There may soon be fewer jobs for economists in both the US and China.

On Monday, December 23, Elon Musk (one of the DOGE Boys) tweeted that the "Fed is absurdly overstaffed." On its website, the Fed in Washington brags: "The Federal Reserve Board employs more than 500 researchers, including more than 400 Ph.D. economists, who represent an exceptionally diverse range of interests and specific areas of expertise." (We, at Yardeni Research, are willing to do what the Fed does for half the cost.)

On Friday, December 20, the state-run China Securities Journal reported that the main securities industry body has told brokerages to ensure their chief economists play a positive role in analyzing official policies and boosting investor confidence. If a chief economist repeatedly causes serious adverse effects owing to inappropriate comments, the employer should punish or possibly fire the person. In other words, China won't tolerate permabears!

Meanwhile, there are still plenty of jobs for China's central planners. On December 24, Reuters reported that the Chinese government decided to issue 3 trillion yuan ($411 billion) worth of special treasury bonds in 2025. That would be the most on record and a sharp increase from this year's 1 trillion yuan. Beijing aims to boost consumption to soften the blow from an expected increase in US tariffs on Chinese imports when President Donald Trump takes office on January 20.

A new subsidy program for durable goods will allow consumers to trade in old cars or appliances and buy new ones at a discount. There will also be subsidies for large-scale equipment upgrades for businesses. More money will be invested in advanced manufacturing electric vehicles, robotics, semiconductors, and green energy. Some of the borrowed funds will be used to capitalize large state banks.

China's economy is weighed down by a severe property crisis, high local government debt, and weak consumer demand. Exports have remained strong, but could soon face US tariffs in excess of 60% if Trump delivers on campaign pledges.

Here are some market indicators that we will be monitoring to assess whether Beijing's latest attempt to boost the Chinese economy is working. We are skeptical, but we will let the markets guide our assessment.

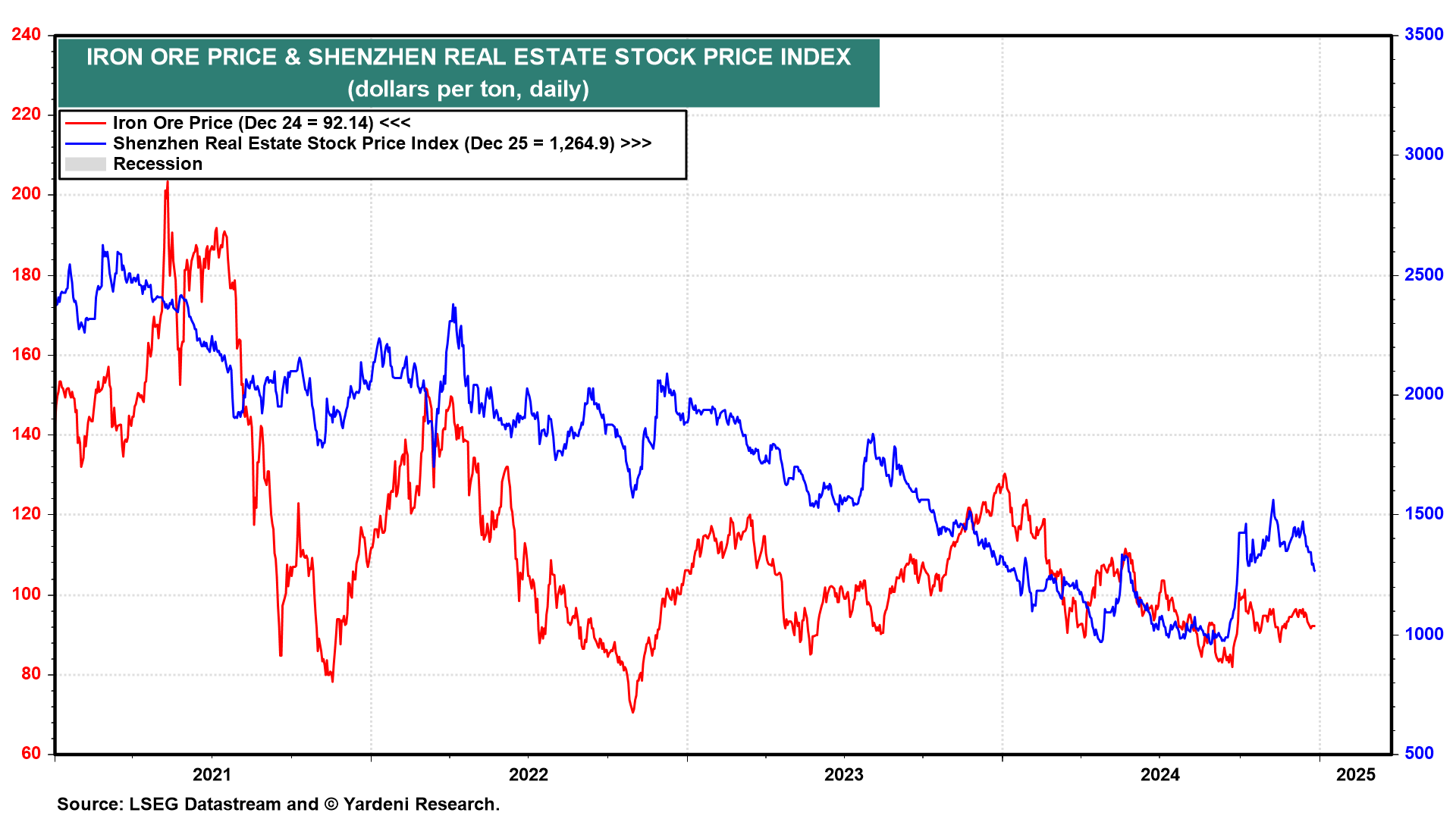

(1) Iron ore price and real estate stock prices. The latest stimulus program is aimed at boosting consumption. So these indicators of the property market may not show much if any improvement from the latest attempts to boost the economy (chart).