Our contrarian instincts give us more confidence in our “growth recession,” or “mid-cycle slowdown,” scenario. A recession next year would be the most widely anticipated downturn on record. Consider the following:

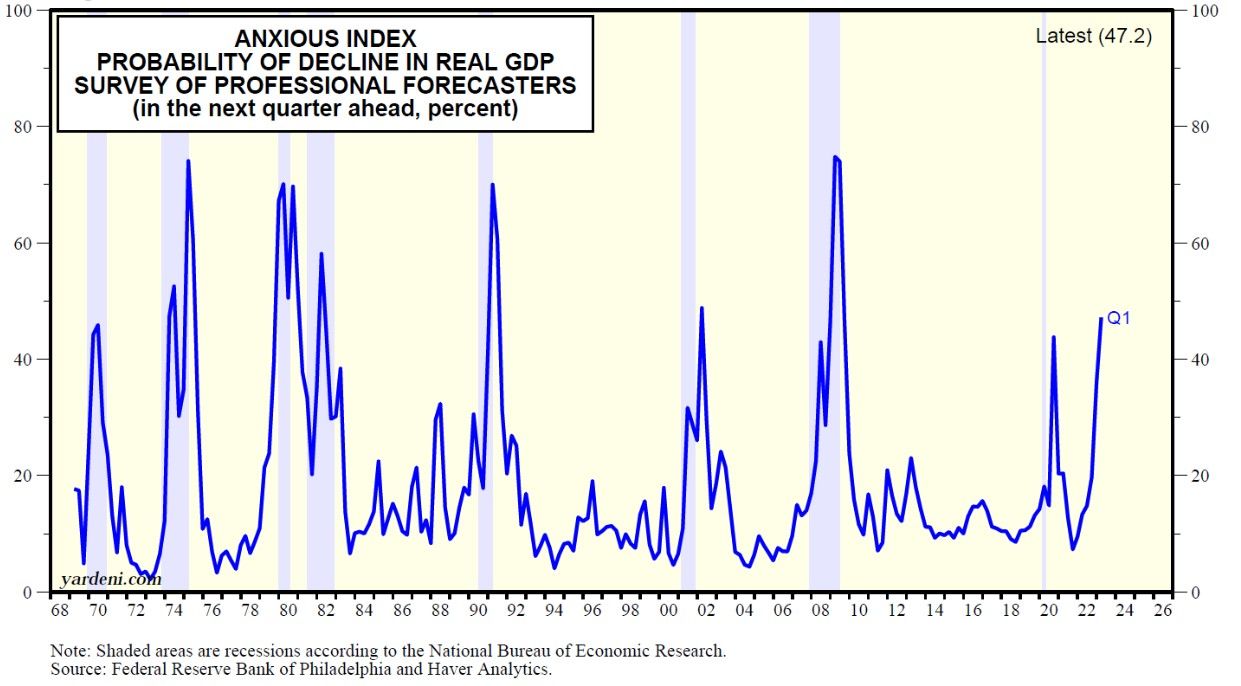

(1) Philly Fed’s Anxious Index. The Philadelphia Federal Reserve Bank’s Survey of Professional Forecasters, which started during Q4-1968, includes the Anxious Index, which is the probability of a decline in real GDP (chart). The survey asks panelists to estimate the probability that real GDP will decline in the quarter in which the survey is taken and in each of the following four quarters. The Anxious Index shows the probability of a decline in real GDP in the quarter after a survey is taken. For example, the survey taken in Q4-2022 yielded an Anxious Index reading of 47.2%, which means that forecasters believe there is a 47.2% chance that real GDP will decline in Q1-2023. That reading is the highest since Q2-2009.

The Philly Fed notes: “The index often goes up just before recessions begin. For example, the first quarter survey of 2001 (taken in February) reported a 32 percent anxious index; the National Bureau of Economic Research subsequently declared the start of a recession in March 2001. The anxious index peaks during recessions, then declines when recovery seems near. For example, the index fell to 14 percent in the second quarter of 2002, when economic indicators began improving.”

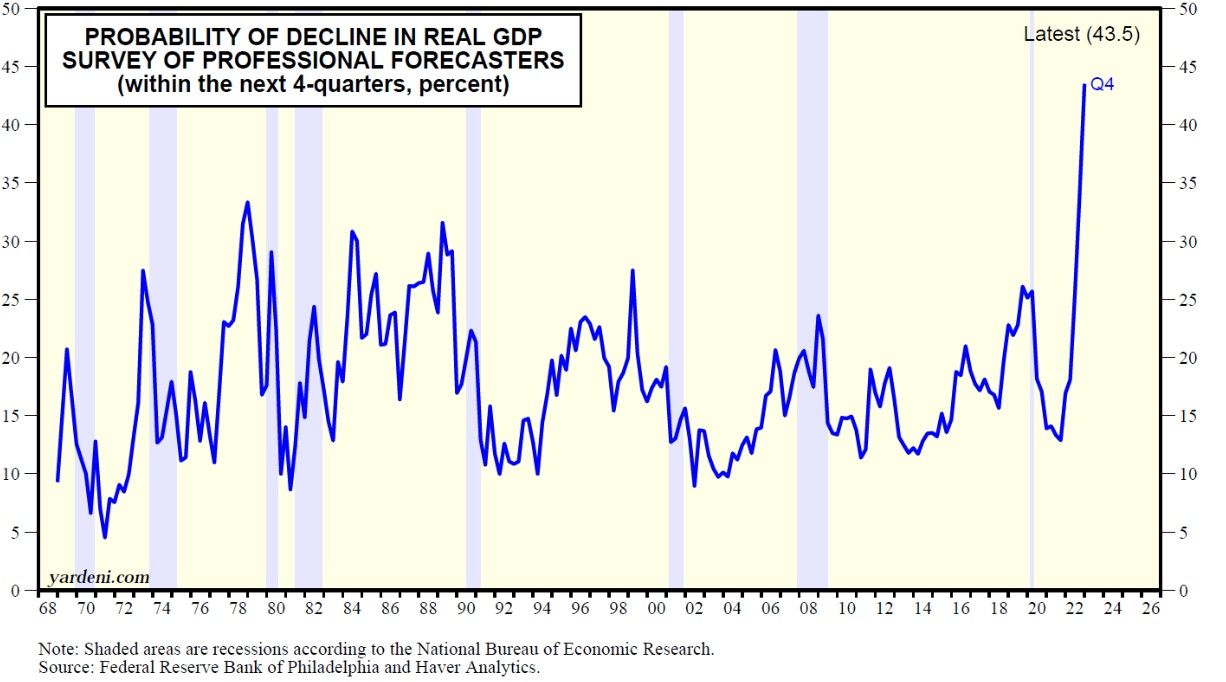

(2) Odds of recession over next four quarters. The probability of a recession over the next four quarters was 43.5%, the highest on record (chart)!