The FOMC meets Tuesday and Wednesday with Fed Chair Jerome Powell conducting a press conference Wednesday afternoon. We expect no change in the federal funds rate. Powell is likely to push back against the market's expectations of sooner-rather-than-later rate cuts by observing that financial conditions have eased and the economy is stronger than expected, thanks in part to productivity.

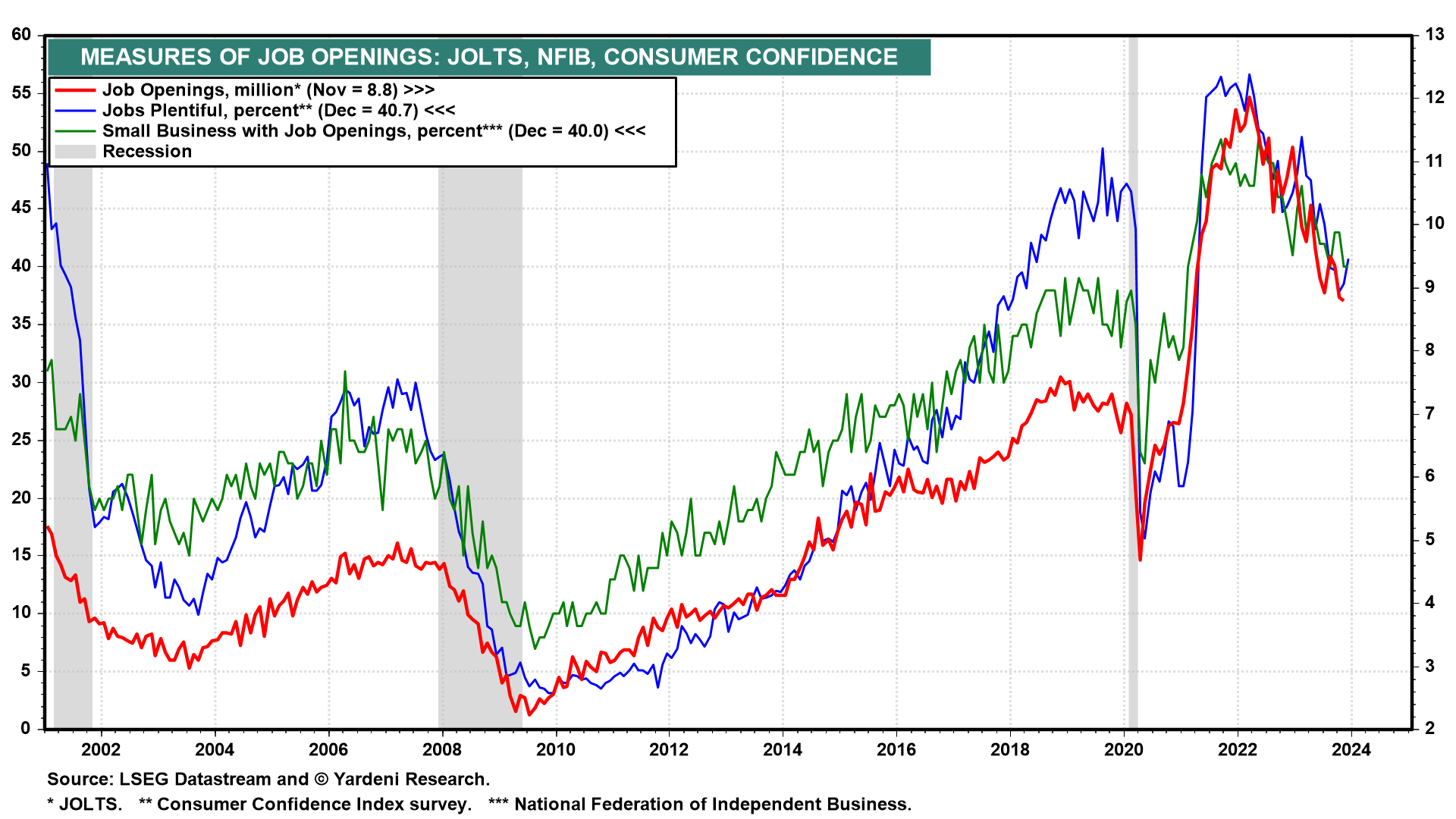

The first week of each month tends to be loaded with employment reports. Starting the fun will be December's JOLTS report on job openings (Tue) and January's consumer confidence survey (Tue) showing whether jobs are still plentiful. The latter is a more timely indicator of the labor market, though the former tends to get more press. Both series have been falling since early 2022, but remained relatively high when they were reported a month ago (chart).

The four-week moving average of initial unemployment claims suggests that January's unemployment rate (Fri) remained below 4.0% (chart). We expect that payroll employment rose 185,000 this month.