It's a light week for economic releases in the US. The focus will be on the Fed. Wednesday will be action packed with the FOMC's latest policy statement and Summary of Economic Projections both out at 2:00 pm and Fed Chair Jerome Powell's presser at 2:30 pm.

Powell is likely to be as hawkish as he was during his August 26 speech at Jackson Hole. He will reiterate that bringing inflation down is the Fed's top priority even if that causes some pain. The financial markets are expecting a 75bps hike in the federal funds rate. We are expecting a 100bps hike, which might actually be well received by the markets if investors conclude: "Great, let's get this over with already--the sooner the better!"

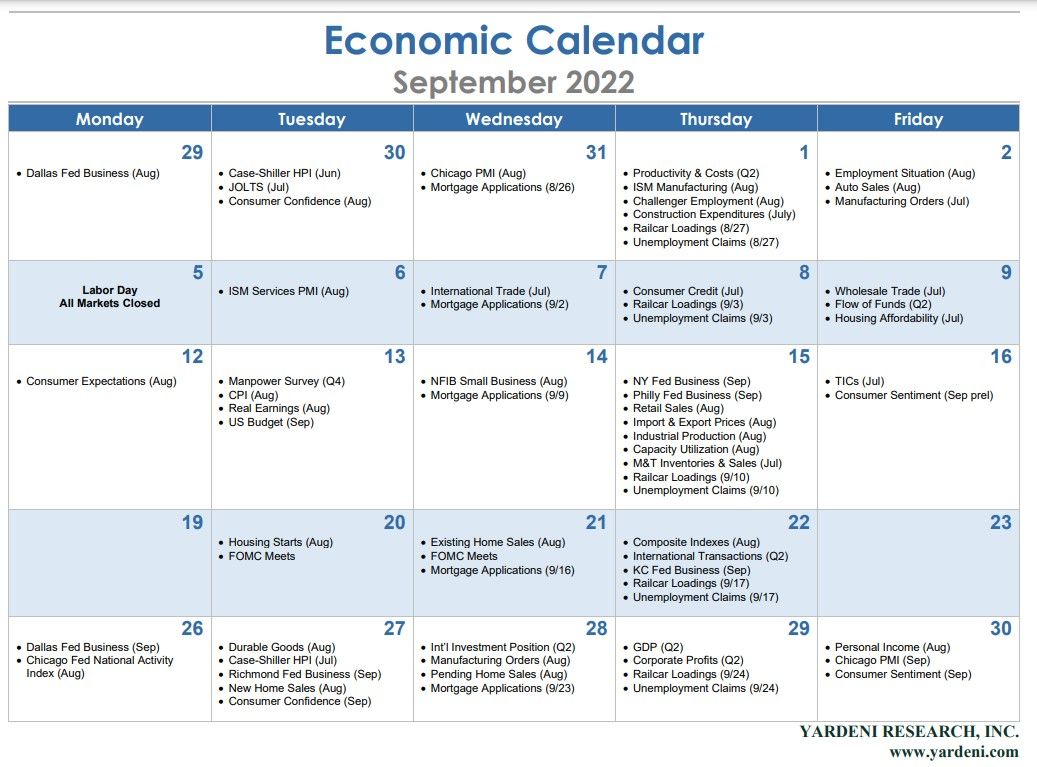

Housing starts (on Tuesday) and both existing home sales and mortgage applications (on Wednesday) should confirm that the Fed has already pushed the housing industry into a recession. Existing home prices should start showing big declines.

On Thursday, August's Index of Leading Economic Indicators is likely to be down for the sixth consecutive month. It peaked at a record high during February. On the other hand, the Index of Coincident Economic Indicators rose to a record high in July, and might have stalled there in August.