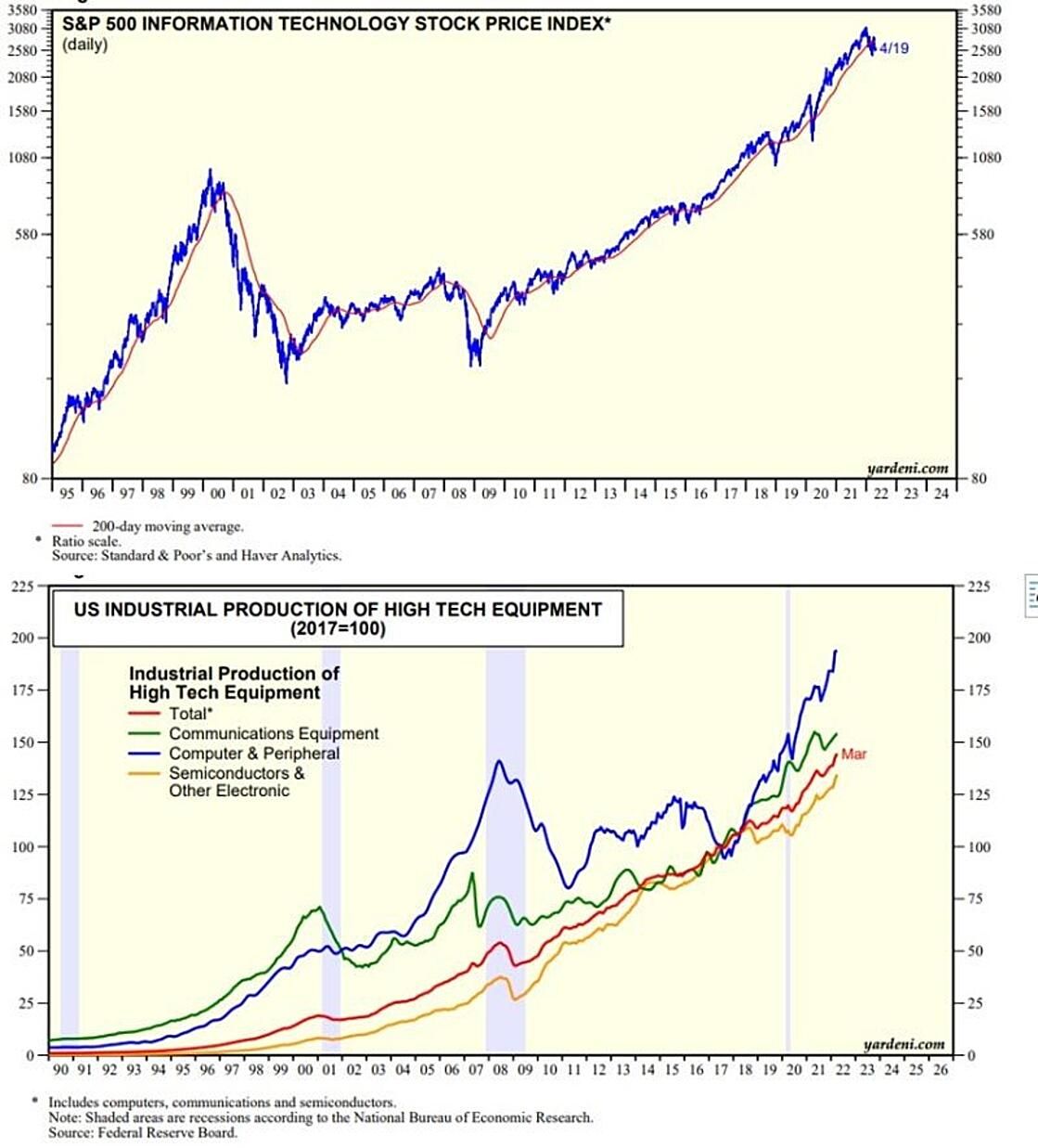

The S&P 500 Information Technology sector and the Communication Services sector are down 13.9% and 14.7% ytd, underperforming the S&P 500, which is down 6.4%. That's mostly because rising interest rates have depressed their valuation multiples and raised fears of a recession. Meanwhile, industry analysts continue to raise their estimates for revenues and earnings for both.

Another concern is now that more people are going back to school and to work, the demand for WFH technologies will weaken. If demand for computers weakens so might demand for semiconductors.

There's no sign of weakness in the production index for high-tech industries (up 8.9% y/y through March and its major components: computers and peripherals (11.9%), communication equipment (1.0%), and semiconductors and other electronics (12.1%).They are all soaring in record high territory.

Supply-chain problems have plagued the production of semis while demand remains high and should go higher. Semis are inside everything that produces data in our digital world. It will take time for capital-intensive more semi-producing factories to come online, but continued exponential growth is likely for semiconductors and many other technologies.