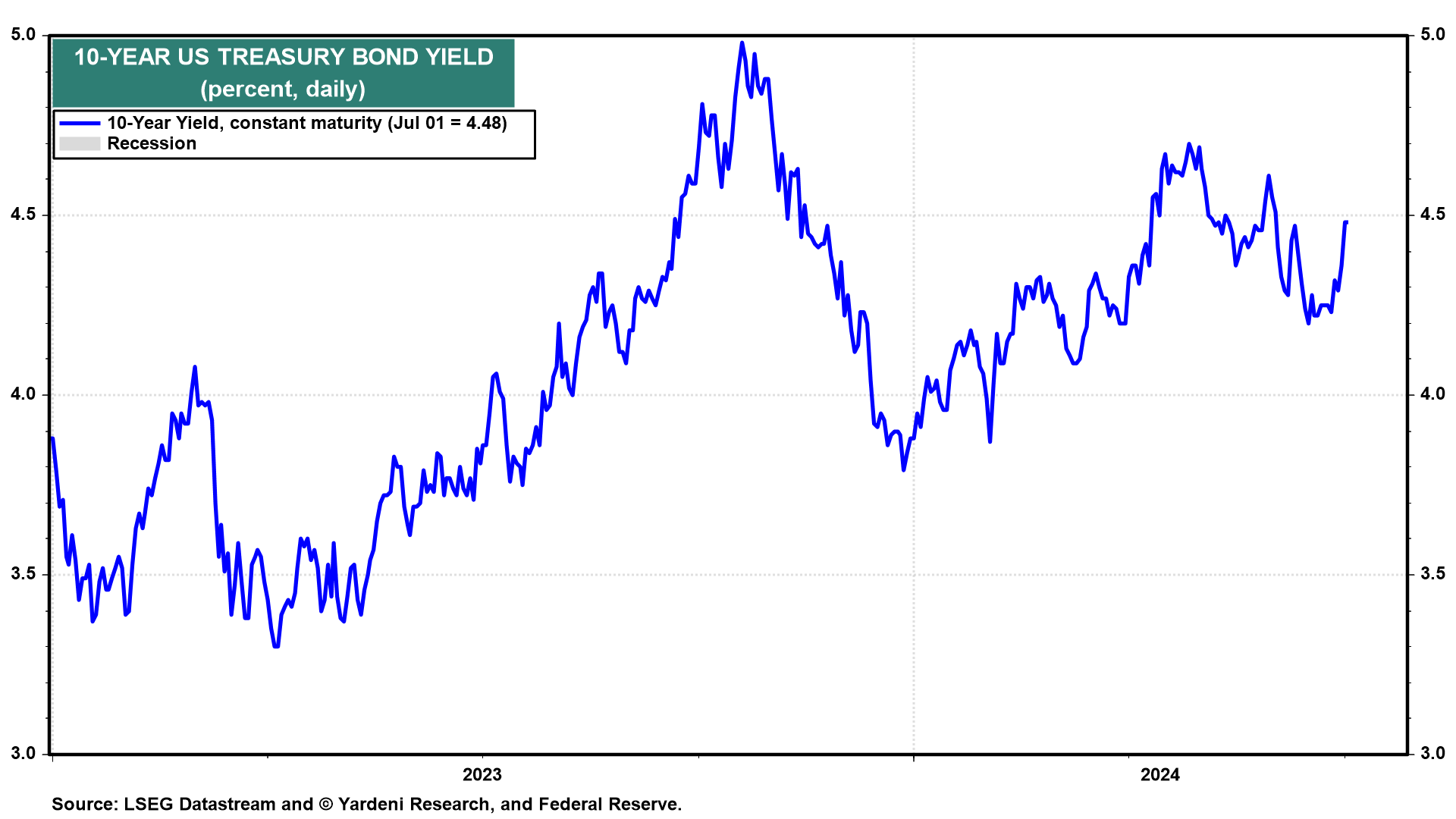

Long-term US government bond prices fell sharply since the presidential debate on Thursday evening. The 10-year Treasury yield rose from 4.29% on Thursday afternoon to 4.48% today, the highest level since May 31 (chart). That was in spite of the lowest y/y print for the personal consumption expenditures deflator (PCED) since March 2021 on Friday and another sub 50.0 report for the M-PMI on Monday. We think the bond market is reacting to the increased probability of a second term in the White House for President Donald Trump.

According to betting marketplace PredictIt, Present Trump's odds of winning the November presidential election have climbed to 57% from 52% a week ago, while President Biden's have fallen to 31% from 48%. The remainder of bids have mostly gone to alternative candidates who could replace Biden as the Democratic nominee. The Treasury market has apparently taken notice. Here's our perspective on the bond selloff:

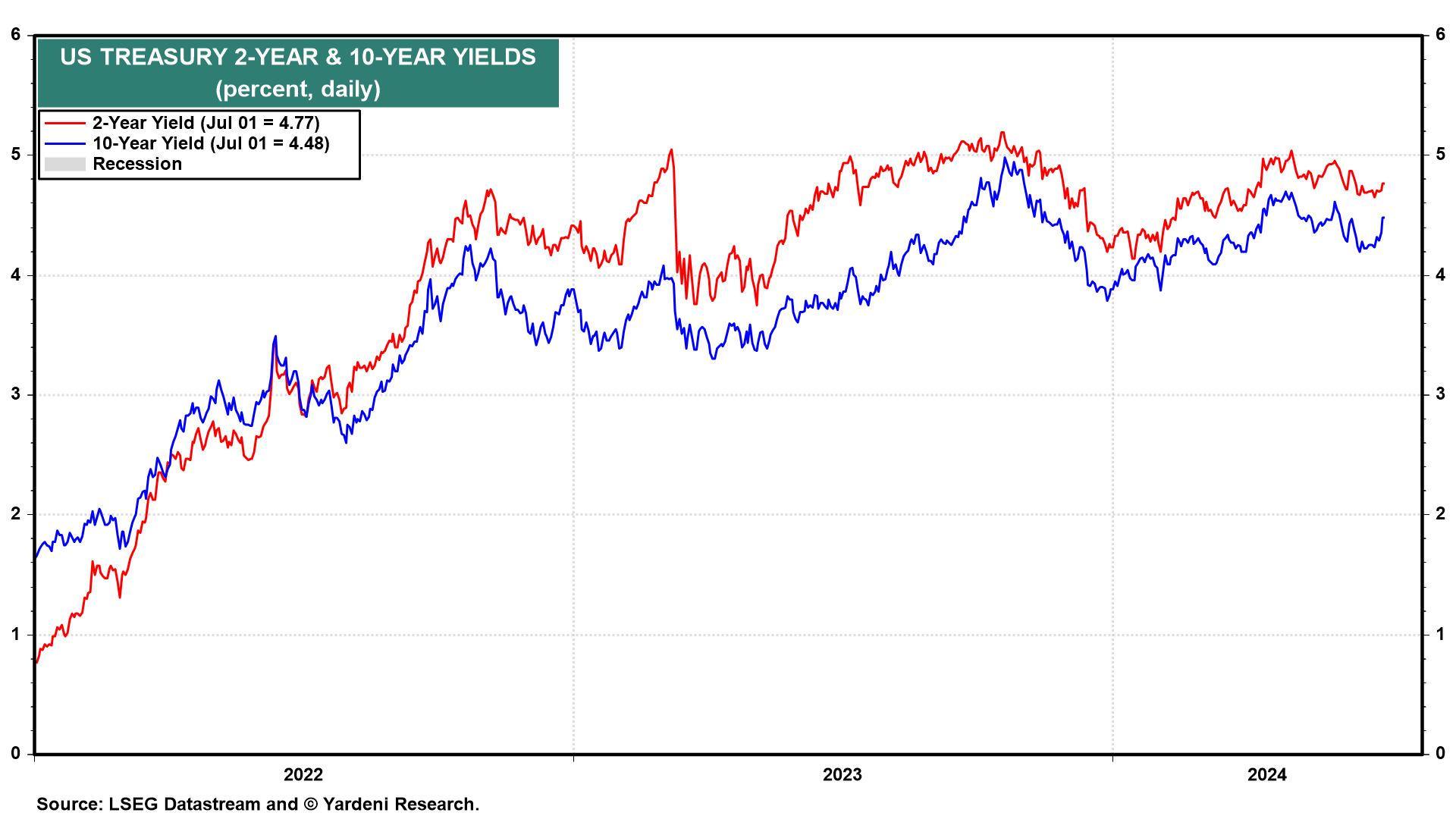

(1) Bear steepening. The 2-year yield is only up 5bps in the last two trading days. Rising yields, led by the long-end of the yield curve, mean investors' long-term economic expectations are shifting while their outlook for Federal Reserve interest rate policy hasn't changed much (chart).

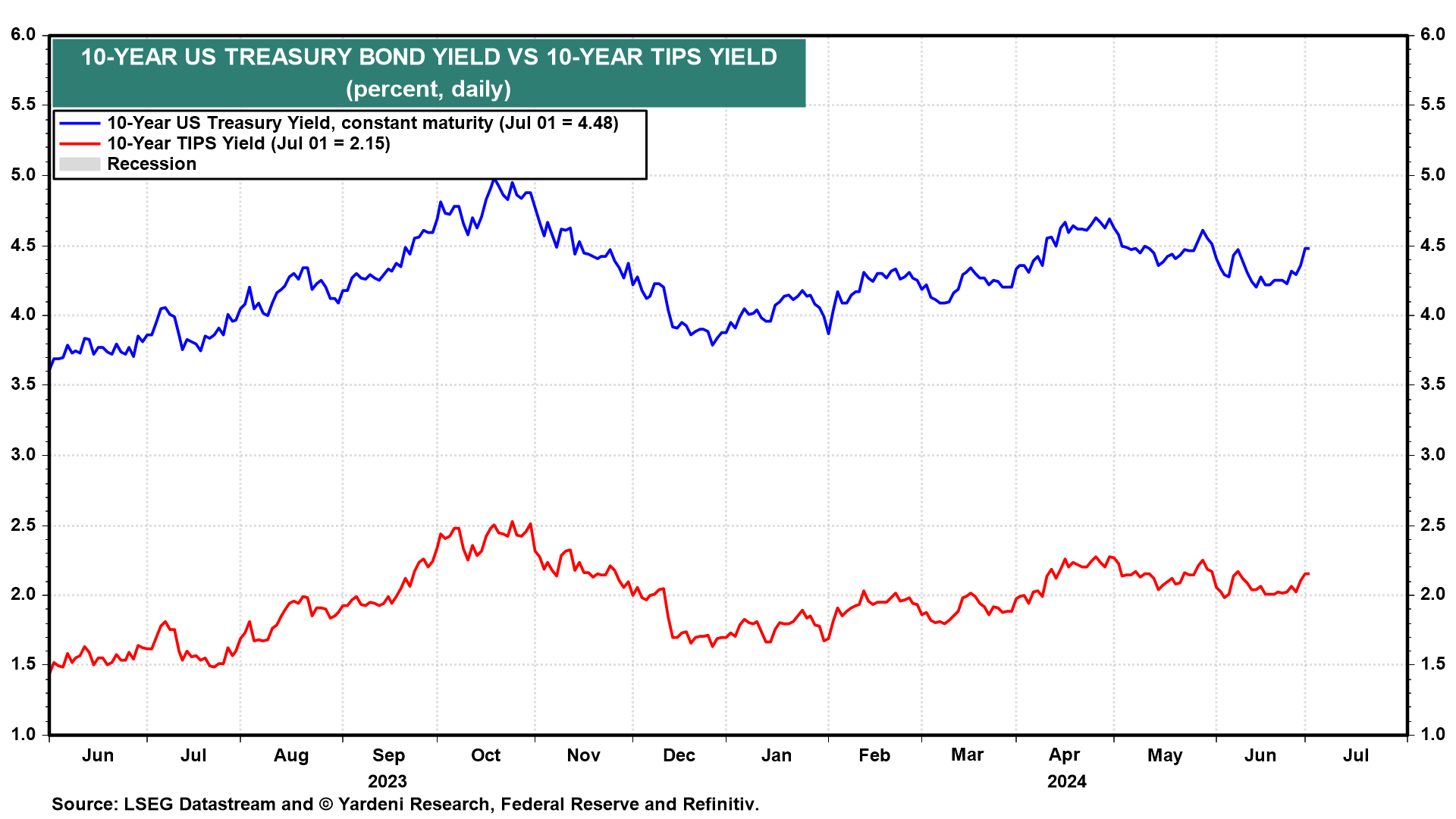

(2) Real rates. The 10-year TIPS yield is up around 14bps to 2.15% since Thursday (chart). Extrapolating the move in nominal and real yields, we think markets see a potential mix of stronger economic growth, higher inflation, and more Treasury supply in the event Trump wins.