Today's batch of economic indicators shows a few signs that Trump Turmoil 2.0 started to weigh on the economy during March. That’s the message from the month's national ISM manufacturing purchasing managers survey. February's construction spending report shows that this sector is losing its upward momentum, for now. On the other hand, February's JOLTS release shows that the labor market remained robust that month with no signs of increasing job losses in the federal government, so far.

The new alternative Atlanta Fed GDPNow model, adjusted for gold imports, shows that real GDP fell 1.4% (saar) during Q1. Real consumer spending is down 0.6%, which we think was mostly a weather-related decline. We expect a rebound in consumer spending during March and April.

Let's have a look at today's mixed nuts:

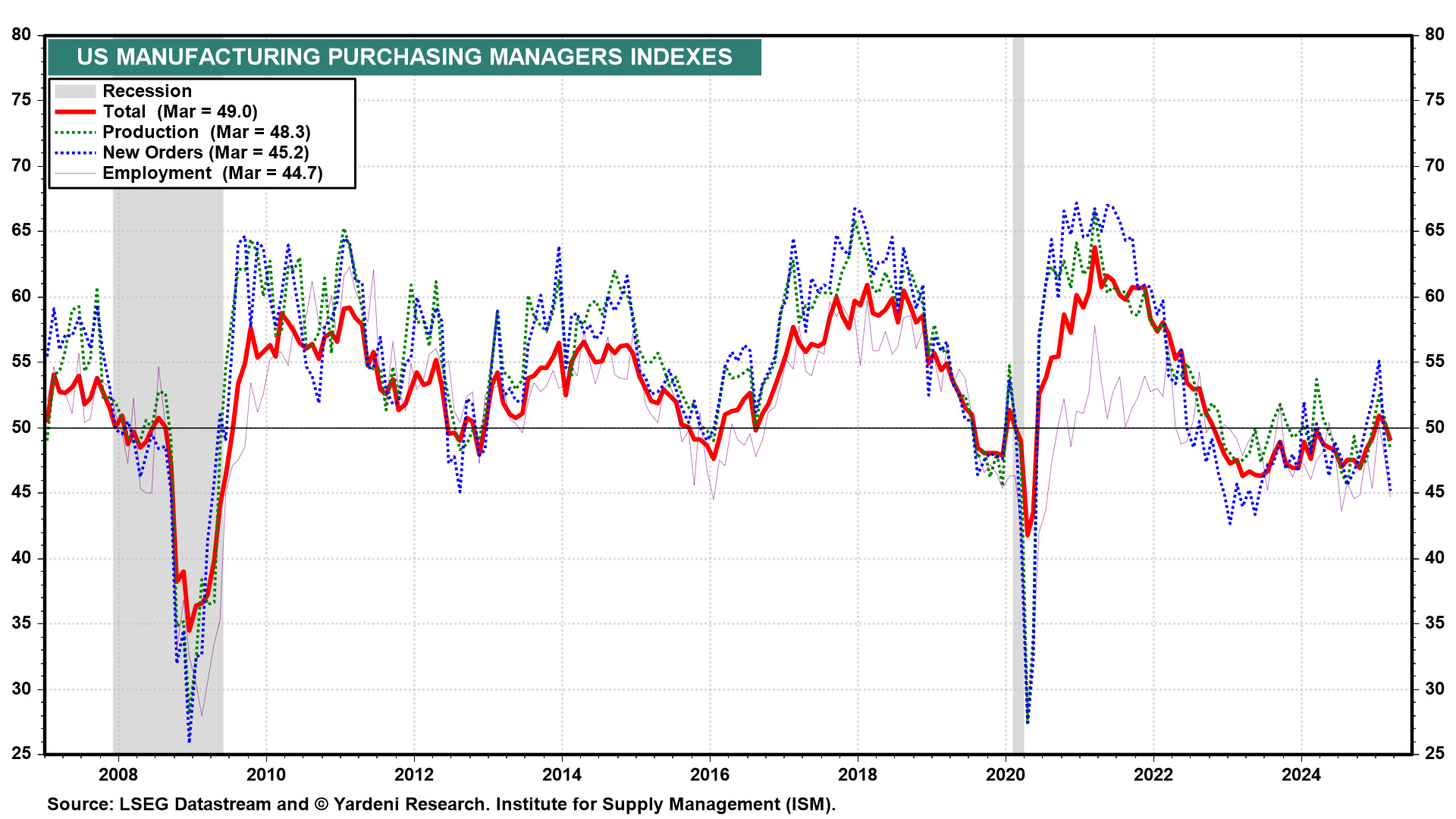

(1) Manufacturing PMI. The M-PMI fell back down below 50.0, indicating contraction, to 49.0 during March (chart). Even weaker were the three major components of the M-PMI. It had been up slightly above 50.0 for two months in a row through February after 26 consecutive months of contraction. The word "tariff" was mentioned 18 times in the latest report as an explanation for weaker business activity and higher materials costs.

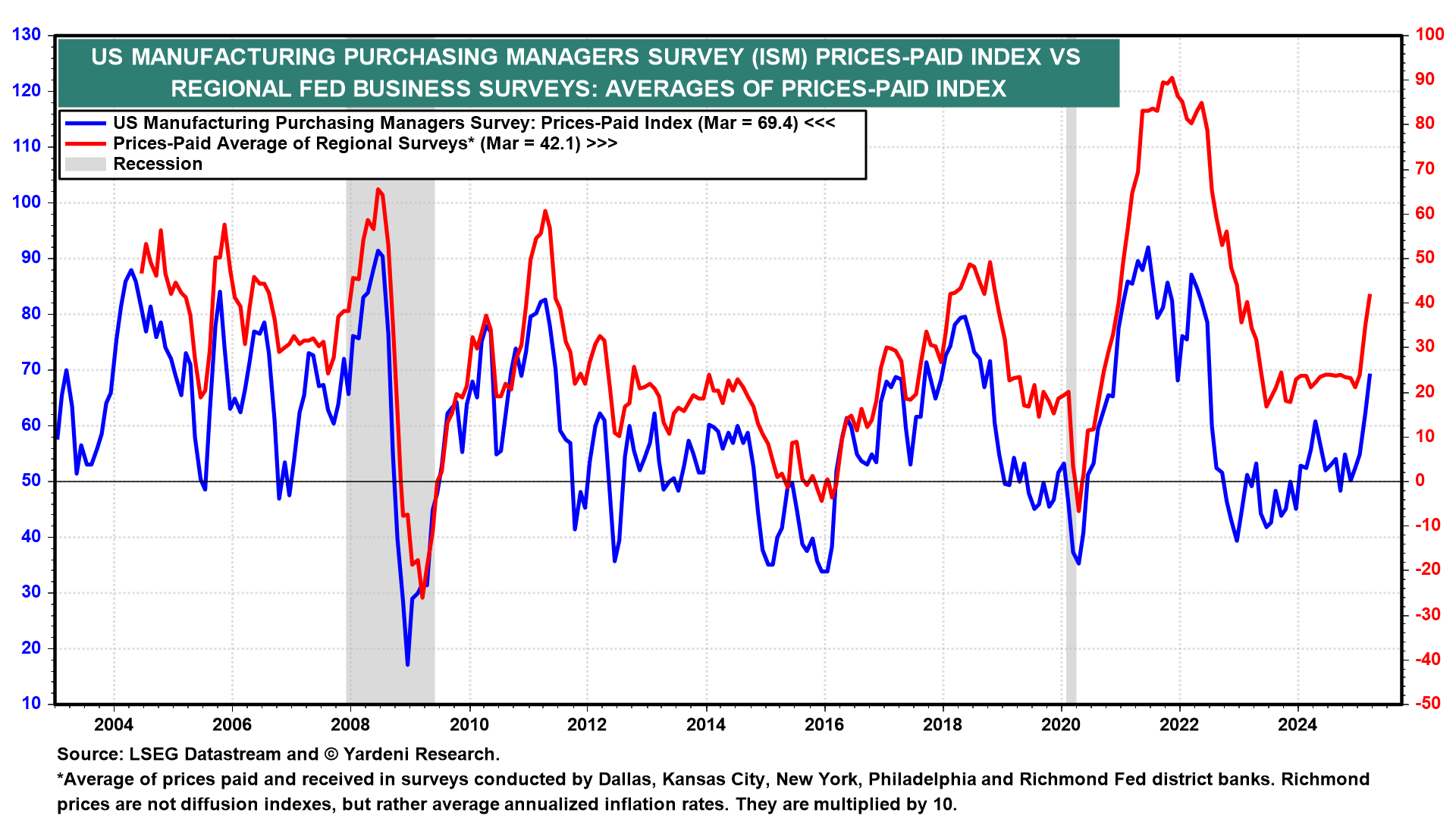

The prices-paid index registered 69.4 in March, up 7 percentage points from the February reading—indicating that raw materials prices increased for the sixth straight month after a decrease in September (chart). Over those six months, the index rose 21.1 percentage points to its highest reading since June 2022 (which was 78.5). There's a strong whiff of stagflation in the M-PMI report.

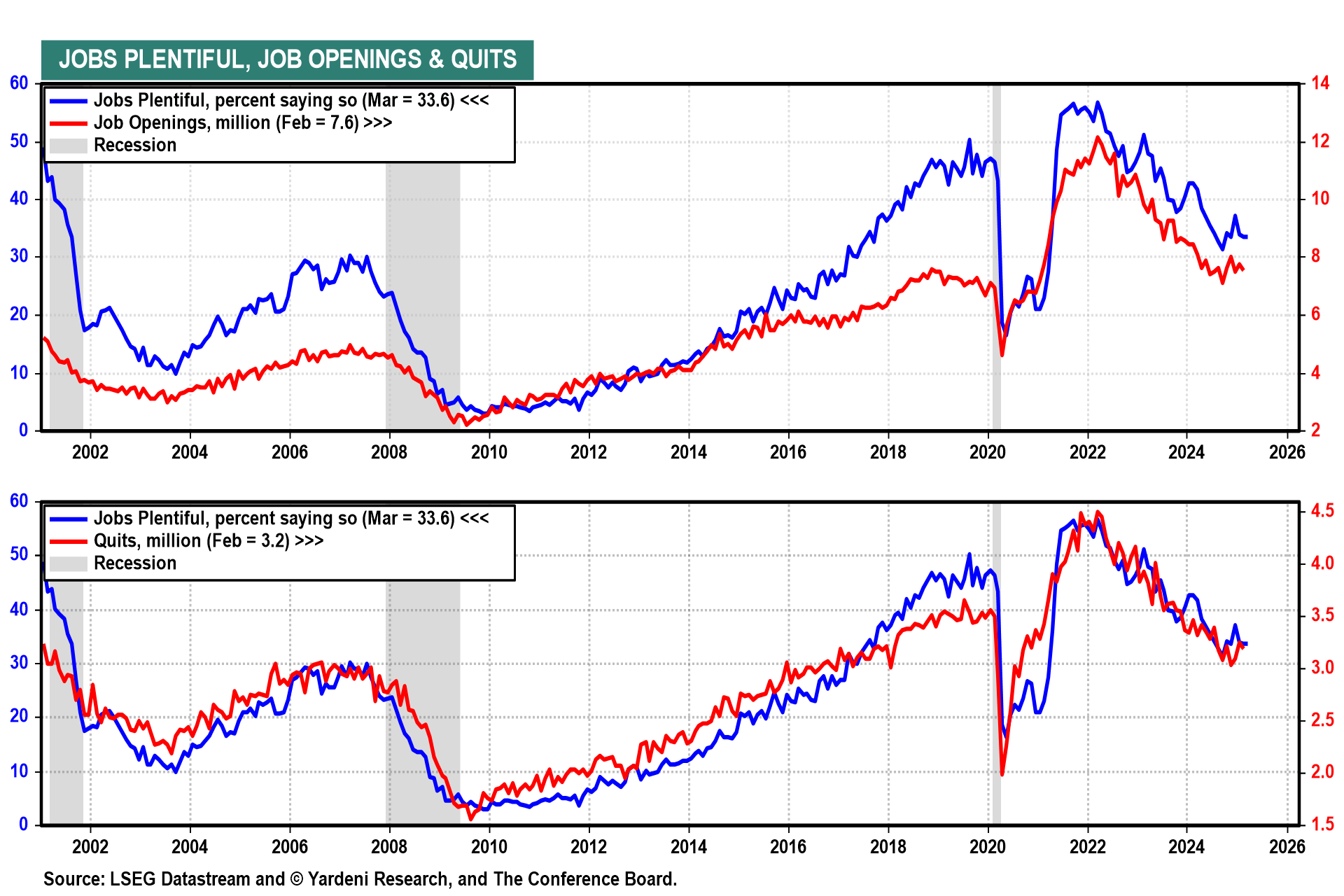

(2) JOLTS. February's JOLTS report is a bit stale. However, it showed a resilient labor market. More current was the March Consumer Confidence Index survey, which showed that jobs remained relatively plentiful in March (chart).

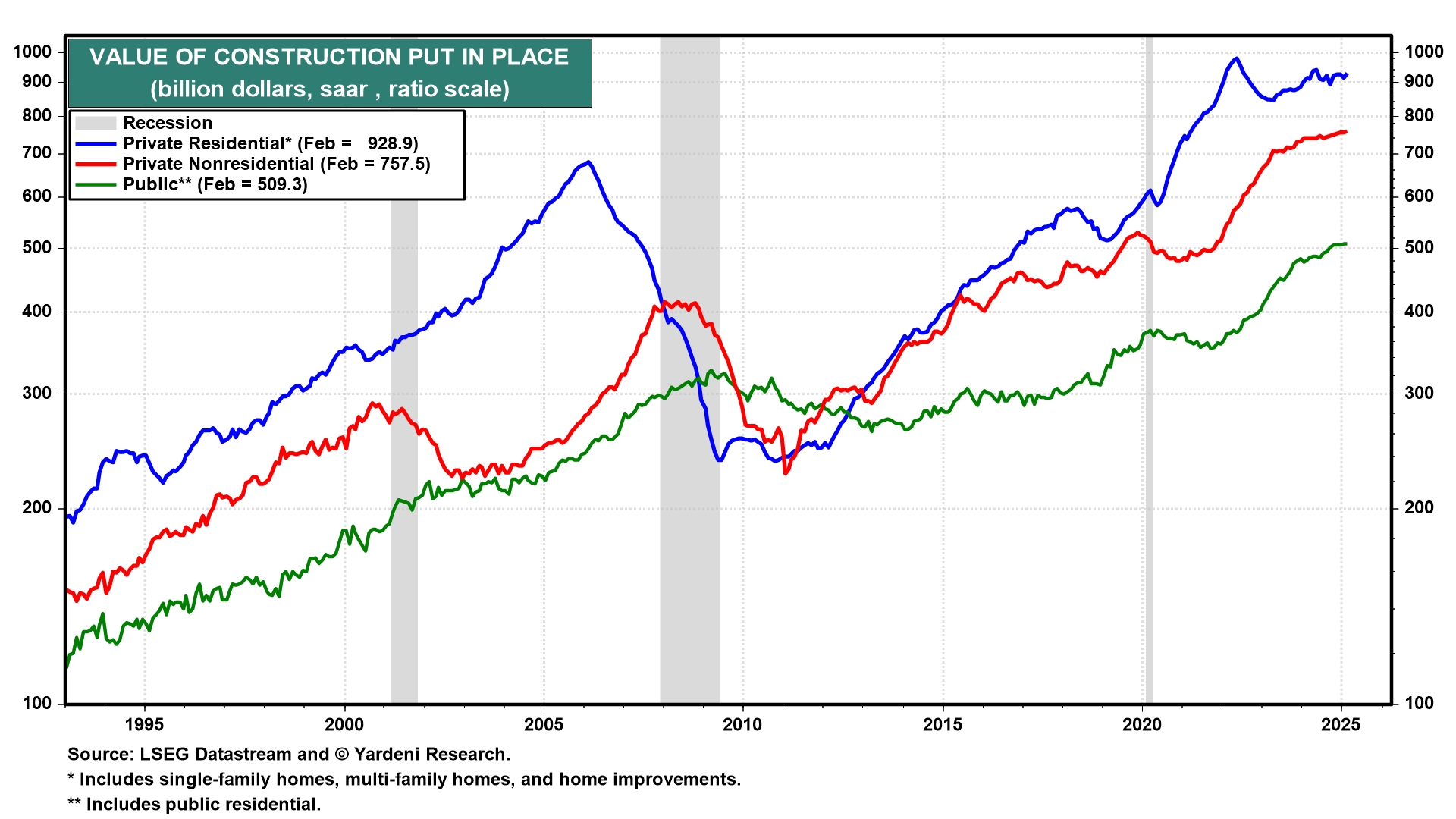

(3) Construction spending. The recent slowdown in construction spending certainly isn't attributable to Trump Turmoil 2.0. After almost three years of big gains, construction spending seems to be stalling, though at a record high (chart). However, Trump has gotten a couple of trillion dollars in foreign and domestic investment commitments. The number of companies and countries investing in the US as part of Trump's push to reshore manufacturing continues to grow. That should boost construction spending when (and if) the commitments are actualized.