The S&P 500 and the Nasdaq might have bottomed on Thursday, but we doubt it for reasons we get into below.

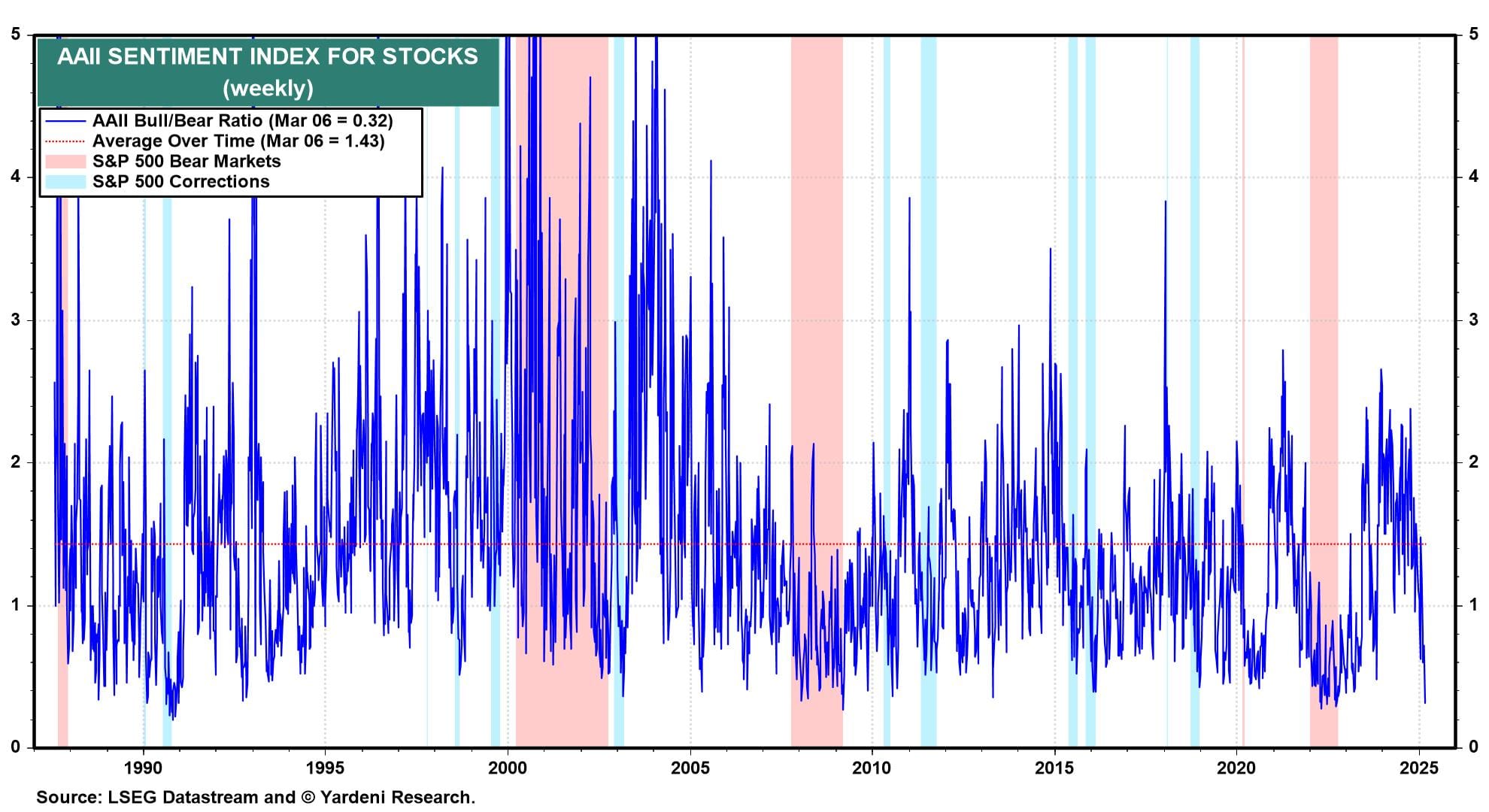

Both indexes rallied nicely on Friday and today. That action jibes with the extremely bearish sentiment readings of the bull/bear ratios compiled by Investors Intelligence and AAII. Last week, the former was down to 0.80, the lowest since the 2022 bear market, and the latter was down to 0.32, well below its average over time of 1.43 (chart). Both these ratios tend to be contrary indicators.

Helping the stock market move higher today was a rebound in February's retail sales, following a downward revision in January. That still caused the Atlanta Fed's GDPNow model to lower Q1's real GDP growth from -1.6% to -2.1%, led by a decline in the growth of consumer spending from 1.1% to 0.4%. However, the pattern of retail sales confirms our view that the weather depressed January's retail sales and also limited the rebound in February. That scenario was confirmed by the 2.4% jump in nonstore sales (which includes online sales) and the 1.5% drop in food services and drinking places last month (chart). We still expect to see strong sales numbers in March and April.