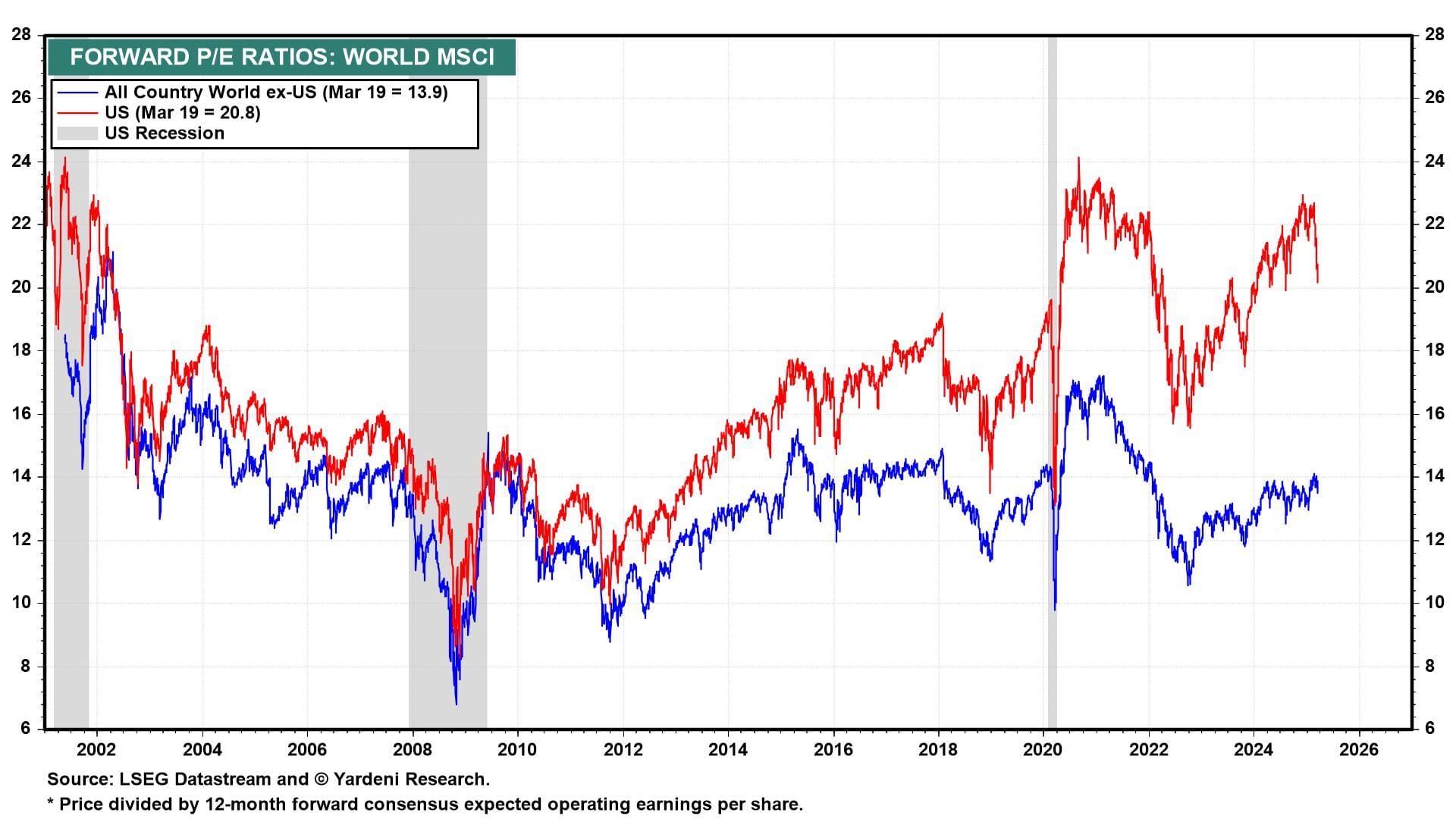

Today's batch of economic data releases was positive on balance but also suggests that Trump Tariff Turmoil 2.0 could dampen future growth. Stock prices seesawed between gains and losses, while Treasury yields slid a bit. Markets continue to suggest that economic growth outside of the US is increasingly likely to improve while downside risks to US growth are rising. As a result, US stock valuation multiples are falling closer to their international counterparts (charts).

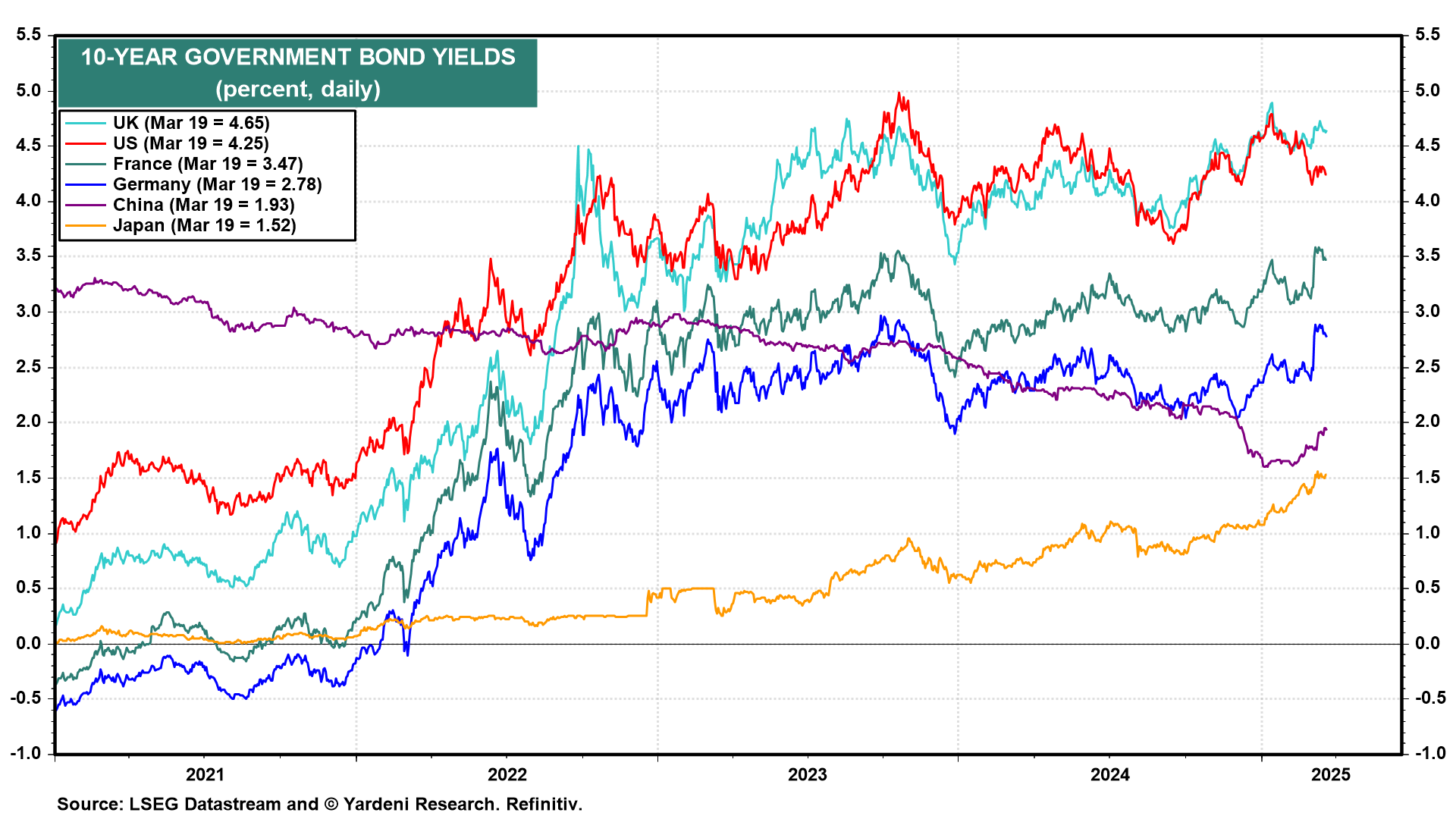

The same can be said about the spread between US government bond yields and foreign ones (chart).

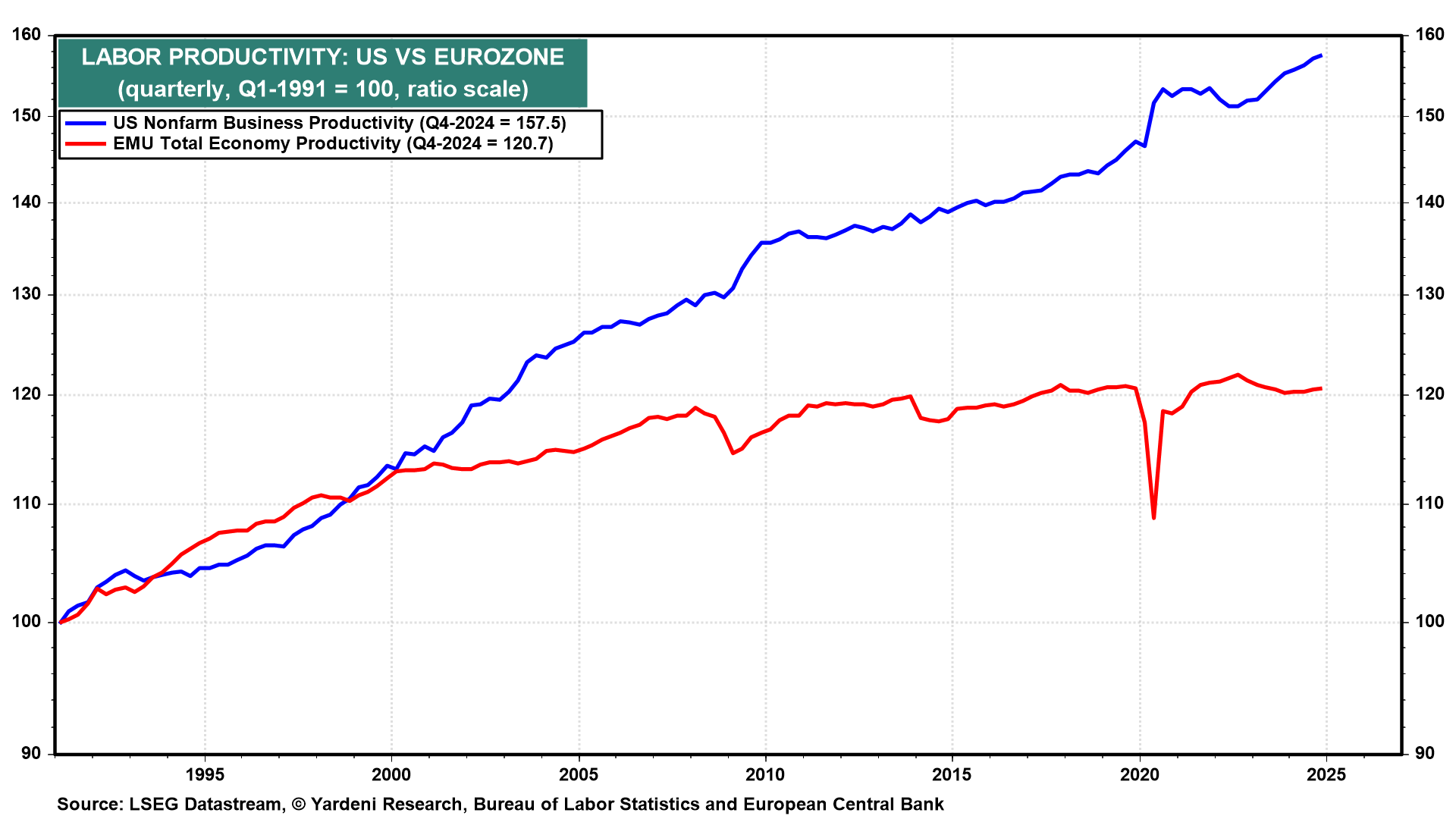

Still, the gaps in stock market multiples and sovereign bond yields in the US relative to overseas ones remain relatively wide. We expect they will remain so if US productivity growth continues to outpace productivity growth abroad, especially in Europe (chart). That’s our expectation.

Let's review today's data, which mostly underscore the US economy's resilience:

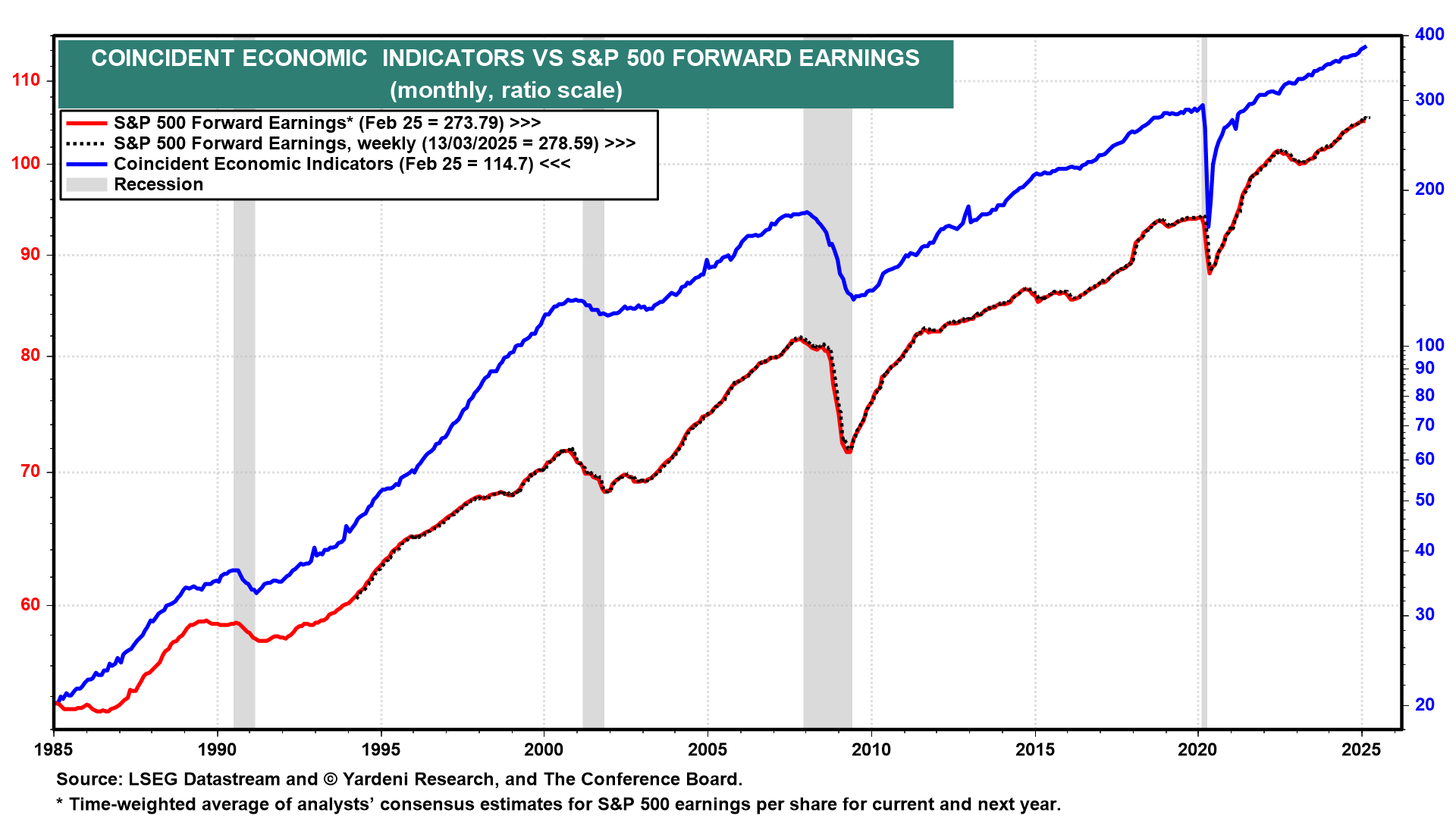

(1) Coincident Indicators. The Index of Coincident Economic Indicators rose 0.3% m/m during February to a new record high (chart). This series is highly correlated with S&P 500 forward earnings, which rose to a record high as well during the March 13 week.

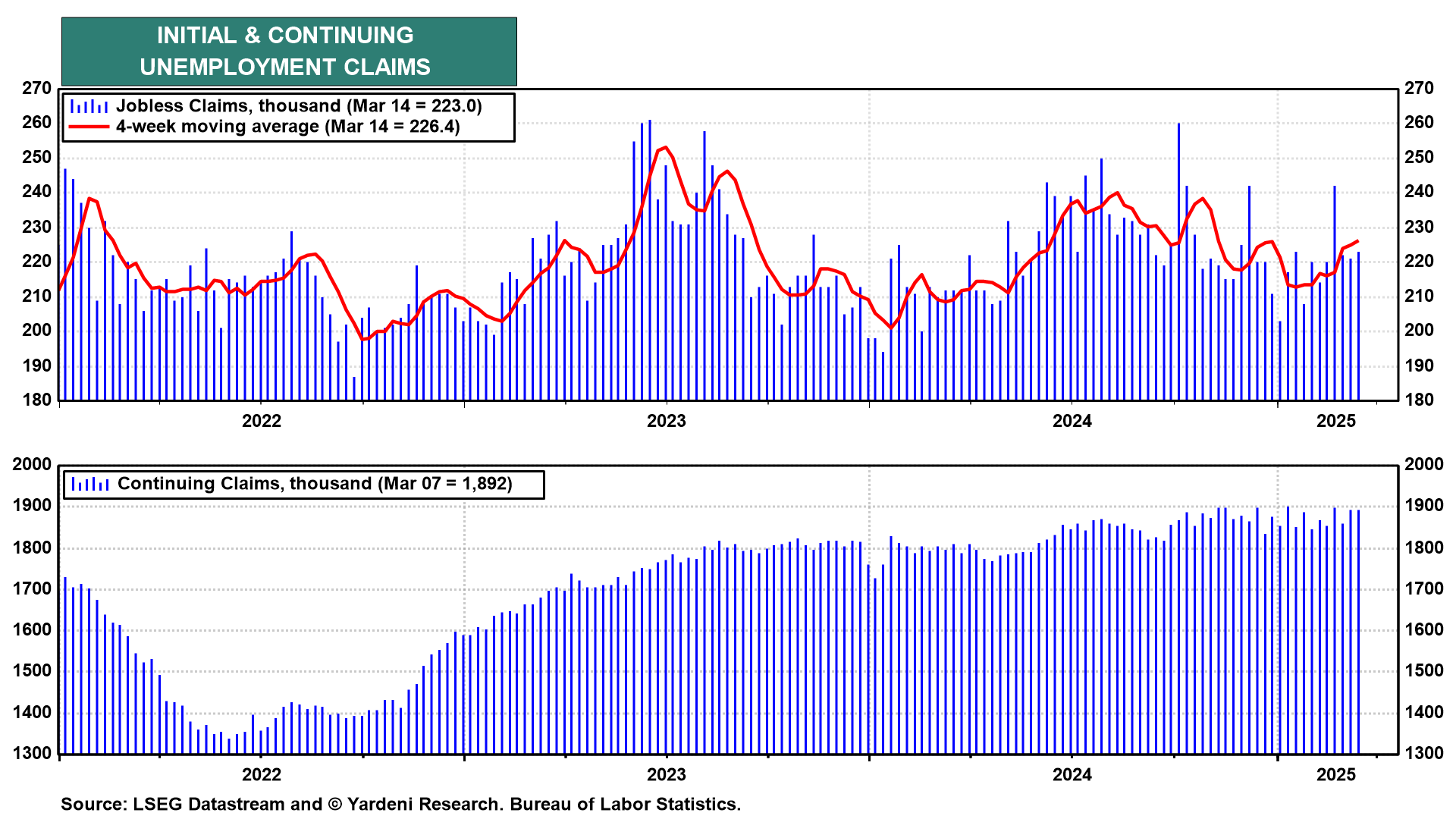

(2) Jobless claims. The labor market remains strong, underpinning our belief in the US consumer. Initial jobless claims totaled just 223,000 for the week ended March 15, up 3,000 from the prior week and historically low (chart). Continuing claims rose 22,000 but have plateaued just below 1.9 million for the past several quarters.

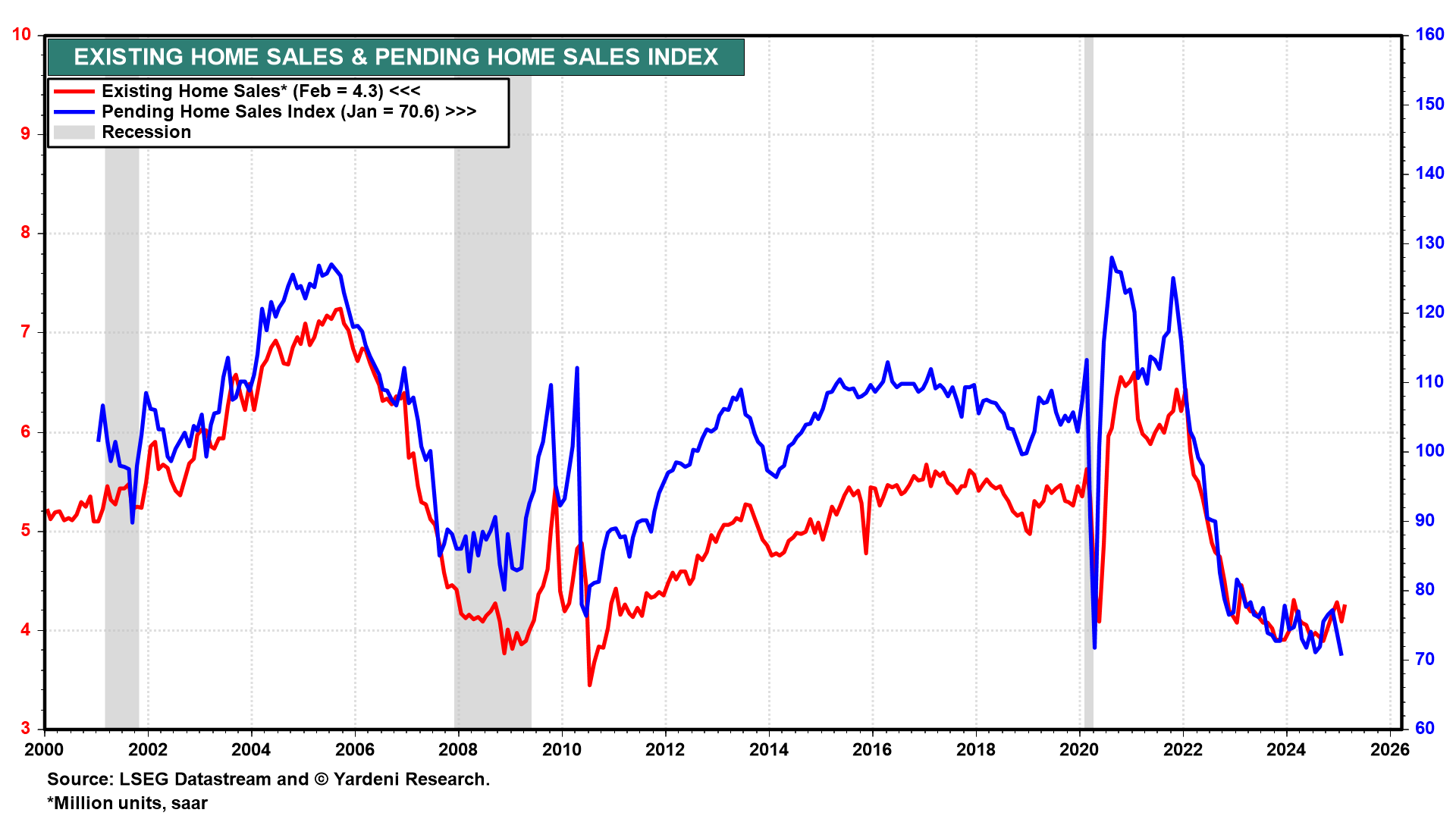

(3) Existing home sales. Existing home sales rose 4.2% (saar) in February (chart). While sales did fall 1.2% y/y, they handily beat expectations for a monthly decrease. Lower pending home sales and rising inventories suggest home sales will fall in the coming months. However, as long as Treasury yields remain around current levels, mortgage rates may be low enough for the housing market to thaw in the spring.

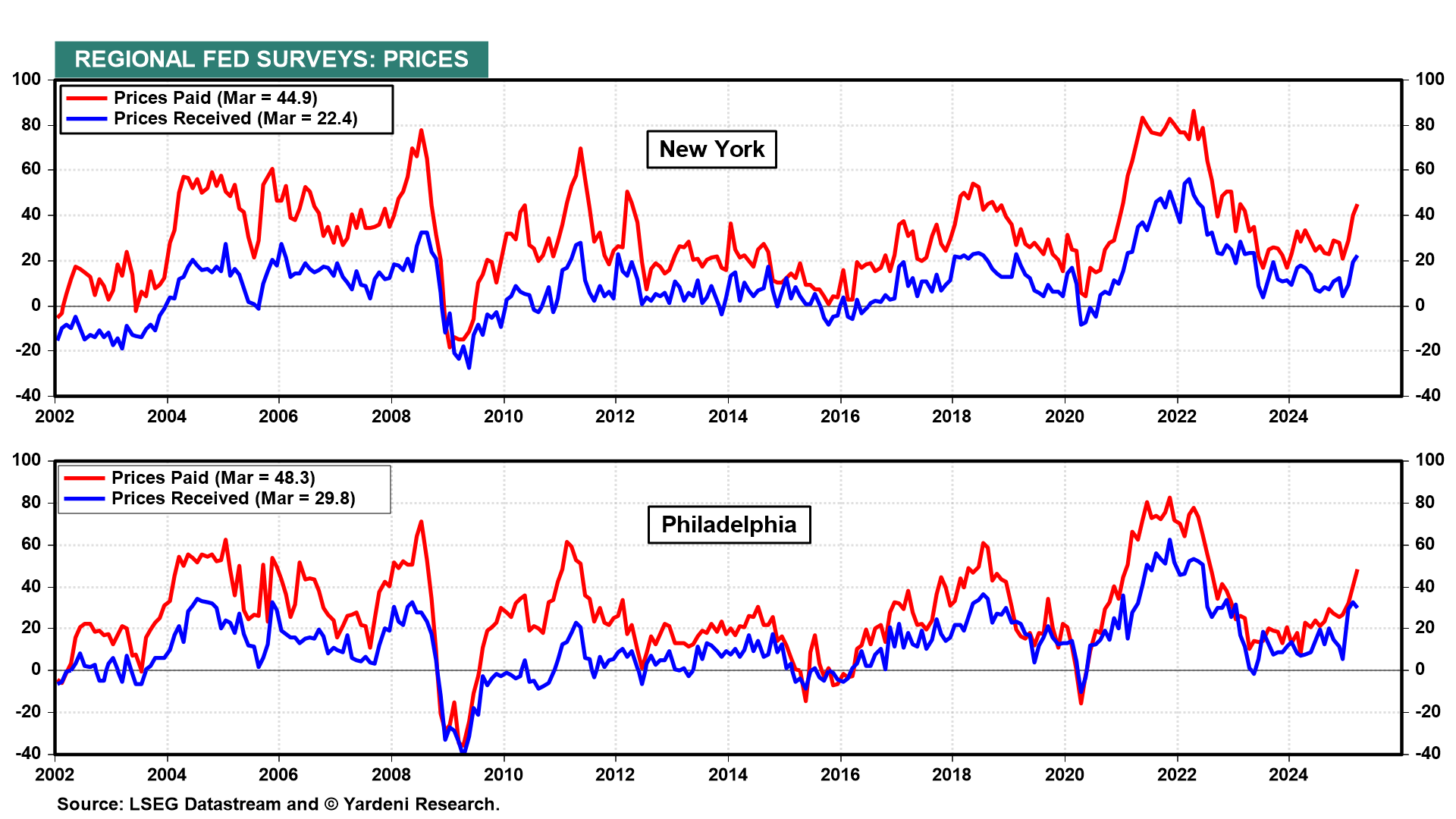

(4) Manufacturing. March's Philly Fed regional M-PMI was weaker than in February, but more upbeat than the New York Fed's March M-PMI released earlier this week. Business activity remained elevated, and employment surged. However, the prices-paid indexes in both surveys have been heating up as a result of tariff effects (chart).

The Philly survey’s expectations for new orders through the next six months fell to the lowest since May 2023. The manufacturing outlook is highly dependent on the outcomes of Trump's "Liberation Day" on April 2 and his tariff tiffs.