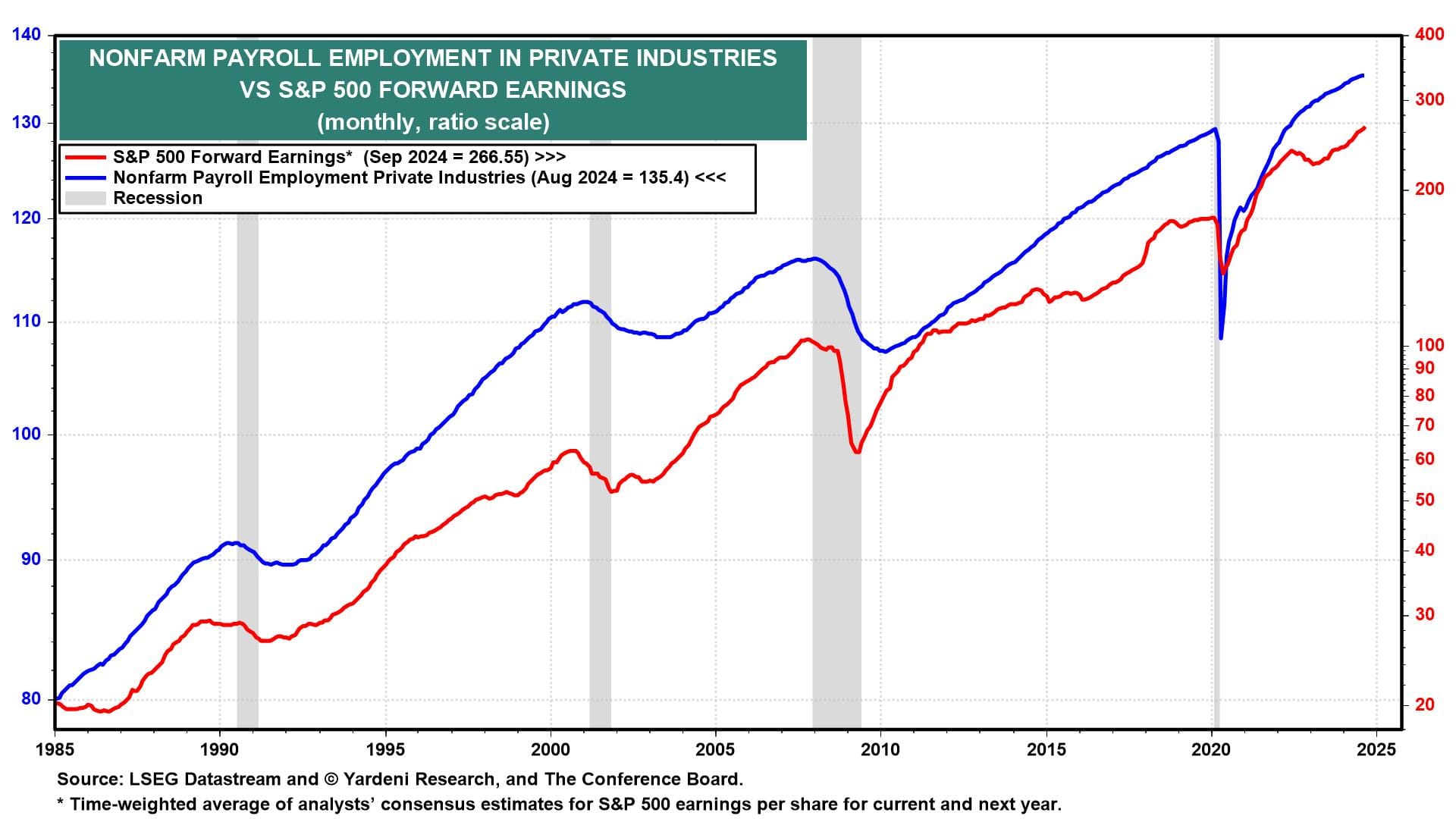

While everyone in our business breathlessly awaits tomorrow's payroll employment report, the economy passed the brunt of this week's labor market tests with flying colors. Of course, the labor market is showing signs of easing. But that's mostly compared to the record tightness seen a couple years ago. We think the labor market is normalizing. Meanwhile, the economy continues to prove stronger than many thought possible. That should continue to boost corporate profits and therefore employment (chart).

Here's more on the latest data:

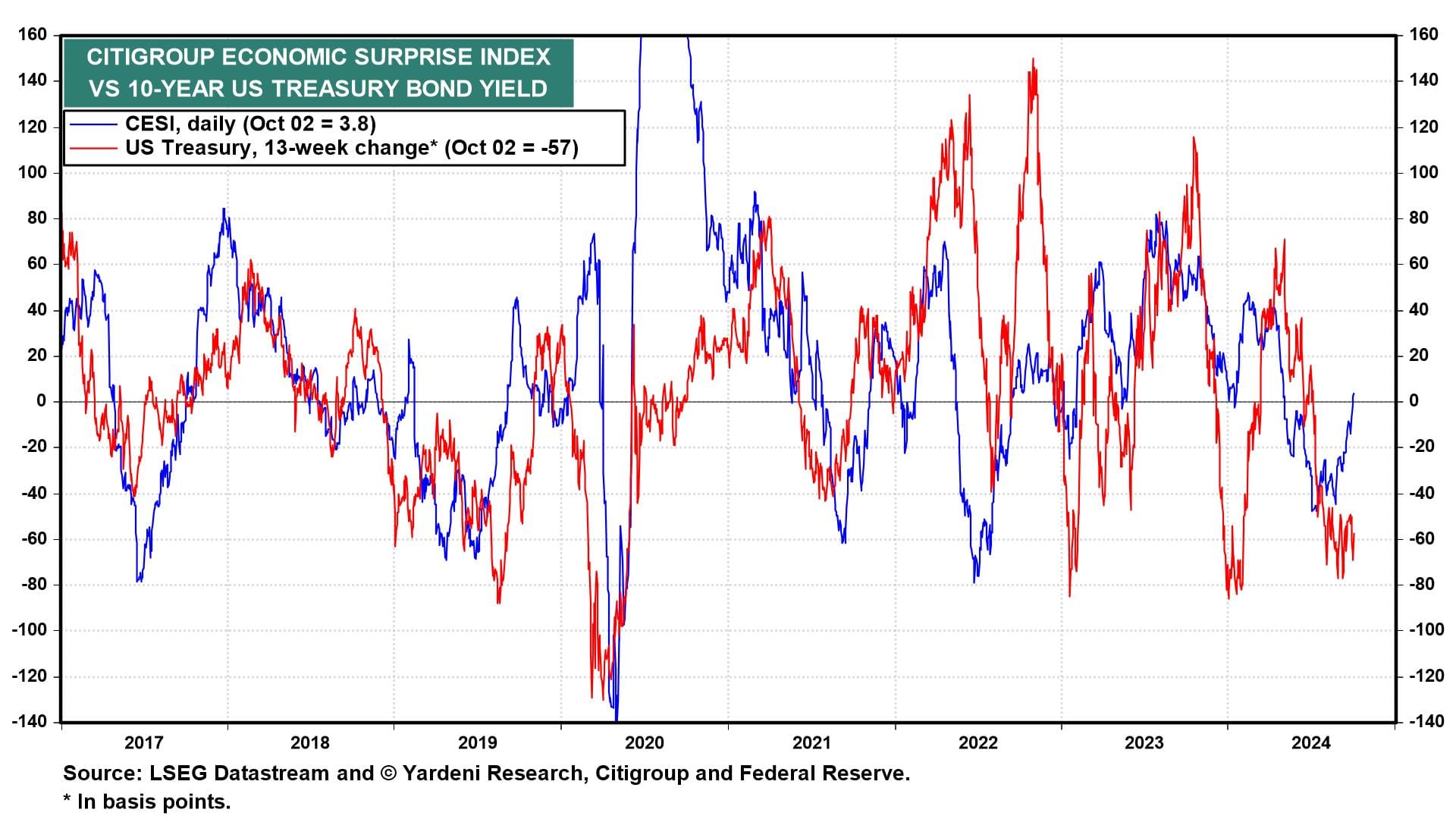

1) CESI. The Citigroup Economic Surprise Index (CESI) turned positive this week for the first time in five months (chart). That's no surprise to us. When economic data are stronger than expected, that tends to boost the economic growth and inflation expectations baked into the 10-year Treasury yield, which is up roughly 2obps to 3.83% since the Fed cut the federal funds rate by 50bps on September 18. We think it could rise back to 4.00%--particularly now that oil prices are rebounding and import prices are likely to rise the longer that the dockworkers' strike lasts.

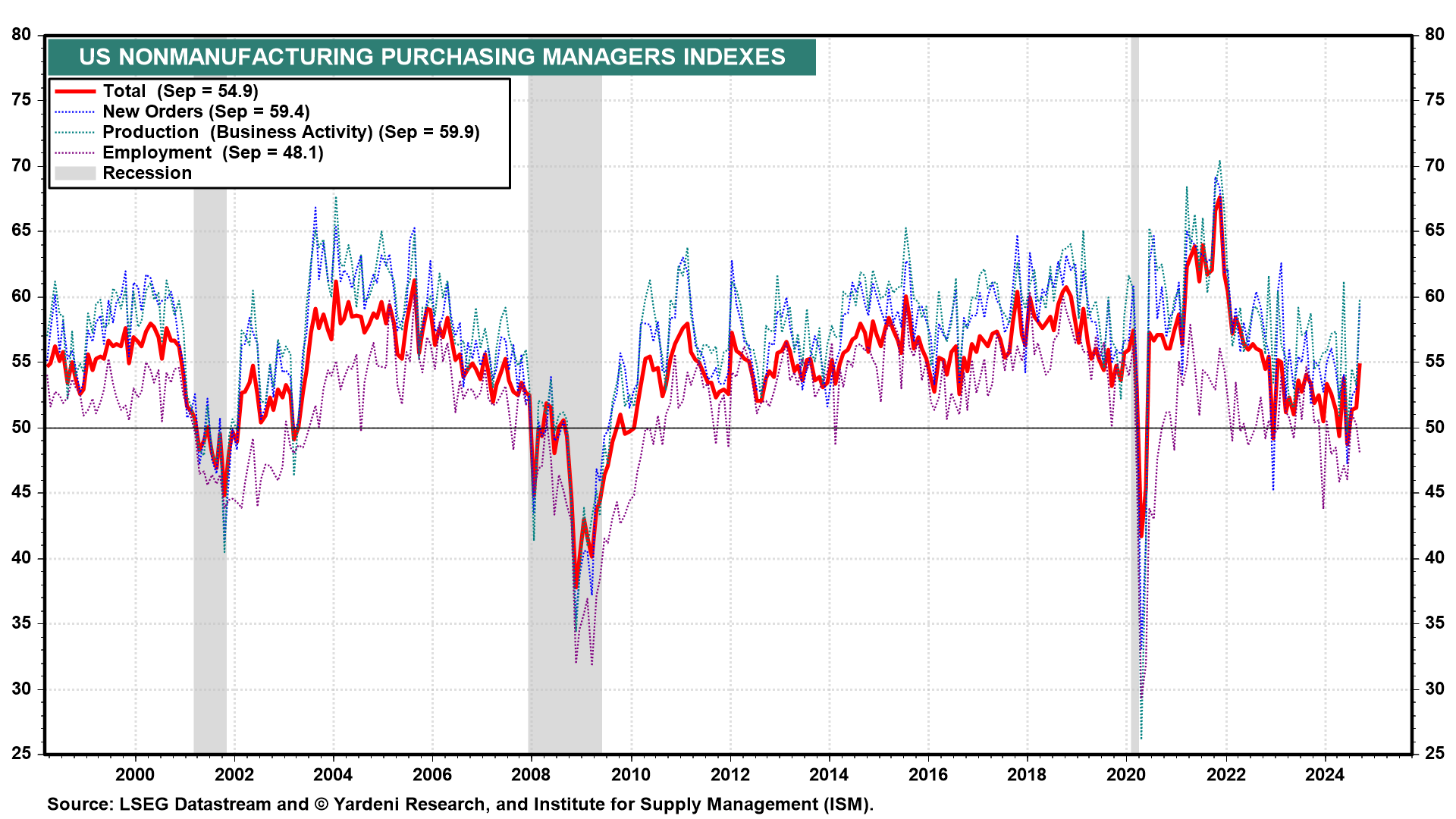

2) NM-PMI. September's ISM nonmanufacturing PMI jumped from 51.5 to 54.9, the highest reading since February 2023 (chart). The new orders and production sub-indexes both surged. The employment sub-index was relatively weak.