Today's Wall Street Journal reports: "Now, as Trump prepares for his second administration, American companies have largely gone silent about the importance of the U.S.-China relationship. That is because American businesses no longer see China as the land of opportunity. The promise of China’s market has faded as its once-booming economy hits trouble."

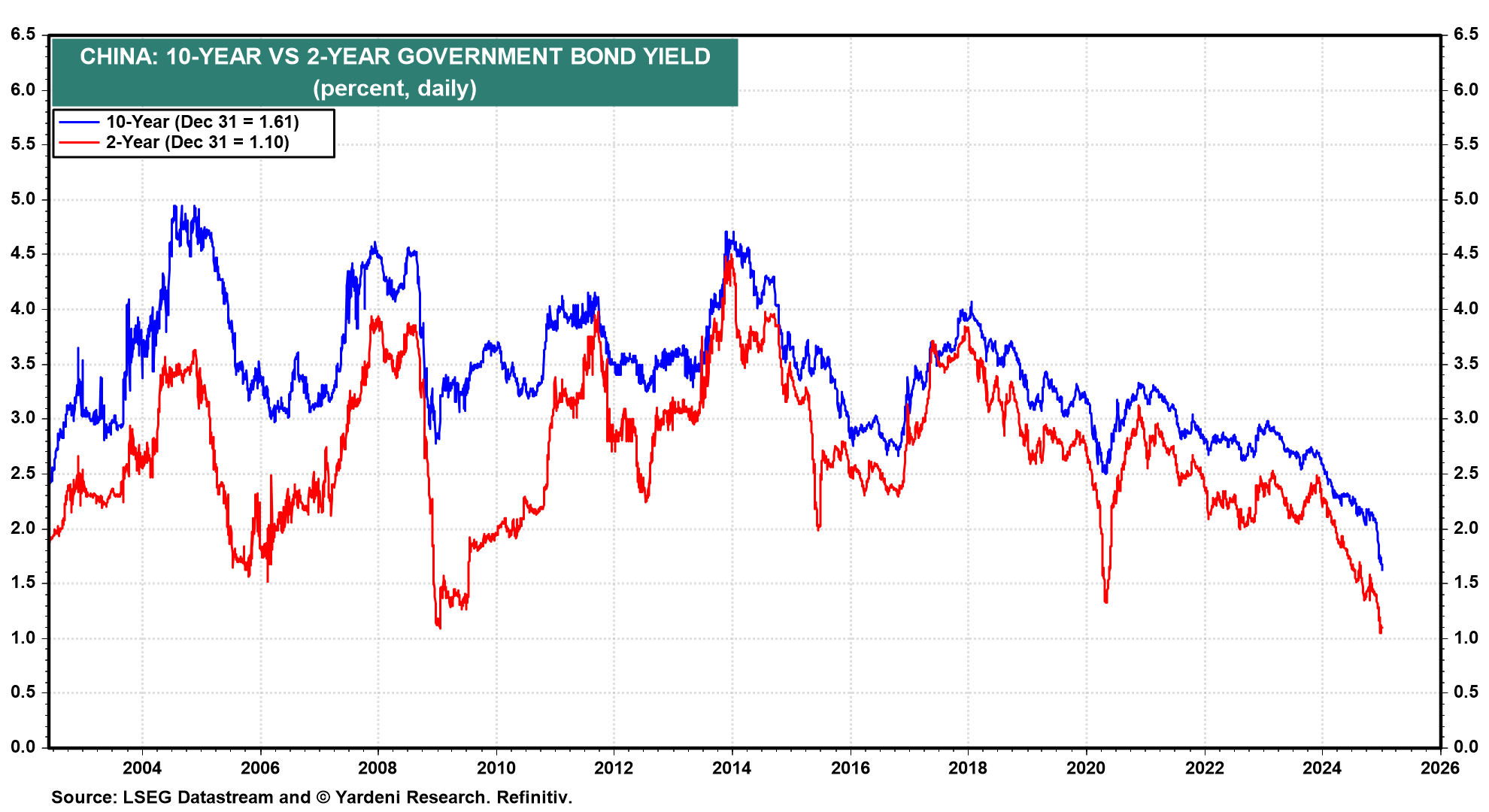

We've been saying for a while that China is uninvestable. That's still our view. And it is corroborated by the recent freefall in yields in China (chart). In the December 26 QT, we noted that the Chinese government was getting set to launch a series of fiscal measures to stimulate the economy within the next few months. We were skeptical that they would do much to revive the flagging Chinese economy. So are the fixed-income markets, where record-low yields are signaling that China's economy may be on the road to deflating the global economy.