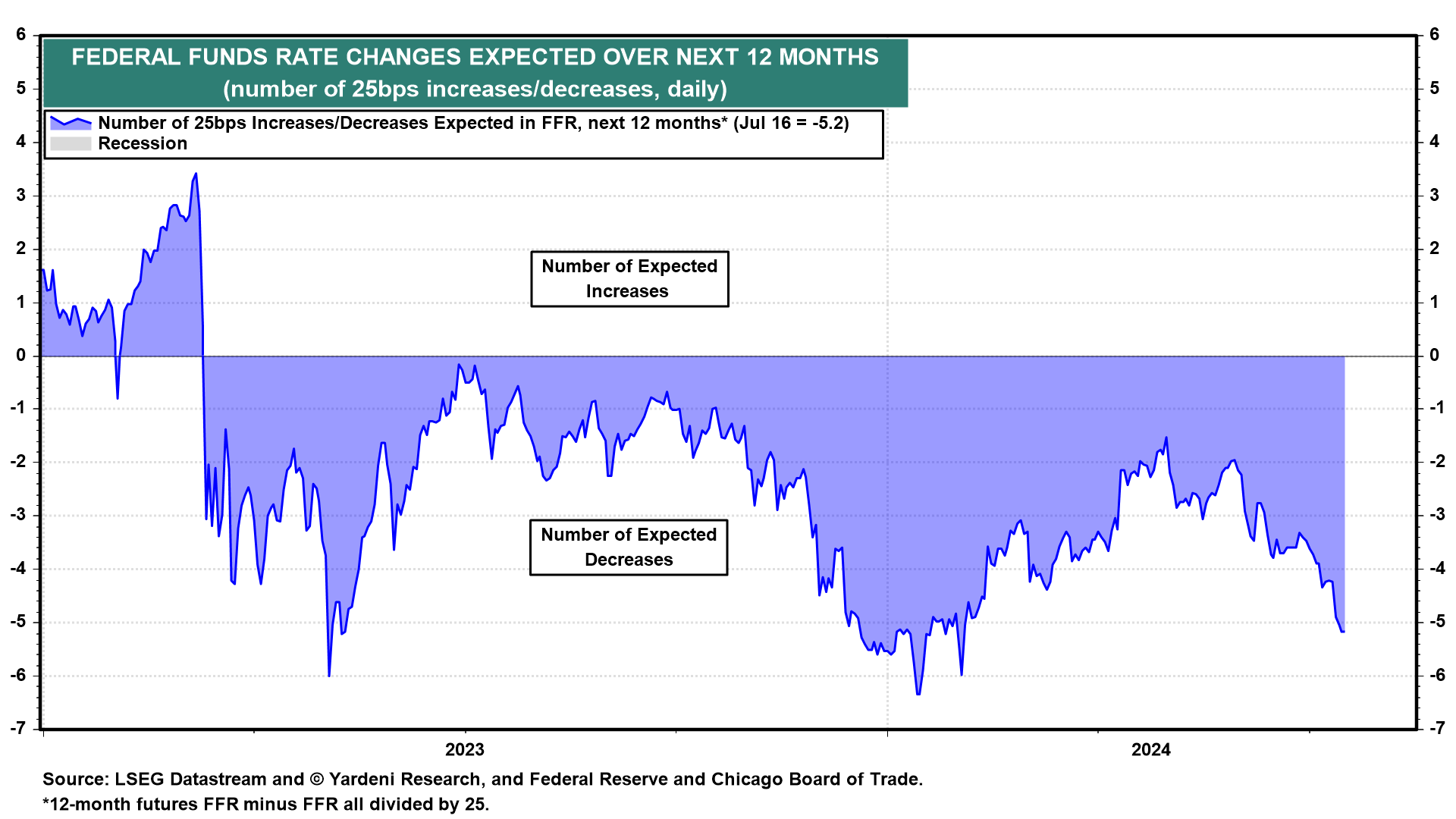

We've been predicting a broadening stock market meltup in the event that the Fed starts cutting the federal funds rate (FFR) as inflation moderates while economic growth remains solid. Last week's CPI and today's retail sales report confirm that's what's happening in the economy. Fed Chair Jerome Powell's dovish comments yesterday sealed the deal: As of this morning, markets were pricing in a 100% chance of a 25bps FFR cut in September, per the CME FedWatch Tool, up from a 70% chance a month ago. A total of five such cuts are expected over the next 12 months (chart).

Also fueling the meltup: The betting marketplace PredictIt is now showing 2:1 odds of former President Donald Trump winning in November, up from a coin-flip two months ago. For now, investors may be focusing on Trump's low tax-rates policy rather than his high tariff-rates policy. Trump is also likely to deregulate business with the help of the recent SCOTUS ruling that reduced the power of the government's regulatory agencies.

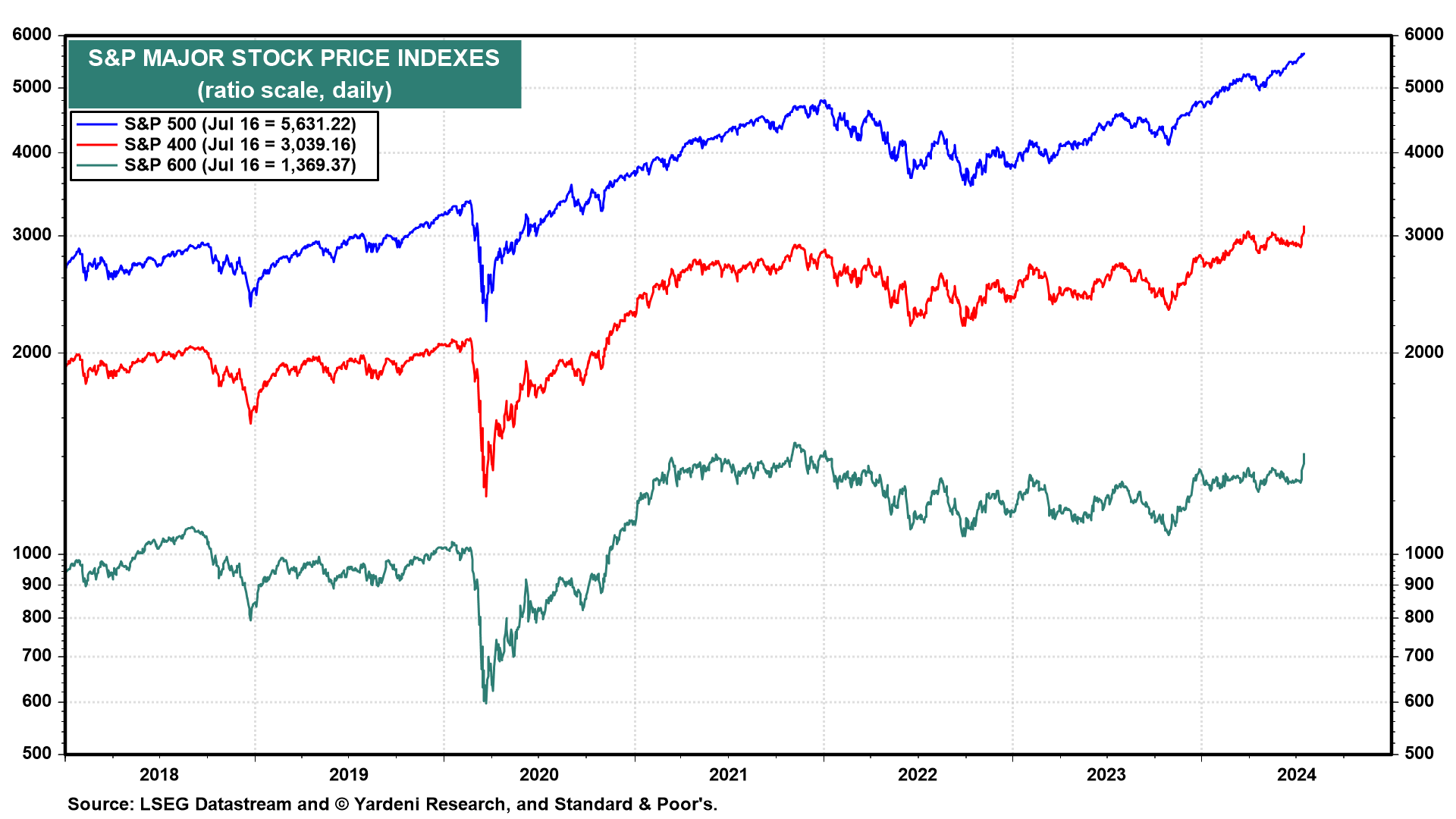

The S&P 500 has climbed 0.9% wtd to a new record high of 5,667, and the 10-year Treasury yield has slid to a four-month low of 4.158%. The stock market rally is finally broadening as investors anticipate that lower interest rates will benefit many of the bull market's laggards. The S&P 400 and S&P 600 are up 3.1% and 5.0% so far this week (chart).

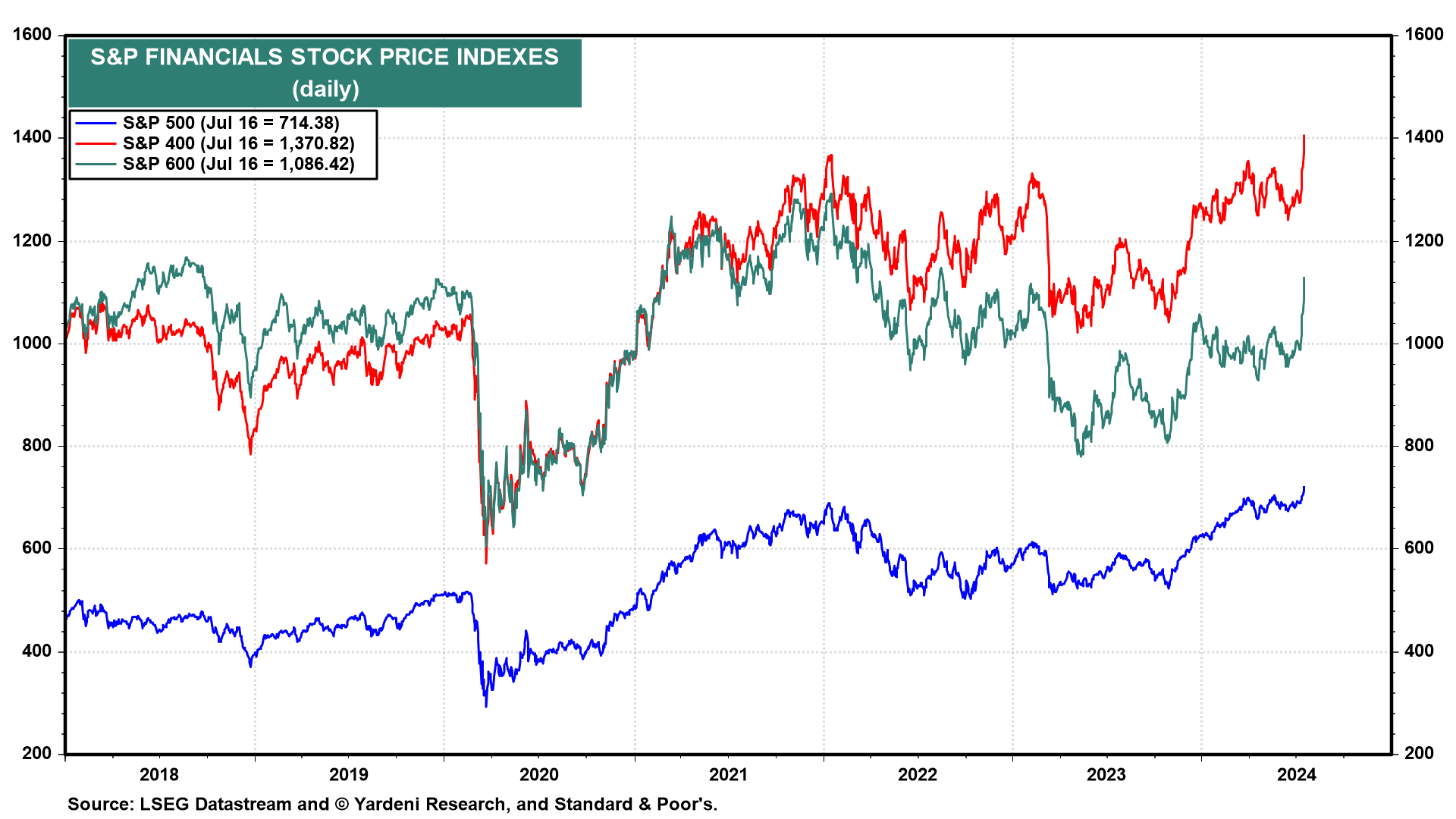

Last week, we predicted that the S&P 500 Financials sector might breakout to record highs on better-than-expected Q2 earnings reports. So far, so good as the sector rose 2.7% wtd (chart). Also jumping to a new record high today was S&P 400 Financials, up 4.6% wtd. The S&P 600 Financials also soared 6.7% wtd, led by small-cap regional banks.

Expectations for a more business-friendly regulatory regime are the boon private markets have been waiting for. As a proxy for future M&A activity, shares of investment banks Evercore (+7.7%) and Lazard (+9.3%) have soared wtd.

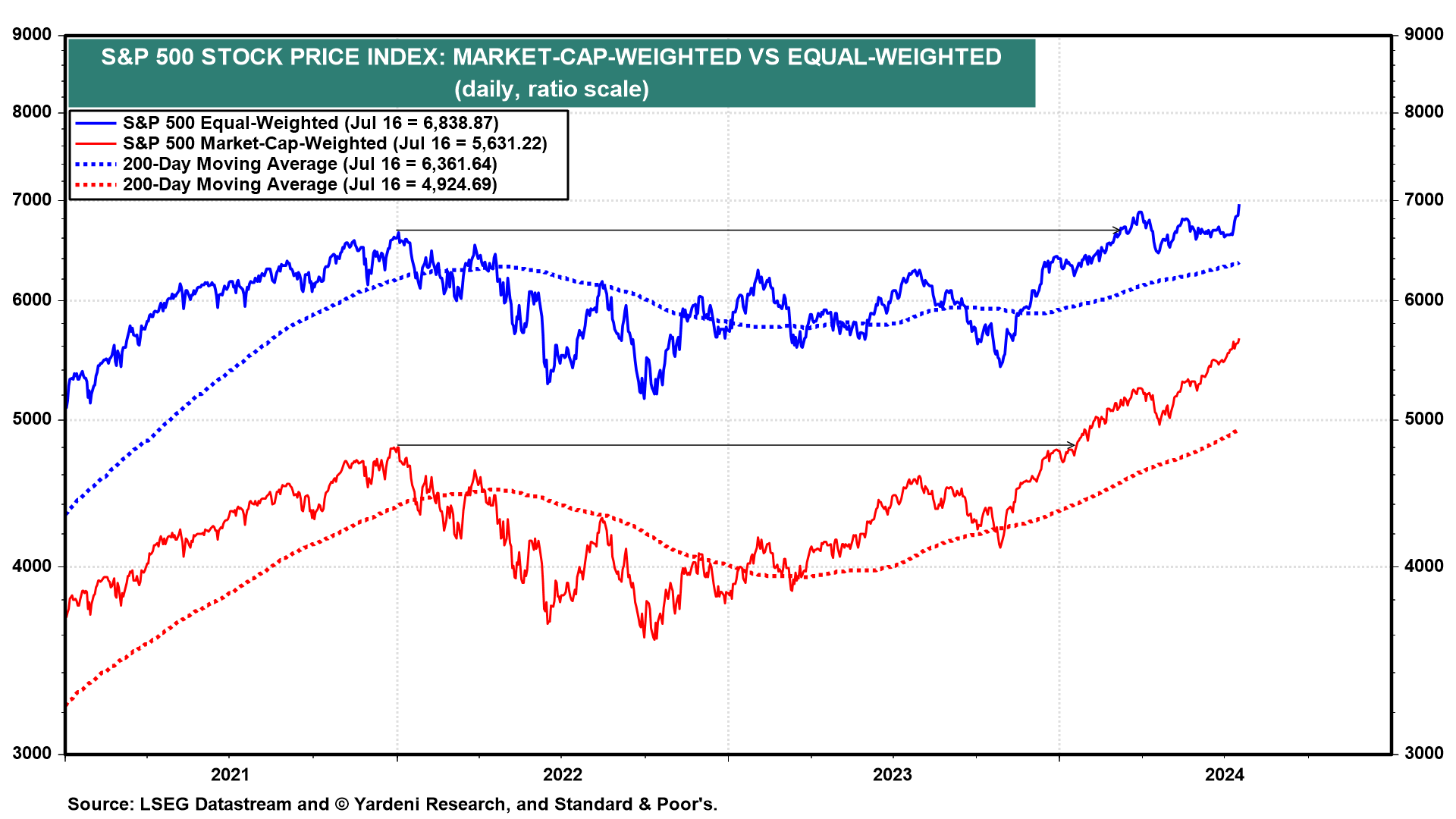

Confirming the broadening of the current bull market is the 1.9% wtd rebound in the S&P 500 equal-weighted stock price index to a new record high (chart).

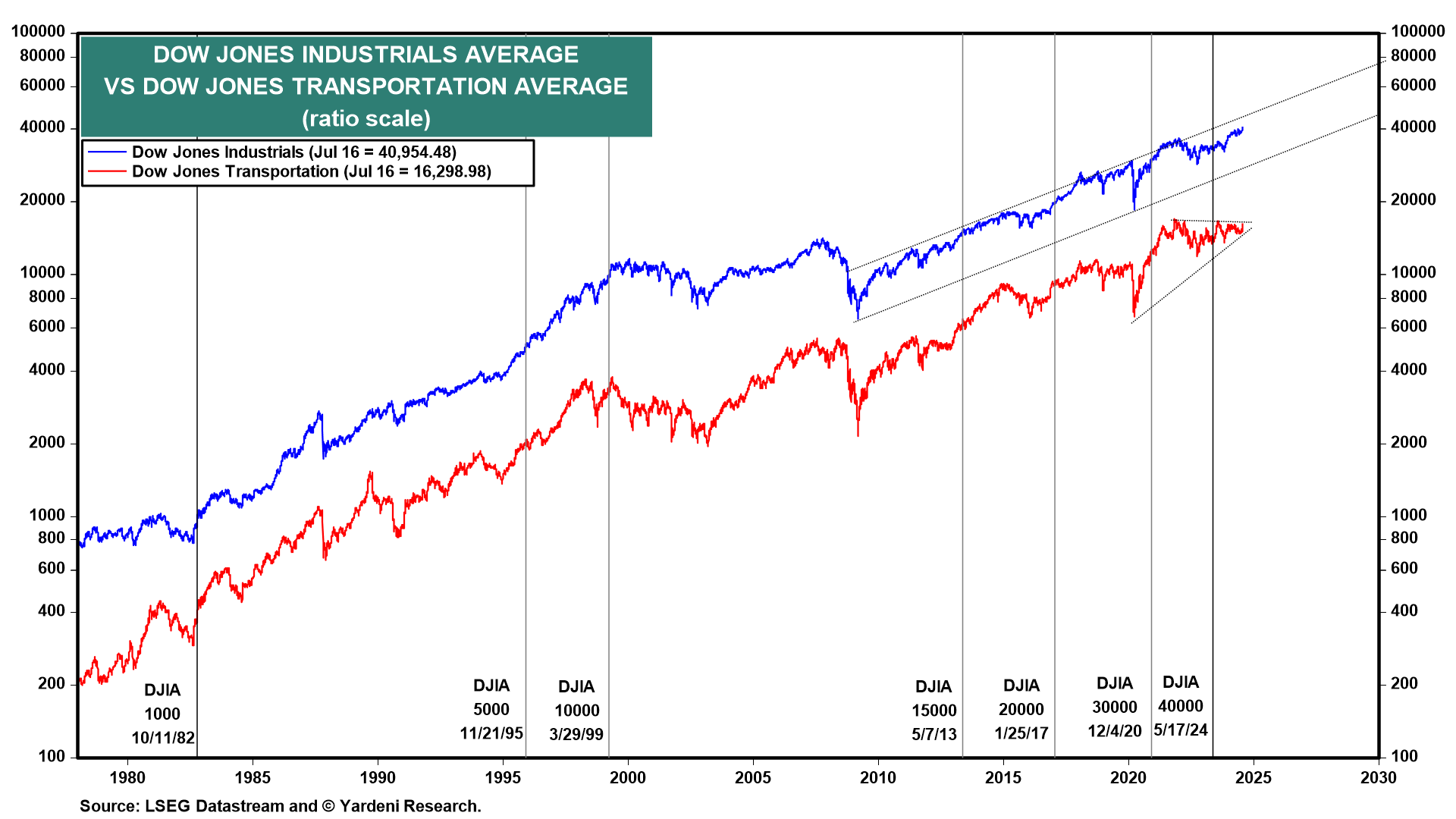

We are expecting a breakout in the DJTA will soon confirm the record high in the DJIA (chart). If so, then Dow Theory would indicate that the bull market is sustainably broadening based on a widespread economic expansion with rolling recessions in a few key economic sectors turn into rolling recoveries as interest rates fall and soaring stock prices all boost consumer spending.

We predicted a meltup if the Fed starts lowering interest rates when such a move might not be necessary. We haven't been rooting for it because now we have to worry about when it might turn into a meltdown. For now, it's still a happy-go-lucky bull market until further notice.