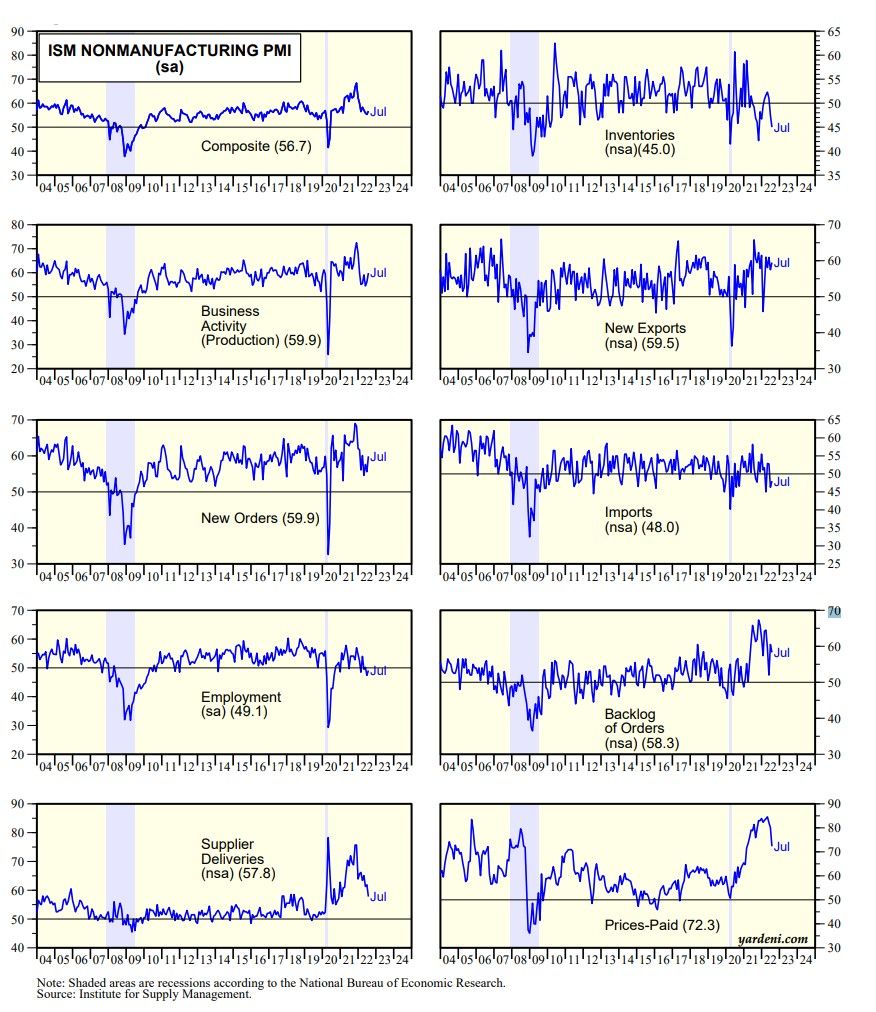

The S&P 500 stock price index and the 10-year US Treasury bond yield are both up today following July's better-than-expected ISM nonmanufacturing purchasing managers index (NM-PMI). It edged up to 56.7 last month. Last week's S&P Global flash estimate suggested it would be weaker. Here's more:

(1) The NM-PMI's new orders index was strong at 59.9. But the employment index (at 49.1) surprised on the downside, though yesterday's JOLTS report did show fewer job openings in some major services industries.

(2) The supply-chain indicators were mixed with the supplier- deliveries index (at 57.8) continuing its decline since late last year, while the backlog-of-orders index (at 58.3) remaining elevated.

(3) As in July's manufacturing survey, the prices-paid index also continued its downward trend since the end of last year, but remained elevated at 72.3.