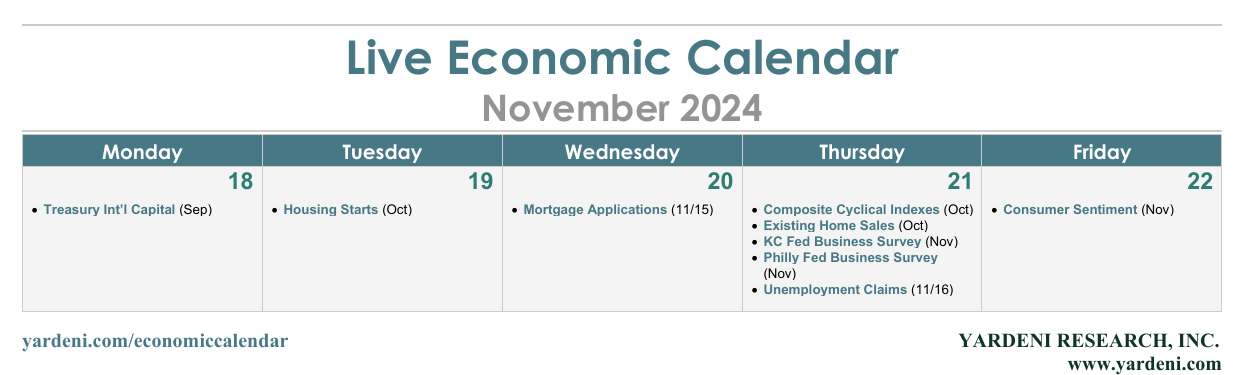

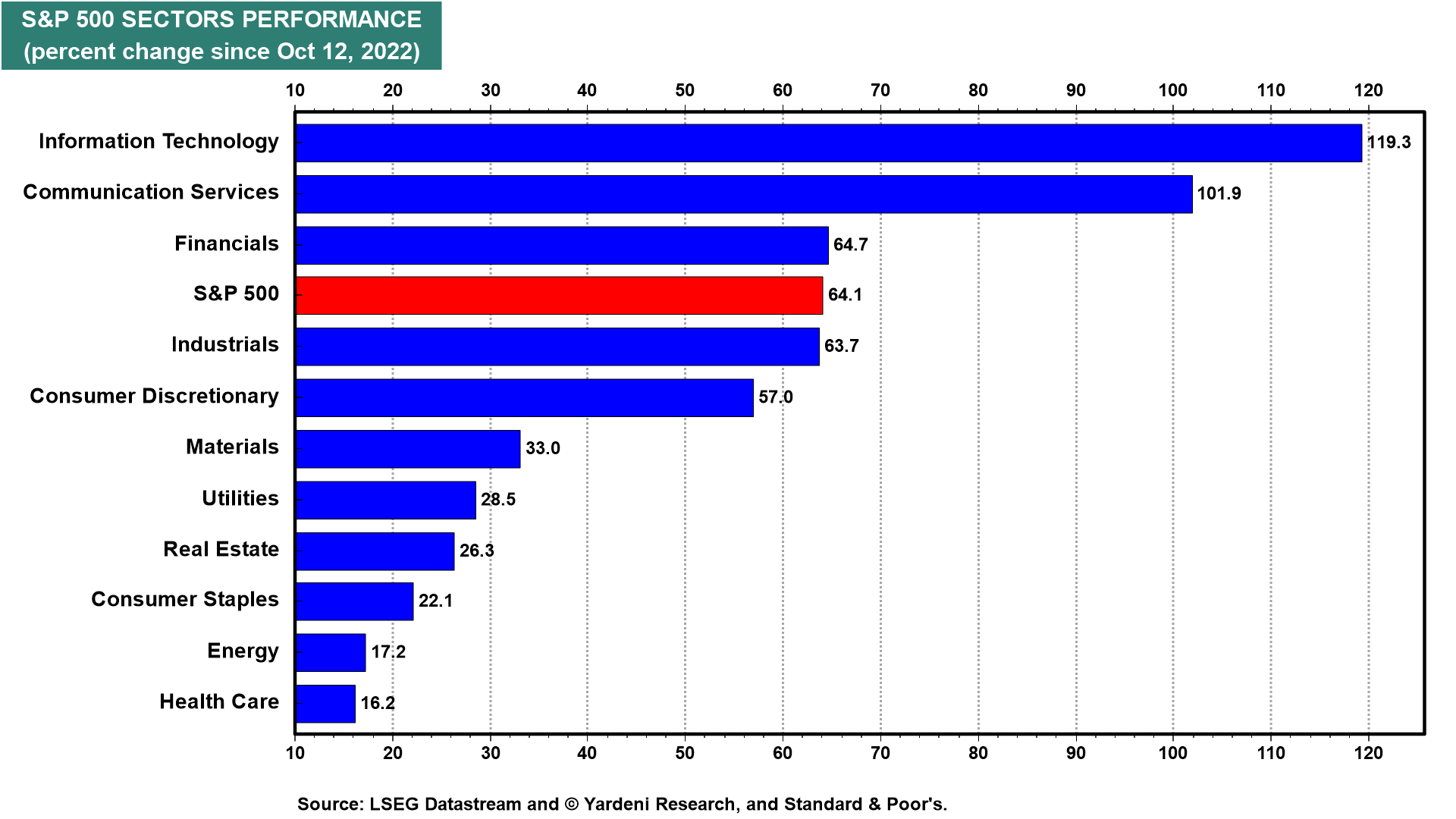

The week ahead will provide important updates of housing and manufacturing indicators. The latter should show that economic growth may be broadening to include the goods sector, which has been relatively flat since the Fed started raising interest rates. Since the start of the bull market, we've been recommending overweighting the following cyclical sectors S&P 500 Information Technology, Communication Services, Financials, Industrials, and Energy (chart). We are sticking with all of them with the exception of Energy. They should all get a boost from stronger-than-expected economic growth over the next few months.

Here's what we're watching this week: