We made it through another year of living dangerously: 2024 is here! The first week of the new year is unlikely to bring any surprises on the economic front. Most of the indicators will provide insights into the labor market and consumer spending on autos and houses:

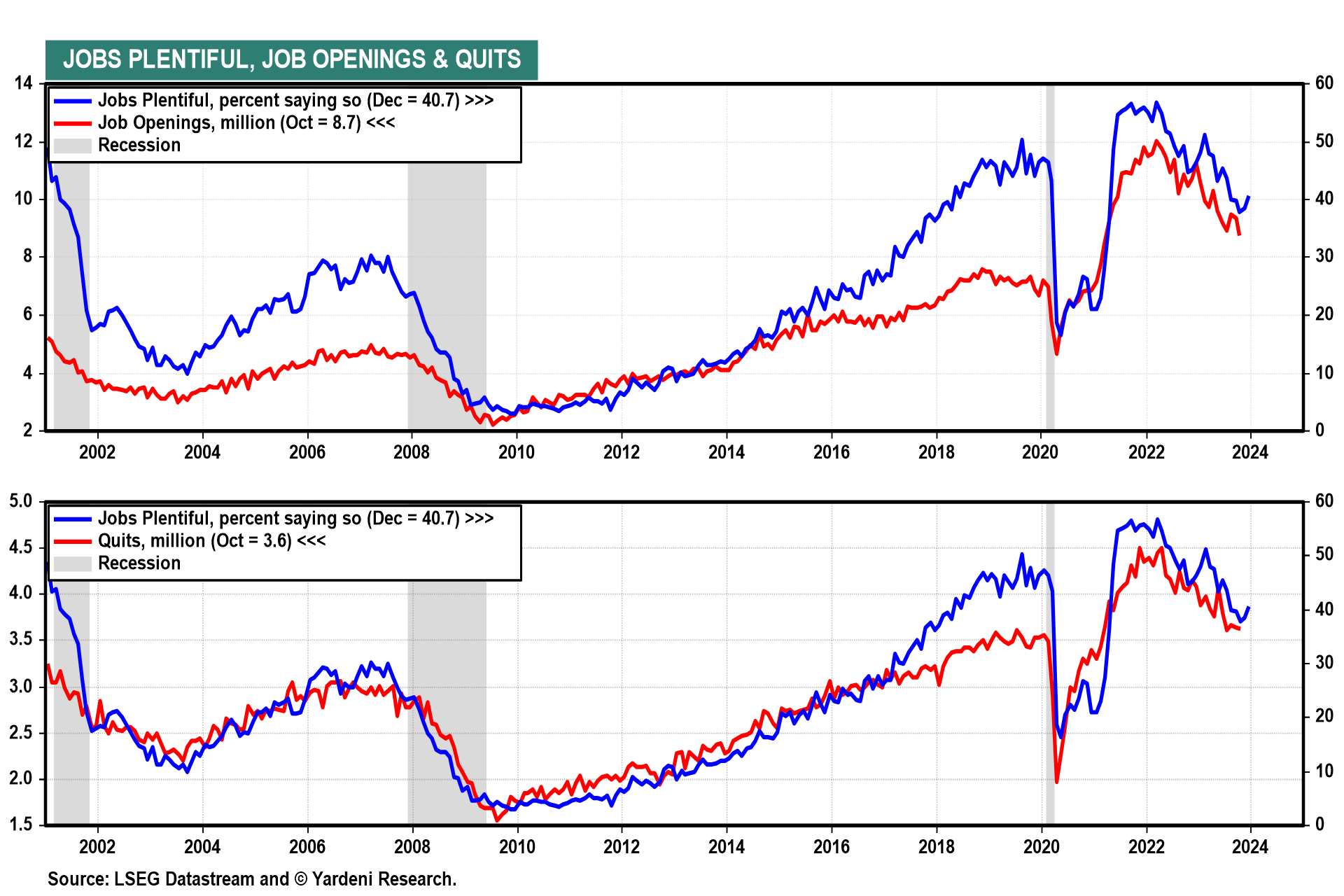

(1) November's JOLTS report (Tue) should confirm that there are still more job openings than unemployed workers. We know that from December's upbeat "jobs plentiful" data included in the consumer confident survey (chart).

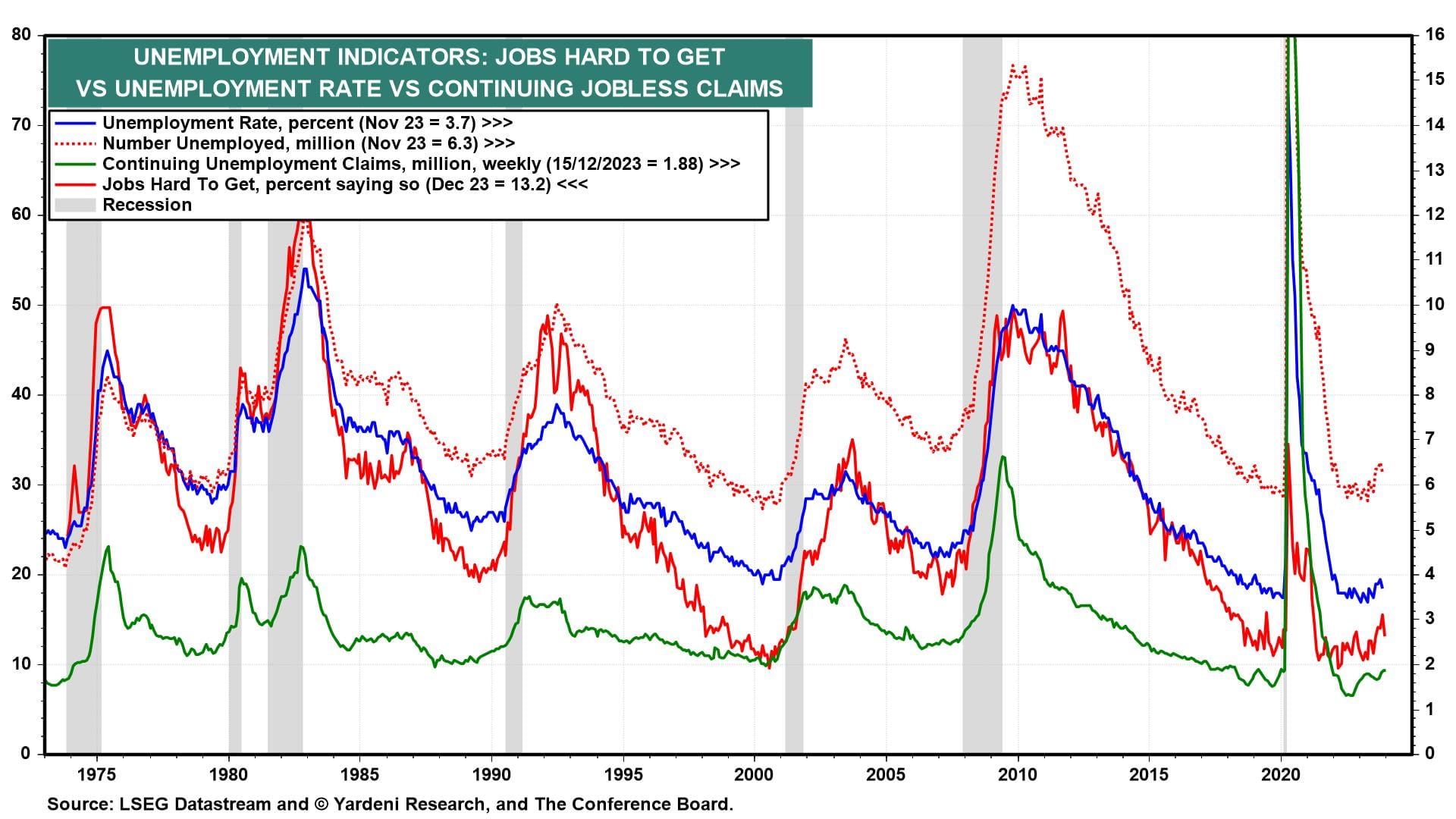

(2) Initial and continuing unemployment claims (Thu) during the last two weeks of December probably remained around 210,000 and 1.9 million, suggesting that December's unemployment rate (Fri) remained below 4.0% and that payroll employment rose solidly, perhaps by around 185,000 (chart). December's wage inflation rate (released with employment on Fri) should show that it remains on a downward trend and still exceeds price inflation, thus continuing to boost consumers' purchasing power.

(3) Hard-landers might get a break from December's ISM M-PMI (Wed), which most likely remained below 50.0 according to the average of the five regional business activities indexes (chart). On the other hand, December's NM-PMI (Fri) should remain solidly above 50.0.