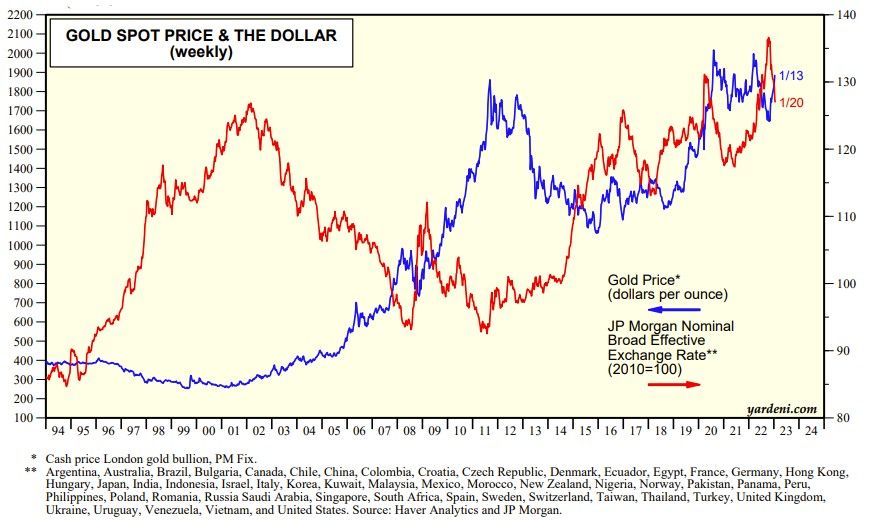

Gold is a commodity priced in dollars. Like other commodities priced in dollars, the gold price is inversely correlated with the trade-weighted dollar (chart). The former has been rebounding since late last year as the dollar has been weakening on expectations that the Fed is almost done raising interest rates.

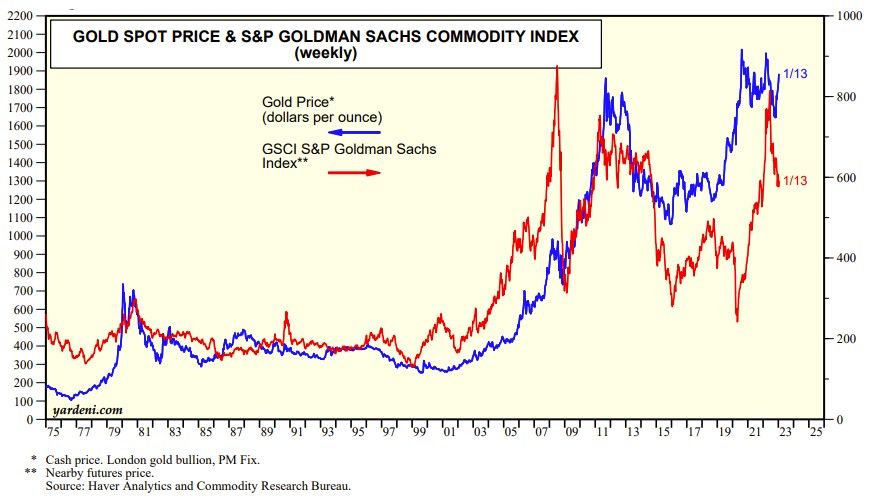

The price of gold tends to track the underlying trend in commodity prices (chart). So its recent rebound suggests that other commodity prices are also likely to move higher. That strongly implies that the outlook for the global economy is improving, which makes sense to us.

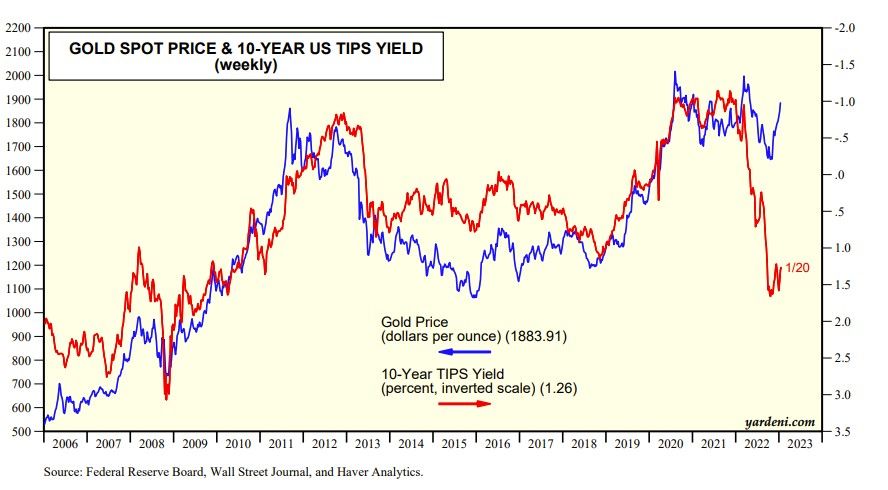

Since 2006, the gold price has also been inversely correlated with the 10-year US TIPS yield (chart). The latter soared during 2022, weighing on the price of gold. It is no longer doing so now that the TIPS yield has been slightly weakening since late last year.