In America we just celebrated our Independence Day. We should also celebrate that we've been energy independent since 2019. So why are gasoline prices so high? Consider the following:

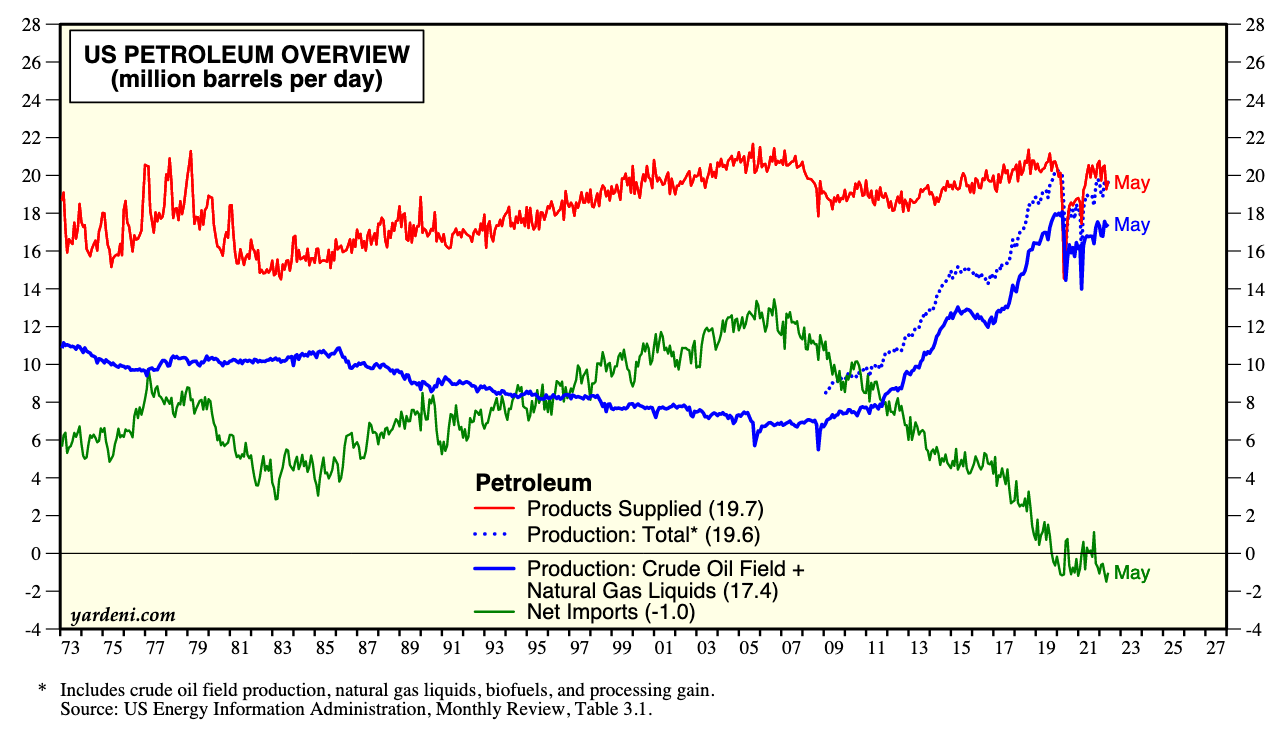

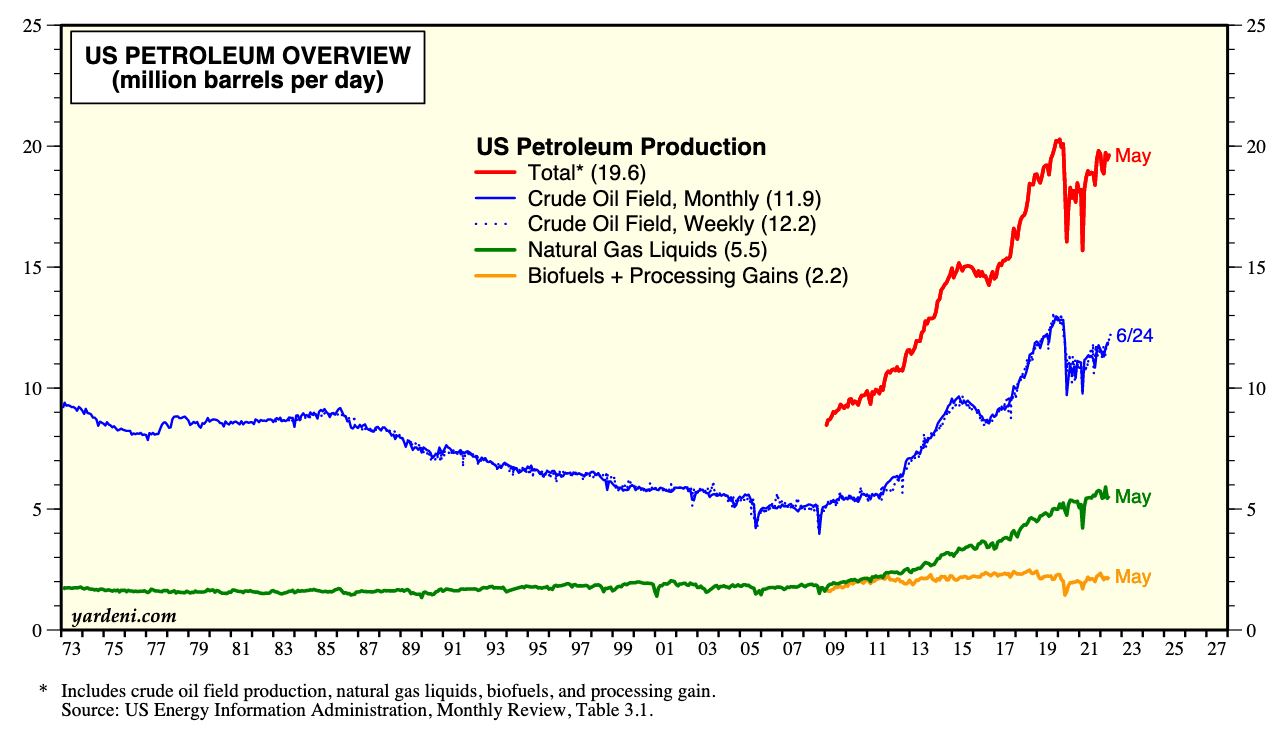

(1) The latest data show that during May, the US produced 19.6mbd of crude oil and petroleum products, while petroleum products supplied (a measure of total demand) was 19.7mbd.

(2) US crude oil field production rose to 12.2mbd during the June 24 week, approaching its 2019 record high of 13.0mbd. It may soon be at record highs again as high prices stimulate more drilling.

(3) Petroleum prices have been soaring in the US and around the world during H1-2022. That's because Western governments responded to Russia's invasion of Ukraine by placing sanctions on Russian oil, which continues to be sold to countries such as India and China at a discount. However, Europeans have had to scramble to find other sources of crude oil, boosting US exports of crude oil and petroleum products to a record 9.6mbd.

(4) The high price of crude oil seems to reflect mostly geopolitical risk rather than a serious shortage of crude. There are no lines at the gasoline pumps. On the other hand, a shortage of refining capacity in the US has widened crack spreads dramatically putting an additional premium on the prices of gasoline and diesel fuels.

(5) Slowing global economic growth is already weakening commodity prices, including energy commodities.

(6) What about JPMorgan's $380 oil scenario? That's a worst-case possibility if Russia slashes output by 5mbd in retaliation for price caps that the G7 nations intend to impose on Russian oil. Odds are that the Russians will continue to sell all the oil they can in global markets at a discount to entice buyers, which is what they are doing now.