The wage-price-rent spiral continues to spiral. Yet, the Bond Vigilantes, who were very vigilant at the start of the year, seem to be taking a siesta now.

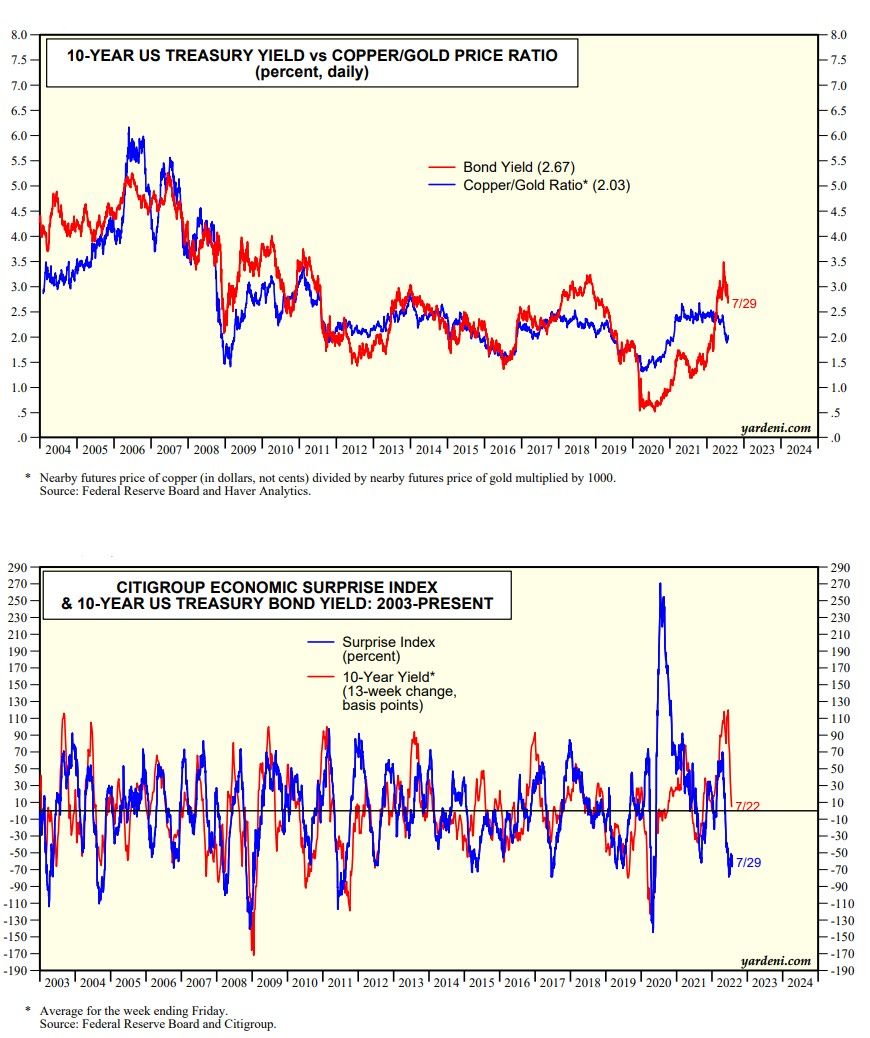

The US Treasury bond yield peaked this year (so far) at 3.49% on June 14, falling to 2.67% on Friday. That’s surprising given that inflation remains so high. But we aren’t surprised. As we’ve pointed out before, the bond yield closely tracks the copper/gold price ratio and the Citigroup Economic Surprise Index (charts below). Both remain bullish for the bond market, with the copper/gold price ratio signaling that the yield should be closer to 2.00%.

Bond investors in the US are apparently expecting that the Fed may not have to raise interest much more to slow the economy and subdue inflation. Foreign investors have also been buying US bonds as a safe haven in a world that's gone mad.