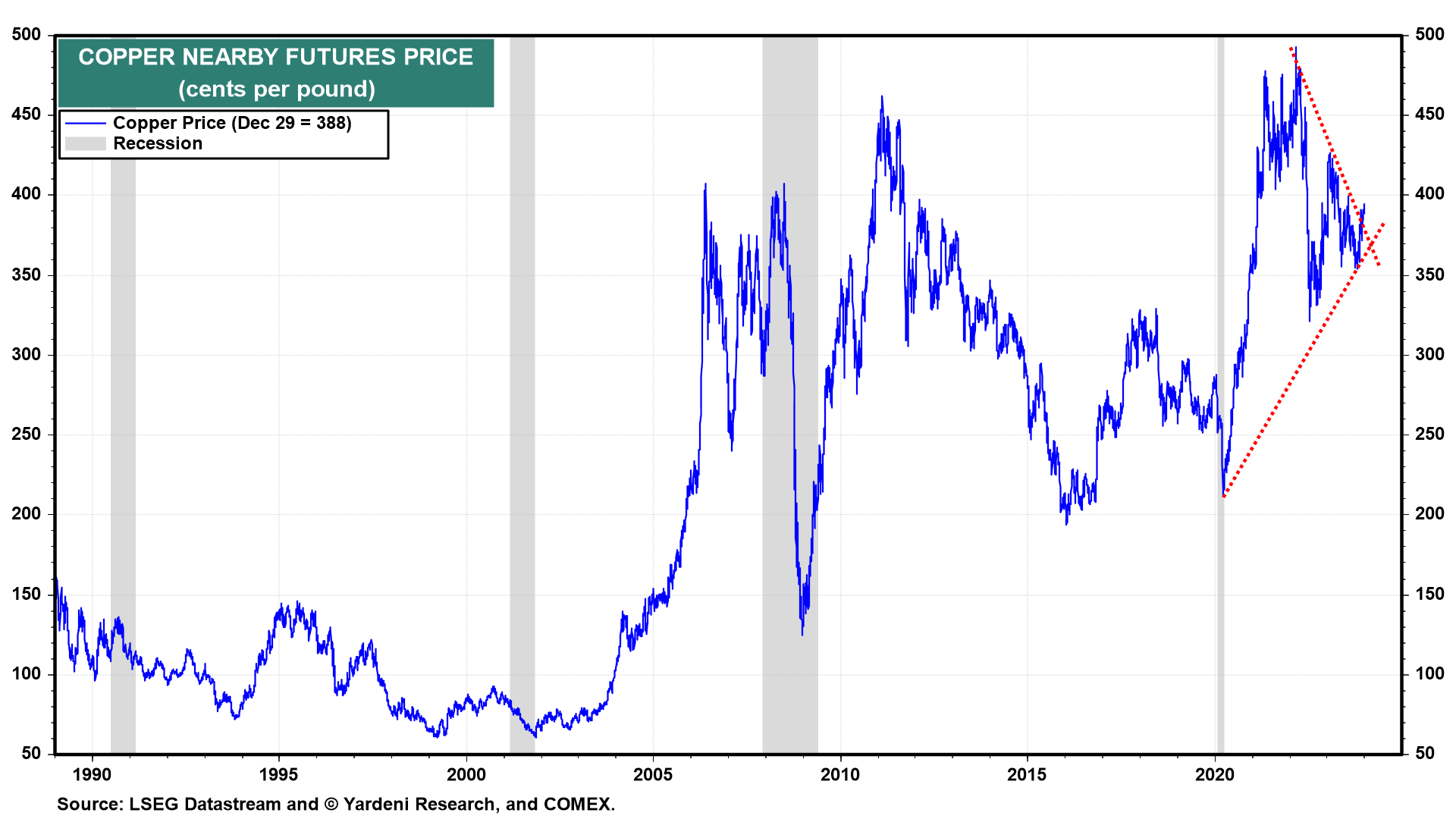

Copper is often described as the shiny metal with a PhD in economics because it provides useful insights into global economic activity. The price of the red metal has rallied in recent days, and could be on the verge of breaking out of its downtrend during 2022 and 2023 that resulted from the bursting of China's property bubble and the decline in US housing starts (chart).

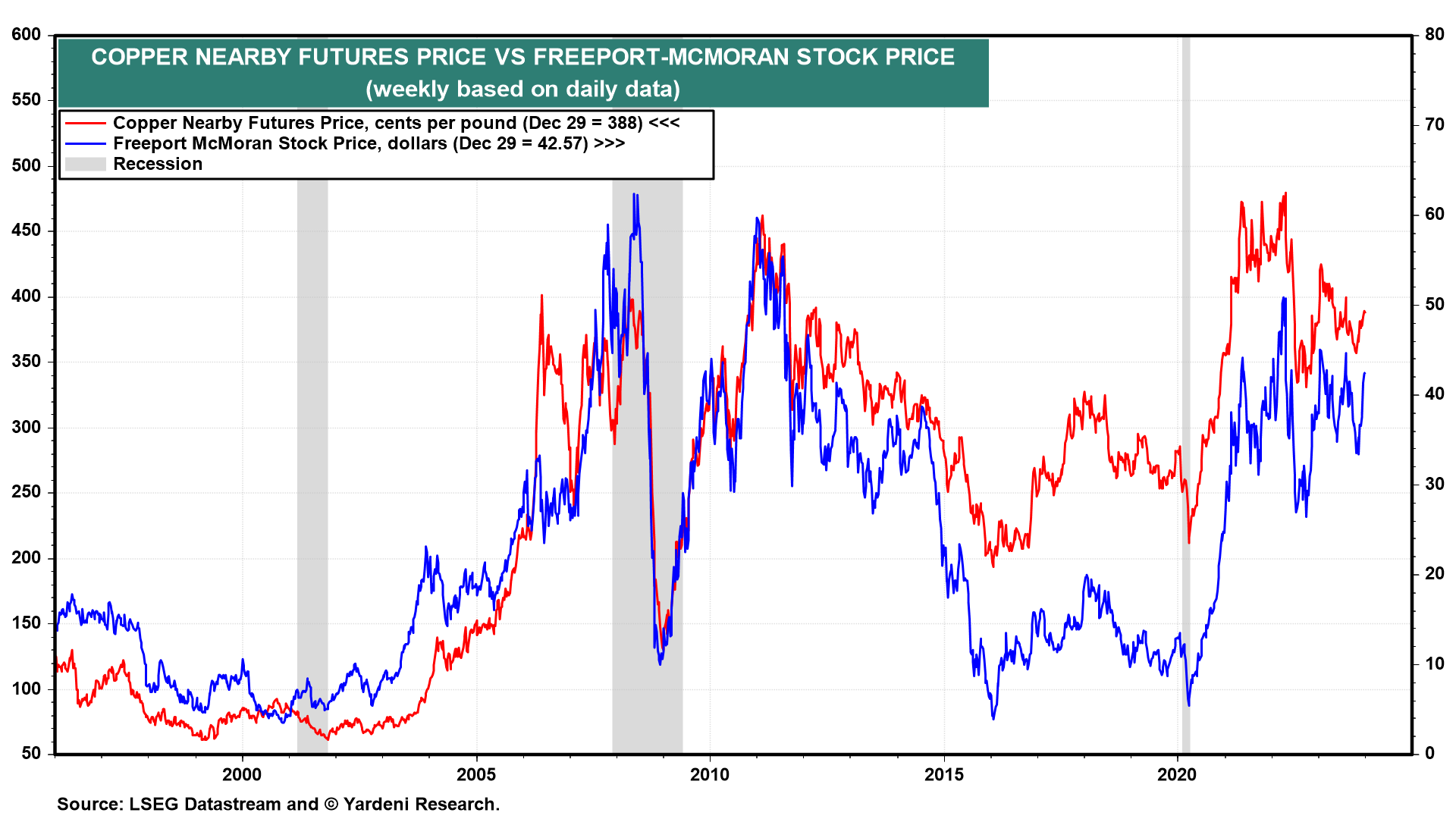

A similar pattern can be seen in the stock price of Freeport-McMoran (chart). The prices of the basic metal and the copper miner may be on the verge of moving higher confirming that the global economic outlook is improving as the new year begins.

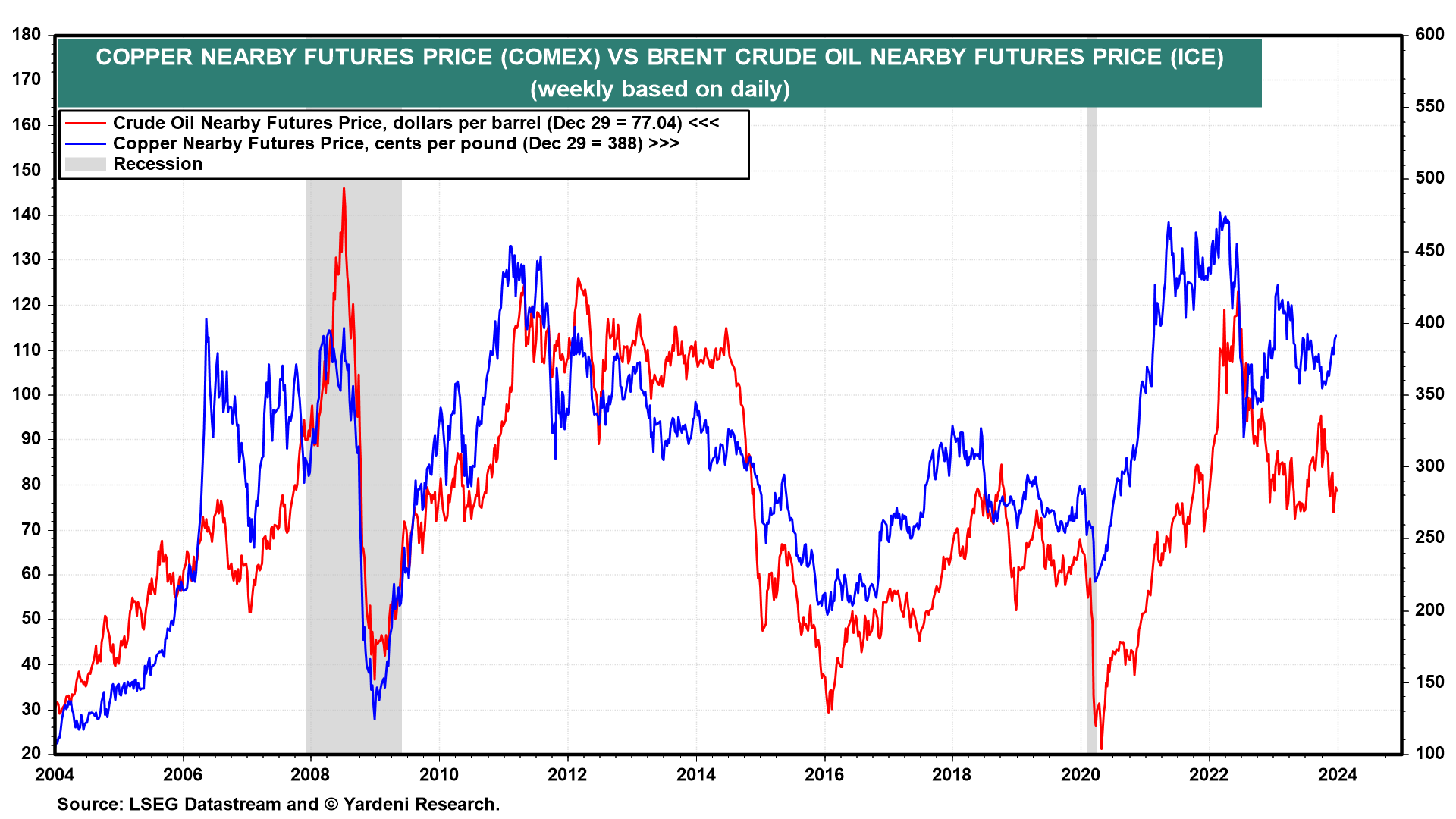

The price of a barrel of Brent crude oil is highly correlated with the price of copper because both are very sensitive to global economic activity. So far, the former is not confirming the recent strength of the latter (chart).

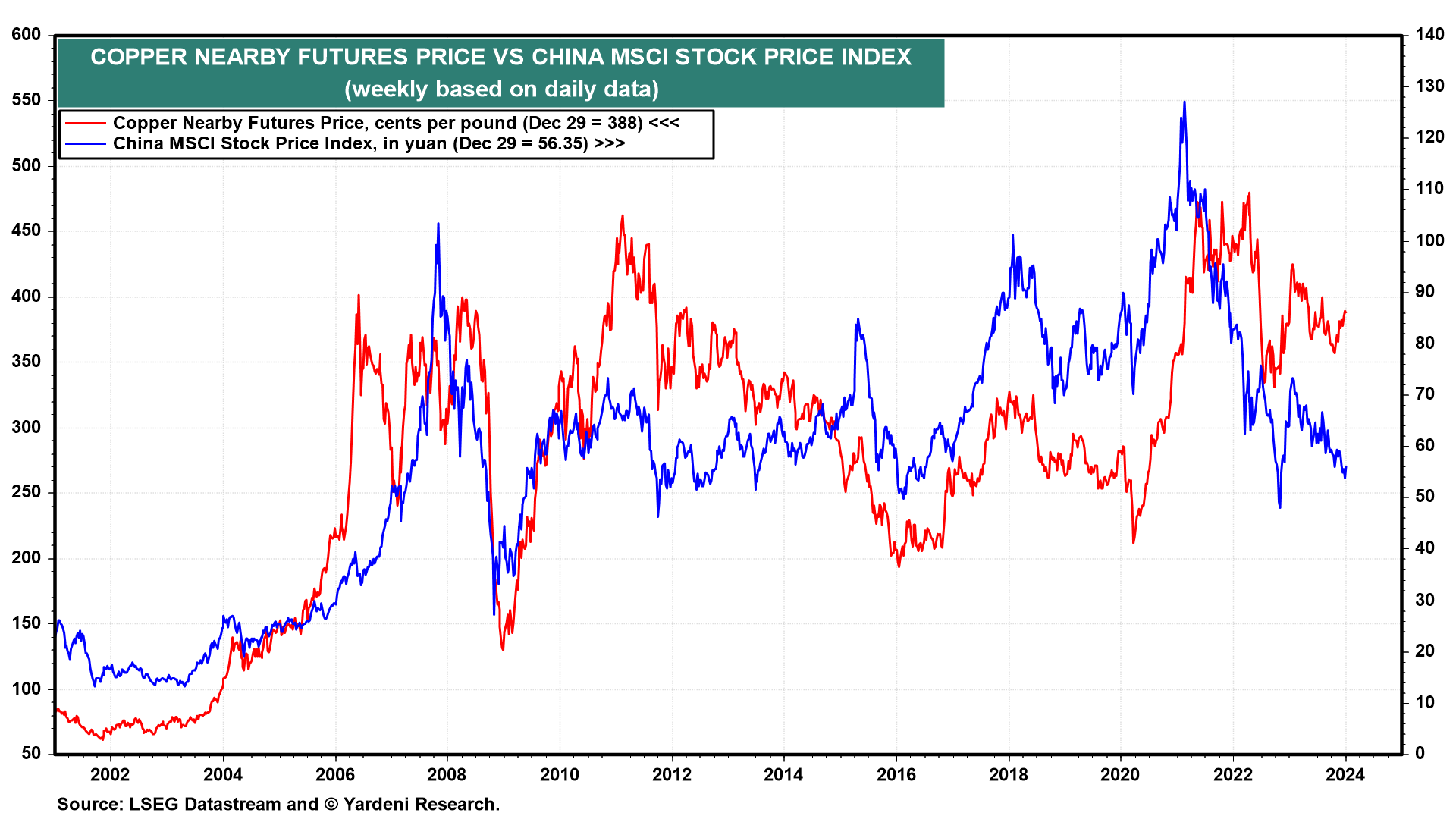

Also disagreeing with Dr. Copper's recent optimism is the China MSCI stock price index, which remains on a significant downtrend reflecting the weakness in China's economy and the country's debt crisis (chart). For now, we aren't convinced that the global economy is improving sufficiently to validate Dr. Copper's forecast. But we are paying close attention to the Doc's daily assessment.

These and other related charts are updated daily in our Copper Price Correlations chart book.