Stock market valuation and beauty have a lot in common: They are both in the eyes of the beholder. At the end of the original version of the movie King Kong (1933), the big ape’s death is blamed by his handler on Ann Darrow, Kong’s blonde love interest, played by Fay Wray: "It was beauty that killed the beast." Lots of investors are worrying that valuation could kill their stock market returns if today's historically high P/E multiples take a dive, especially now that bond yields are rising and the Fed is on pause.

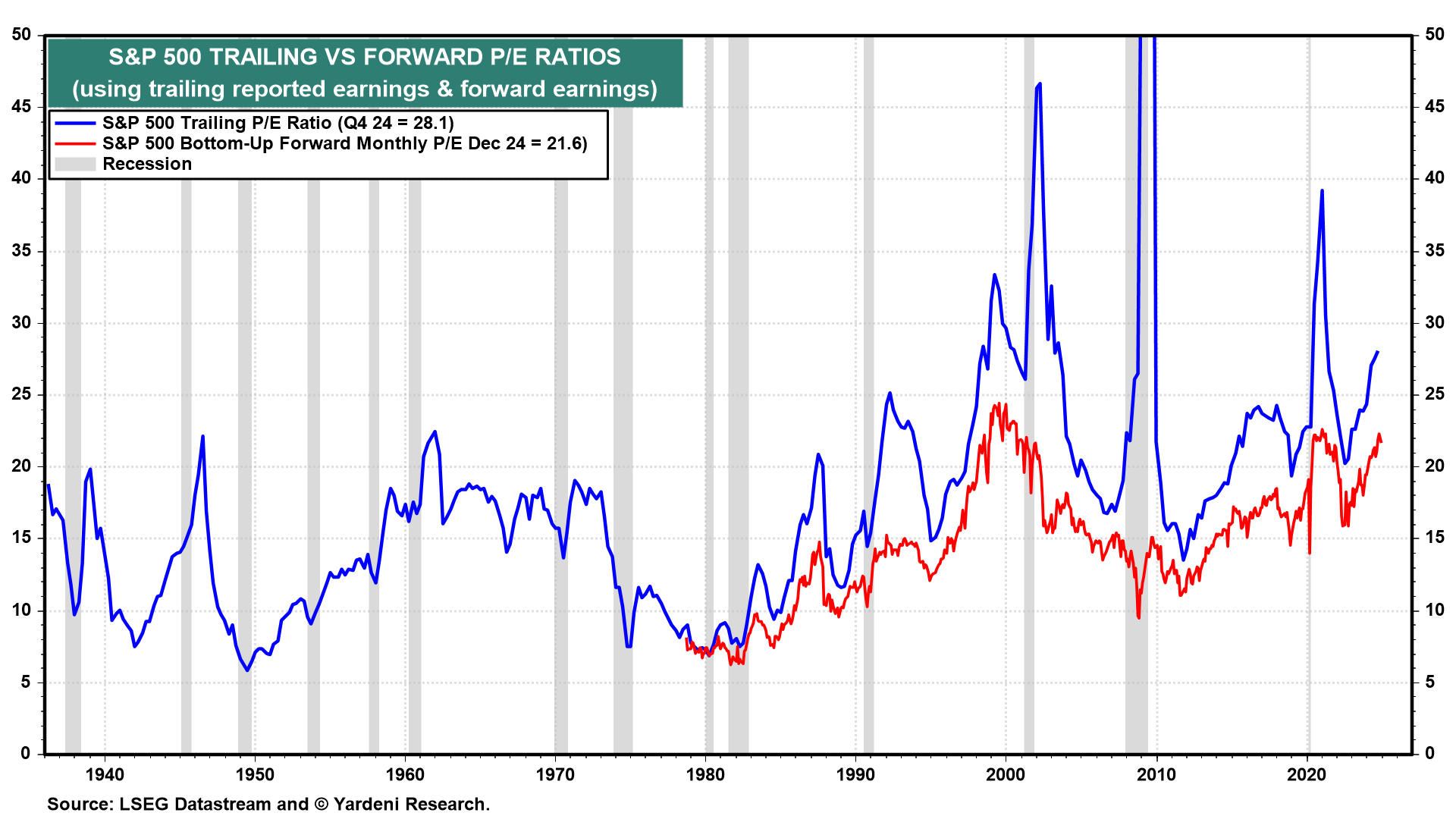

While this is a legitimate concern, multiples are high because investors perceive that the current economic expansion (which started during Q3-2020, just after the pandemic lockdowns were lifted) might last for a while longer, perhaps through the end of the decade. That outlook is consistent with our Roaring 2020s scenario. Valuation multiples tend to rise during long expansions and to fall quickly during recessions until early in the recovery periods that follow (chart).

From 1985 through 2000, the S&P 500 forward earnings yield and the 10-year Treasury bond yield tracked one another relatively closely. Then they diverged through 2020, mostly because the bond yield fell relative to the forward earnings yield. Arguably, bonds were grossly overvalued because of the Fed's quantitative easing during most of that period. The two yields are now equal for the first time since 2022. Stocks are now fairly valued relative to bonds. (BTW: Dr Ed dubbed this relationship the "Fed's Stock Valuation Model" in 1997.)