Other than Nvidia's AI lovefest during the first three days of the week and the FOMC meeting on Tuesday and Wednesday, it's a quiet week for economic indicators.

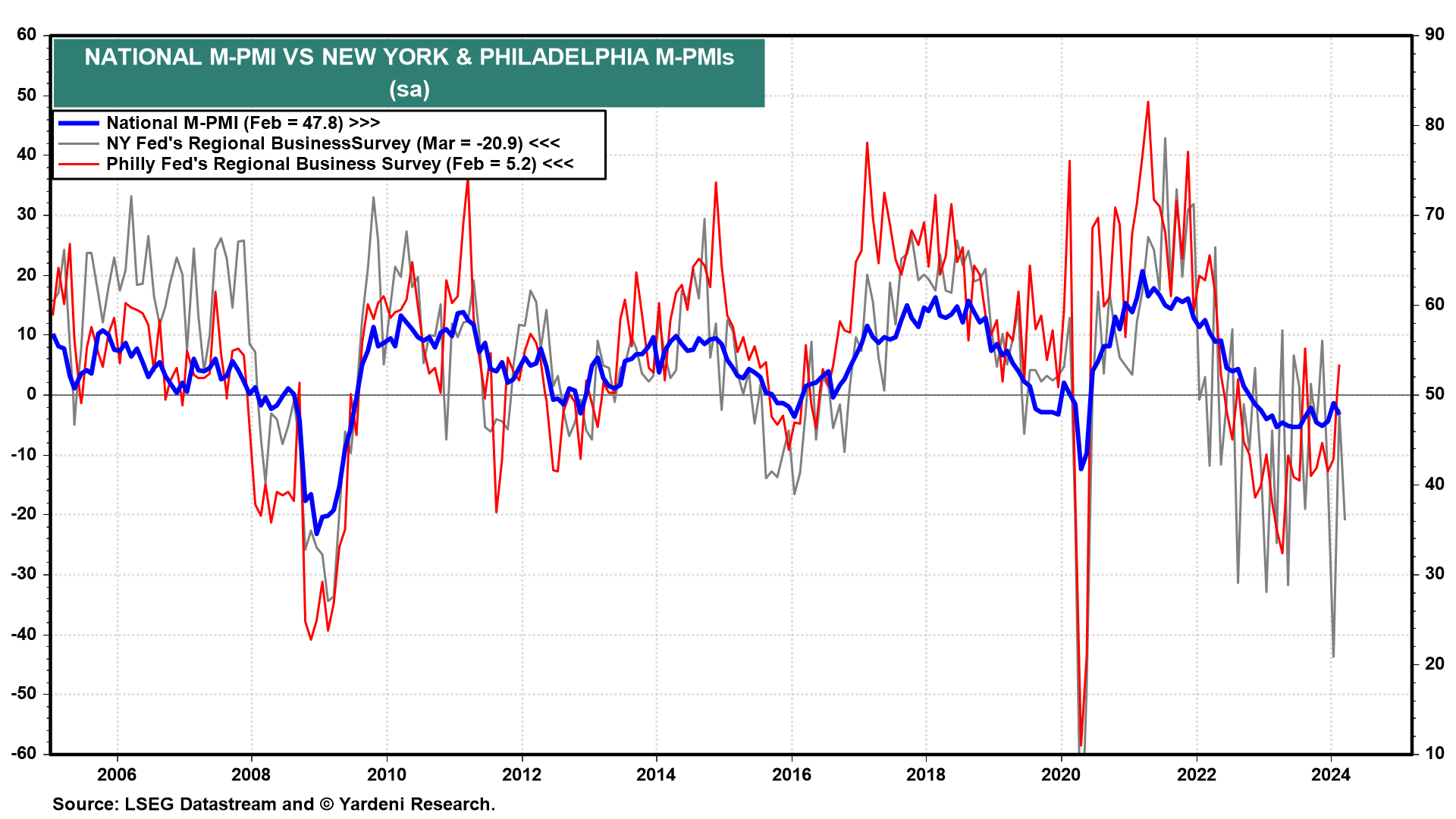

It will be interesting to see if the Philly Fed's regional business survey (Thu) for March confirms the weakness in last week's similar survey released by the NY Fed (chart). Both of these regional surveys, especially the NY one, tend to be much more volatile than the national purchasing managers survey (chart).

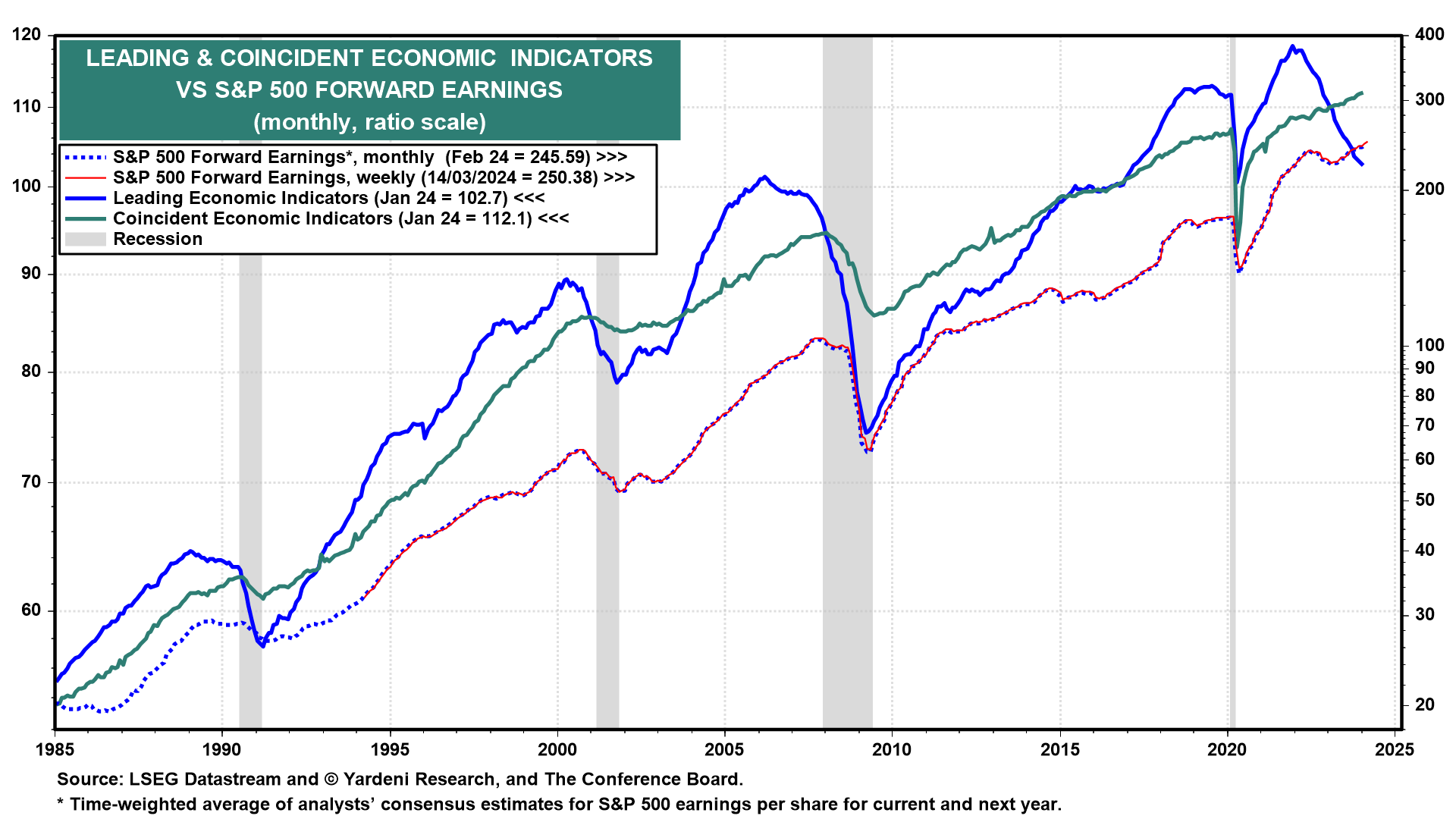

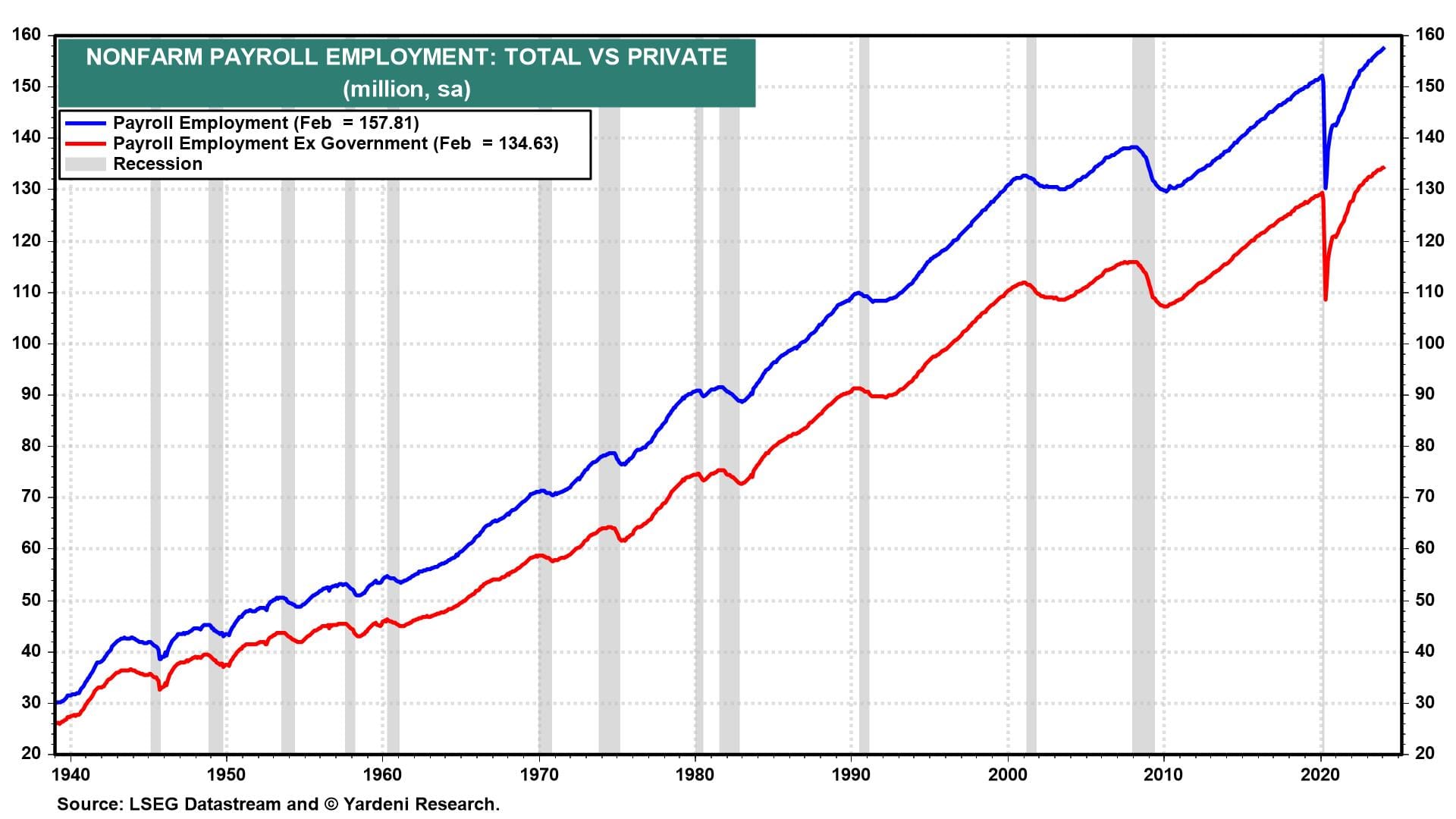

February's Index of Coincident Economic Indicators (Thu) should be up to another record high. That's confirmed by the increases in private payroll employment, industrial production, and retail sales during the month (chart).

A new record high for the CEI is also confirmed by weekly S&P 500 forward earnings per share, which rose to yet another record high of $250.38 during the February 24 week, which is consistent with our $250 per share forecast for 2024 (chart).

And what about February's Index of Leading Economic Indicators (Thu)? It is likely to continue to be a misleading indicator of an imminent recession that refuses to show up as predicted by this widely followed indicator. We've previously noted that it tends to be biased towards goods without giving enough weight to services. It is overdue for a product recall in our opinion.