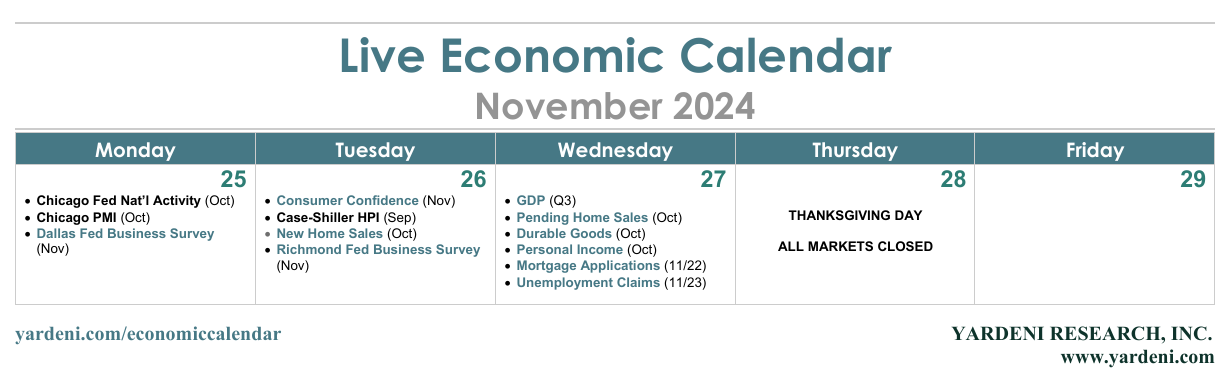

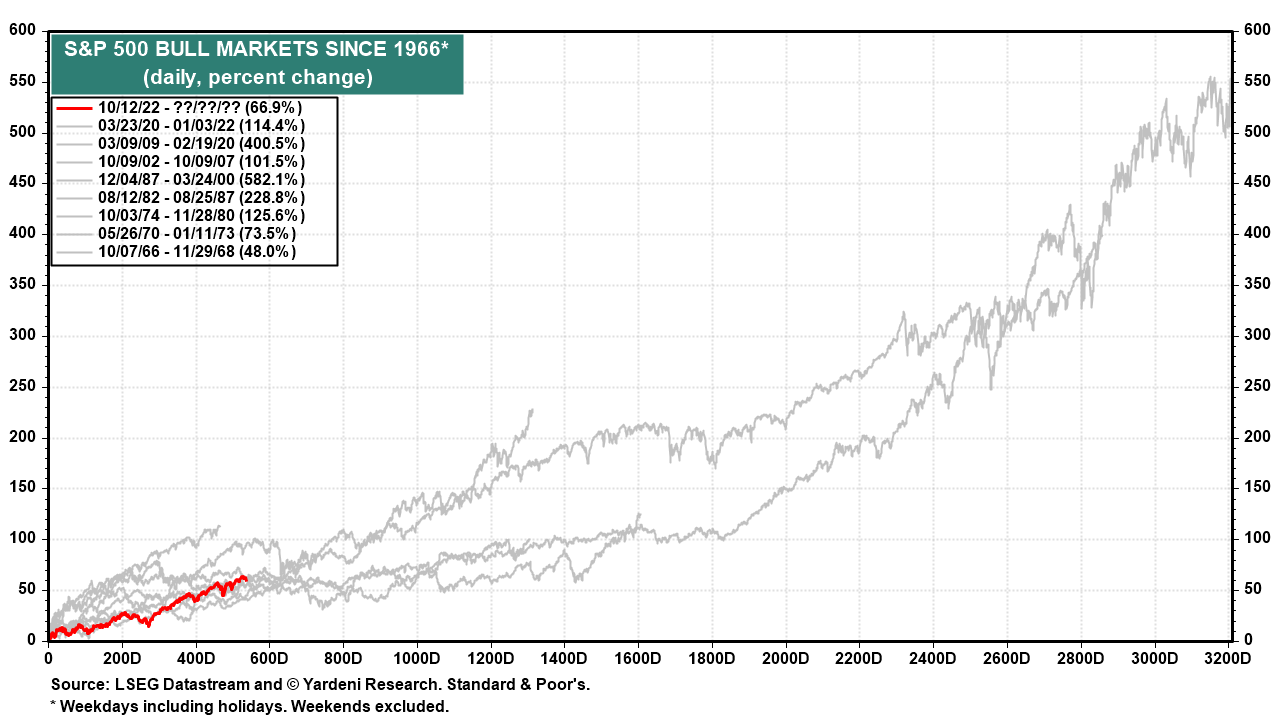

The week ahead is jampacked with economic indicator releases, all in the first three days before the Thanksgiving holiday. They are likely to confirm that we have much to be thankful for this year. The US economy and stock market are doing well. The most widely anticipated recession of all time has been a no-show for a third year. The S&P 500 is up 25.9% ytd and 66.9% since the bull market started on October 12, 2022. The current bull market may very well continue to produce strong gains as it rages on, perhaps through the end of the decade and into the 2030s. Yes, it could turn out to be one of the longer bull markets on record (chart).

The animal spirits unleashed by Trump 2.0 and the all-too-dovish Fed could fuel more gains for the economy, stock market, gold, and bitcoin through the end of this year and into 2025. This week's data might point to a long-awaited upturn for the goods sector. Here's what we're watching: