Young bull markets tend to be widely hated. That's because many investors who sold during the preceding bear market fail to get back in at the bottom. Quite a few of them might have sold near or even at the bottom. The current young bull market is no exception.

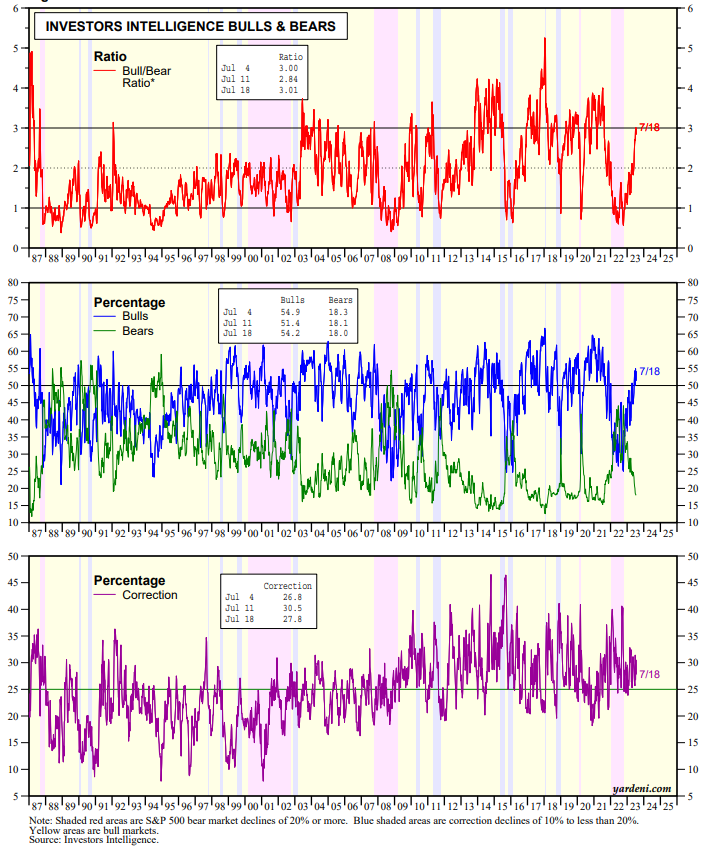

So why is the Investors Intelligence Bull/Bear Ratio (BBR) so high? It was 3.01 during the latest survey week (chart). The percentage of bulls is relatively elevated at 54.2%. That still leaves 18.0% in the bearish camp and 27.8% in the correction camp. Not everybody is bullish. And BBR readings of 3.0 or more don't work as contrary sell signals as well as do readings of 1.0 or less work as buy signals.

We reckon that there are still plenty of investors with lots of cash on the sidelines who are rooting for a correction to commit more money to the stock market. The sum of all commercial bank deposits and money market mutual funds rose to a record $22.8 trillion during the first week of July (chart). That's a lot of liquidity.