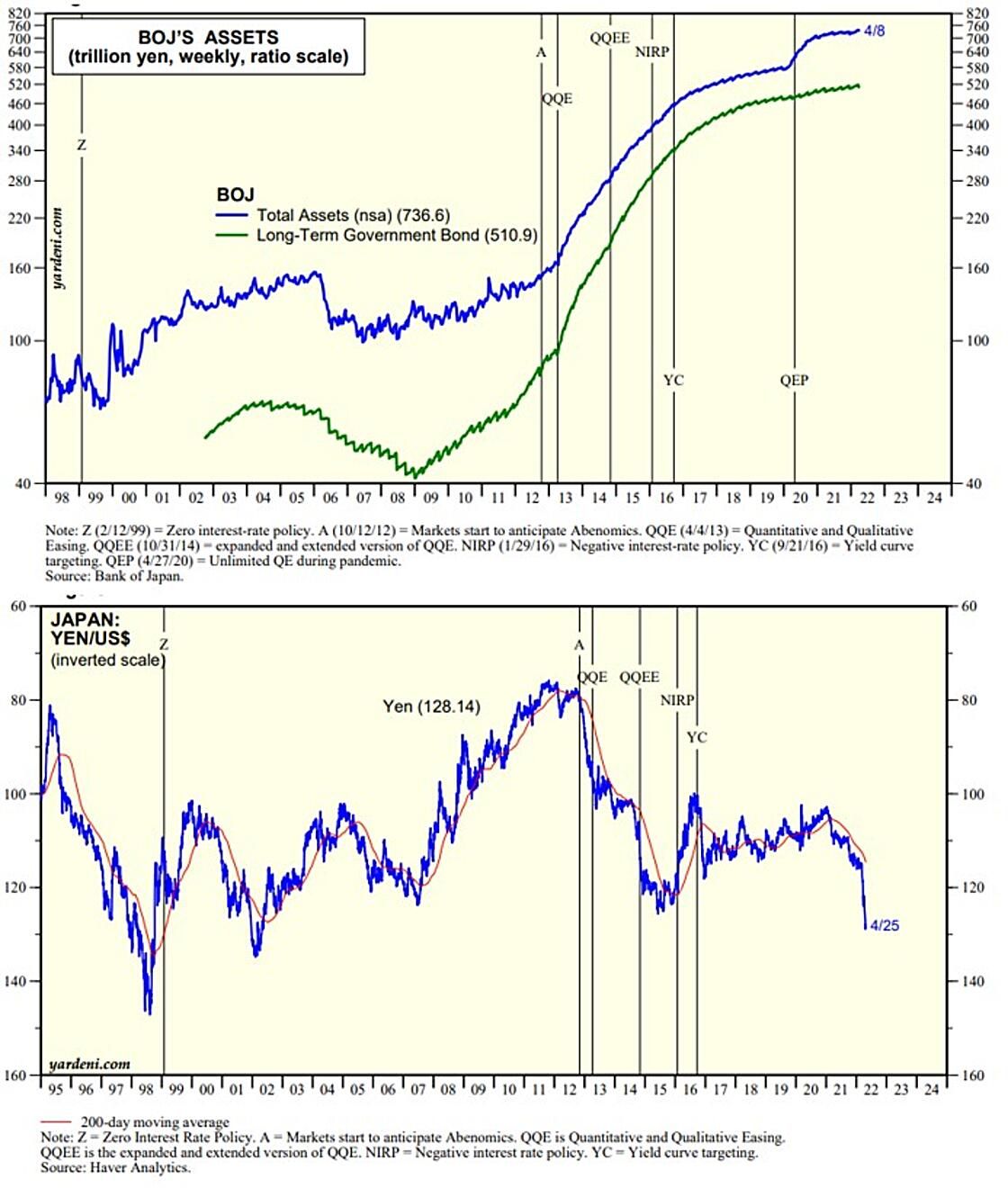

The Bank of Japan (BOJ) is an outlier. While all the other major central banks are turning more hawkish, the BOJ remains extremely dovish. This is causing the yen to dive.

Last week, the BOJ reiterated its ultra-easy monetary policy with four days of unscheduled bond buying as Japan’s widening interest-rate gap with the US put upward pressure on bond yields and weakened the yen.

At a two-day policy meeting ending on Thursday, the BOJ is widely expected to maintain its short-term rate target at -0.10% and its target for the 10-year bond yield around 0%.

Japan’s headline and core inflation rates remained remarkably low during March at 1.2% and -1.6% y/y.

Meanwhile, over in China, the Chinese yuan posted its largest three-day losing streak in nearly four years on growing worries of an economic slowdown in the world’s second-largest economy as a result of the pandemic lockdowns there. Commodity prices have declined modestly in response to China’s weakening economic prospects and a more hawkish Fed.

No wonder that the US Dollar Index is up 13.4% since the start of 2021.