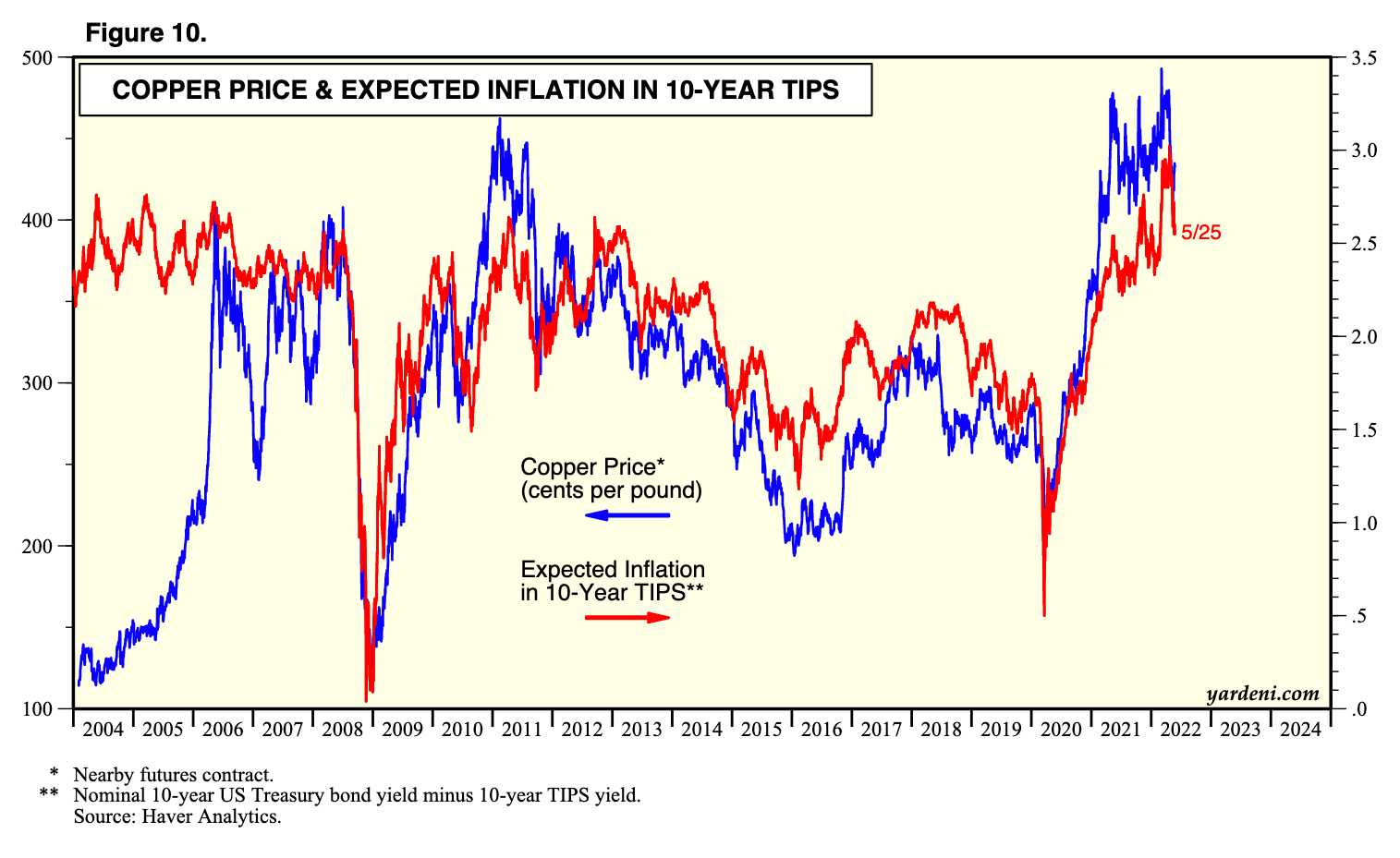

The widely followed proxy for the expected inflation rate in the 10-year TIPS market dropped in recent days from over 3.0% to 2.6%. Is that just volatility? Or, is it signaling a global economic slowdown since it is highly correlated with the nearby futures price of copper, which has also been weak lately?

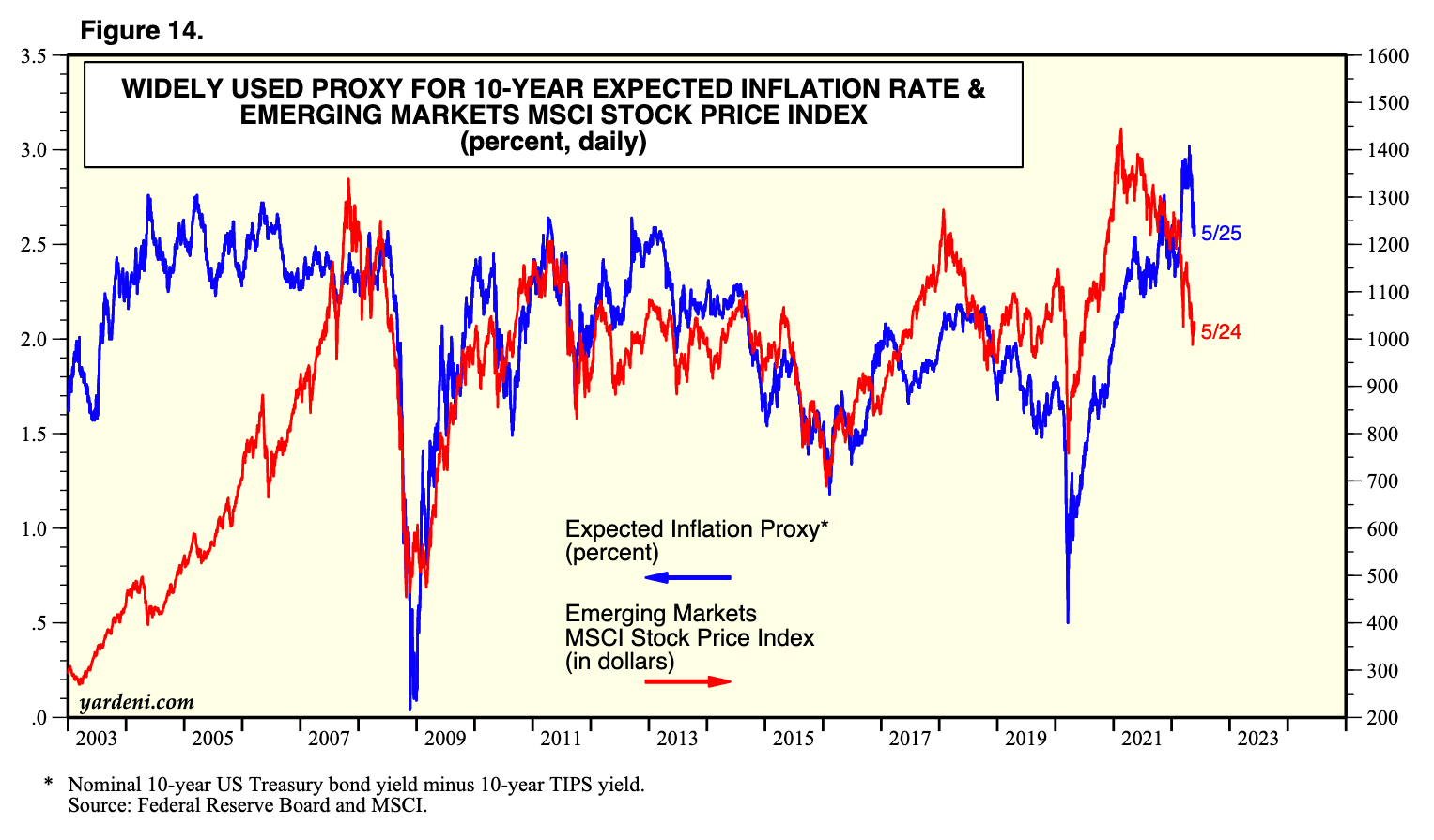

The expected inflation rate is also highly correlated with the Emerging Markets MSCI stock price index in both dollars and local currencies, though they've diverged since early 2021 with the former trending higher and the latter trending sharply lower.

A global economic slowdown could put downward pressure on commodity prices and cool inflationary expectations. That would likely keep the bond yield around 2.75%-3.00%. In this scenario, stock prices would probably remain in a volatile range, but more to the upside than the downside of the range for now.