We've been bullish on the dollar for a while. Since, the Fed's September 18 meeting, the US Dollar Index (DXY) is up 5.8% (chart). Roughly half of that move has occurred since last Tuesday's US elections. The strong dollar confirms our view that the Fed has already cut the federal funds rate too much too soon, and now likely won’t be lowering rates as much as previously expected going forward. The bond market agrees, as we have noted before.

Lo and behold, Fed Chair Jerome Powell in prepared remarks for a speech [starts at 19:00] to business leaders in Dallas today said that, "the economy is not sending any signals that we need to be in a hurry to lower rates." Suddenly, he seems to agree with us that the economy is "remarkably good" and the labor market "remains in solid condition." He also acknowledged, "Inflation is running much closer to our 2 percent longer-run goal, but it is not there yet." By Jove, that sounds like our no-más case for rate cuts!

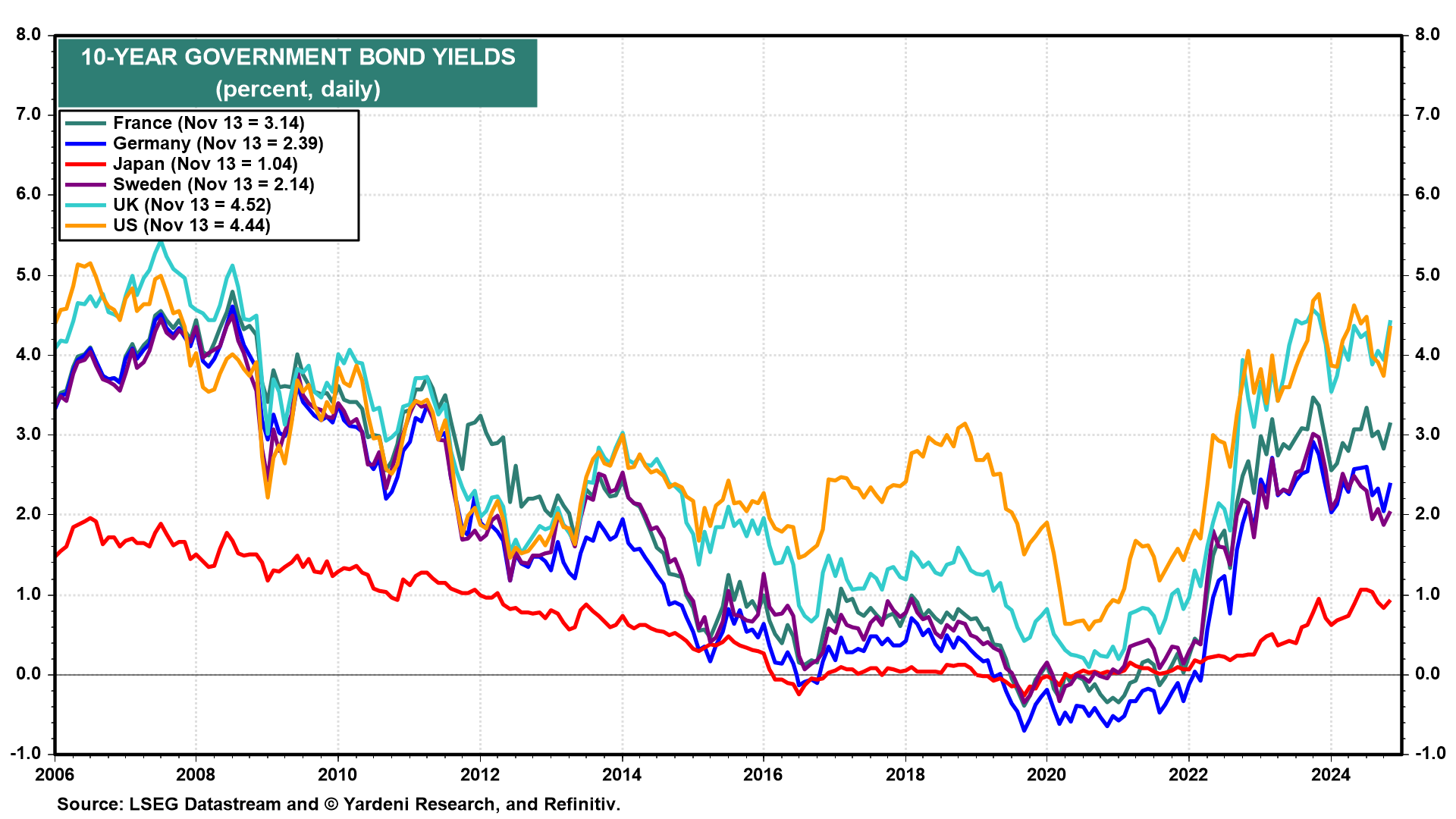

The prospect of higher tariffs under Trump 2.0 may also be boosting the greenback. But the case remains that investing in other developed economies, like those in the Eurozone and Japan, is simply not as compelling. US bonds offer higher yields (chart). US profits growth also stands out.