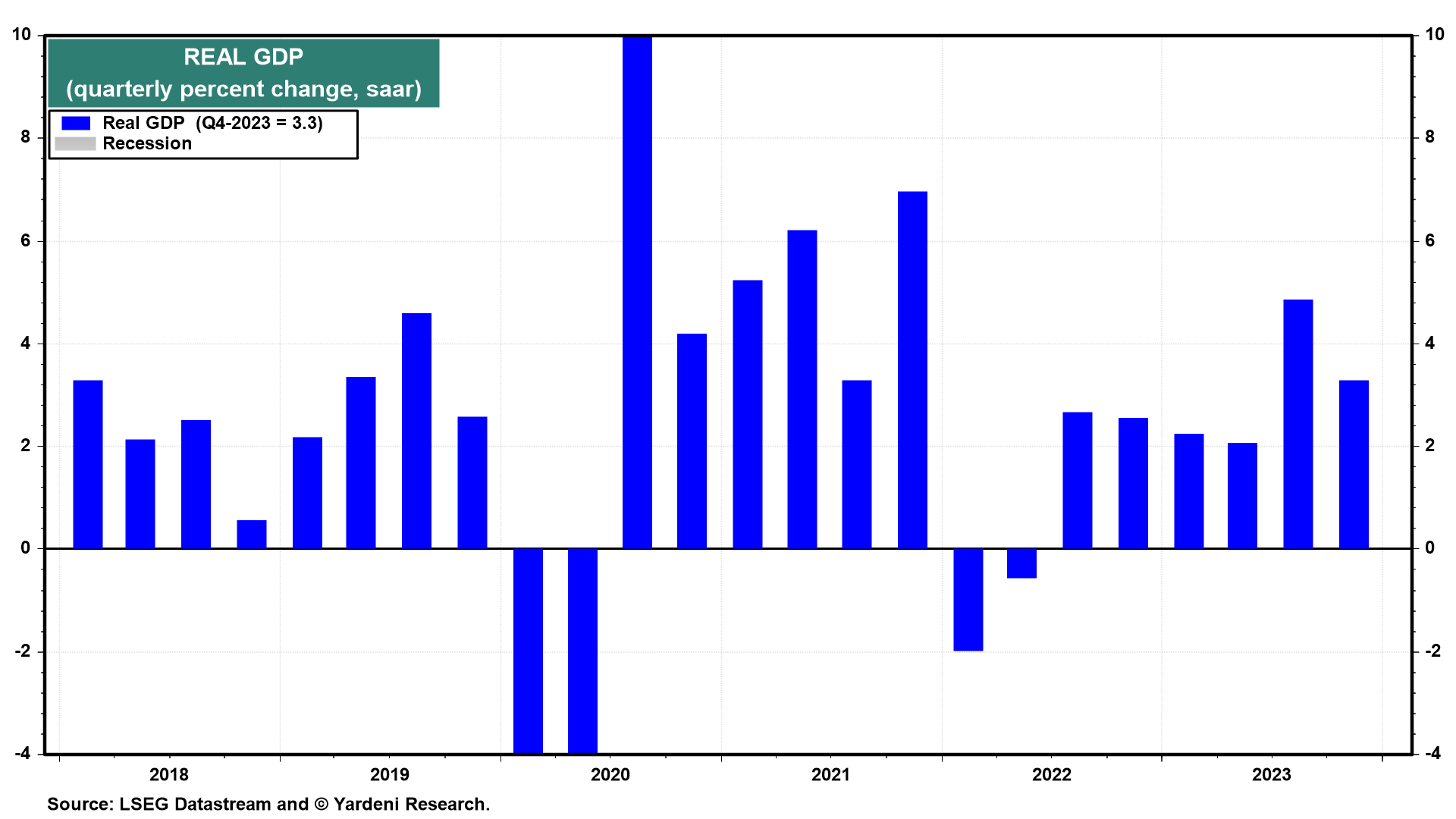

One day, there will be a recession. It just didn't happen in 2022 or 2023, as was widely predicted. The best growth rates in real GDP over this two-year period occurred during the final two quarters of 2023 at 4.9% and 3.3% (chart). Real GDP rose 2.5% during 2023 following 1.9% during 2022. (Several economists got the magnitudes right, but the signs wrong.)

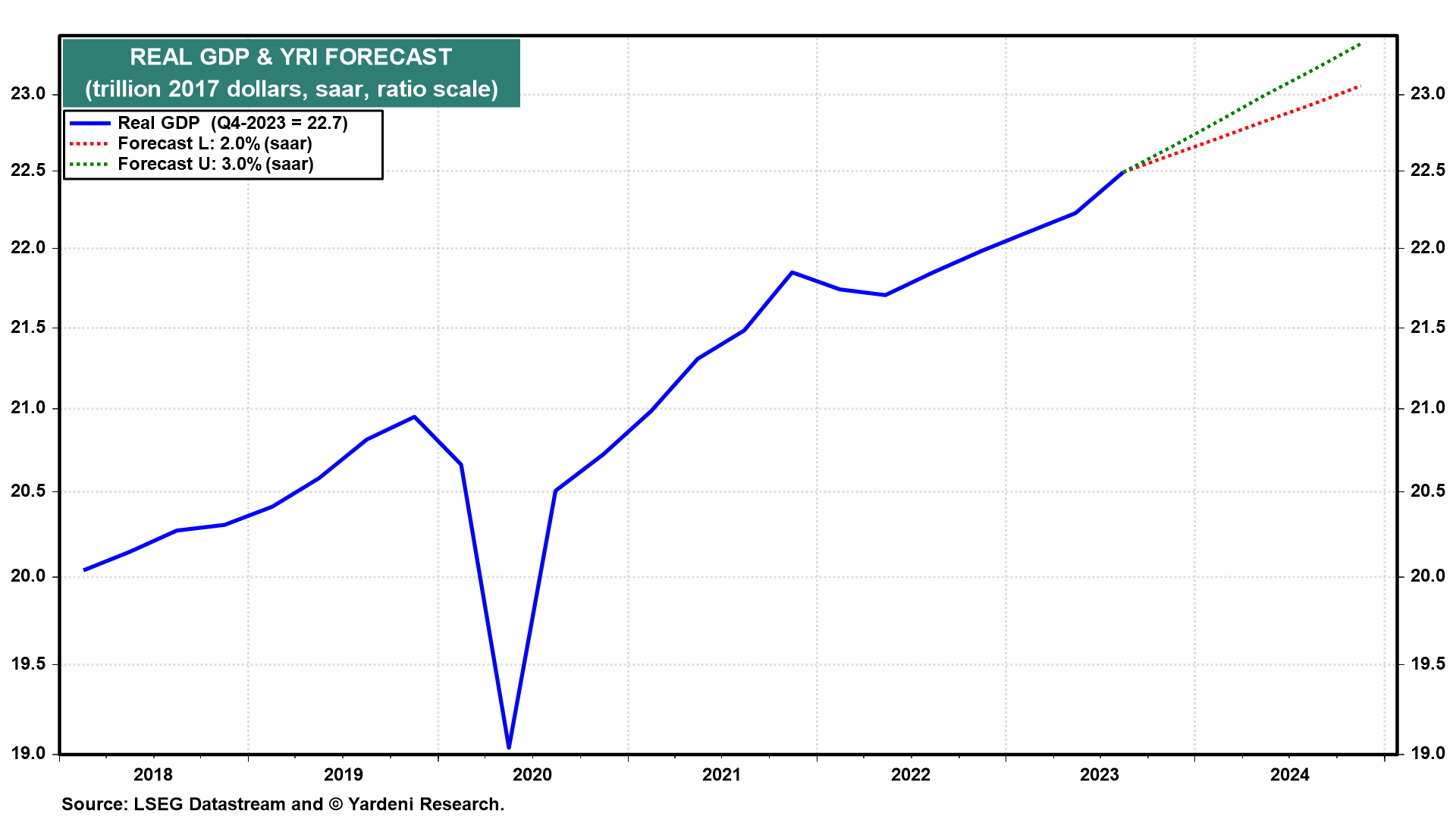

We are expecting real GDP to grow between 2% and 3% this year (chart). If we are wrong, we are inclined to believe that it will be stronger rather than weaker as a result of better-than-expected productivity growth.

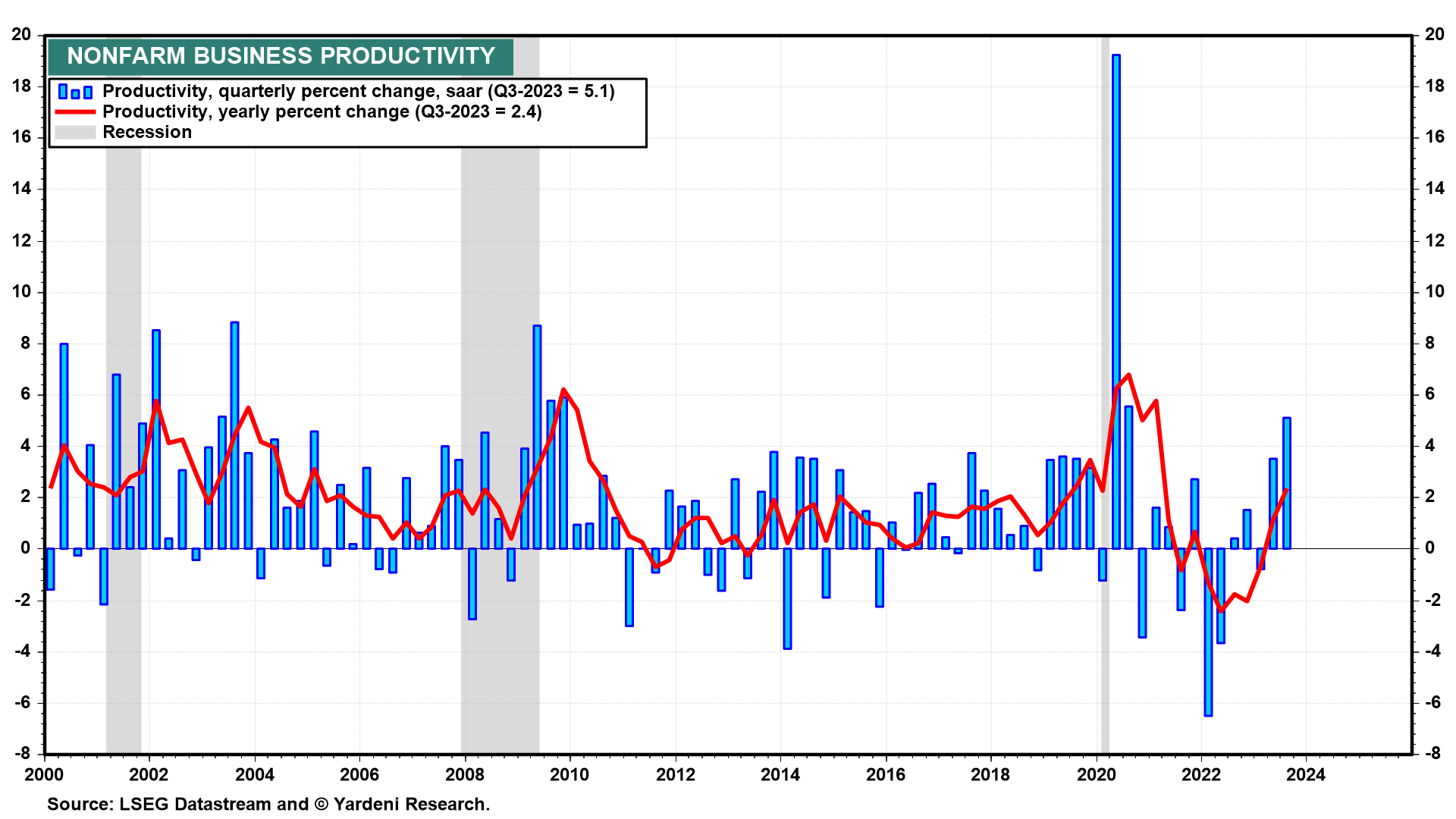

Indeed, economic growth has been boosted recently by better-than-expected productivity growth at 3.1% and 5.1% during Q2 and Q3 of 2023 (chart). During Q4, aggregate hours worked edged up by just 0.4% suggesting that productivity growth was close to 3% during Q4. That is helping to bring inflation down and to boost real wages, providing consumers with more purchasing power. Consumer spending in real GDP was up 2.8% during Q4.

Helping to boost the economy has been onshoring. Capital spending on structures in real GDP rose 12.7% last year. Leading the way has been construction of manufacturing facilities (chart).