“Ugly” is the only way to describe today’s stock market selloff. The S&P 500 is down 13.5% ytd since it set a record high on January 3. So it’s still in correction territory. It dropped 3.6% today, but that was after a 3.0% jump the day before.

The air has been coming out of the valuation multiples of the S&P 500 Growth MegaCap-8, which have dragged down the valuation multiples of the S&P 500 Communication Services, Consumer Discretionary, and Information Technology sectors. The MegaCap-8 were big outperformers during 2020 and 2021, the first two years of the pandemic.

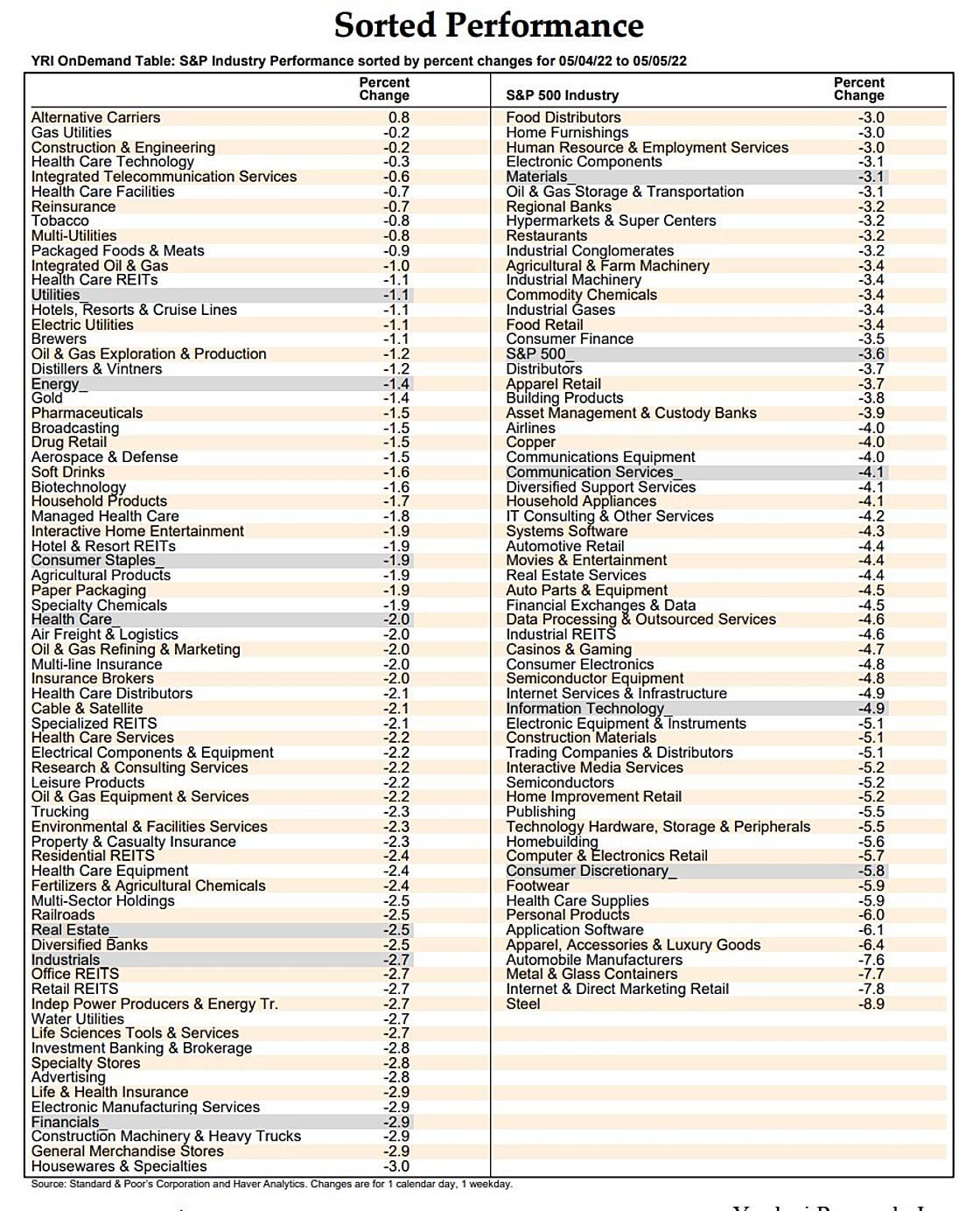

So far this year—i.e., since January 3—the big outperformer among the 11 S&P 500 sectors has been Energy: Energy (40.6% ytd), Utilities (0.9), Consumer Staples (-0.6), Materials (-4.2), Health Care (-6.9), Industrials (-8.4), Financials (-11.7), Real Estate (-11.9), S&P 500 (-13.5), Information Technology (-19.6), Communication Services (-24.6), and Consumer Discretionary (-24.8). Today’s selloff was consistent with the ytd ranking of the sectors (see table below).

We’ve been recommending overweighting the S&P 500 Energy, Financials, and Information Technology sectors to outperform the S&P 500. Two out of three ain’t too bad in this volatile market.

Among S&P 500 industries, here are some ytd winners that also held up well yesterday and might continue to outperform: Integrated Oil & Gas (44.0% ytd), Agricultural Products (31.7), Fertilizers & Agricultural Chemicals (31.5), Property & Casualty Insurance (10.6), Agriculture & Farm Machinery (9.4), Aerospace & Defense (5.1), Airlines (4.2), and Construction & Engineering (7.8).