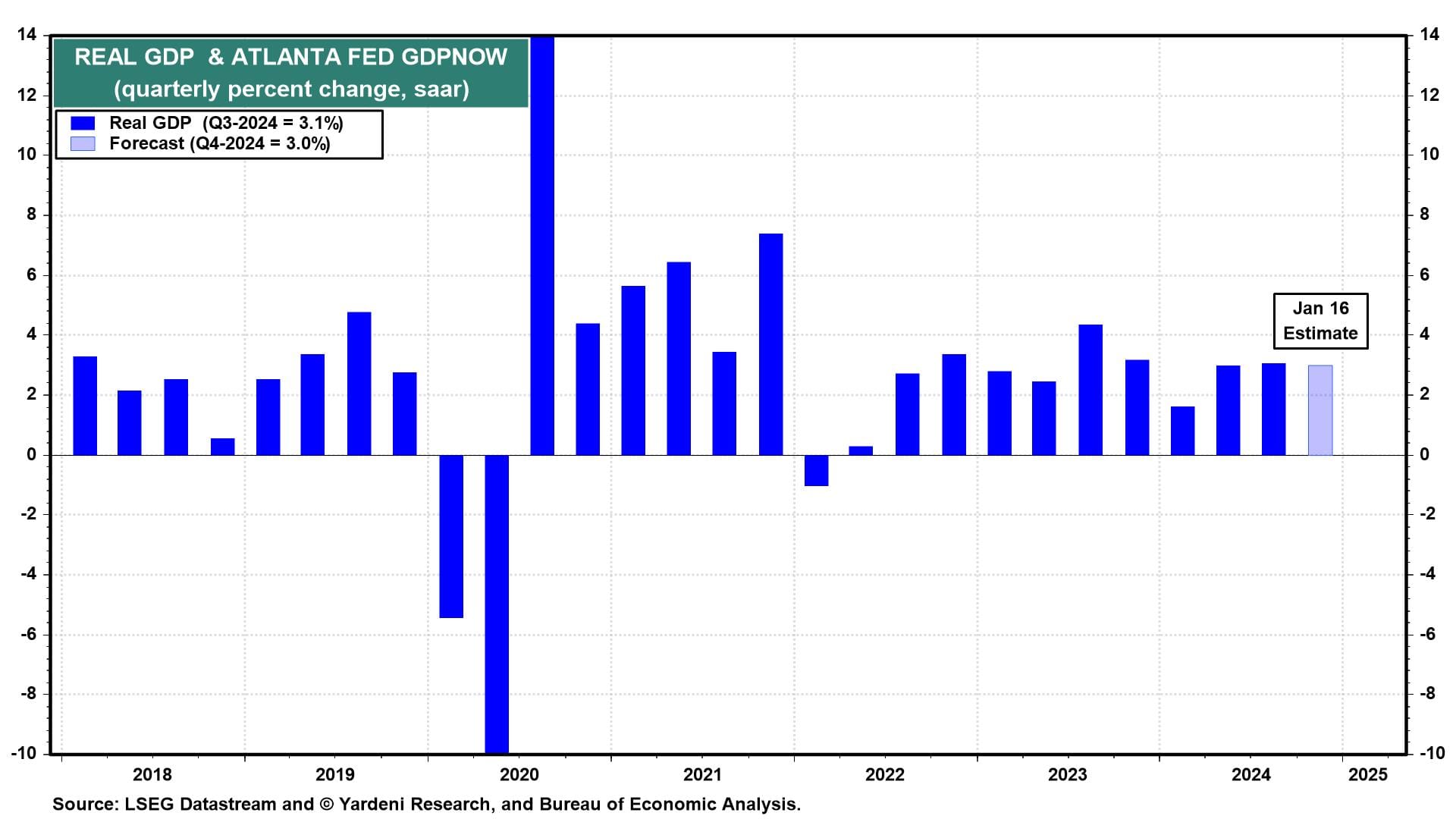

Today's batch of December economic indicators in the US has mostly eased any downside concerns about the labor market, consumers, and the economy overall. The Atlanta Fed's GDPNow tracking model is now showing Q4-2024 real GDP growth of 3.0% (saar), driven by a 3.7% increase in consumer spending on goods (chart). The latter was revised up from 3.3% after retail sales was released today. Data for January are now showing a potential rebound in the manufacturing sector.

It's clear that the Federal Open Market Committee (FOMC) erred by easing monetary policy too soon and by too much, as we've said since September 18, when they cut the federal funds rate by 50bps and followed up with two more 25bps cuts in November and December. (Our offer stands to the DOGE Boys: We will do what the Fed does for half the cost.)

In any event, strong economic growth should lead to higher corporate earnings, which should boost both capital spending and hiring. In turn, these developments should drive stock prices higher. Despite some near-term uncertainties about Trump 2.0, we remain bullish and expect the S&P 500 to reach 7000 by year-end.

Let's have a look at today's data:

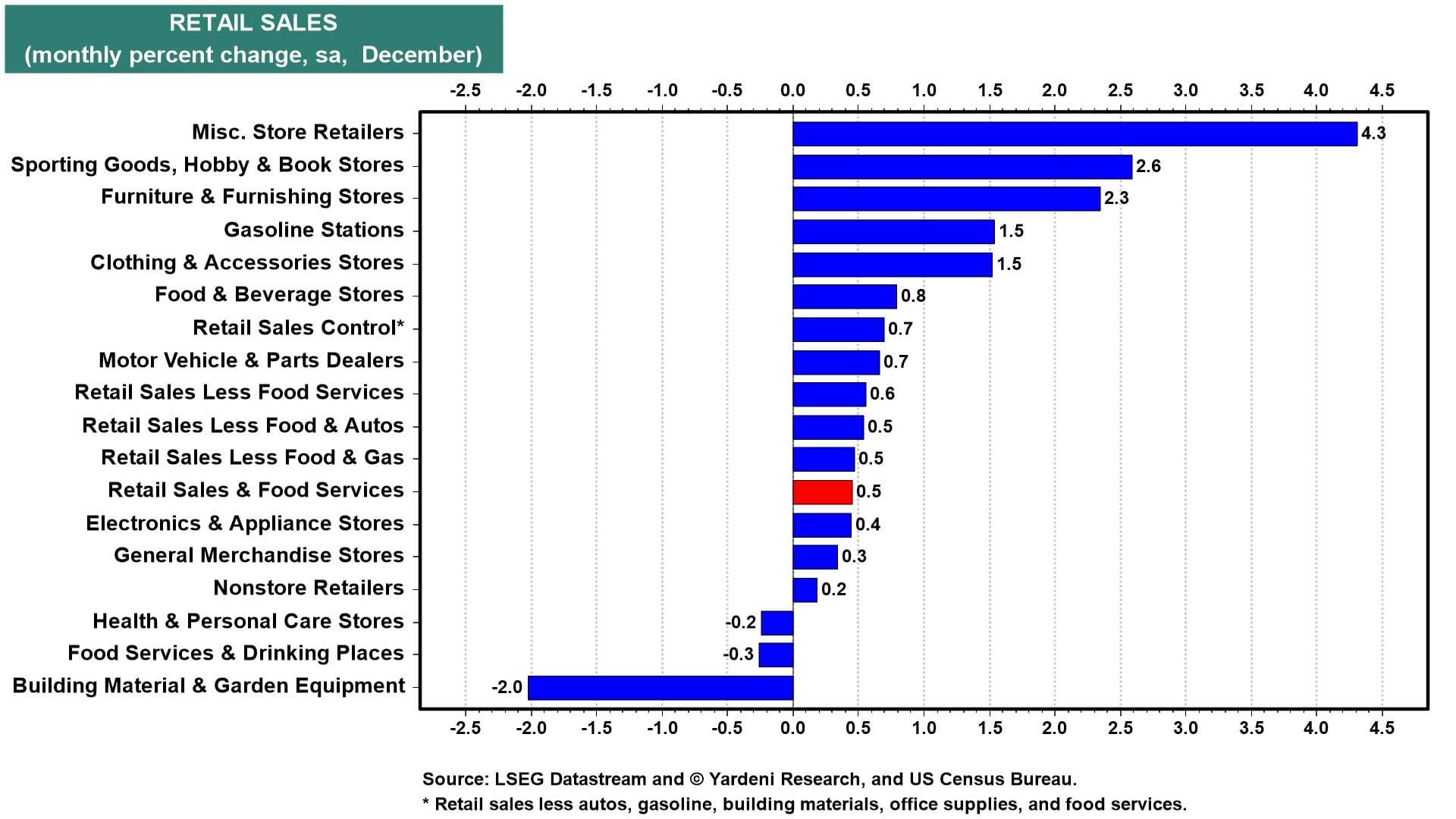

(1) Retail sales. December's retail sales rose 0.4% m/m (3.9% y/y) to a new record high, roughly in line with the 0.5% increase in our Earned Income Proxy. November's sales was also revised up from 0.7% to 0.8% m/m.

The biggest downer in an otherwise strong month was building material and garden equipment, which fell 2.0% m/m after such sales boomed in the prior three months due to hurricane-related repairs and rebuilding (chart). The retail sales control group, which is used to calculate GDP (and excludes autos, gasoline, and building materials) increased 0.7%. Because CPI goods fell 0.2% m/m in December, real retail sales increased roughly 0.9% m/m as it relates to GDP.

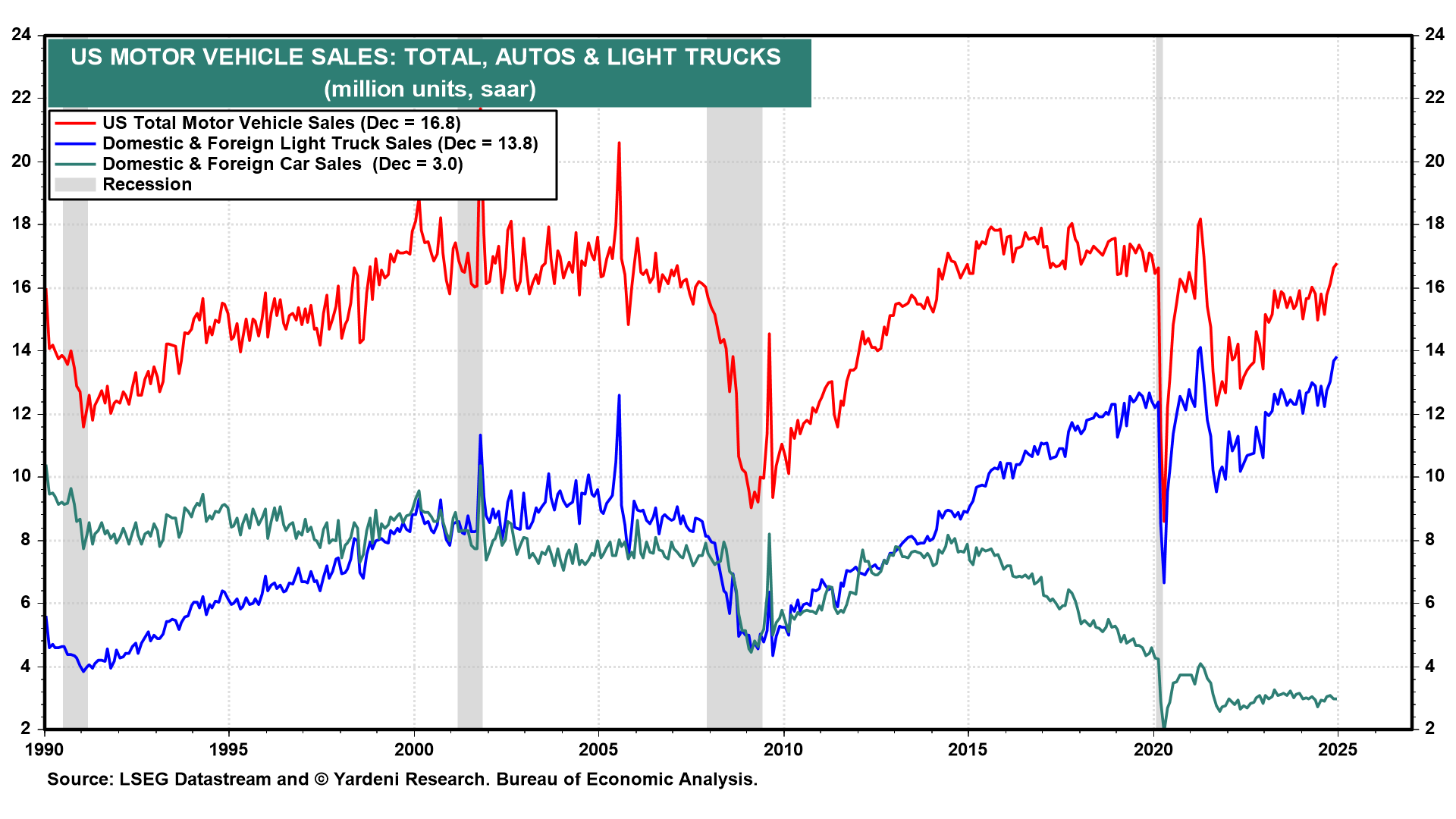

Auto sales jumped 8.4% y/y in December to 16.8 million units (saar), a new post-pandemic high (chart). Consumer demand for durable goods looks to be strengthening.

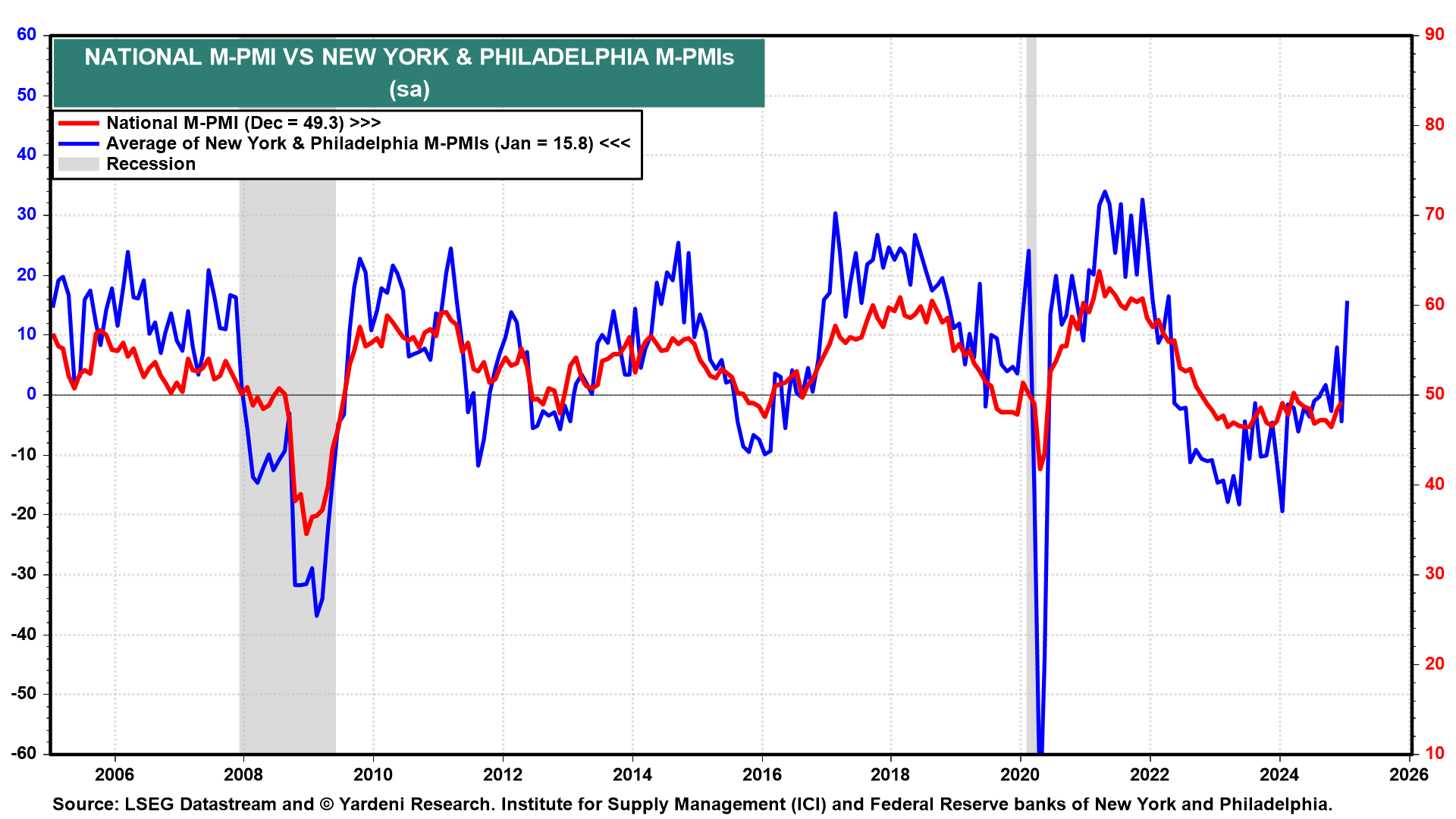

(2) Manufacturing. Speaking of demand for goods, January's Philly Fed regional M-PMI rose from -10.9 to 44.3, one of the highest readings on record. Shipments and new orders both rose to multiyear highs. The average of the New York Fed and Philly Fed regional surveys, which correlates with the ISM national M-PMI, jumped to its highest reading since 2021 (chart). A rolling recovery for the manufacturing sector may be underway.

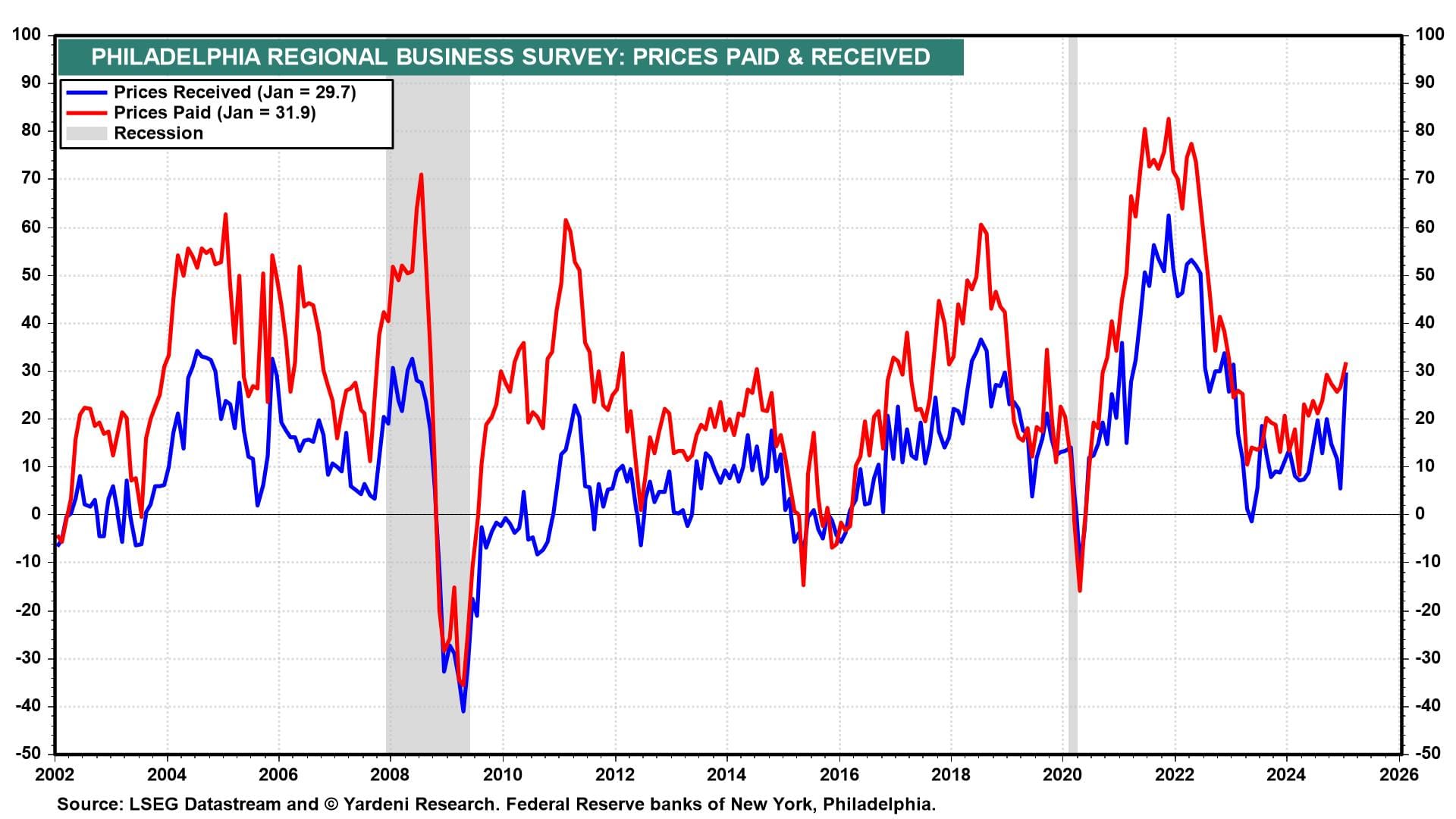

(3) Inflation. One negative in the Philly Fed survey was the surge in prices received and paid (chart). While services inflation has been sticky at high levels, it looks like the improving manufacturing sector might start raising goods prices as well.

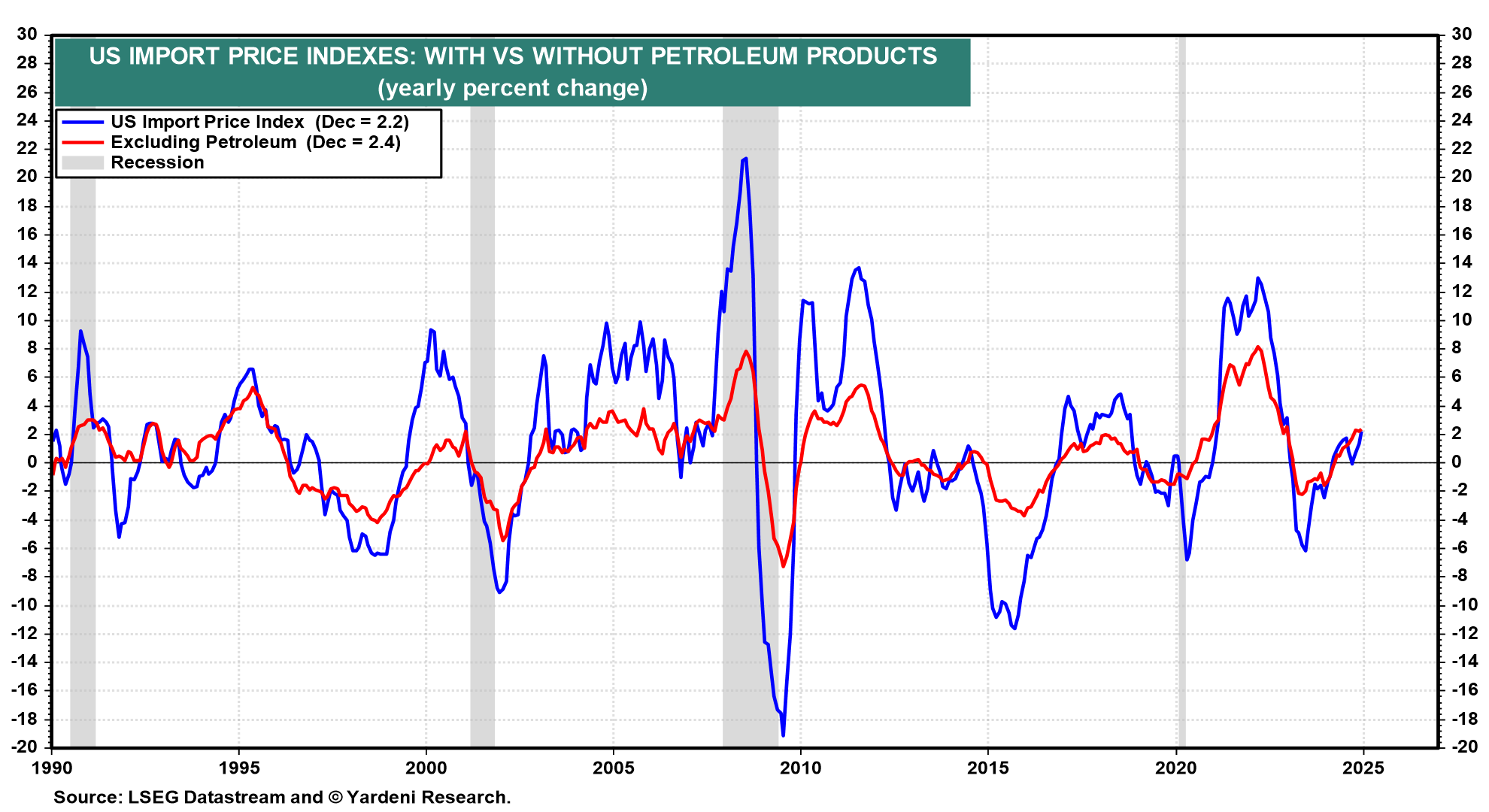

Import and export inflation both rose more than 2.0% y/y in December (chart). The Bureau of Labor Statistics notes: "BLS does not include tariffs in estimates derived for the U.S. Import and Export Price Indexes. However, tariffs may still have an impact on the index values as market participants change behavior on the basis of stockpiling, substitution, and pass-through effects. Data users can track the U.S. Import and Export Price Indexes before, during, and after tariff announcements to gain insight on tariff-based price changes."

During Trump 1.0. tariffs seem to have slowed global economic growth, thus weighing on the BLS measures of export and imports inflation during 2018 and 2019.

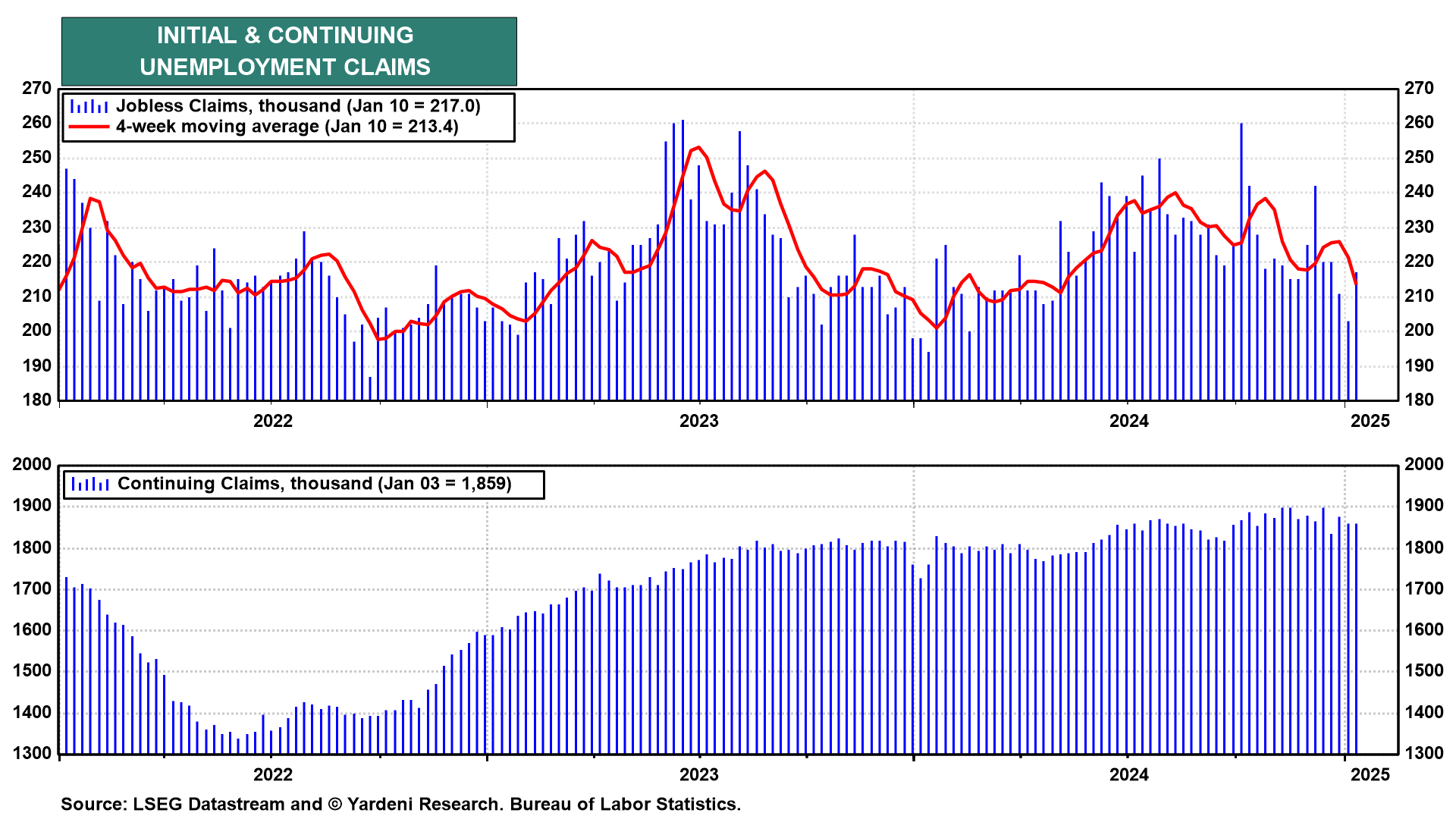

(4) Labor market. Initial jobless claims rose 16,000 to 217,000 in the week ended January 11, remaining historically low (chart). Continuing unemployment claims fell 8,000 for the week prior. The US jobs market's low-firing environment may soon be accompanied by a pickup in hiring and an overall labor market reacceleration thanks, in part, to the animal spirits unleashed by Trump 2.0.