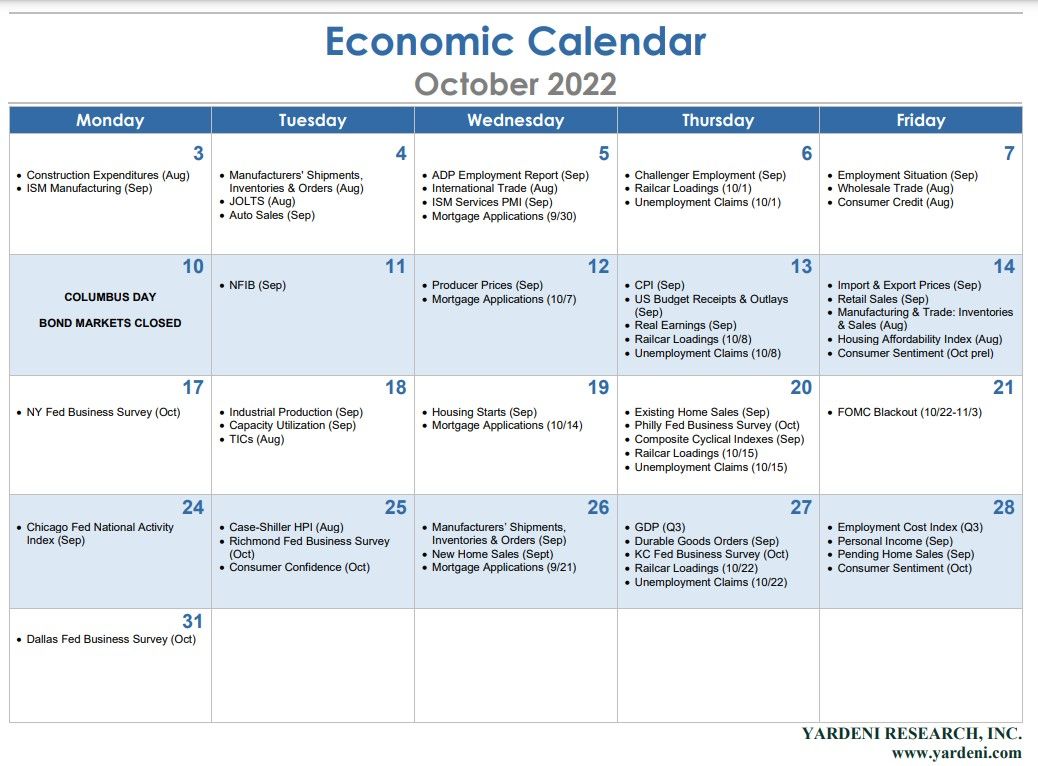

Good news in the labor market is now bad news for the bond and stock markets because it gives the Fed more leeway to tighten monetary policy to fight inflation. This week's labor market indicators include August's JOLTS (Tue.) and both September's ADP Private Payrolls (Wed.) and the BLS Employment Situation (Fri.). Last weeks low jobless claims number suggests that labor demand continues to well exceed supply.

September's M-PMI survey (Mon.) and NM-PMI survey (Wed.) are likely to be more consistent with our "growth recession" scenario with manufacturing and non-manufacturing activity slowing and prices-paid indexes continuing to fall for both.

September's Auto Sales (Tue.) and August's Consumer Credit (Fri.) are likely to show some pickup in pickups, though parts shortages are still an issue, and ongoing reliance on credit to boost purchasing power.

August's Construction Spending will be front and center on Monday morning. It should show weakness in the single-family housing and commercial segments of the construction industry.