Stock traders took some profits today. They were probably nervous that Fed Chair Jerome Powell will be less dovish tomorrow than the markets are about the outlook for rate cuts beyond 25bps in September. We've been less dovish than the markets since mid-June because we've been more bullish on the economy and the labor market than the consensus.

Today's economic releases showed the US economy continues to chug along. The services-providing sector remains strong, and there are even green shoots sprouting in housing. Abroad, there's some optimism percolating that real growth may be improving in Europe. Nevertheless, we continue to favor the US over the Eurozone. The US has a much more compelling growth story, in our opinion.

Here's more on today's economic releases:

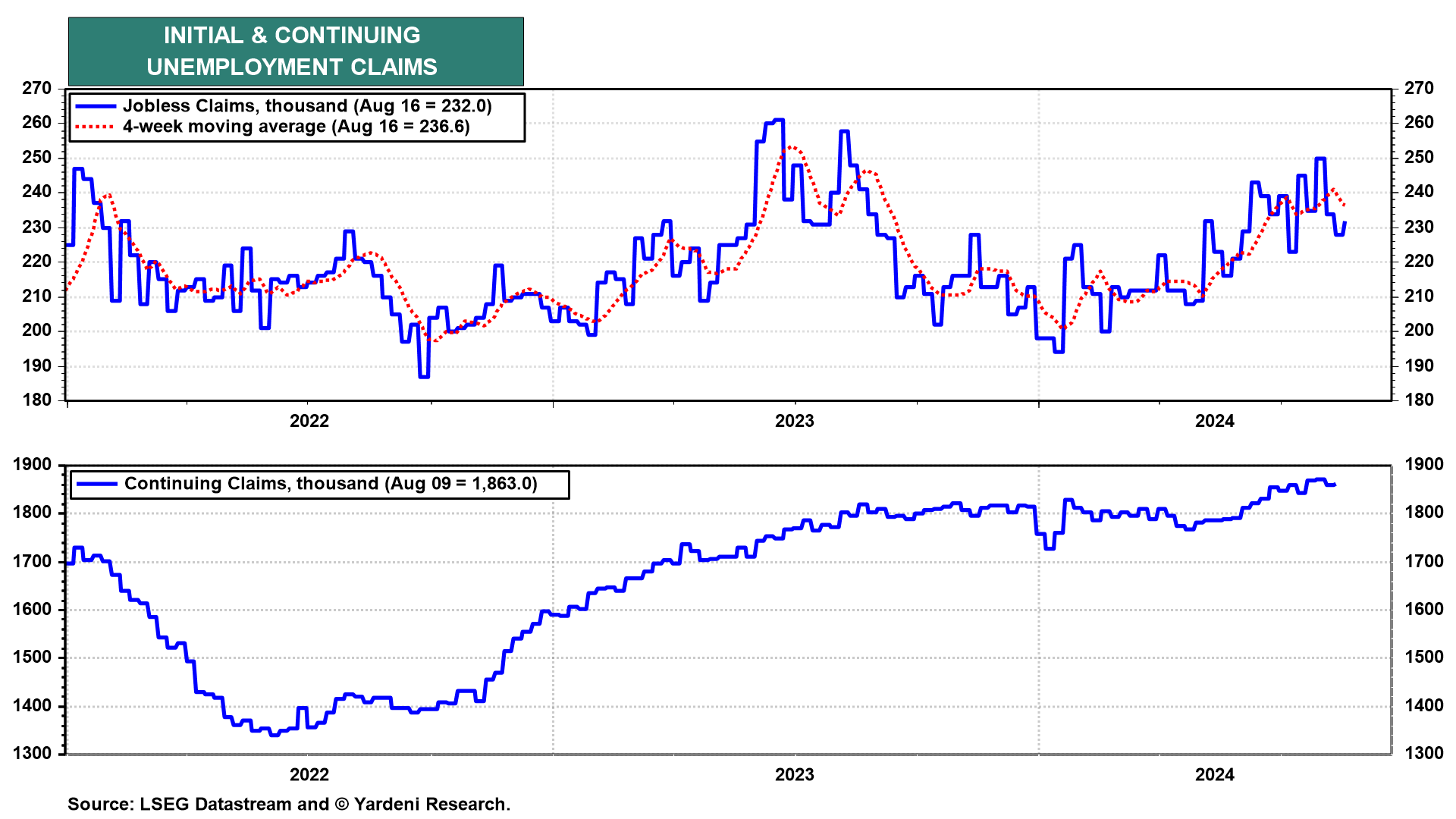

(1) Unemployment claims. We've been keenly focused on jobless claims, Challenger layoffs, and the JOLTS reports for confirmation that the labor market remains resilient. Today's jobless claims report was a good one for us. Initial claims rose 4,000 to 232,000 (sa) in the week ended August 17, while continuing claims fell 1,000 to 1.863 million (chart). The insured unemployment rate, which is based on state unemployment insurance claims, remains at just 1.2%. The latest claims data cover the survey week for this month's employment report and raise the possibility that August's unemployment rate might surprise with a downtick.

(2) Purchasing managers surveys. Today's August flash PMI report from S&P Global for the US showed that the NM-PMI rose from 55.0 in July to 55.2 this month, while the M-PMI fell from 49.6 to 48.0. Prices charged for goods and services rose at their second slowest pace since June 2020. This all aligns with our view that the services economy's strength is still offsetting the rolling recession in goods, and that disinflation prevails.

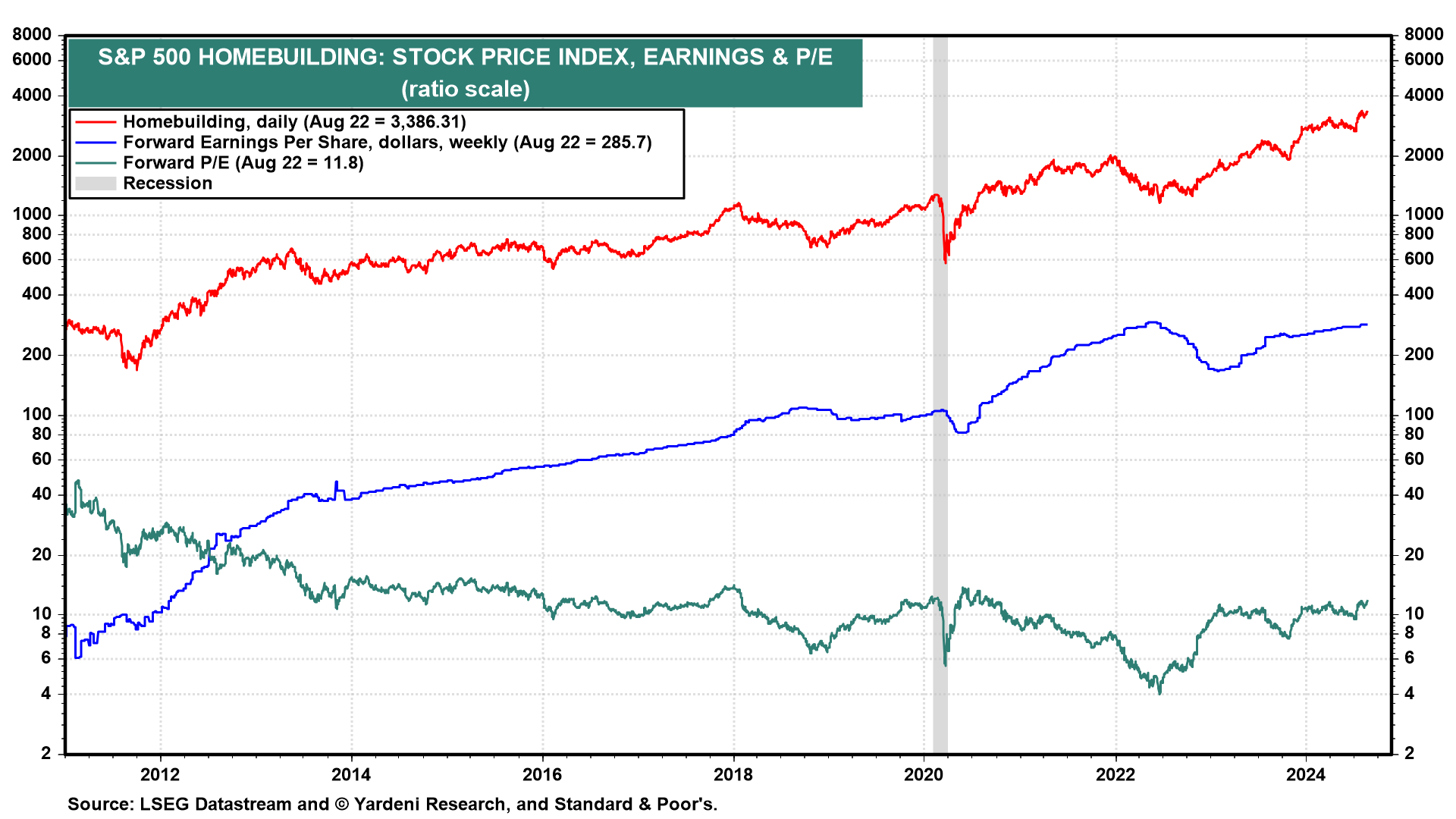

(3) Housing. July's existing home sales rose 1.3% m/m to an annual rate of 3.95 million units (sa), stronger than expected. However, sales are down 2.5% y/y. But with the average rate on a new 30-year fixed-rate mortgage down to 6.49% from a six-month high of 7.22%, we expect that housing will recover from its rolling recession in coming months. Indeed, the S&P 500 Homebuilding stock price index is back in record-high territory (chart).

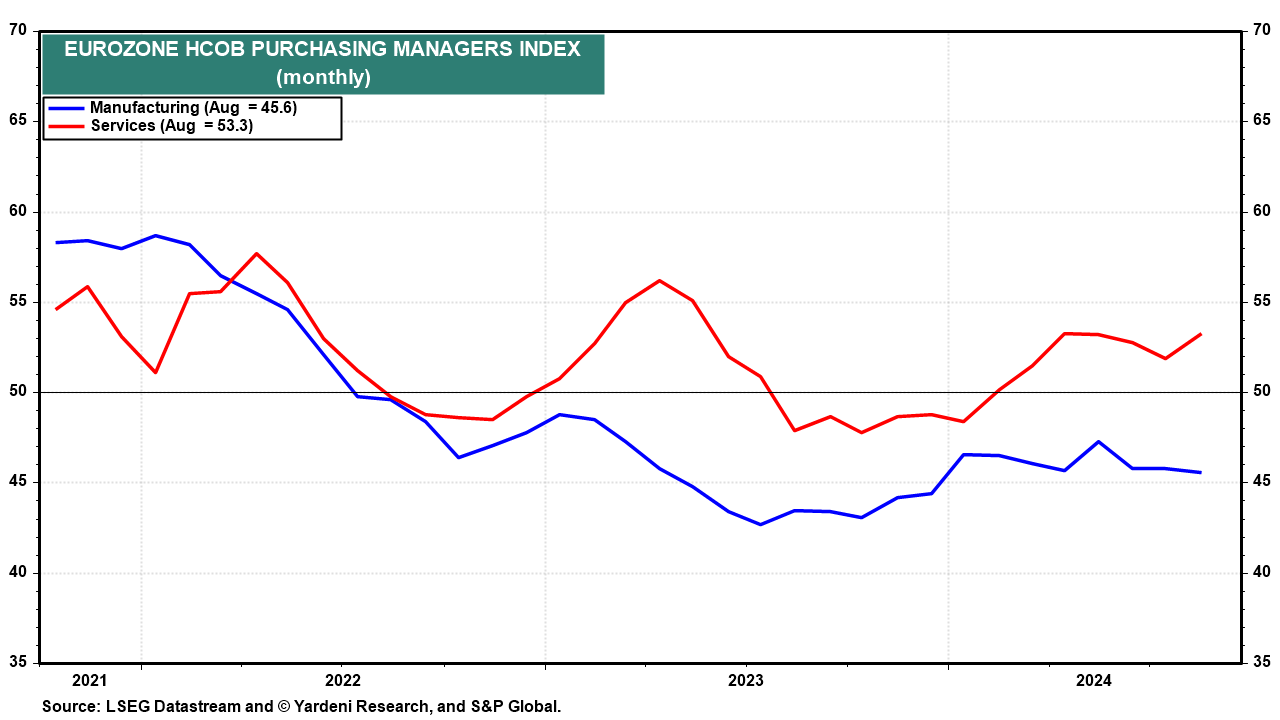

(4) Europe. Flash NM-PMIs for the Eurozone were stronger than expected, perhaps indicating that growth is recovering in the region (chart). However, much of the Eurozone's strength came from France, where the NM-PMI jumped from 50.1 to 55.0 thanks to hosting the Olympics. The region's M-PMI remained depressed in August.

Another potential positive we learned today was that negotiated wage growth fell from 4.74% y/y in Q1 to 3.55% in Q2. Perhaps that gives the European Central Bank room to cut rates a bit quicker.

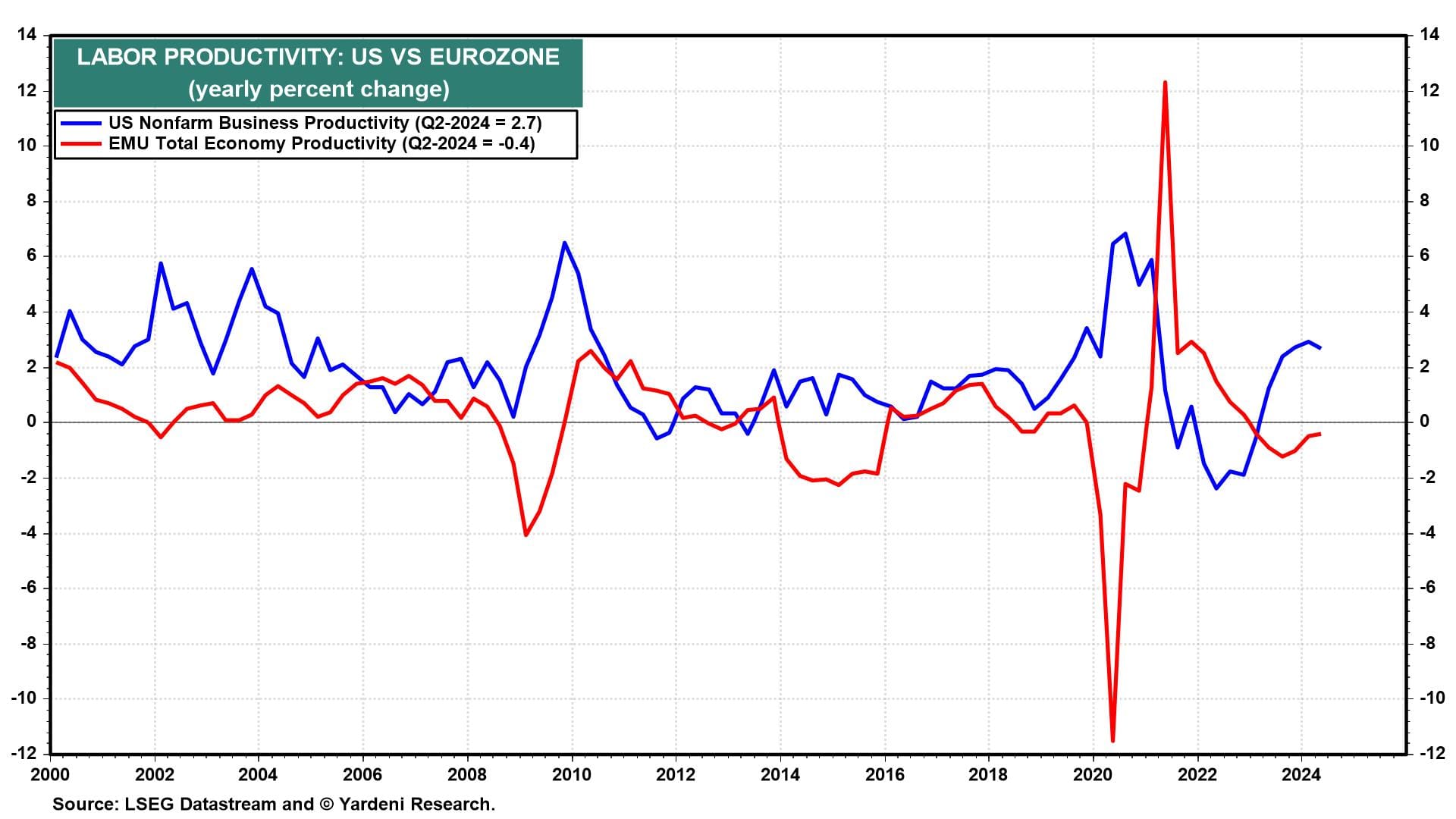

(5) US versus Eurozone. One reason we're still cautious on the Eurozone is that productivity there is weak. A very inflexible labor market along with regulatory barriers to innovation create a wide gap between productivity growth in the US and Eurozone (chart). Yesterday's US payroll revisions imply US nonfarm productivity rose 3.4% y/y in Q1 rather than 2.9%. Eurozone productivity growth has been negative for several quarters.

*Curious readers may note the inverse relationship between US and EU productivity during recessions. That's because European employers are much more likely to hang onto employees during downturns, weighing on productivity. US employers, meanwhile, can fire at-will, allowing labor to shift to where it's needed. That's one factor that's driven US outperformance in the post-pandemic period.