Will the Fed start raising the federal funds rate again? We expect to be hearing this question more often following today's hotter-than-expected CPI inflation report. The previous two reports for January and February were also hotter-than-expected. We don't think that the Fed will raise rates again this year, but we've pushed back against the widely-held notion of several cuts this year and argued that no cuts at all was increasingly likely. Now that's our base case scenario. So is a 4.75%-5.00% yield on the 10-year Treasury bond in the next few months. We've been expecting the stock market rally to pause and suggested taking some profits, but we still expect the S&P 500 to end the year around 5400.

We also still believe that inflation hasn't stalled, and will continue to moderate to 2.0%-2.5% by the end of this year. The so-called "last mile" may not be as hard to travel as suggested by today's CPI report. Consider the following CPI developments:

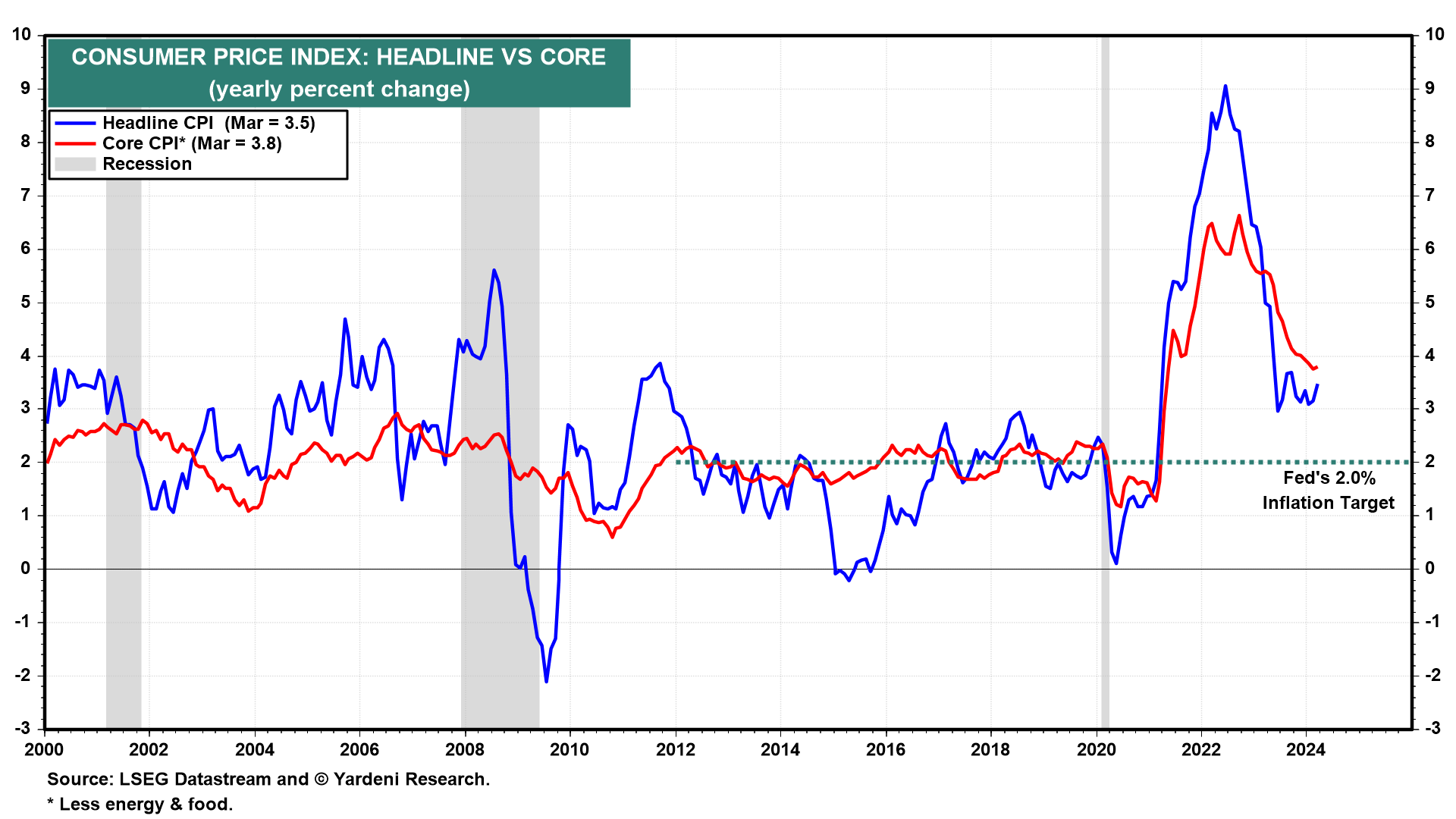

(1) Headline & core. The headline CPI inflation rate has stalled around 3.5% y/y over the past several months (chart). The core rate edged up to 3.8% in March, the first uptick since it peaked last year.

(2) Headline & core less shelter. Nevertheless, we are encouraged to see that the headline and core CPI inflation rates excluding shelter were only 2.3% y/y and 2.4% in March (chart). Shelter inflation remains on a slow, but steady moderating trend. It was down to 5.7% y/y in March from 8.3% a year ago.