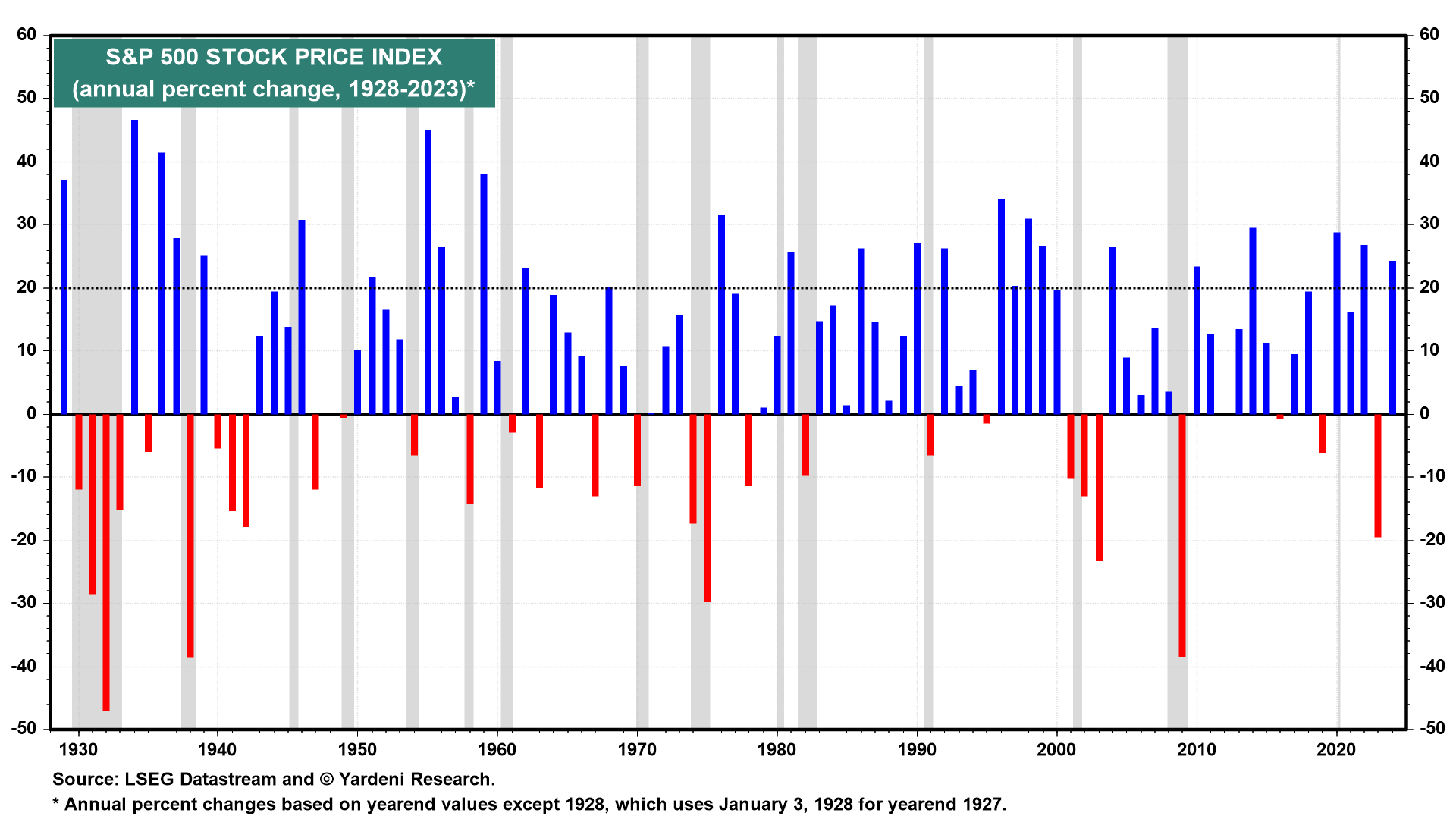

The S&P 500 rose 24.2% last year after falling 19.4% during 2022 (chart). Since the start of the data in 1928, years with gains of over 20% were followed by years of 5.9% gains on average. Excluding recession years, the second-year gains averaged 9.7%. Losses during recession years averaged 10.1%. Down years for the market are more likely than not to be associated with recessions.

We think that the odds of a recession are still relatively low in 2024. We raised the odds of a recession before the end of 2024 from 30% to 35% in our October 23, 2023 Morning Briefing because of our concerns about geopolitical turmoil as a result of the Gaza War. That remains our current assessment.

We've been bullish on stocks since November 3, 2022, when we wrote that the S&P 500 bottomed on October 12. We remain bullish on the outlook for stocks in 2024. The S&P 500 closed at 4,769.83 on Friday. We are targeting 5400 by the end of 2024—a 13.2% gain. We think that real GDP will increase by at least 2.0% in 2024 and that inflation will fall to the Fed’s target of 2.0% y/y at some point during the year. We expect the Fed will lower the federal funds rate two or three times over the course of 2024. The 10-year Treasury bond yield should hover between 3.75% and 4.25% during the year.

This year has turned out to be a very happy year for stock investors. Below is the performance derby of the S&P 500 and its 11 sectors and 100+ industries (table). A significant chunk of the gains occurred since October 27, when the market bottomed followed a 10% decline that started on August 1. (We called that correction bottom too, on November 1.) Since then, investors have become less concerned about a recession and inflation, and more convinced that the Fed is done tightening. So the leadership has been among the more cyclical sectors and industries.