The shortened week ahead is an important one for labor market indicators. We expect them to show that August's employment continued to grow at a solid pace, and better than July's pace, which was weakened by bad weather. That should lift bond yields, the dollar, and cyclical sectors of the S&P 500. Here's more:

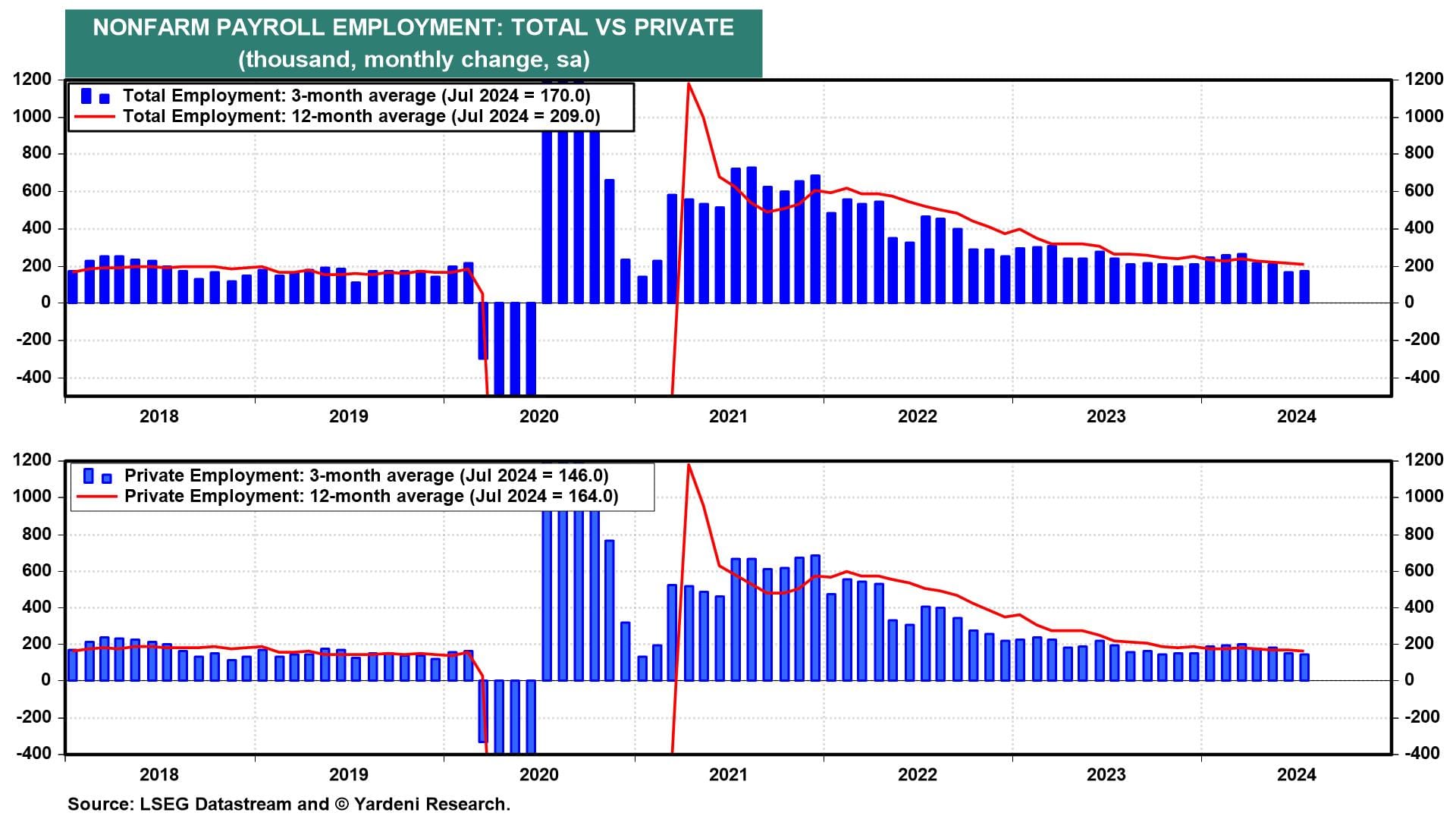

(1) Employment. August's employment report (Fri) should show payrolls rose by 200,000-225,000 to another record high and that the average workweek rebounded from July's weather-depressed reading. In any event, the average monthly increases recently suggest that the labor market has normalized back to its pre-pandemic average of roughly 170,000 per month (chart).

We expect the unemployment rate slipped to 4.2% in August from 4.3% in July, which we think was partly boosted by bad weather as evidenced by initial unemployment claims, which rose in July and eased in August.

(2) JOLTS. July's JOLTS report (Wed) should show job openings and quits continued to fall from pandemic highs, coinciding with the jobs-plentiful series in the consumer confidence survey (chart). That's consistent with moderating wage inflation, which we expect to see in August's average hourly earnings (Fri).