So said Federal Reserve Governor Christopher Waller this evening at the Economic Club of New York in a speech titled “There’s Still No Rush.” He noted that the latest inflation figures were "disappointing" and that the economy and labor market remain strong. So, in his opinion, "it is appropriate to reduce the overall number of rate cuts or push them further into the future in response to the recent data." The Summary of Economic Projections released last week by the FOMC showed that nine of the 19 participants projected two cuts or fewer this year. Nevertheless, Fed Chair Jerome Powell sounded more dovish in his presser last week and dismissed the inflation news as "bumps."

We agree with both Powell and Waller: Inflation should continue to moderate as Powell implied, so what's the rush to lower interest rates if the economy is strong?

In any event, it was a good day on Wall Street. Could it be that as long as no one at the Fed is talking about raising interest rates, then the focus might be turning to the improving outlook for corporate earnings? Indeed, Waller said there is no reason to think about raising interest rates.

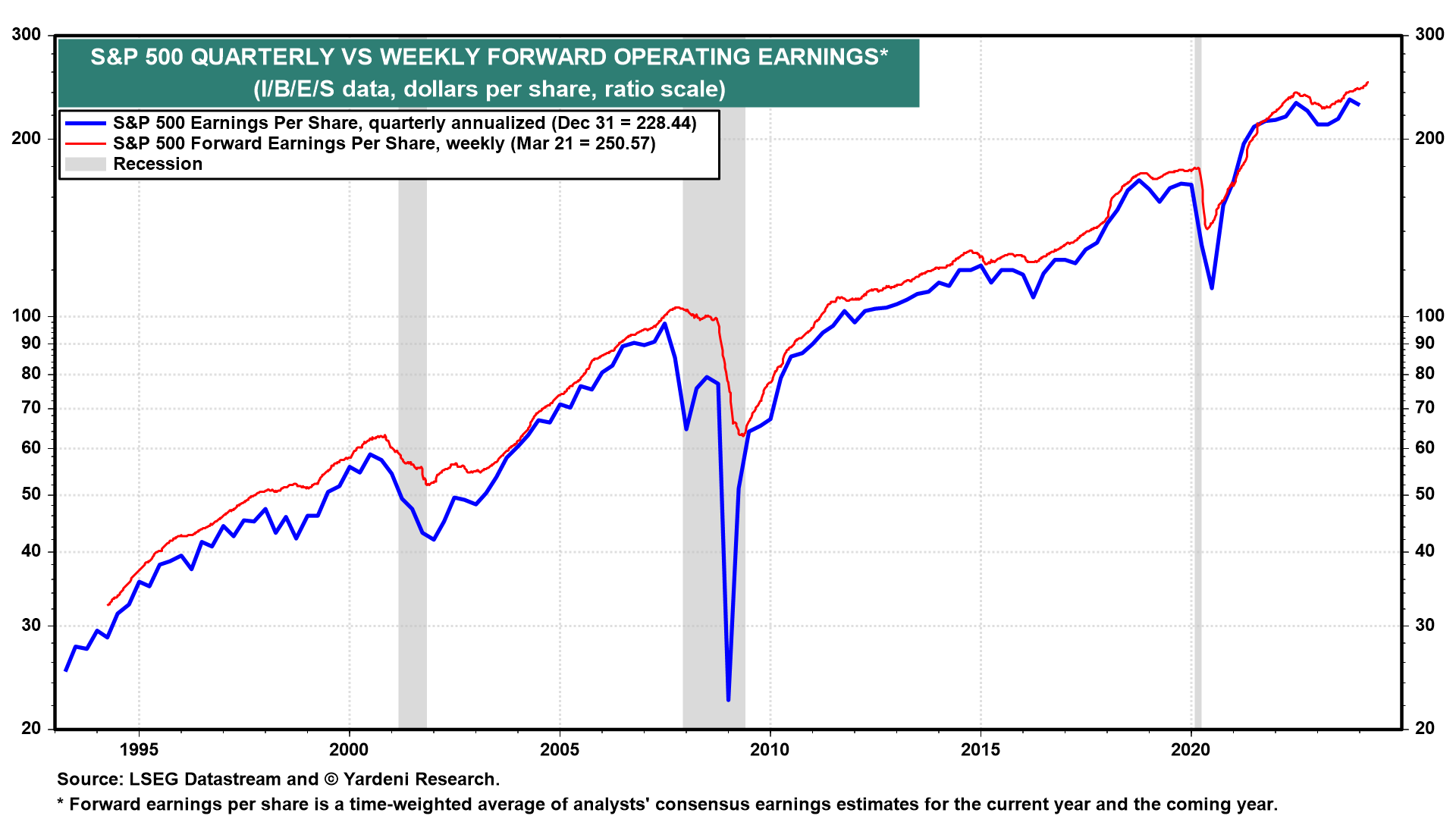

Meanwhile, April is coming. That means that Q1's earnings reporting season is around the corner. Needless to say, almost every earnings call with managements will mention AI multiple times. In any event, S&P 500 forward earnings rose to another record high during the March 21 week, suggesting that Q1's operating earnings rose to a record high (chart).

Is there anything to worry about?