Earlier this year, the decline in these multiples reflected the jump in the 10-year US Treasury bond yield, which occurred in response to increasingly hawkish talk from Fed officials. In recent days, it seems to reflect increasing concern that the Fed will soon be too tight and cause a recession.

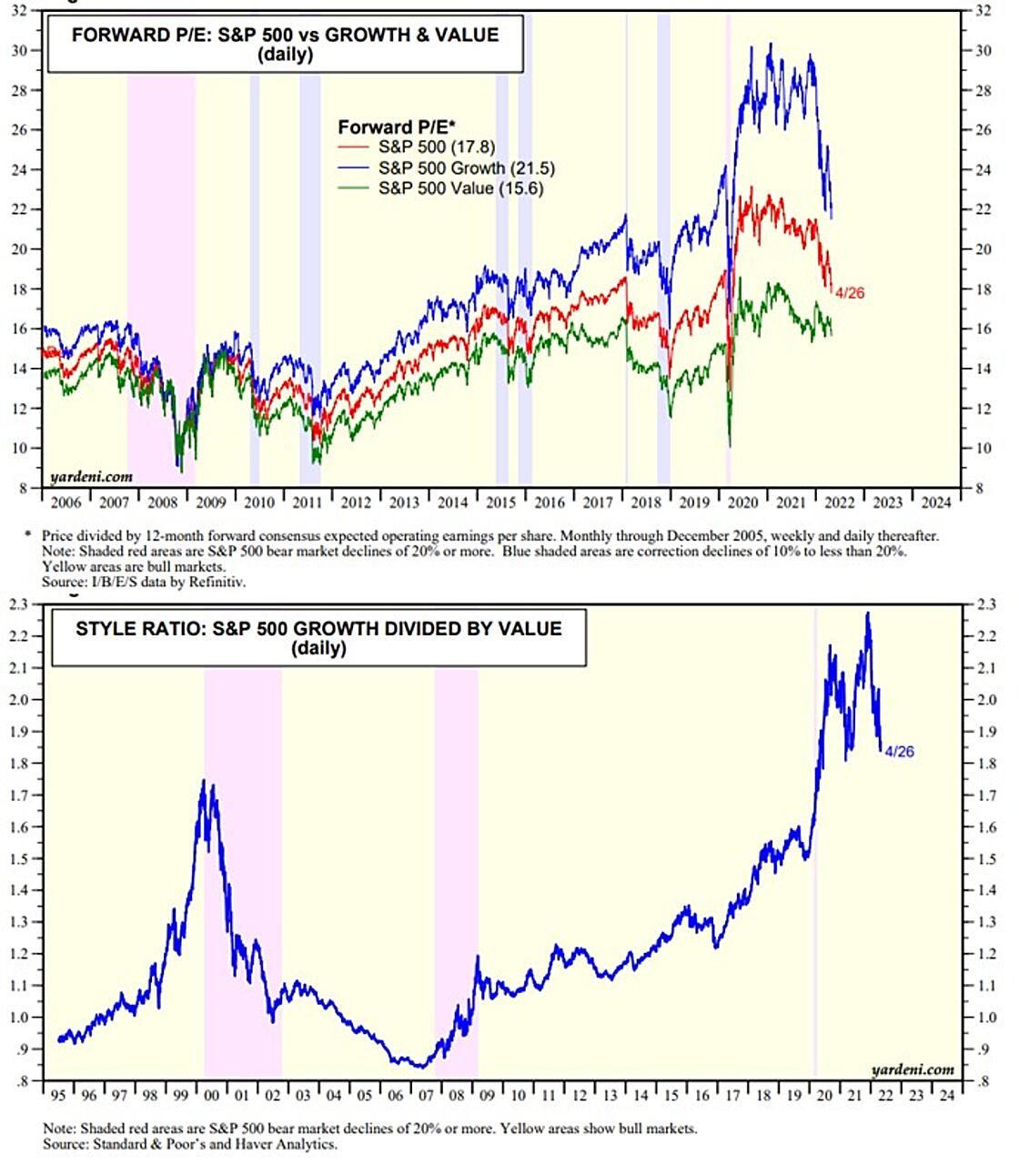

The yield rose from 1.63% at the start of the year to peak at 2.94% on April 19. Since then, it has dropped to 2.73% as of Tuesday's close, while the S&P 500's forward P/E fell from about 21.0 at the start of this year to 17.8. That's the lowest since early April 2020.

The forward P/E of S&P 500 Value has been holding up around 15.0-17.0 since the start of the year. Value has outperformed Growth since earlier this year mostly because the S&P 500 Energy sector has significantly outperformed all the other sectors of the index. Financials have also outperformed the S&P 500 Growth so far this year, but the rising bond yield stopped boosting the relative performance of this sector earlier this year once it rose above 2.00% on its way to almost 3.00%.

Here is the performance derby of the 11 sectors of the S&P 500's sectors since the record high on January 3 through today's close: Energy (28.7%), Utilities (2.9), Consumer Staples (1.8), Health Care (-5.5), Real Estate (-5.9), Materials (-5.9), Industrials (-8.3), Financials (-10.8), S&P 500 (-13.0), Consumer Discretionary (-20.1), Information Technology (-20.6), and Communication Services (-24.5).

The MegaCap-8 have weighed heavily on the S&P 500 Growth's valuation multiple and contributed significantly to the underperformance of the Consumer Discretionary, Information Technology, and Communication Services sectors.

Joe and I are still in the correction camp. The risks of a financial crisis and a recession have increased, but we don't expect they will happen this year. In our scenario, the S&P 500 remains volatile this year with the forward P/E ranging between 16.0 and 19.0. The bull market should be back next year. So this should be a good year for picking cheaper stocks.