The blackout period is over for the members of the Federal Open Mouth Committee. This week, we can expect that many of the Fed's talking heads will repeat the hawkish remarks made by Fed Chair Jerome Powell during his presser last Wednesday, i.e., monetary policy needs to be more restrictive to bring down inflation.

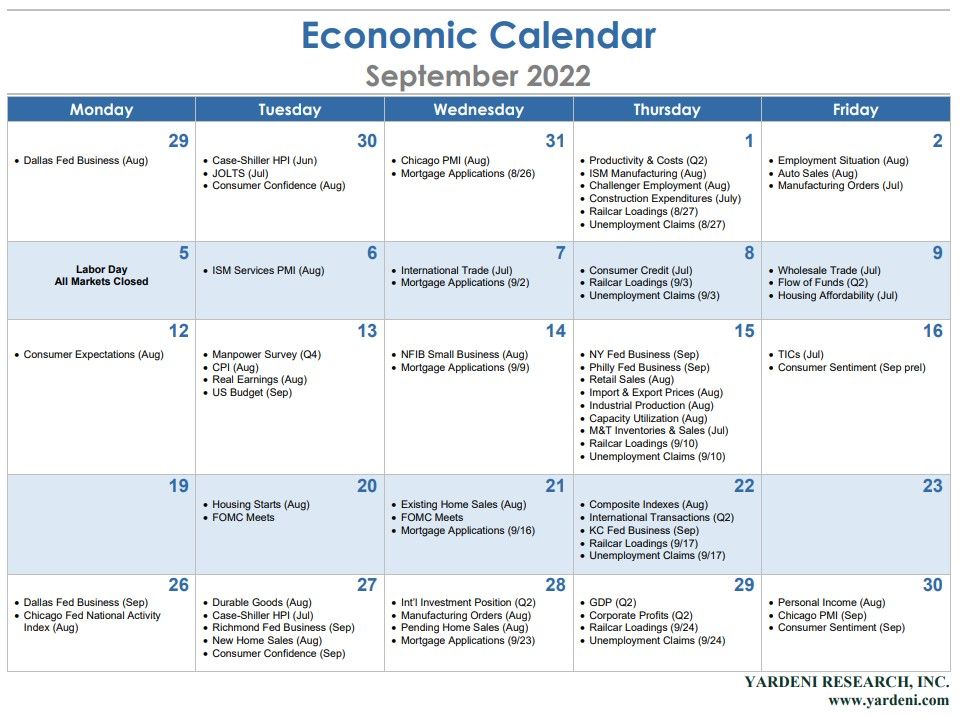

The week ahead is also jam packed with economic indicators:

(1) Consumers & inflation. The most important release will be August's personal income report (Fri.). It will include the headline PCED inflation rate which should be slightly negative on a m/m basis. The core rate will be boosted by rent inflation, which has a lower weight in the PCED than in the CPI.

September's Consumer Confidence (Tue.) and Consumer Sentiment (Fri.) surveys should show that consumers were a little less depressed than in August, reflecting the decline in gasoline prices during the summer.

(2) Housing. August's new home sales (Tue.), July's Case-Shiller home price index (Tue.), and August's pending existing home sales (Wed.) are all likely to show that monetary policy is already very restrictive, pushing the housing industry into a severe recession and depressing home prices.

(3) Business. September's regional business surveys conducted by the Dallas Fed (Mon.) and Richmond Fed (Tue.) are likely to show weakening growth and easing inflationary pressures as did the NY, Philly, and KC surveys.

August's durable goods orders (Tues.) is likely to show that capital spending is slowing along with the economy. Q2's GDP and corporate profits revisions will be reported on Thursday.