On Tuesday, the stock market sold off on fears of a hard landing. On Wednesday, the market rallied on better-than-expected earnings reports from Nike and FedEx and better-than-expected consumer confidence.

Today, the market sold off on news that the labor market remains tight, raising fears of higher-for-longer Fed rate hiking. On the other hand, the Index of Leading Economic Indicators, released today, was very weak. After the close yesterday, Micron announced it would reduce its headcount by about 10% in 2023, in the latest example of a technology industry slowdown weighing on employment.

The bulls can't win. If the economic indicators are too strong, the Fed will have no choice but to tighten until a recession occurs. If they are weak, then a recession might be coming sooner.

The only way the bulls can win is if inflation comes down faster than the Fed expects and the economy's landing in 2023 is soft rather than hard. That happens to be our scenario. We expect that Friday's personal income data for November will support our narrative.

The bears obviously won their tug-of-war with the bulls today. For those fearing that a strong economy will force interest rates higher (inevitably causing a recession) there were the following developments:

(1) Q3 real GDP growth was revised up to 3.2% from 2.9%. On December 20, the Atlanta Fed's GDPNow tracking model showed real GDP up 2.7% during Q4.

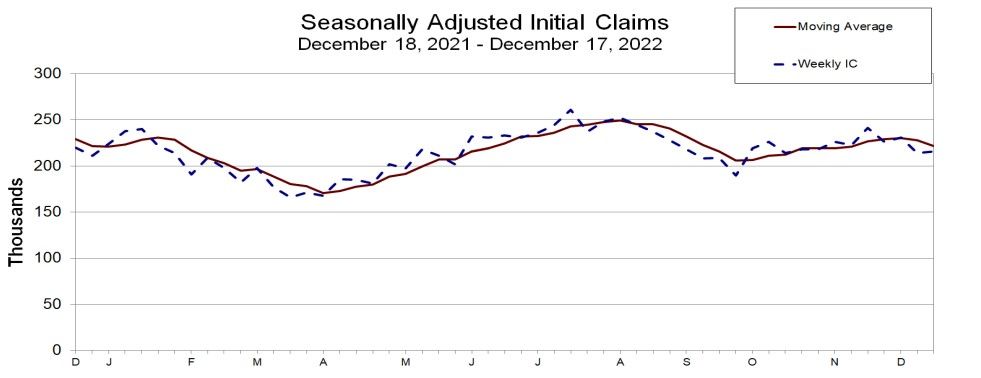

(2) Weekly data published today showed 216,000 people filed initial claims for unemployment benefits last week, up 2,000 on the week before (chart). They have hovered around that level since May, a sign of continuing labor-market strength.

(3) November's Index of Coincident Economic Indicators edged up 0.1% m/m to a new record high.

On the other hand, November's Index of Leading Economic Indicators (LEI) fell 1.0% m/m. It peaked nine months ago during February. Only stock prices contributed positively to the US LEI in November. The Conference Board, which compiles the data concluded: "[W]e project a US recession is likely to start around the beginning of 2023 and last through mid-year.” (See chart below.)