The stock and bond markets are marking time. They might continue to do so during the first half of this year. The stock market should resume its advance during the second half of the year. The 10-year bond yield may continue to hover around 4.00% +/- 25bps this year. Here are the major issues hanging over the markets currently:

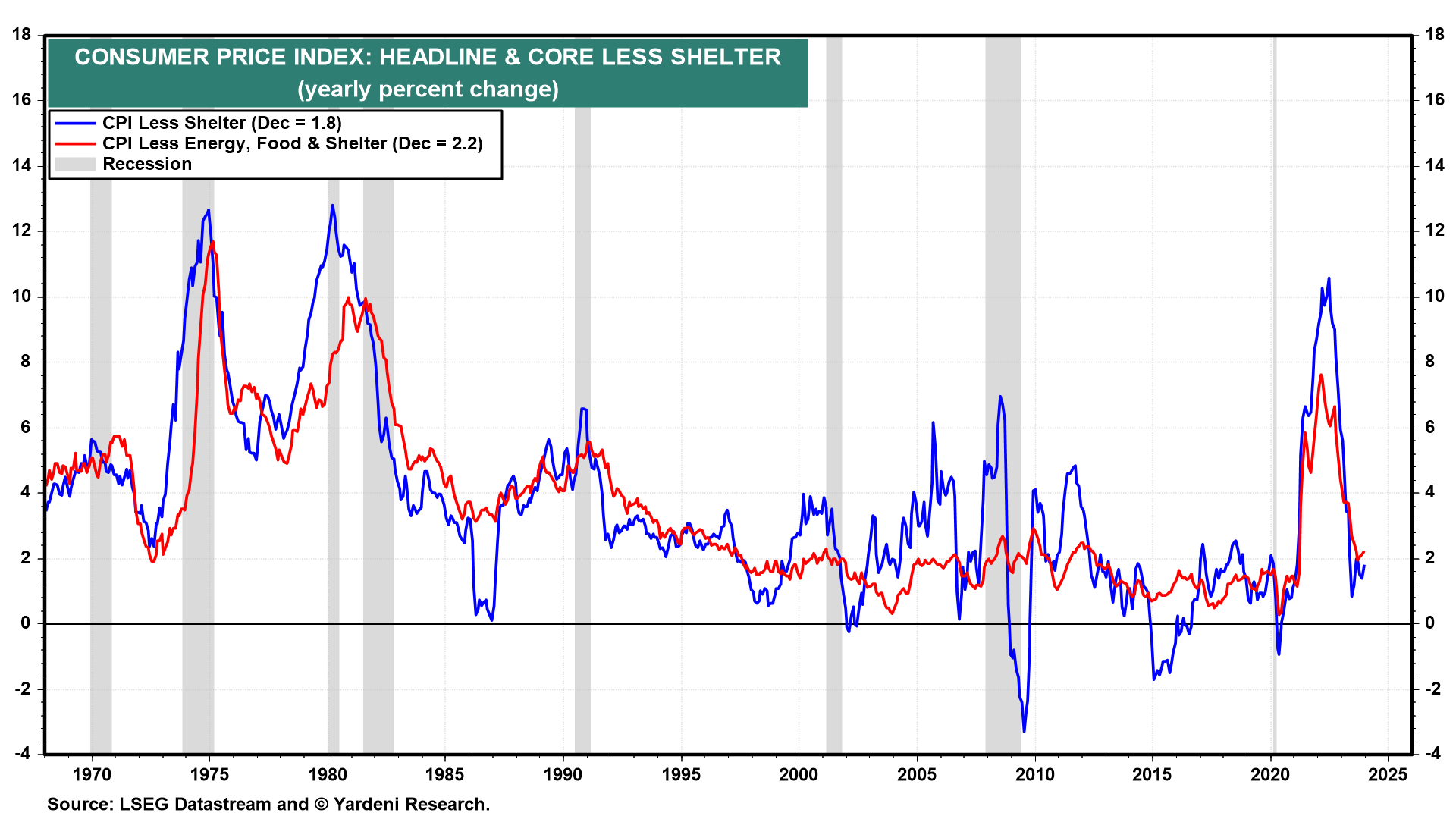

(1) Inflation. December's CPI release showed a slight uptick in the headline rate to 3.4% y/y, while the core rate edged down to 3.9%. The markets are coming around to our view that while inflation remains on a downward trend, the Fed is in no rush to lower interest rates. The problem is that rent inflation as measured in the CPI remains sticky. Excluding shelter, the headline and core CPI inflation rates are down to1.8% and 2.2% (chart). That's really good news, but the Fed wants to avoid a rebound in inflation, which is why we expect fewer-and-later rate cuts this year.

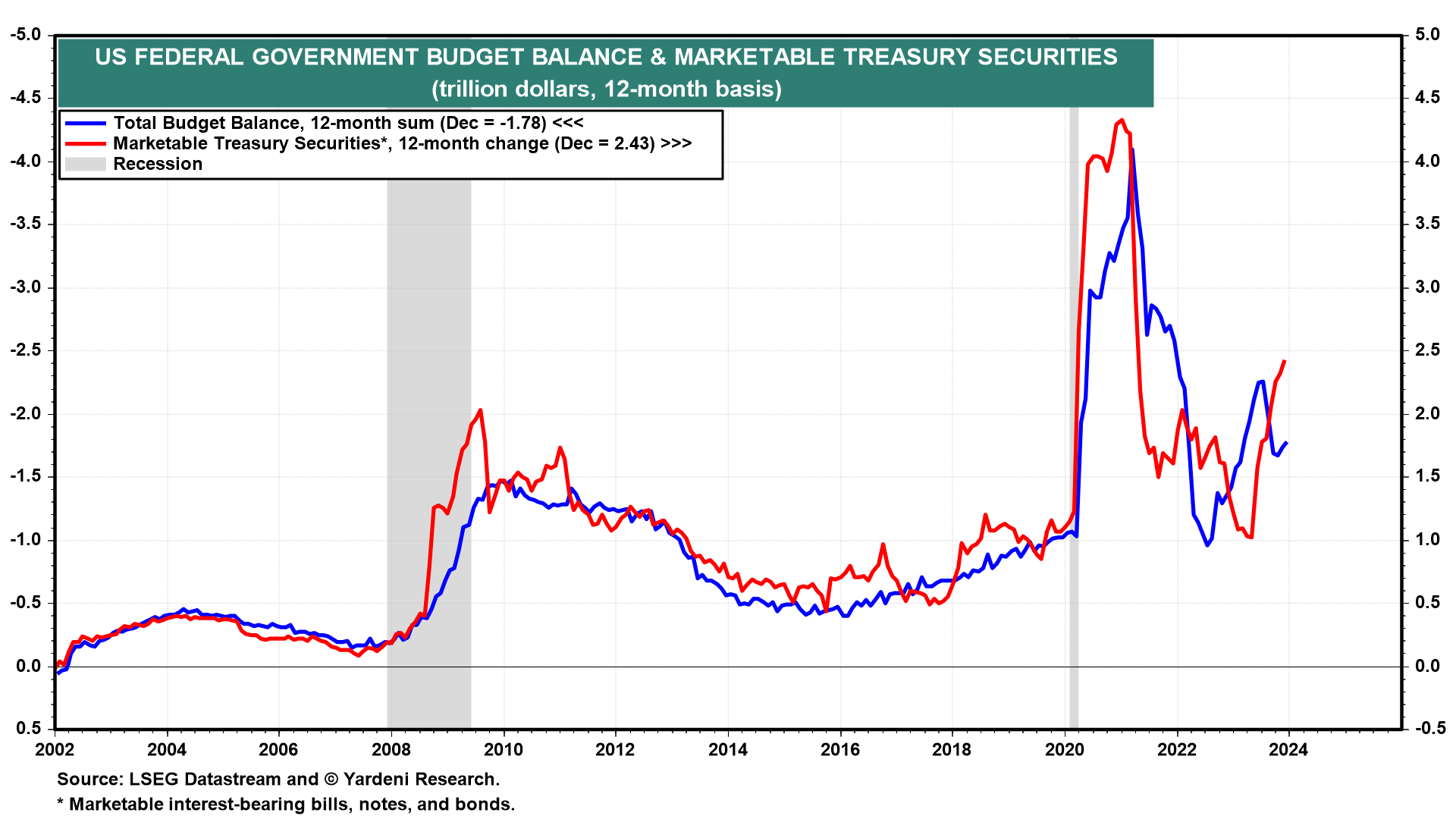

(2) Budget deficit. The Treasury’s auction of 10-year bonds Wednesday was slightly weak at a yield of 4.028%. This afternoon, the US Treasury released December's deficit and debt data showing the former at $1.78 trillion over the past 12 months while the latter rose $2.43 trillion over the past 12 months (chart).

Net interest paid by the Treasury rose to a record $730.4 billion, and will soon exceed defense spending, which has been rising more rapidly recently as the world gets more dangerous (chart).