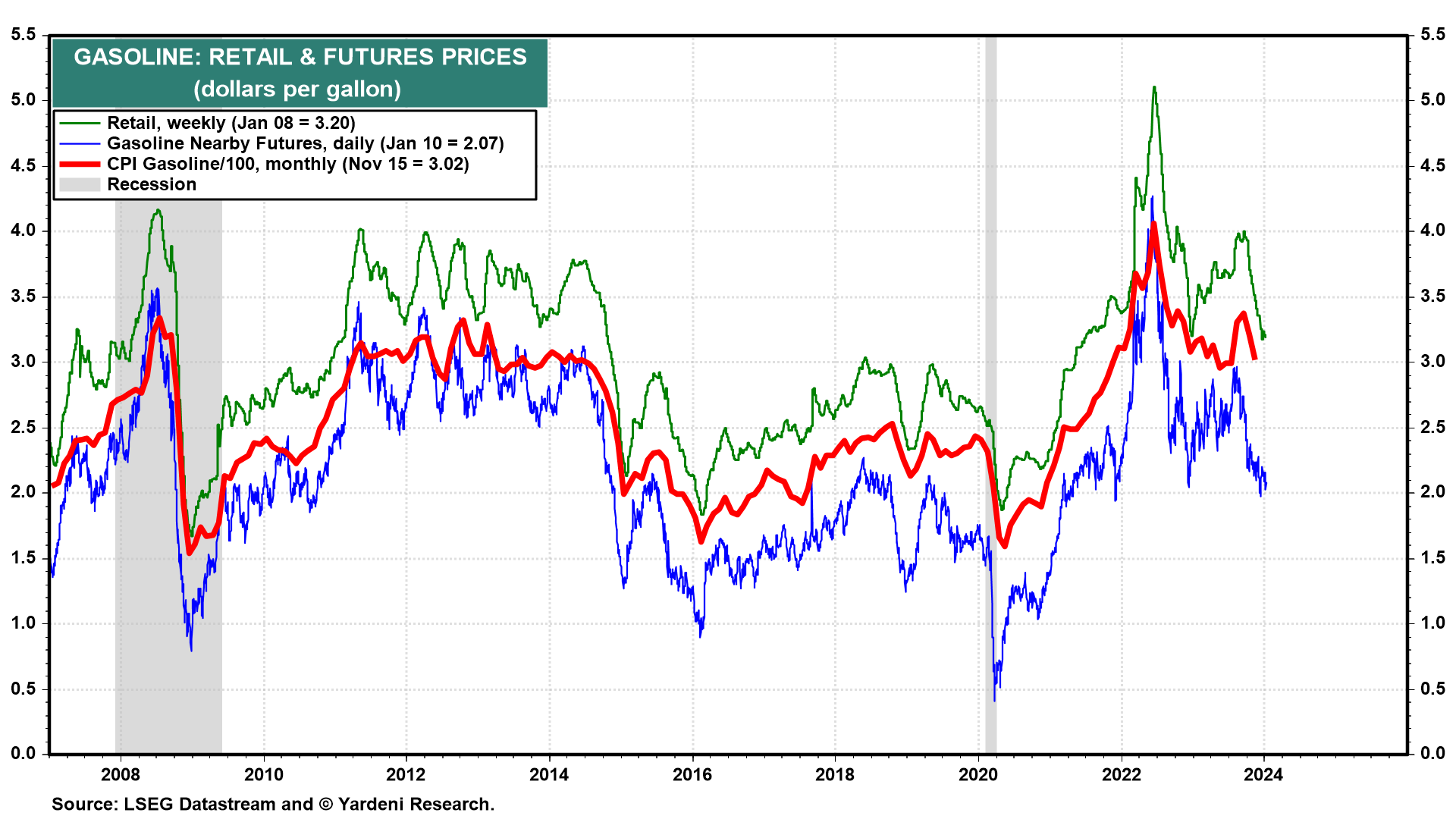

The second week of the month tends to be light on economic releases compared to the other weeks of the month. However, it usually includes the CPI. The Cleveland Fed Inflation Nowcasting is projecting that tomorrow's headline and core CPI inflation rates for December will both be up 0.3% m/m. We are thinking that the headline might be closer to zero given that gasoline prices continued to fall last month (chart). As for the core rate, used car prices continued to fall in December and market rent indexes suggest that this component of the CPI is heading lower.

December's PPI (Fri) should confirm that the downward trend in inflation is widespread.

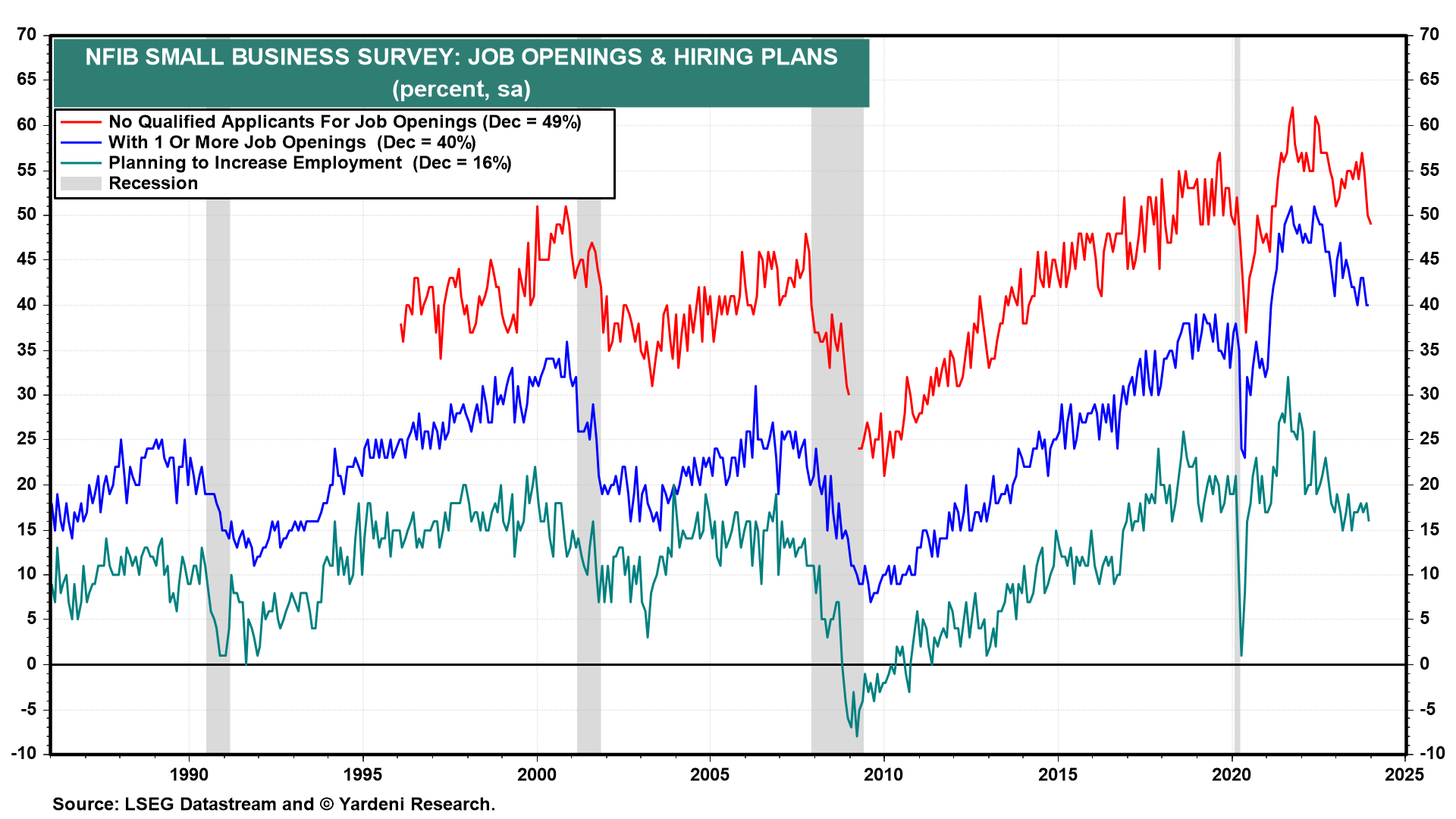

Initial unemployment claims for the January 6 week (Thu) probably remained close to 200,000. December's Small Business Owners survey showed that 40% said that they have job openings (chart).

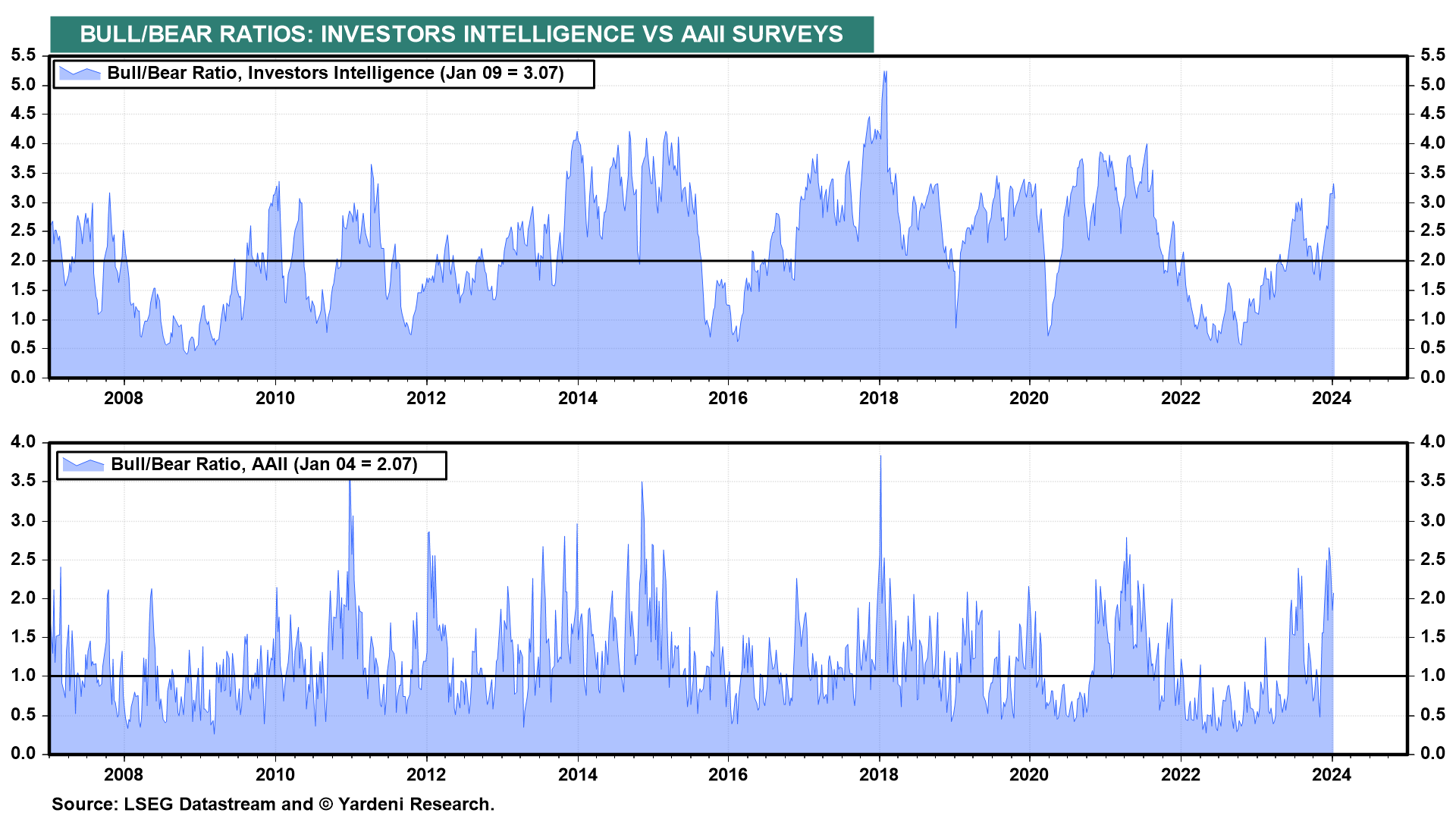

The latest batch of indicators are all consistent with our "immaculate disinflation" economic scenario, which is bullish for stocks. The only question is whether the market has discounted all the good news for now. Sentiment indicators remain very bullish, which is bearish from a contrarian perspective (chart).