President Trump's Wednesday night announcement of a 25% tariff on imports of foreign motor vehicles caused a selloff in auto stocks today. Components such as engines and transmissions are also impacted, while previously trade-compliant parts from Canada and Mexico will be slapped with tariffs at a later date.

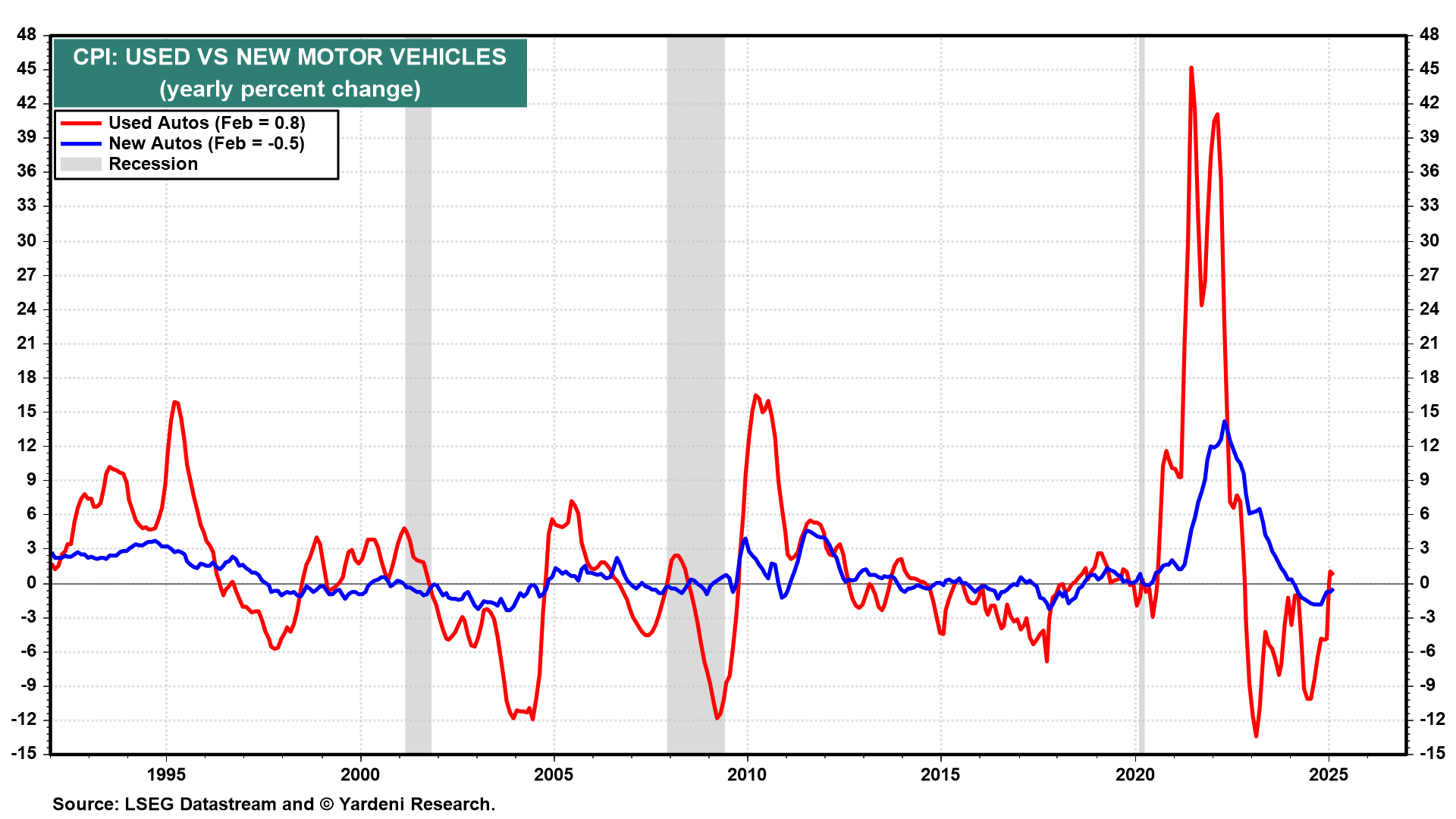

At the moment, the 25% tariff is expected to be on top of those coming on April 2. That would put cumulative tariff rates as high as 50% for imported autos. Demand for used cars is likely to surge as tariffs make new cars less affordable, which will likely boost consumer inflation (chart). Higher auto prices would depress consumer spending on autos.

Notwithstanding a rough day for auto stocks, the broader market held up okay, as the latest US economic data remained relatively solid on balance. The rebound from the soft patch in January and February is boosting bond yields, though, which combined with trade policy uncertainty is putting a damper on the stock market. The 10-year Treasury yield reached 4.37% today, its highest level in a month.

Consider some of the recent data:

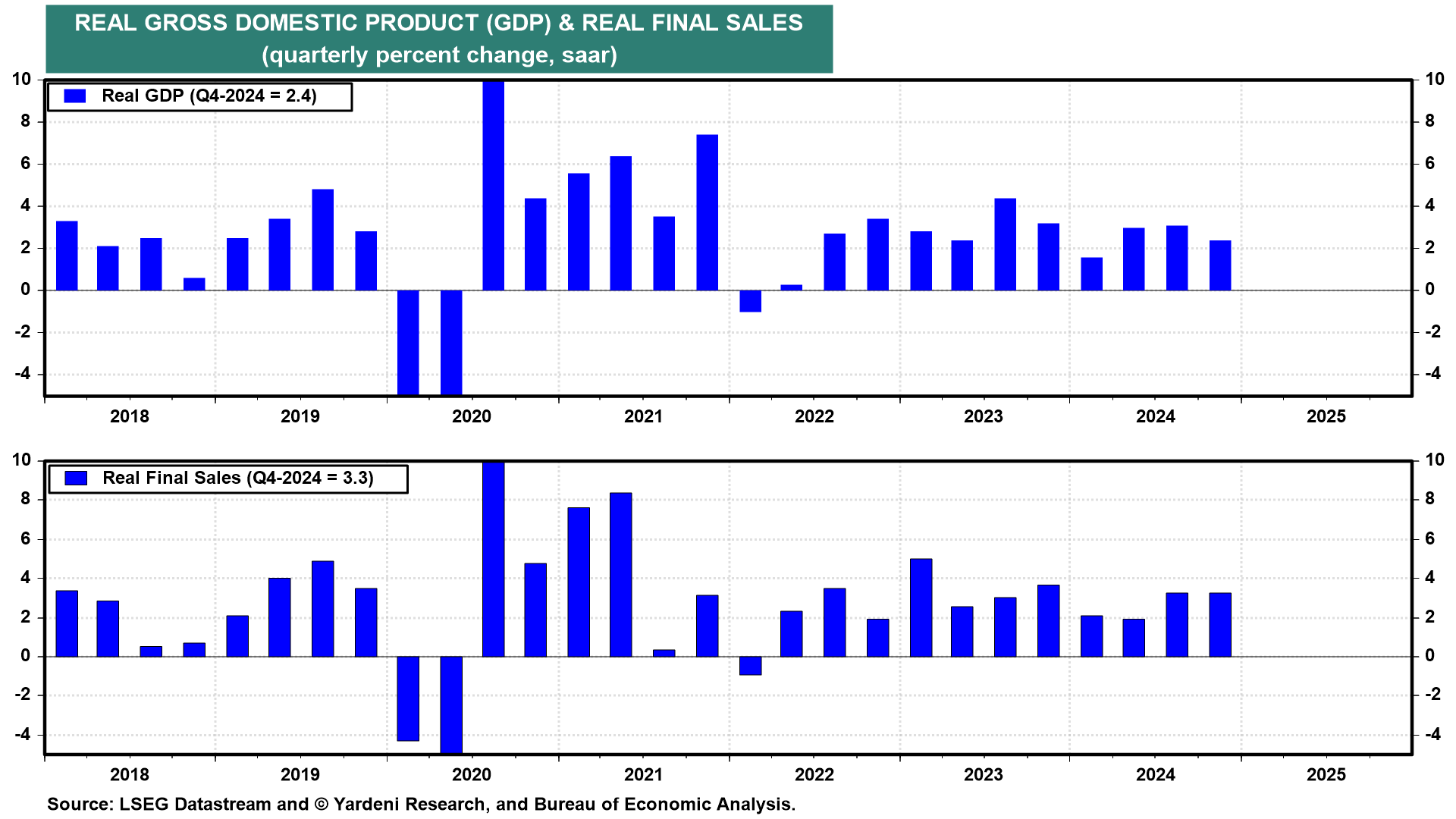

(1) Q4 real GDP was revised 0.1% higher to 2.4% (saar) (chart). Real final sales was strong at 3.3%, and real Gross Domestic Income (GDI) was 4.5%, putting the average of GDP and GDI at a very strong 3.5%.

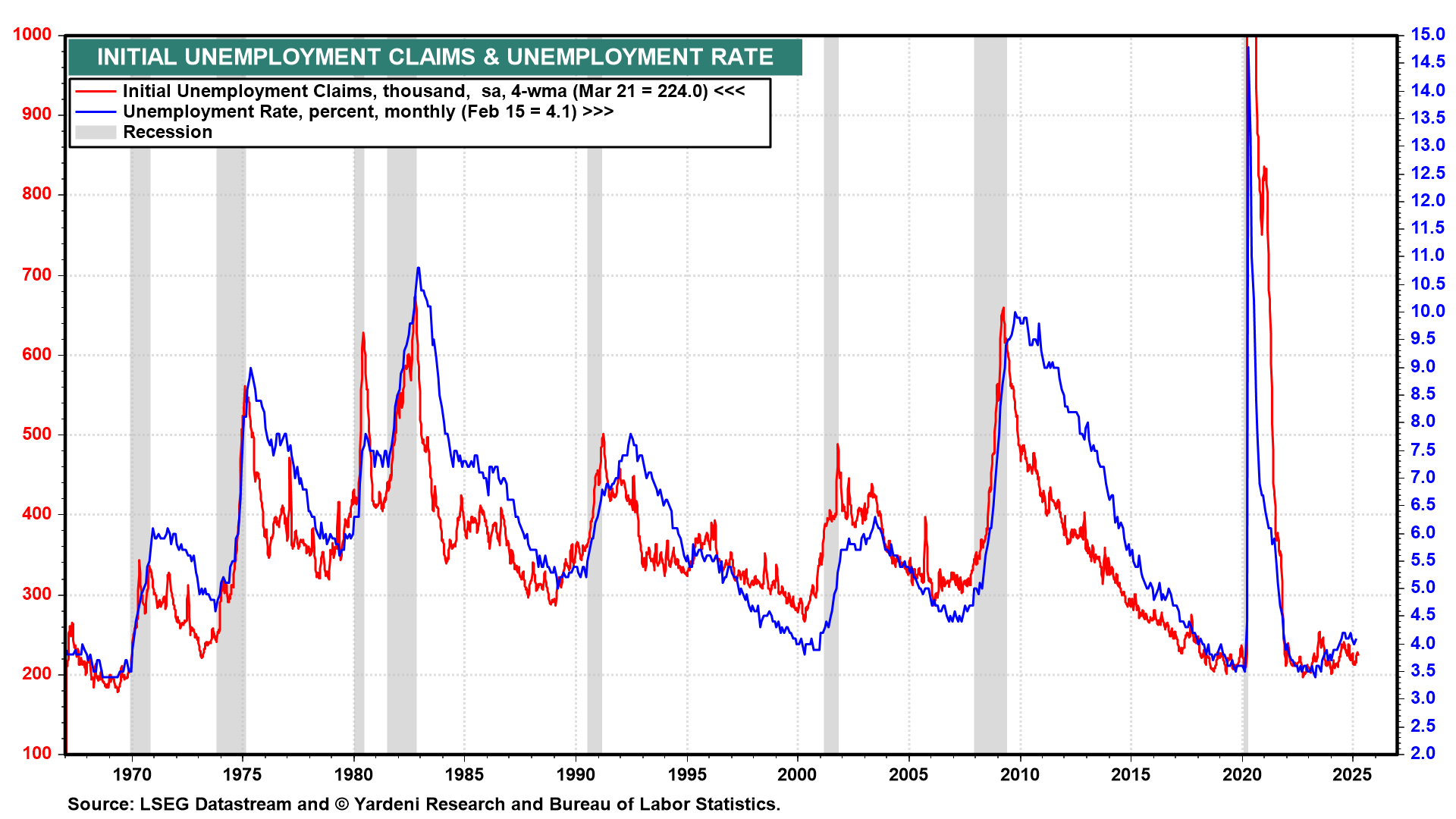

(2) Unemployment. Initial unemployment claims continue to indicate that layoffs and the unemployment rate remain low (chart). Initial claims increased 1,000 to 224,000 last week, while continuing claims fell 36,000 to 1.856 million.

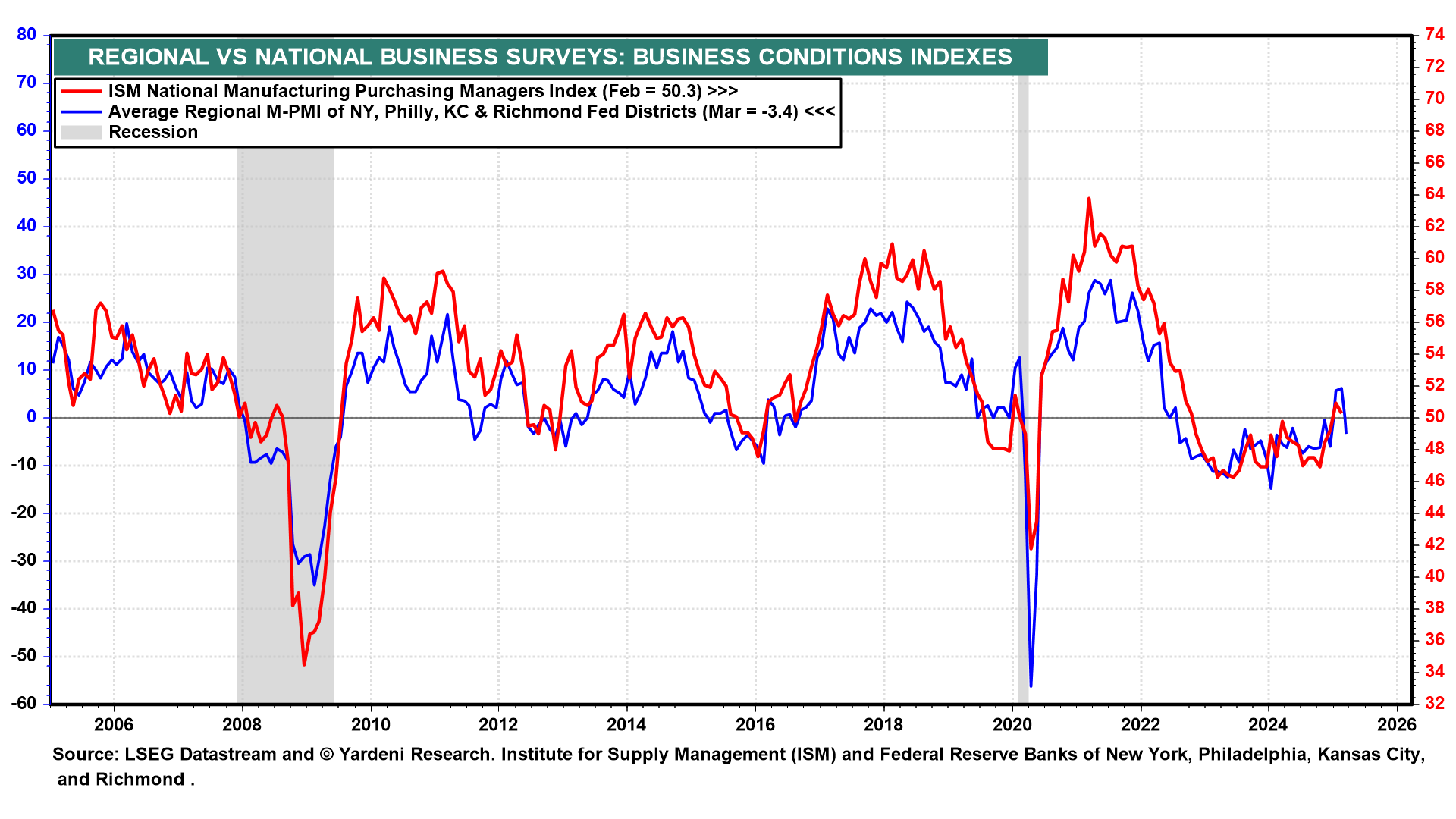

(3) Manufacturing. March's regional M-PMI from the Kansas City Fed suggested tariff turmoil is depressing the manufacturing sector in the district. Growth expectations are down, and prices paid are rising. The rolling recovery in manufacturing is on hold, and the national ISM M-PMI may sink back below 50.0 in March after two months in expansion territory (chart).