Following Iran's attack on Israel Saturday, geopolitics should dominate this week's market action. The Q1 earnings reporting season will also merit investors' attention. In addition, Fed officials are likely to chatter about whether any rate cuts are likely this year given last week's hotter-than-expected March CPI. And there are plenty of economic reports coming out this week. They are likely to show that the US economy is continuing to do well.

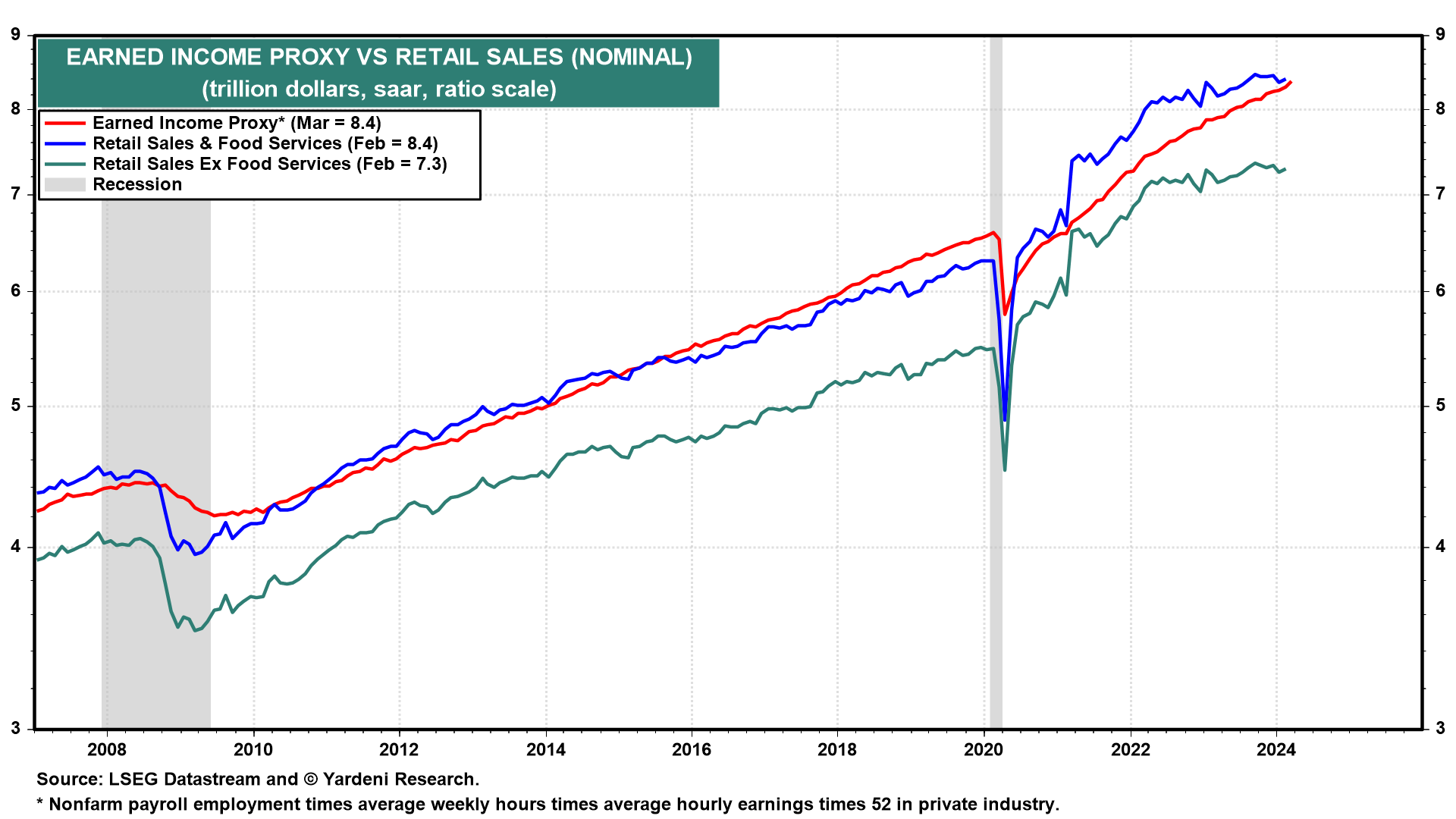

March retail sales (Mon) should be strong since our Earned Income Proxy for private industry wages and salaries rose 0.8% m/m last month (chart). However, the gain may not be as impressive in real terms because the CPI goods inflation rate was 0.66% m/m in March led by a 1.3% increase in gasoline prices.

March industrial production (Tue) should be up slightly reflecting the increase in aggregate hours worked in manufacturing last month (chart). This (along with the March M-PMI) suggests that the rolling recession for goods producers and providers is ending.