Today's CPI report for November matched expectations. The CME FedWatch tool shows 95% odds that the FOMC will cut the federal funds rate (FFR) by 25bps next week, and the Fed doesn't like to surprise market expectations.

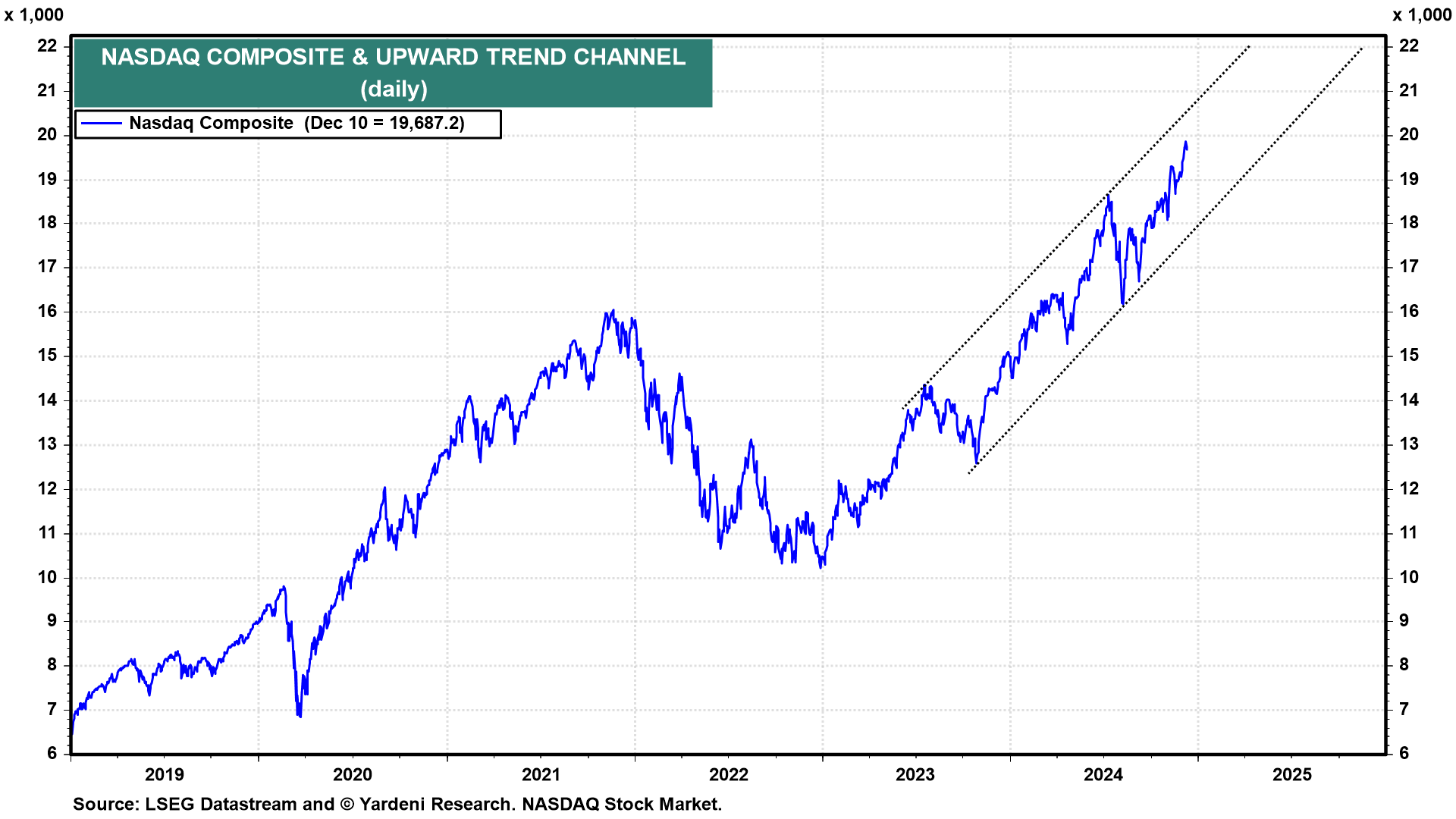

The Nasdaq front-ran our forecast to reach 20,000 by mid-2025 by reaching that milestone today (chart). Now we are aiming for 22,000 by mid-2025. Our yearend target of 6100 for the S&P 500 may also soon be exceeded ahead of schedule. Perversely, the big gains piling up in stock portfolios could trigger a significant pullback in January as investors rebalance in 2025 rather than now to defer capital gains taxes.

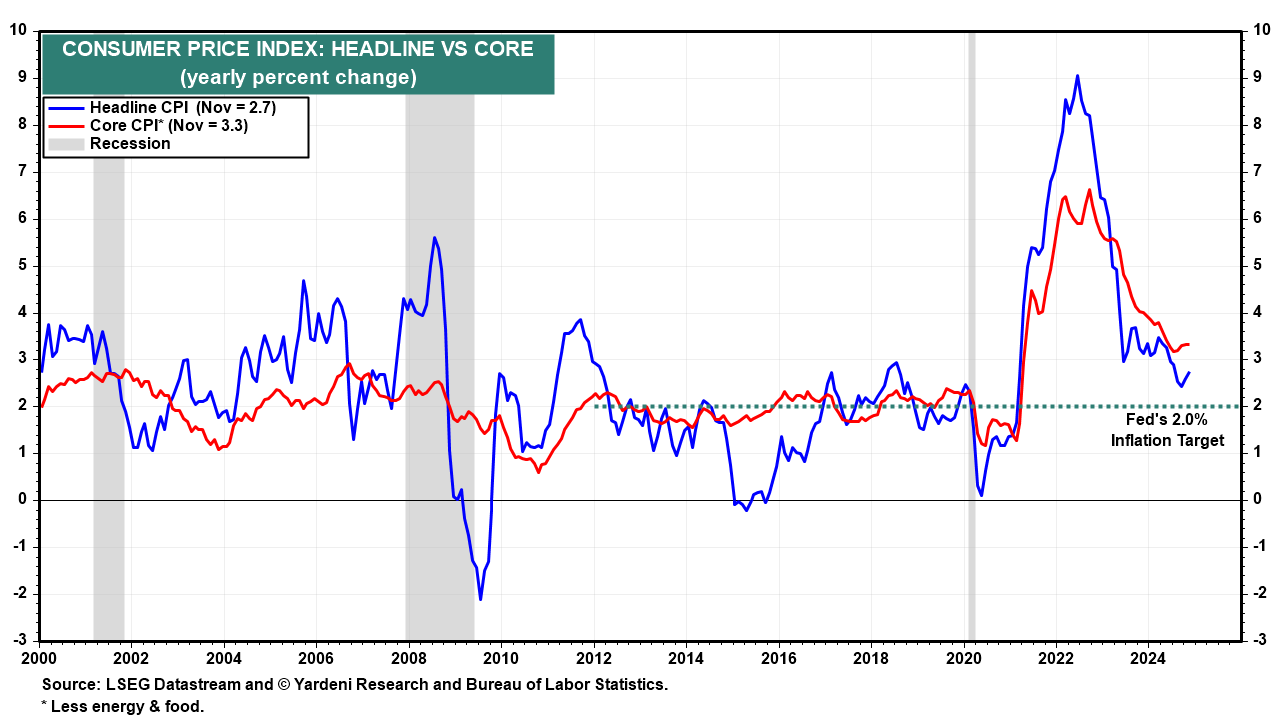

Today's inflation report suggests that it is still heading in the right direction towards the Fed's 2.0% target. However, it's not there yet, while the labor market remains strong. Further easing by the Fed risks heating up price inflation and speculative excesses in the financial markets.

Let's review today's CPI report:

(1) November's headline and core CPI inflation rates were 2.7% and 3.3% y/y (chart). Both exceed the Fed's 2.0% inflation target, though it actually applies to the PCED inflation rate, which tends to be lower than the CPI inflation measure. Indeed, October's headline and core PCED inflation rates were 2.3% and 2.8%.

Rent inflation still remains high, but it is moderating. Excluding shelter, the headline and core CPI were up just 1.6% y/y and 2.2% in November. Inflation has moderated as we predicted during the summer of 2022.

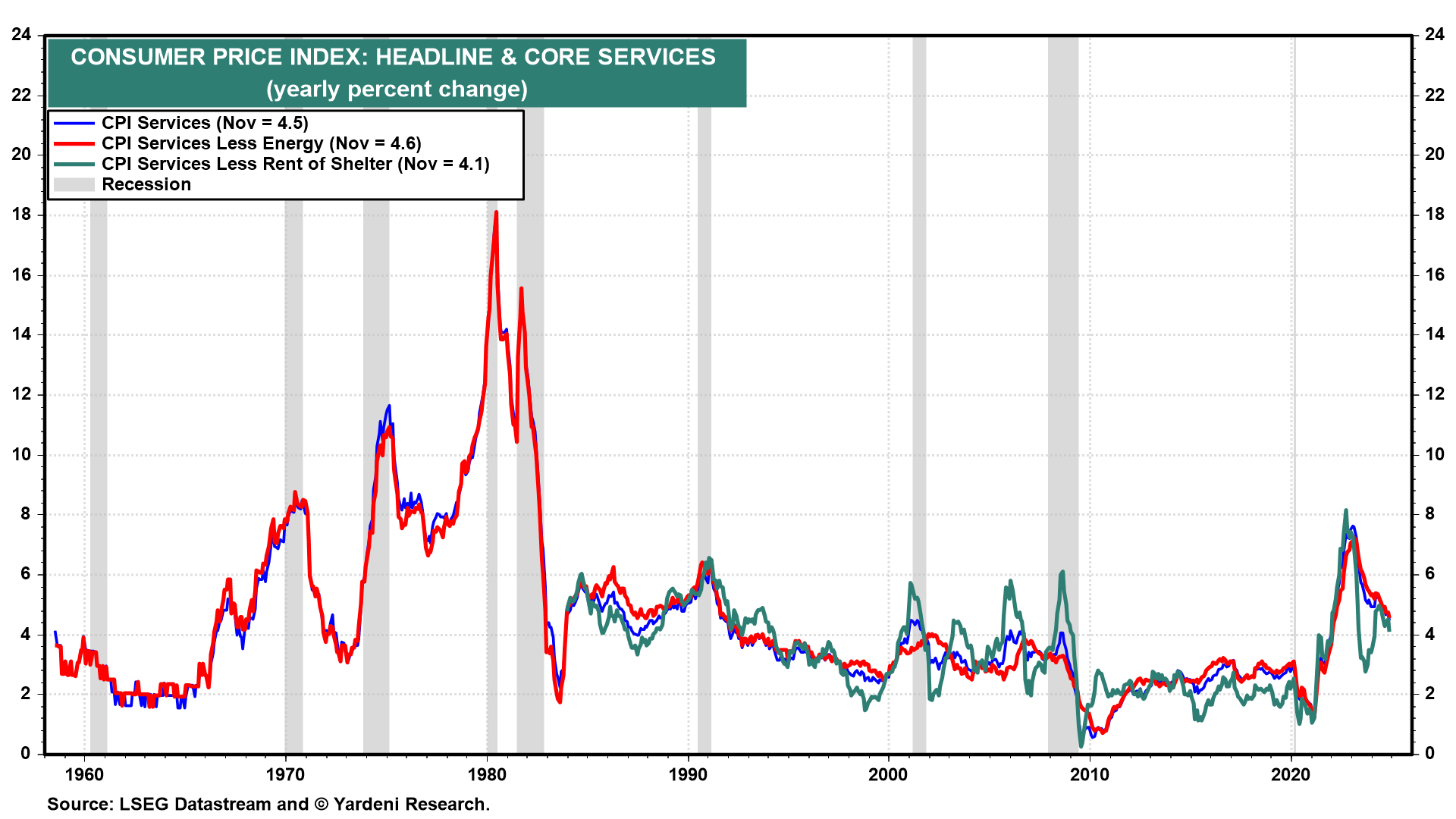

(2) There was good news and bad news in the CPI services component. The good news is that services inflation is moderating. The bad news is that it remains too high (chart). The CPI services ex-shelter fell from 4.5% y/y in October to 4.1% in November (chart).

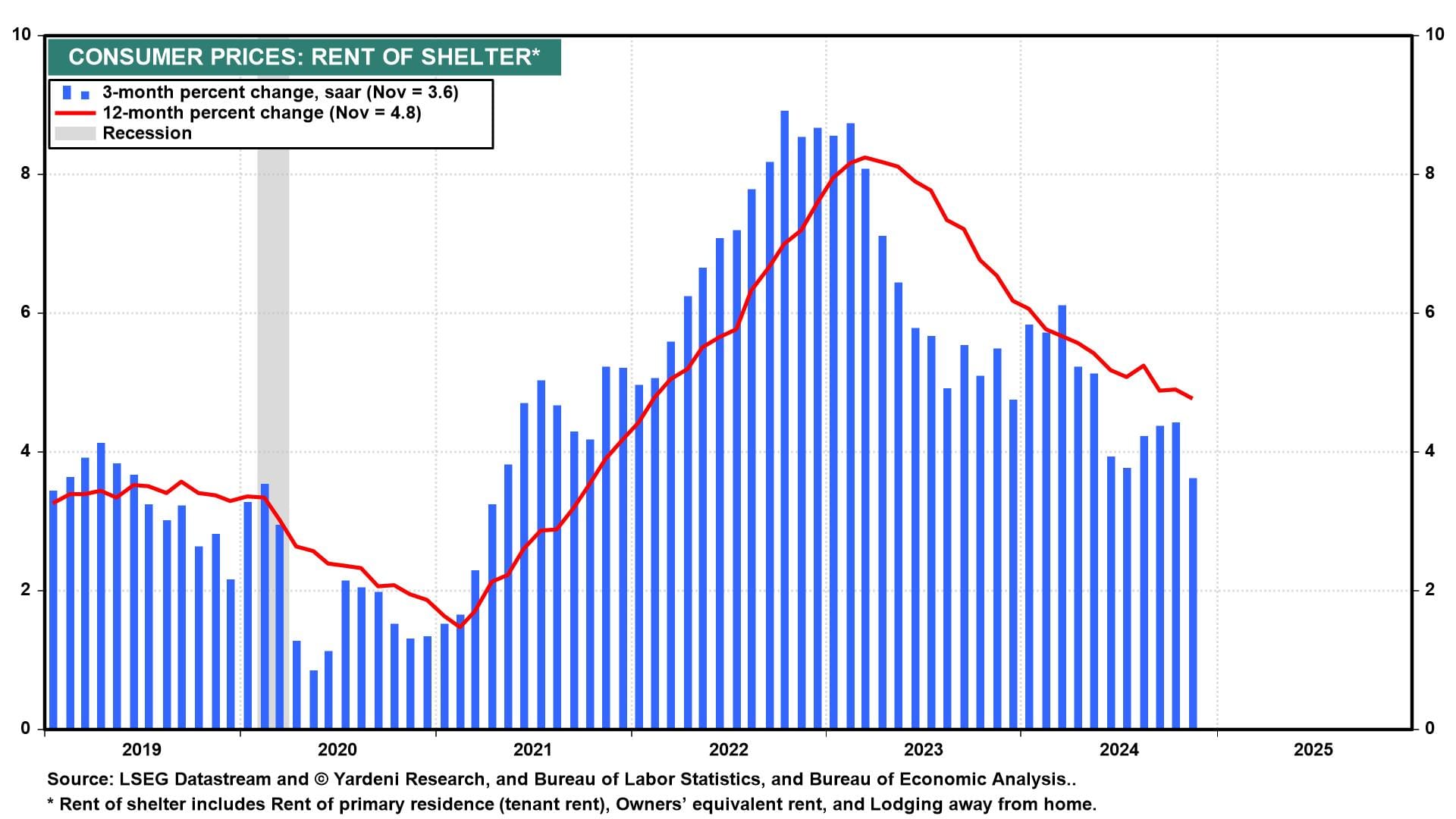

(3) The three-month annualized percent change in the CPI shelter fell from 4.4% in October to 3.6% in November, the lowest since May 2021 (chart). That said, the more important PCED weights shelter at about 1/6 of its basket versus 1/3 for the CPI. Still, renewed shelter disinflation is welcome.

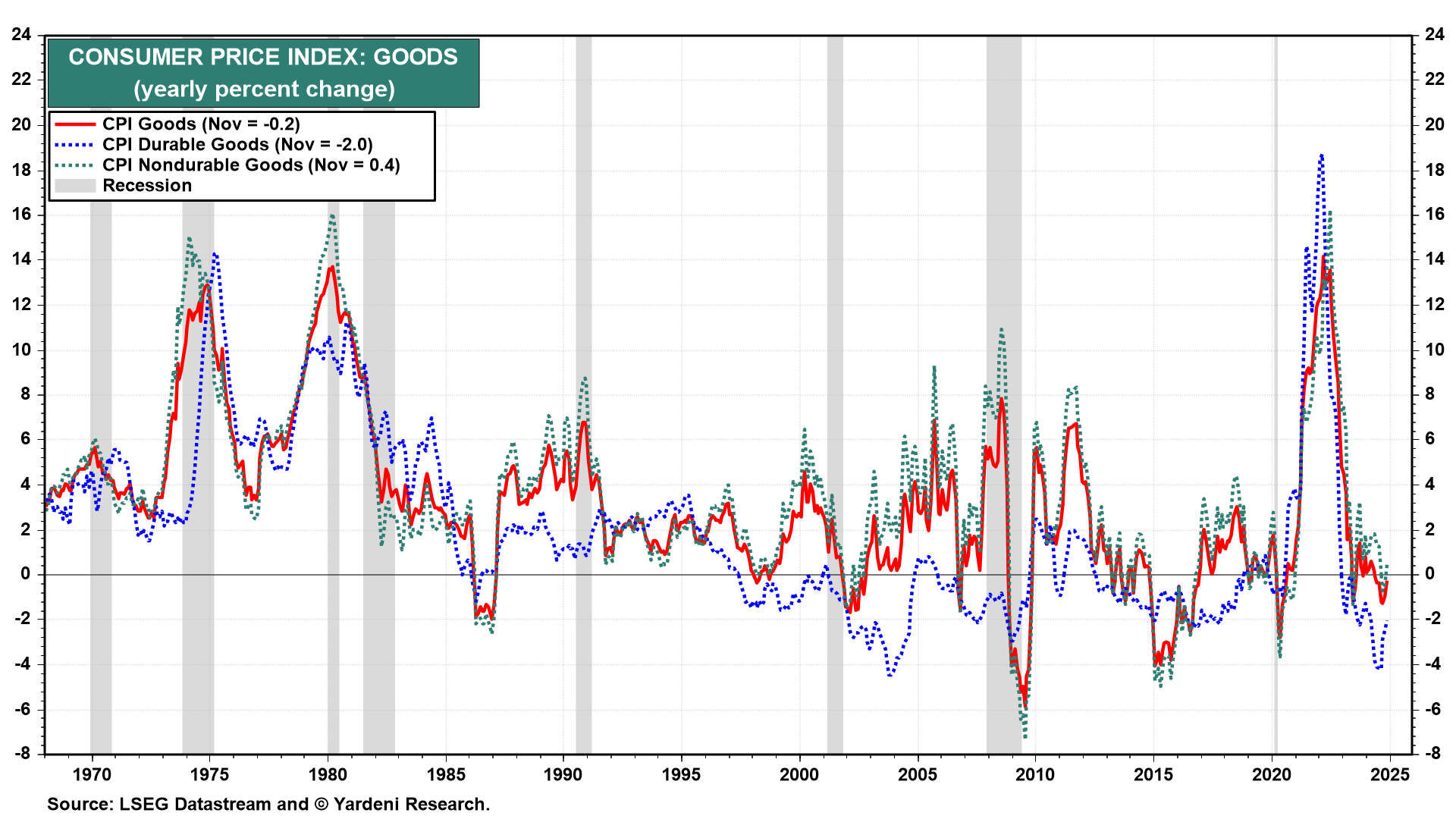

(4) One worry is that goods deflation might be ending for a little while anyway (chart). Nondurable goods inflation rose back into positive territory in November. Tomorrow's November PPI report will provide more information on whether goods deflation is ending because of base effects (less dramatic decreases when comparing to low prints a year ago), or because some goods prices may be starting to increase.

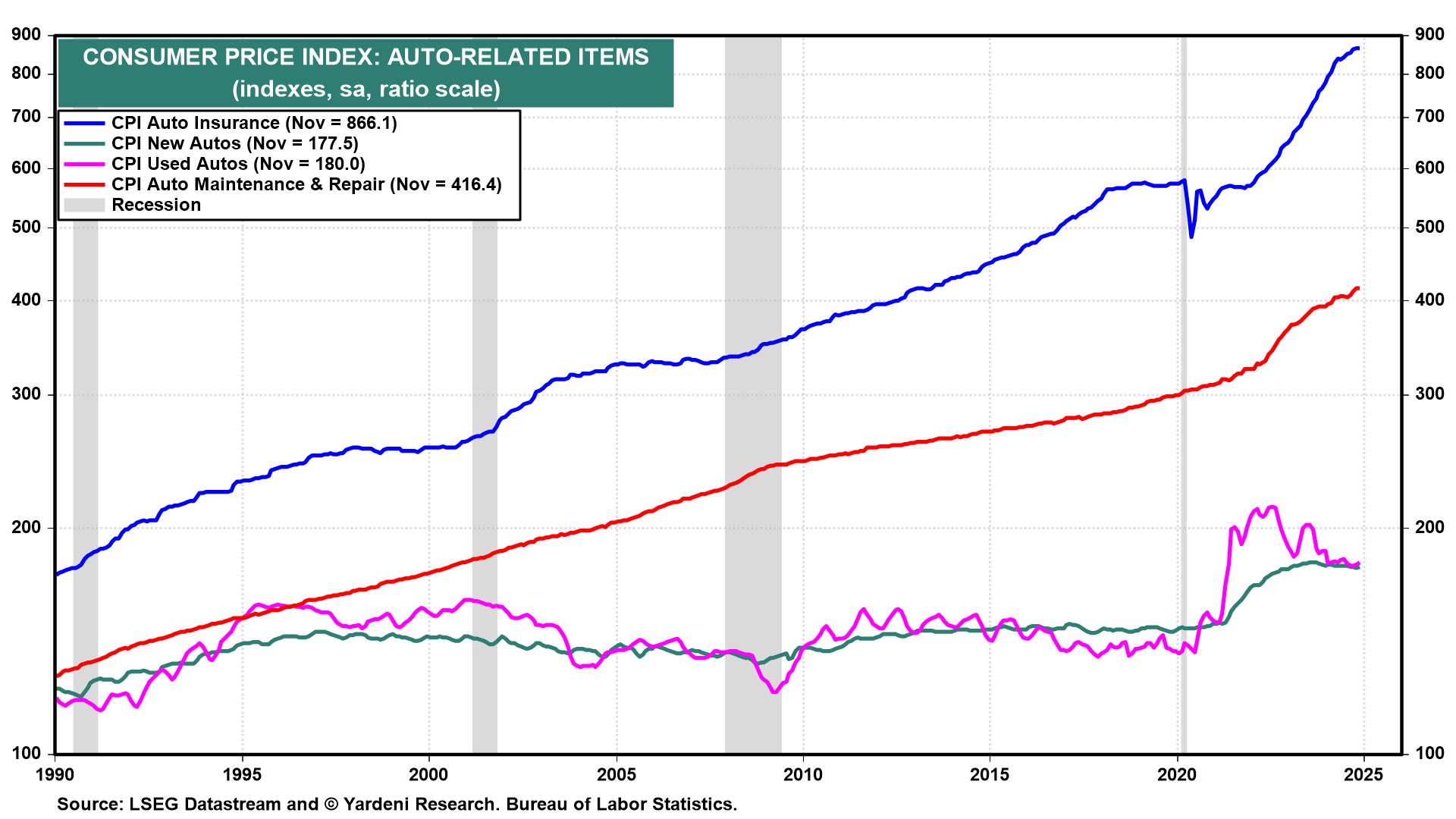

(5) Used car prices, for instance, are no longer falling. They rose 2.0% m/m in November after increasing 2.7% in October (chart). On the other hand, the CPIs for auto insurance and auto maintenance & repair both down ticked last month, finally.

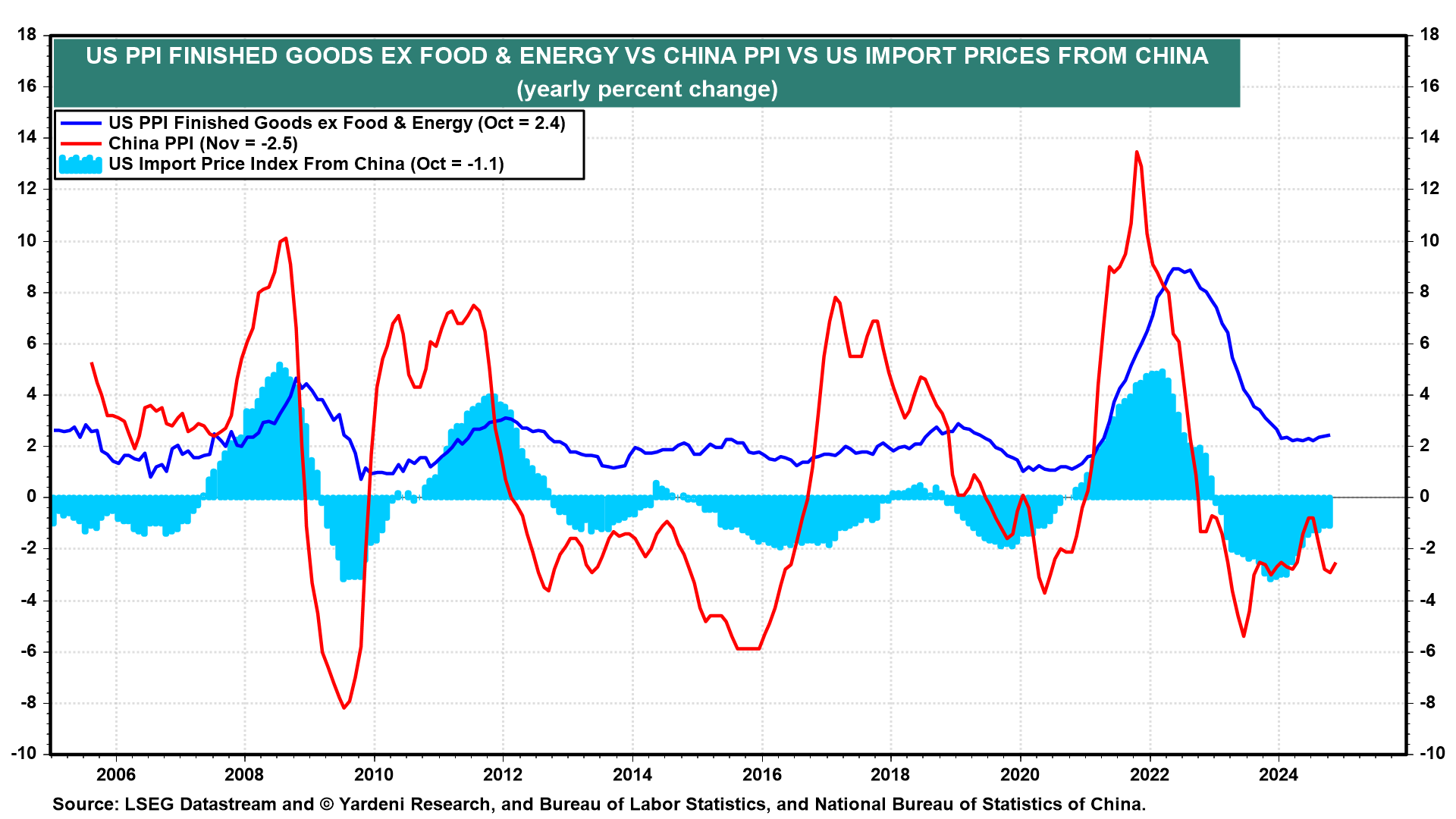

(6) Deflating Chinese import prices have helped to lower the US inflation rate for core CPI and core PPI goods (chart). Tariffs under Trump 2.0 could boost these import prices. However, China's top leaders reportedly are considering allowing the yuan to weaken in 2025 as they brace for higher trade tariffs. In other words, Trump's tariffs could spark both trade and currency wars.

(7) Fed officials seem to be ignoring the economic and inflation outlook under Trump 2.0. We suggest they pause easing until they get a better handle on the incoming administration's policies. If they do cut the FFR by 25bps on December 18, we might raise our subjective probability of a meltup in the stock market from 25% to 30%.