Rollercoaster rides are unnerving on the way up and then thrilling on the way down. Stock markets are thrilling on the way up and unnerving on the way down. The market had a thrilling meltup late last year and a slightly unnerving selloff during the first three days of the new year. Last year's yearend rally has fizzled so far this year.

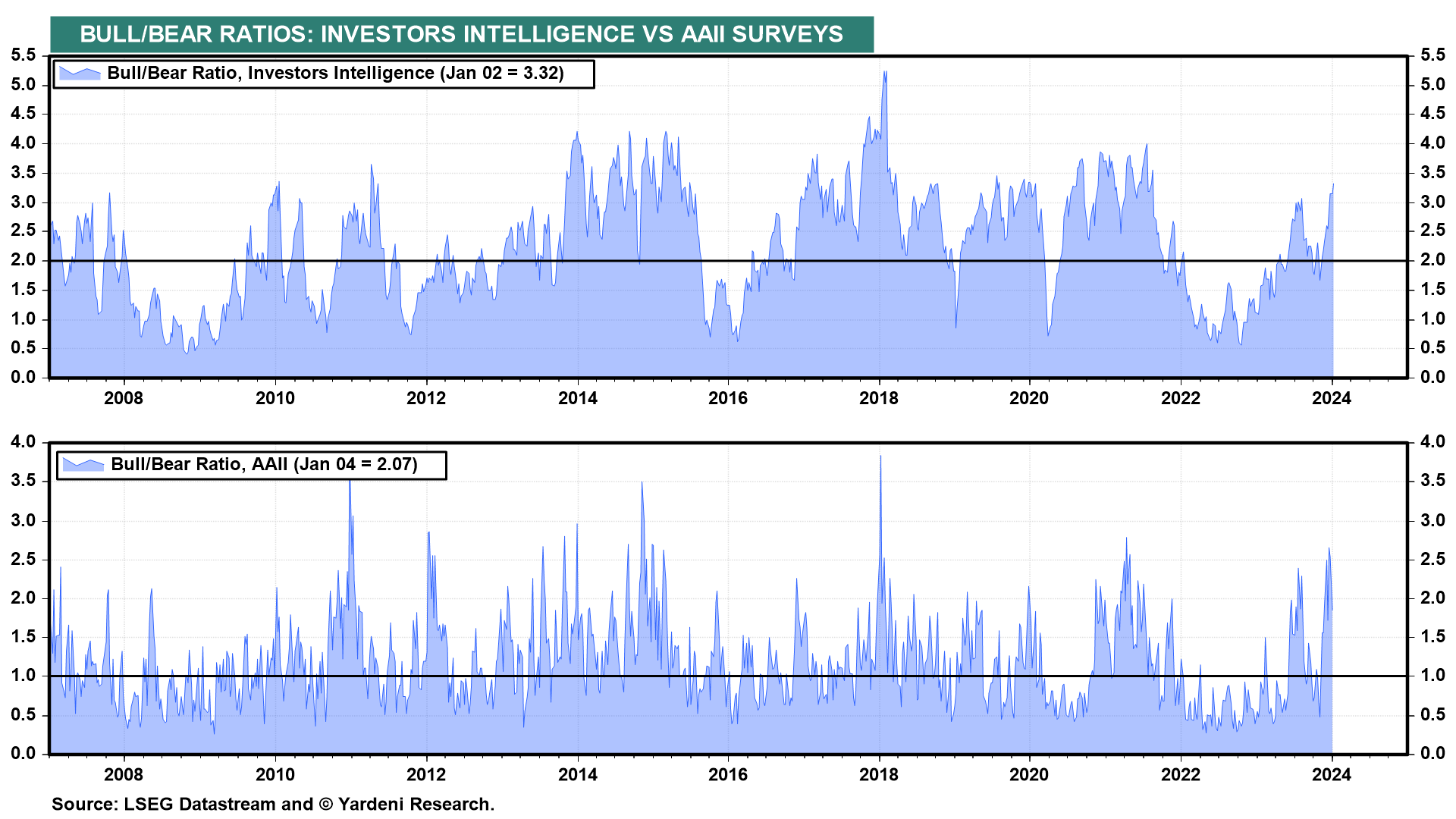

That's mostly because investors are having second thoughts about whether the Fed will cut the federal funds rate as much as many expected, though not us. In addition, they've just realized that China's recession can depress the earnings of American companies doing business over there. Some are simply taking some profits in the SMidCaps that had a thrilling ride late last year. Furthermore, the market may simply be too crowded with bulls as evidenced by the highly elevated bull/bear ratios with their rollercoaster rides (chart).

Also unnerving is the widening regional war in the Middle East. On January 2, Israel eliminated senior Hamas official Saleh Al-Arouri in a precision strike in the heart of Hezbollah-controlled south Beirut. That increases the chances of a war between Israel and Hezbollah, though both sides may simply continue to keep their conflict limited and contained to Israel's northern border. The US and its key allies issued a final warning yesterday to the Houthi Yemeni terrorists (supported by Iran) to stop attacking international shipping in the Red Sea. Today, Islamic State claimed that yesterday's bombing in Kerman, Iran was their doing. Nevertheless, the price of a barrel of Brent crude oil has been trending downwards since Hamas attacked Israel on October 7 (chart).