This week's economic indicators should confirm our view that the Fed cut the federal funds rate (FFR) by 50bps (rather than 25bs) last week just as the economy is rebounding from its recent soft patch. Fed Governor Chris Waller's Friday comments on CNBC suggest even previously hawkish FOMC members are now onboard Chair Jerome Powell's easing train.

Meanwhile, regional manufacturing surveys (Tue & Thu) could signal the goods-producing sector is entering an upswing after its stagnation over the past three years. Consumer sentiment indicators (Tue & Fri) might have rebounded in September, which would counter concerns over the labor market and consumer balance sheets.

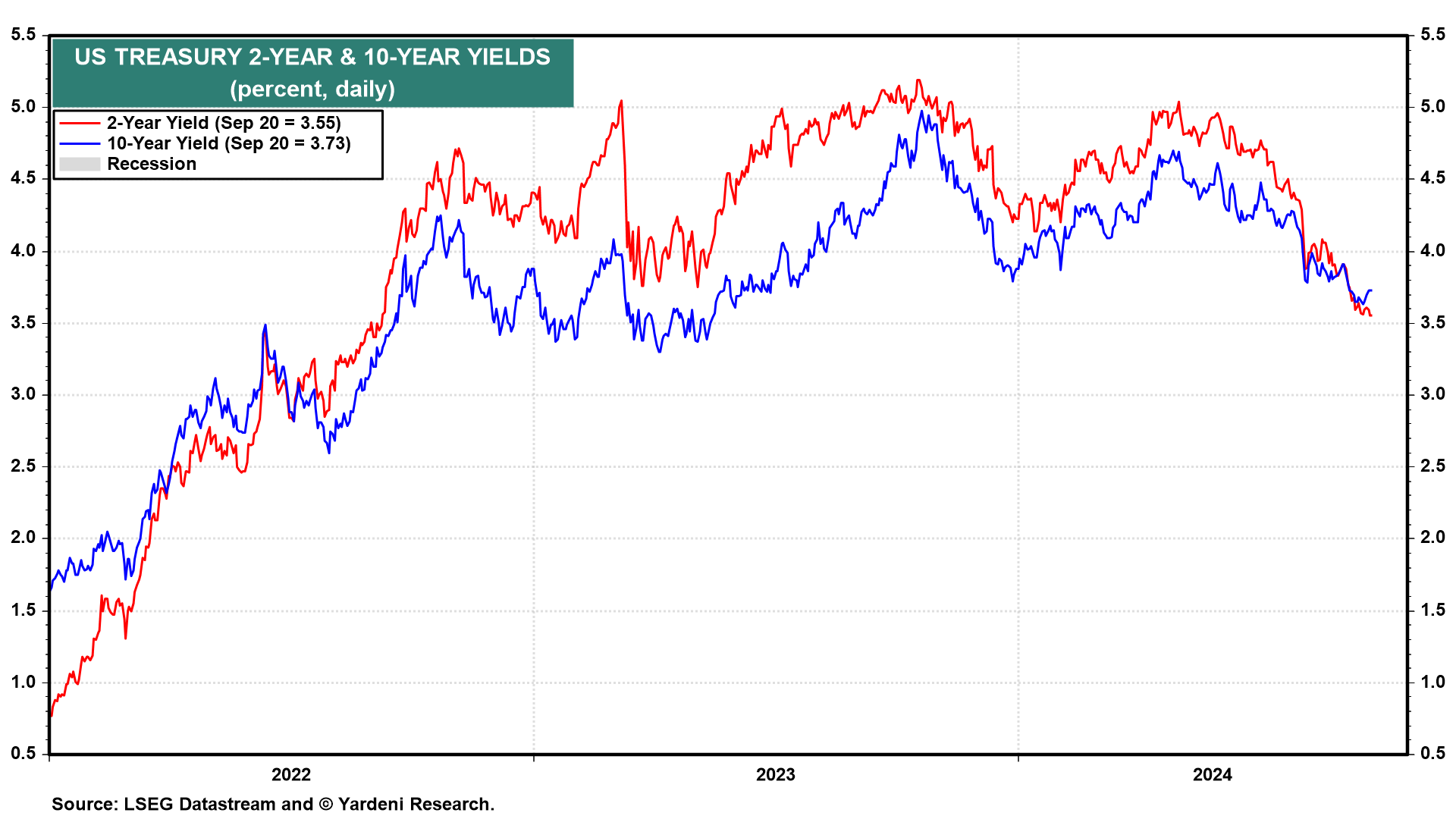

Stronger-than-expected economic data would be a boon for stocks. Stocks in the S&P 493 should benefit from looser monetary policy and solid economic growth. Bondholders may be less enthused, as long-term Treasury yields likely continue to rise in this recession-less scenario (chart).

Let's discuss what we're watching this week:

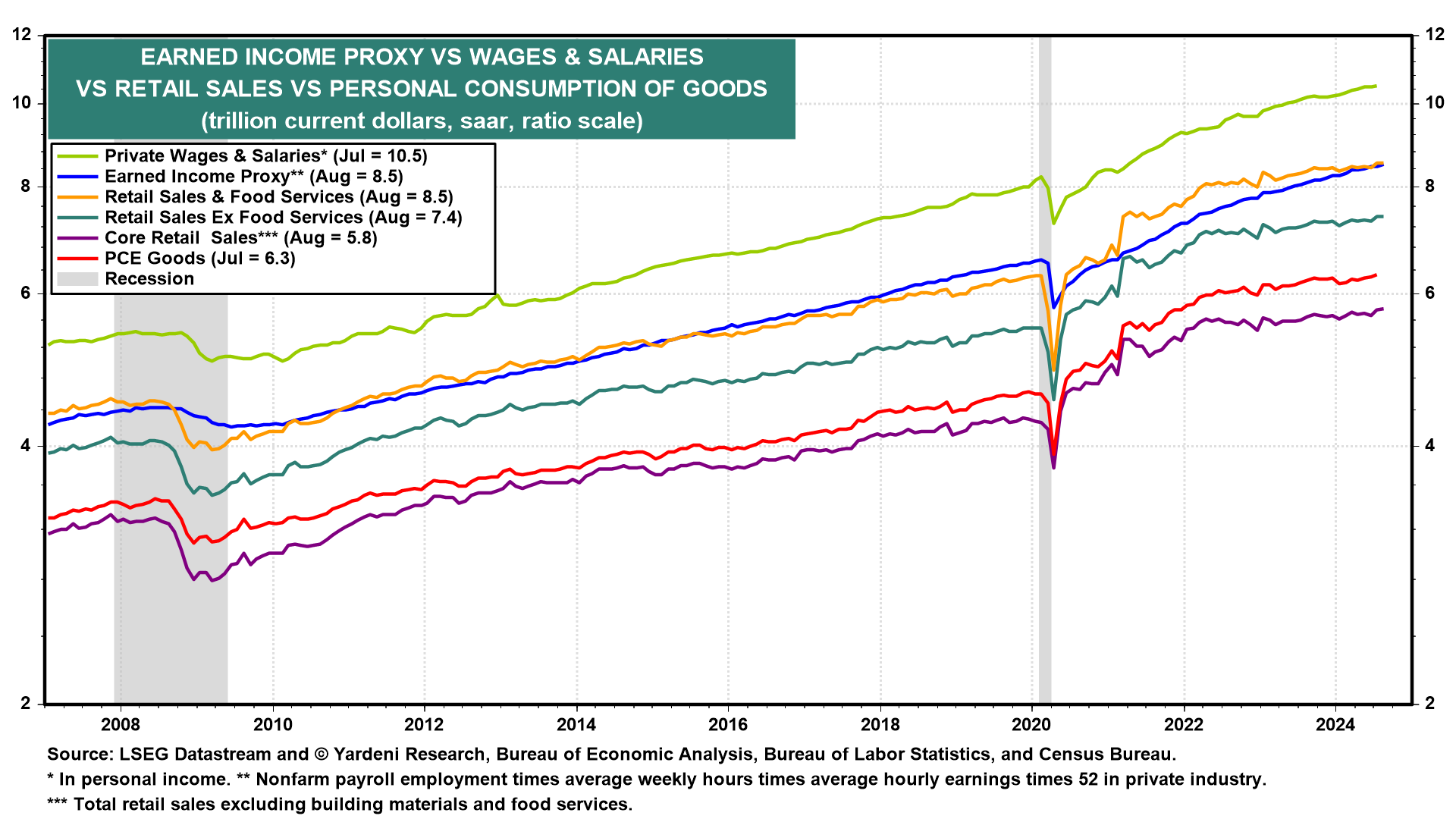

(1) Personal income and outlays. Our Earned Income Proxy for private wages and salaries in personal income rose 0.8% m/m in August, suggesting that personal income and consumer spending (Fri) climbed to new record highs in August (chart).