the S&P 500, they were up 1.44%, 3.28%, and 2.01%. We continue to recommend overweighting the LargeCap S&P 500 Information Technology and Communication Services sectors. We aren't as keen on the MidCap S&P 400 or the SmallCap S&P 600 (collectively the “SMidCaps”), or especially the SmallCap Russell 2000, all of which continue to underperform the S&P 500 (chart). The latter was down slightly today.

Boosting semiconductor stock prices today was news that Foxconn's revenues rose 15% y/y. That gave Nvidia a 3.4% boost. Jensen Huang, Nvidia's CEO, is delivering a keynote address at the 2025 Consumer Electronics Show this evening.

The relative underperformance of the SMidCaps since mid-2022 is attributable to the relatively flat trends in their forward earnings over the same period, while the forward earnings of the S&P 500 has been rising to new record highs since mid-2023 (chart). This divergence is unusual. Our theory is that the profitable SMidCap companies with the most potential to become LargeCaps are getting acquired by LargeCap companies before they can do so.