YRI Bulletin Board. Our colleague Eric Wallerstein is taking a leave of absence. He has accepted a position on the President’s Council of Economic Advisers. We wish him all the best.

The following is a reprint of our Morning Briefing which we sent to our institutional investors today. We wanted to share it with our QuickTakes community of individual investors and business professionals. Your comments are always welcome.

Reign Of Tariffs I: Losing Confidence

Does President Donald Trump want a recession? He is going to get one if he continues to pursue his chaotic tariff policies. Consider the following:

(1) CFOs & CEOs. According to a recent small survey of chief financial officers conducted by CNBC and discussed in a March 25 CNBC post: “In a word, the ‘pessimism’ has crept back in where the animal spirits had been after Trump’s election. That’s one way to sum up the results from the latest CNBC CFO Council quarterly survey for Q1 2025.”

Ninety percent of the surveyed CFOs say tariffs will cause “resurgent inflation.” The majority of the CFOs expect a recession in the second half of 2025. They should know: The CFO Council survey is a sampling of views from CFOs at large organizations across sectors of the US economy. The Q1 survey covered replies from 20 respondents and was conducted between March 10 and March 21.

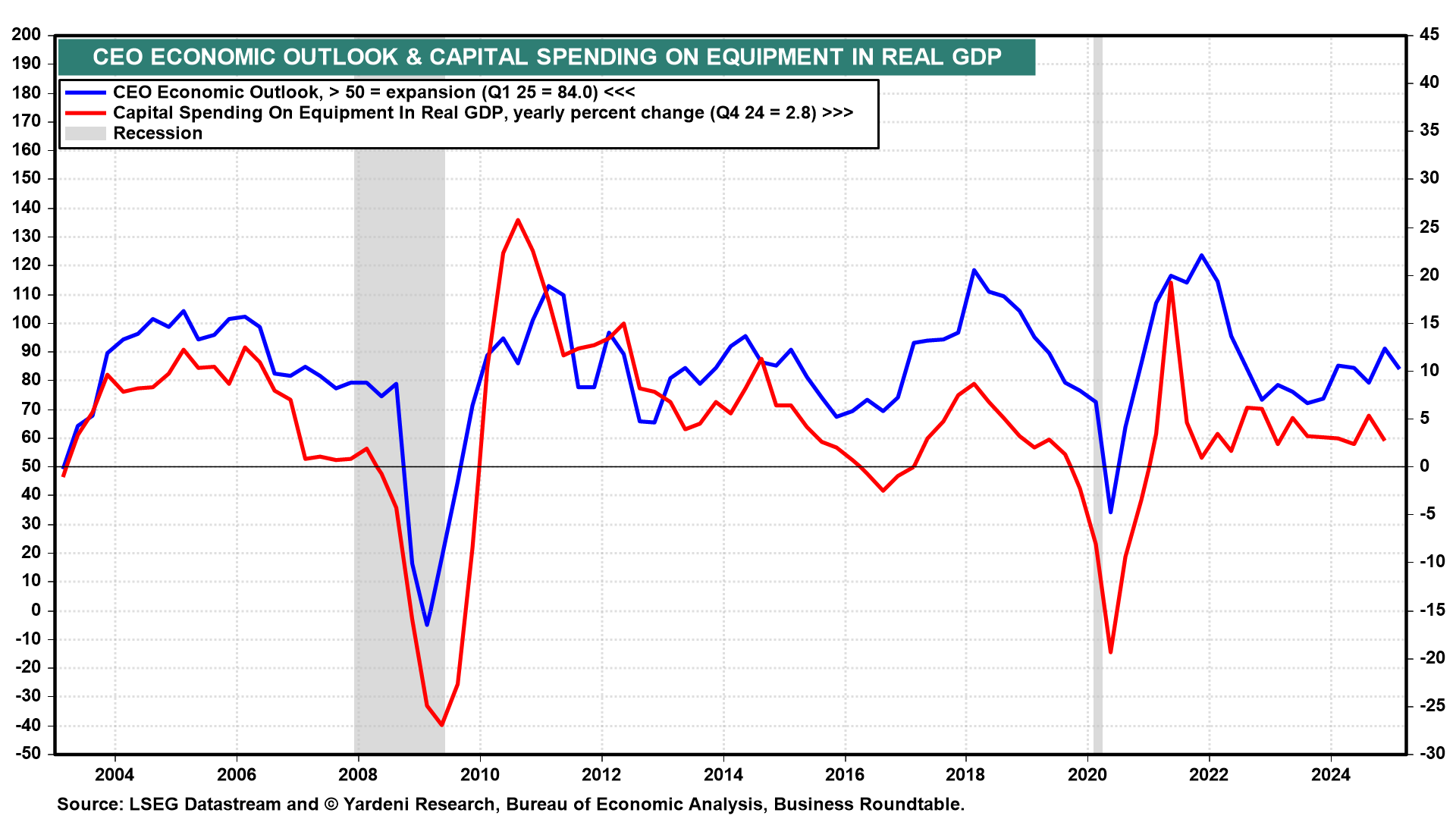

The Business Roundtable CEO Economic Outlook Index dipped modestly during Q1 (Fig. 1 below). In a special question posed this quarter, chief executive officers were asked to identify policies and actions that are important for strengthening domestic manufacturing. Seventy percent of respondents selected keeping tariffs low on intermediate inputs and raw materials, particularly those that cannot be sourced in the US.

This quarter’s survey, conducted from February 19 through March 7, 2025, was completed by 150 CEOs. More than three-quarters of responses were submitted before the 25% US tariffs on Canada and Mexico were announced on March 3, 2025. Odds are that the Q2 survey will show a big drop in the CEO index, which could weigh on capital spending.

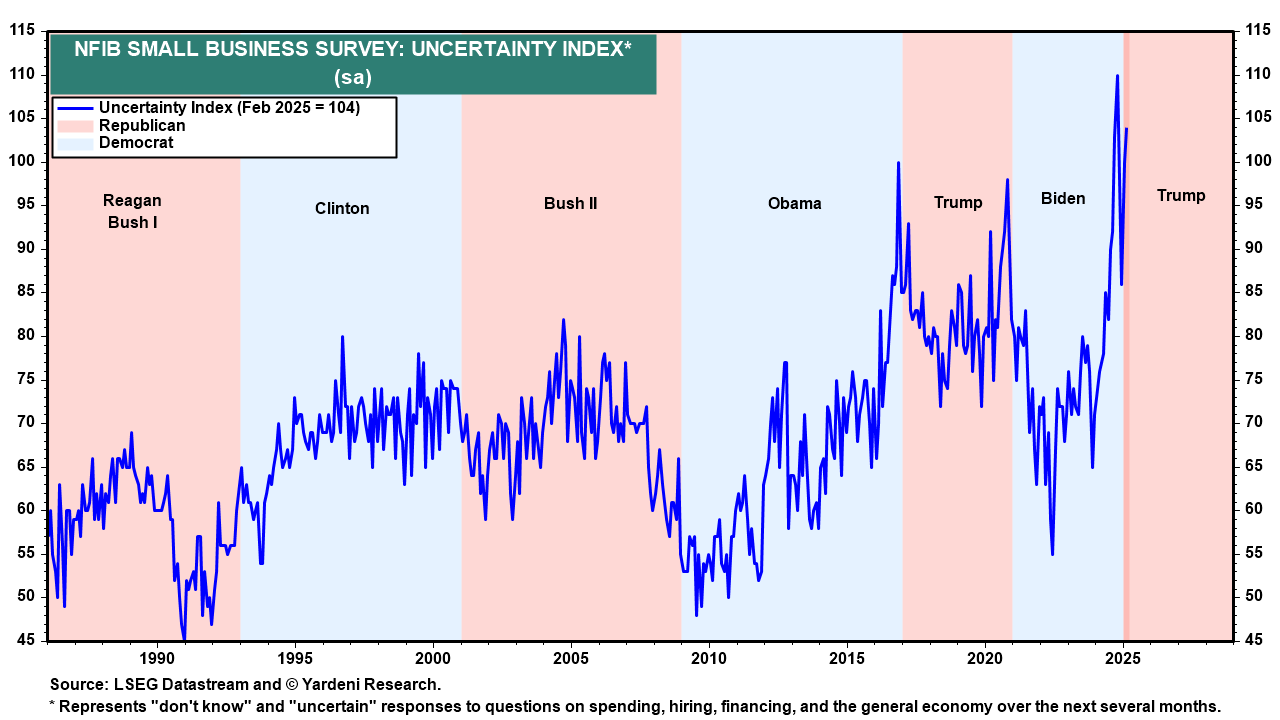

(2) Small business owners. The Uncertainty Index, compiled by the National Federation of Independent Business from a monthly survey of small business owners, was 104 in February, the second highest on record (Fig. 2 below). The highest was 110 during October 2024.

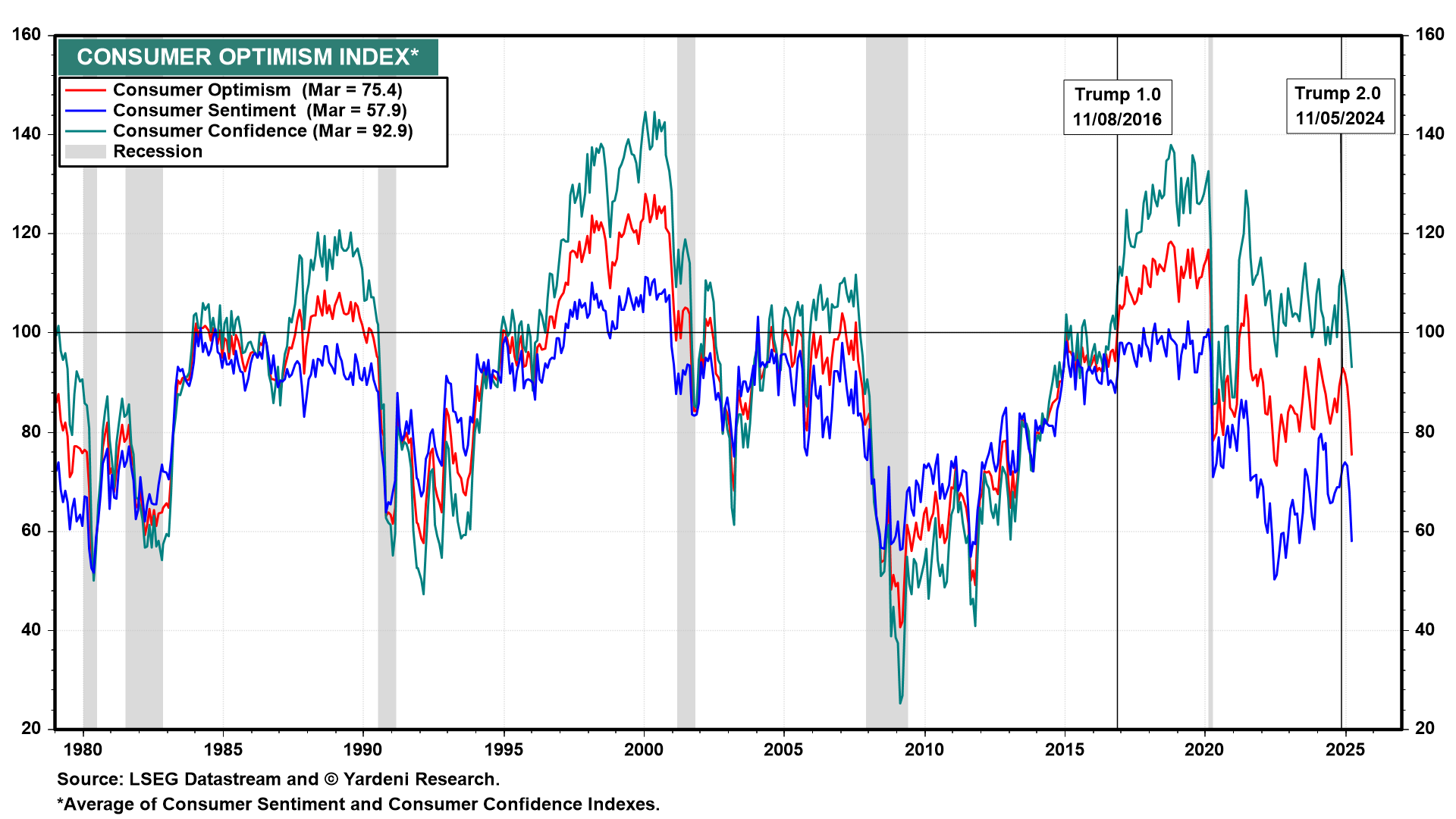

(3) Consumers. Also losing their confidence in Trump 2.0 are consumers. Debbie and I track the Consumer Optimism Index (COI), which is the average of the Consumer Sentiment Index (CSI) and the Consumer Confidence Index (CCI). It fell to 75.4 during March, which is the lowest since July 2022 (Fig. 3 below). In March 2017, during Trump 1.0, the COI was 111.3. Leading the way down has been the COI expectations component at 58.9 in March, the lowest since July 2022 (Fig. 4).

According to the CSI survey, consumers are depressed because their inflationary expectations soared in March to 5.0% over the next 12 months, up from 3.3% in January (Fig. 5). Their five-years-ahead inflationary expectations also jumped, to 4.1% in March from 3.2% in January. According to the CCI survey, more consumers are expecting fewer jobs will be available in six months (Fig. 6).

(5) Credit investors. The yield spread between the high-yield corporate bond composite and the 10-year Treasury bond yield has risen from a recent low of 239bps on January 24 to 320bps on Thursday (Fig. 7). That’s still a relatively narrow spread. Starting to show more signs of stress is the Invesco Senior Loan ETF (BKLN). It is down 1.7% so far this year (Fig. 8).

(6) US stock investors. On Saturday, March 22, President Trump said that he would be “flexible” on reciprocal tariffs. The S&P 500, which had fallen to a 2025 low of 5521.52 on March 13 (a 10.6% correction), peaked at 5776.65 on March 25 (Fig. 9). At Friday’s close, it was back down to 5580.94 as investors realized that Trump was actually turning less flexible on tariffs. Indeed, on Monday, March 24, Trump threatened that countries that purchased oil and gas from Venezuela would face a 25% tariff on trade with the US. The S&P 500 is now down 9.2% from its record high on February 19. The Nasdaq is back in correction territory, with a 14.1% decline (Fig. 10).

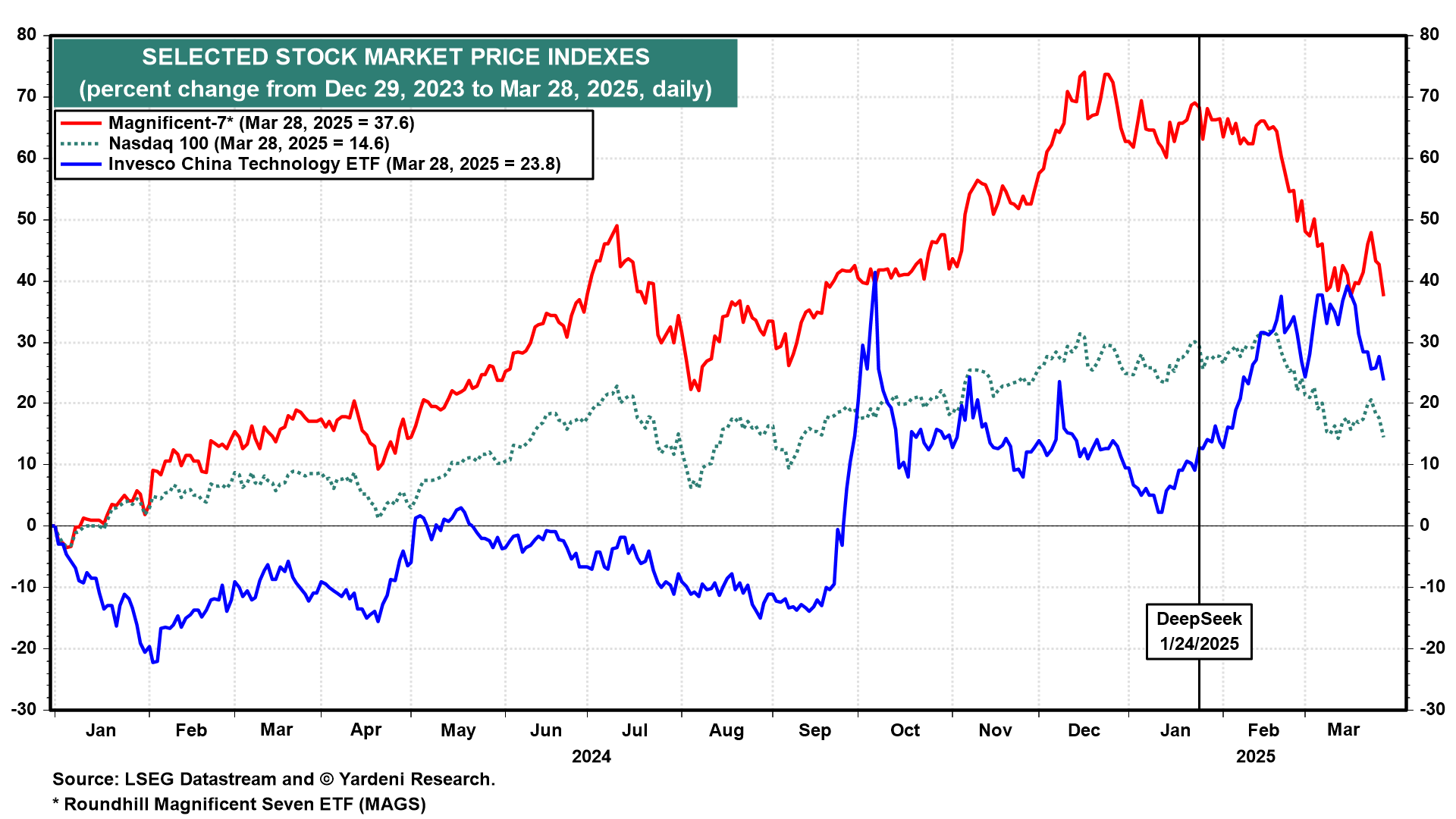

To be fair, the stock market’s woes aren’t all attributable to Trump 2.0. Investors have been questioning the sustainability and credibility of the AI story, with more concerns that it might be a bubble that is starting to burst. The Magnificent-7 have been at the forefront of this story. The Roundhill Magnificent-7 ETF (MAGS) is down 15.4% so far this year, while the Defiance Large Cap ex-Mag 7 ETF (XMAG) is down only 0.6% over this same period (Fig. 11). The S&P 500 Data Center REIT has dropped 21.8% since it peaked at a record high on November 29, 2024 (Fig. 12).

(7) Global stock investors. Even overseas stock markets are weakening as investors realize that Trump’s tariffs are bad news not only for the US economy but for plenty of other economies around the world. Indeed, many economies might be more vulnerable to the tariffs than the US if their exports to the US are greater than are their imports from the US. Trade is more important to many economies than it is to the US economy.

The outperformance of overseas stock markets relative to the US stock market, which started at the beginning of this year, might be over already, as the ratio of the US MSCI stock price index to the All Country World ex-US MSCI stock price index appears to be bouncing off its long-term uptrend line (Fig. 13). In addition, the China AI rally also seems to be over. The Invesco China Technology ETF (CQQQ) has declined 11.1% since it peaked this year on March 17 (Fig. 14 below). Over this same period, the Nasdaq 100 (QQQ) is down only 2.7%.

Reign of Tariffs II: Stagflationary Consequences

Along with CEOs, CFOs, small business owners, consumers, and investors, we are losing our confidence in Trump 2.0. Trump’s Reign of Tariffs is tariff-y-ing:

(1) In a March 18 Fox Business Network interview, Treasury Secretary Scott Bessent said, “We are going to go to them [our trading partners] and say, ‘Look, here is where we think the tariff levels are, nontariff barriers, currency manipulation, unfair funding, labor suppression, and if you will stop this, we will not put up the tariff wall.’” If a country doesn’t change those policies, he continued, “then we will put up the tariff wall to protect our economy, protect our workers, and protect our industries.” That sounds like a reasonable way to force other countries to lower their trade barriers.

(2) Trump’s “flexible” comment a few days ago reflected his realization that estimating the impact of nontrade barriers was an impossible feat. So the reciprocal tariffs that he will be announced on April 2 will be based on estimates of average tariffs imposed by each trading partner with a trade deficit with the US.

In his Fox interview, Bessent said, “I’m optimistic that, April 2, some of the tariffs may not have to go on because a deal is pre-negotiated,” he added, “or that once countries receive their reciprocal tariff number, that, right after that, they will come to us and want to negotiate it down.”

(3) However, some tariffs will be permanent, according to Trump. On March 12, he imposed 25% tariffs on all steel and aluminum coming into the US; on March 26, he announced 25% tariffs on all motor vehicles and parts imported into the US. These will be even more prohibitive if they are stacked on top of the average reciprocal tariffs.

The permanent tariffs on autos and parts, along with the permanent tariffs on aluminum and steel and possibly copper, are already boosting the prices of the metals and may soon increase both new and used car prices (Fig. 15 below). Would-be auto buyers might respond to higher prices by continuing to drive their current vehicles. If so, then the auto industry will be hit with stagflation.

Initially, auto sales might boom in the next month or two as buyers scramble to buy autos before prices are raised to reflect the higher costs of producing a car in the US. Meanwhile, Trump warned automakers on Thursday not to raise their prices; yet not doing so would kill their profit margins. On Saturday, Trump told NBC News in an interview that he “couldn’t care less” if automakers raised prices.

For now, dealers have stockpiled a two- to three-month supply of new cars, so the impact of the tariffs might not start to be felt until June. At that point, vehicle prices could rise by more than 10% to offset the tariffs. That would push up auto insurance fees and the costs of maintenance and repair (Fig. 16).

(4) The collective impact of all these tariffs is increasingly likely to be stagflationary. The tariffs will be paid either by foreign exporters to the US, US importers, and/or US consumers. The result will be higher prices and narrower profit margins than otherwise.

Economists generally agree that tariffs are a tax on imported goods that are normally paid by the importing company, which in turn passes on some or most of the cost of the tariffs to consumers in the form of higher prices.

Reign of Tariffs III: Stagflationary Readings

It’s really a shame that Trump is so willing to take a wrecking ball to the economy. It has been very resilient over the past three years in the face of the tightening of monetary policy. We are losing our confidence that it can remain resilient in the face of Trump’s Reign of Tariffs. The latest batch of data suggests that stagflation is already eroding the stellar performance of the economy, which hasn’t been in a recession since the pandemic lockdown in early 2020:

(1) Personal income, consumption, and saving. Colder-than-normal weather during January and February undoubtedly depressed consumer spending those two months. Industrial production of utilities rose to record highs in both months (Fig. 17). The Atlanta Fed’s GDPNow tracking model is showing that real consumer spending rose only 0.3% (saar) during Q1. We expect to see strong rebounds in March and April consumer spending as the weather improves and consumers scramble to buy autos and other goods before their prices go higher. That could set up the economy to be quite weak during Q3 and Q4 if consumers retrench when they are hit by higher prices attributable to Trump’s tariffs. Capital spending is also likely to get hit during the second half of this year.

For now, the labor market remains strong, as reflected by low initial unemployment claims. February’s real personal income rose 0.4% m/m, and the nominal personal saving rate increased from 3.3% in December to 4.6% in February because the cold weather held down consumer spending.

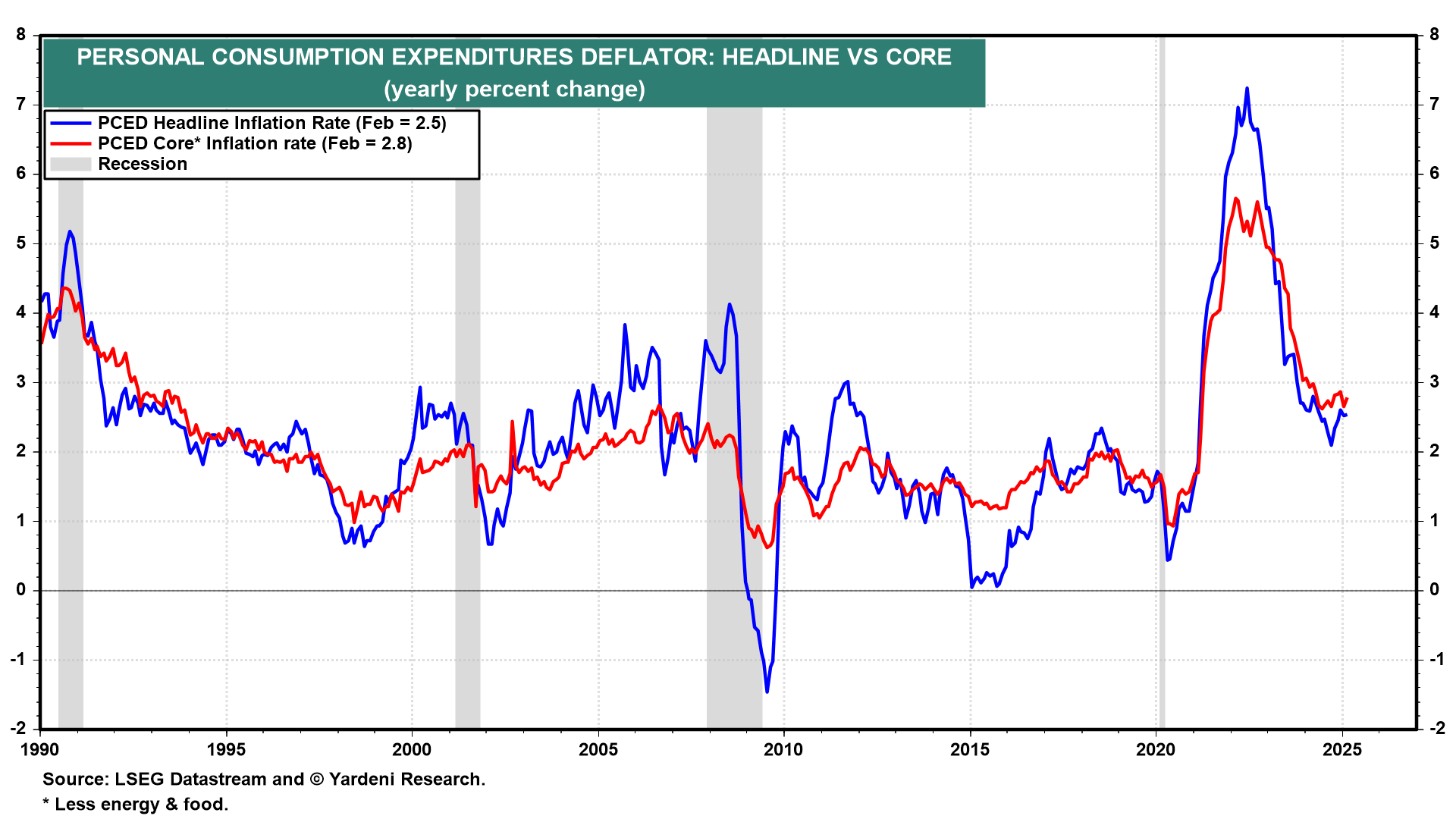

(2) PCED inflation. We no longer expect that the PCED inflation rate will range between 2.0%-3.0%, as it has since early 2024 (Fig 18 below). Instead, we expect to see it range between 3.0%-4.0% over the rest of this year before it settles back down to 2.0%-3.0% next year, maybe. The PCED services inflation rate should continue to moderate (Fig. 19). However, the PCED goods inflation rate is likely to rise faster along with tariffs in coming months (Fig. 20).

(3) Regional business surveys. The ISM manufacturing PMI was showing signs of recovering during January and February (Fig. 21). The same can be said about the regional business surveys conducted by five of the 12 Federal Reserve district banks. However, the regional surveys suggest that the manufacturing recovery faltered in March in reaction to Trump Tariff Turmoil 2.0.

Just as disturbing is that the regional prices-paid and prices-received indexes jumped higher since the start of the year through March (Fig. 22 and Fig. 23). The surveys suggest that stagflation is seeping into the economy. The obvious source of the problem is Trump’s tariffs.

Reign of Tariffs IV: Recalibrating Our Forecasts Again

We’ve alerted you before that we might have to change our minds more often because Trump changes his mind so often. Here we go:

(1) Raising stagflation odds. We are reducing the subjective odds of our optimistic Roaring 2020s scenario from 65% to 55% and raising the odds of a pessimistic stagflation scenario from 35% to 45%. The former worked out great for us during the first half of the current decade. We still expect it to prevail over the remainder of the decade. But Trump’s Reign of Tariffs is likely to get in its way this year. The stagflation scenario includes the possibility of a shallow recession during the second half of this year. The higher inflation part of stagflation is almost a certainty.

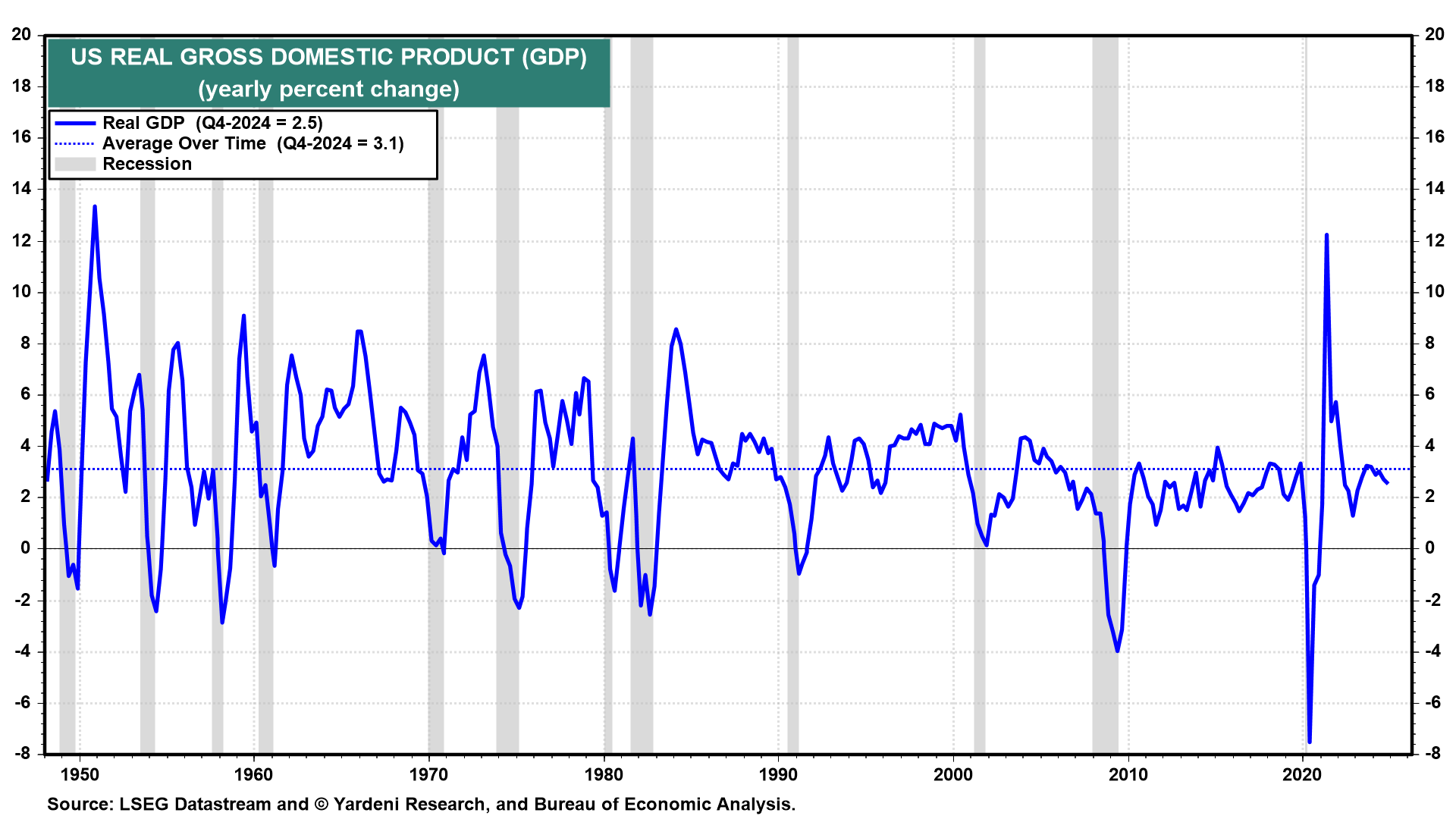

(2) Real GDP. We had been expecting 2.5%-3.0% real GDP growth this year, similar to the pace of the past year (Fig. 24 below). We are lowering that to 1.5%. Here are our forecasts for the four quarters of 2025: Q1 (1.0%), Q2 (3.5%), Q3 (0.5%), and Q4 (1.0%). The last two quarters could have negative signs. The surge in Q2’s real GDP reflects a buy-in-advance rush by consumers during April and May before tariffs jack up prices in June.

(3) Inflation. As discussed above, we are raising our PCED inflation forecast range to between 3.0%-4.0% over the rest of this year and then lowering it back down to 2.0%-3.0% in 2026. That assumes that there won’t be a trade war with tit-for-tariff retaliation. If there is, there will be a recession that will bring inflation down.

(4) Interest rates. We’ve been predicting none-and-done for Fed rate-cutting this year because of better-than-expected GDP growth. Now we are predicting that the Fed won’t be able to ease even if the economy stagnates because higher inflation will force the Fed to stay put. The Fed Put will remain on hold. As a result, we aren’t changing our forecast for the 10-year Treasury bond yield to remain in the 4.25%-4.75% range this year.

(5) Stock market. We’ve previously written that we couldn’t rule out a bear market under the circumstances, which have continued to deteriorate under Trump’s Reign of Tariffs. Our increased stagflation odds—to 45%—is also the odds that the current stock market correction will turn into a full-blown bear market. In other words, if we have stagflation in the economy, we can expect to have a bear market in stocks.

So we are lowering our S&P 500 year-end target (again) from 6400 to 6100, which would be up 4% from the end of last year. In this scenario, the current correction could turn into a bear market in coming months before turning into a bull market again later this year on expectations of a resumption of the Roaring 2020s in 2026 and beyond. In addition, later this year, investors might begin to anticipate that the Fed will start lowering interest rates early in 2026 to clean up the mess from Trump’s Reign of Tariffs.

(6) Politics. The Stock Market Vigilantes are also losing their confidence in Trump 2.0. The risk is that they cause a bear market, resulting in a consumer-led recession as the negative wealth effect depresses consumer spending (especially by retiring Baby Boomers). This time, the Fed won’t come to the rescue so quickly if inflation is heading higher again. We are hoping that the Republicans will realize that the odds are increasing that they will lose their majorities in both houses of Congress if the White House continues to pursue stagflationary trade policies.